- A critical week ahead as early strength followed by potentially sharp selloff

- Dollar rebound likely to begin by Friday

- Gold moving higher early on with high risk of late week declines

- Crude to rise again above $70 early followed by selloff by Friday

- A critical week ahead as early strength followed by potentially sharp selloff

- Dollar rebound likely to begin by Friday

- Gold moving higher early on with high risk of late week declines

- Crude to rise again above $70 early followed by selloff by Friday

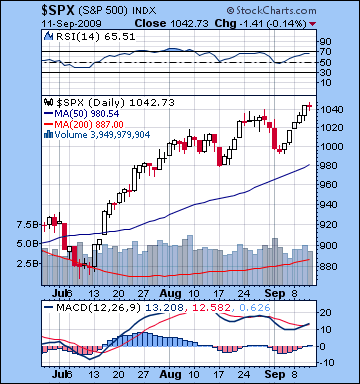

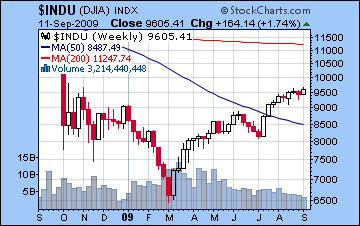

Stocks in New York rose another 2% last week as investors were encouraged by improving consumer sentiment numbers. The indexes rallied higher to make new highs for the year, as the Dow closed at 9605 while the S&P finished at 1042. While I had been fairly bullish this week due to the Sun-Venus-Jupiter pattern, the absence of any significant pullback Friday was disappointing and left the market somewhat higher than expected. Tuesday saw a moderate gain despite the apparent bearish influence of the Aries Moon. Wednesday and Thursday saw further gains which I predicted in last week’s newsletter as the expansive energy of the Venus-Jupiter aspect increased risk appetite. I had expected more of a decline in the aftermath of this aspect, but stocks hung on tenaciously and the market ended down only fractionally. That failure to correct was perhaps emblematic of the staying power of the current rally which remains defiantly intact despite the various hurdles it has had to surmount such as the Mercury-Mars square, and the current Mercury retrograde cycle. While the market has shown signs of topping in the past few weeks, it has nonetheless managed to edge higher.

Stocks in New York rose another 2% last week as investors were encouraged by improving consumer sentiment numbers. The indexes rallied higher to make new highs for the year, as the Dow closed at 9605 while the S&P finished at 1042. While I had been fairly bullish this week due to the Sun-Venus-Jupiter pattern, the absence of any significant pullback Friday was disappointing and left the market somewhat higher than expected. Tuesday saw a moderate gain despite the apparent bearish influence of the Aries Moon. Wednesday and Thursday saw further gains which I predicted in last week’s newsletter as the expansive energy of the Venus-Jupiter aspect increased risk appetite. I had expected more of a decline in the aftermath of this aspect, but stocks hung on tenaciously and the market ended down only fractionally. That failure to correct was perhaps emblematic of the staying power of the current rally which remains defiantly intact despite the various hurdles it has had to surmount such as the Mercury-Mars square, and the current Mercury retrograde cycle. While the market has shown signs of topping in the past few weeks, it has nonetheless managed to edge higher.

New highs are certainly indicative of market strength, but it is important to put them into perspective. While the S&P made new highs, the Dow has only equaled its intraday highs from late August. Unless and until the Dow moves above its current level, the new high will have a tentative and conditional quality. And despite a return to normal business after the Labour Day holiday, volume was not significantly greater than it has been in the summer. This is perhaps further evidence that the rally does not enjoy broad participation and that makes it more vulnerable to correction. MACD has turned more positive thus reflecting last week’s gains, but one should note the negative divergence of the falling MACD peaks against the rising levels on the SPX. By itself, this only indicates a decline in the rate of price increase and yet it often occurs before a trend reversal. RSI has reached 65 which is very close to the overbought zone and is another possible indicator that we could be on the cusp of a correction. Another potentially revealing technical clue can be found in the relationship between stocks and bonds. An astute newsletter reader reminded me this week that long term treasuries are now rising in value while the market makes new highs, an untenable situation in the long run. Since stocks and bonds usually have an inverse relationship, this rise in treasuries shows a growing number of investors are seeking safety in bonds, perhaps anticipating a pullback in equities. Given we’re entering a very astrologically intense period in the coming weeks with the Saturn-Uranus opposition, we can make a very plausible case that we are on the verge of a major correction. So despite feeling some disappointment and frustration over these recent new highs, I see no reason to change my basically bearish outlook for the weeks ahead as we move deeper into the autumn.

This week will be critical for shaping the future direction of the market as pessimistic Saturn makes its exact opposition aspect (180 degrees) to unpredictable Uranus on Tuesday. Later in the week, the Sun will conjoin Saturn and thus activate the energy in this opposition and by Friday the Moon will add its presence to the alignment. This is a very powerful pattern that has the potential to not only move markets sharply but also to mark a shift in the dominant trend. Since both Saturn and Uranus are very slow moving bodies moving only a few minutes of arc per day, the energy from their aspect may not manifest exactly on time. That is why the Sun and Moon may be necessary to act as triggers later in the week. I should also note that previous Saturn-Uranus aspects in the current series also coincided with market declines although significantly they occurred after the aspect was exact. Actually, the market reached an interim peak on November 4, 2008, the day of the exact opposition and then fell 20% towards the November 21 lows. Similarly, the exact opposition occurred February 5, 2009 near an interim high, and then the market fell sharply in the following month culminating in the March 6 lows. For this reason, we may see the market try to push higher this week, especially early on before the full impact of the Saturn-Uranus opposition begins to take effect. Monday and Tuesday have a potential for more gains, as Venus will move into aspect with the Saturn, Uranus and Neptune and the Moon transits Cancer. I doubt that both days will be positive, but there may be a net positive outcome from that pattern that could very well push the S&P to 1050-1060. Wednesday may start out bullish as the Moon conjoins Venus in early Leo but sentiment could falter as the day goes on as the aspect separates. The Sun conjoins Saturn on Thursday while Mercury squares Pluto so this could be a very important day for the market both in terms of volatility and the beginning of any retracement down. Friday seems worse as the Moon conjoins the Sun-Saturn while Mercury falls under the aspect of Rahu. Friday afternoon looks especially powerful, so we could see a big move down then. It’s possible the decline may only be 2-4% and that its larger significance for the market will be as a sign of a trend reversal. But it’s also possible it will be a much larger decline, say, between 5-10%.

Next week (Sep 21-25) will likely start very bearish on the Mercury-Saturn conjunction Monday and Tuesday but some kind of recovery is likely later in the week although Friday in particular also looks like a drop. The week looks bearish overall. The following week (Sep 28-Oct 2) also starts negatively as Mercury will end its retrograde cycle and turn direct in close aspect with Mars. This rest of the week is hard to read so some kind of rally attempt is likely, but again the Friday seems weak as Mercury’s velocity will match that of Mars and will probably move markets lower. After that, the bearishness is likely to accelerate as Mars conjoins Ketu while Mercury is in conjunction with Saturn and falls under Rahu’s aspect. This is a very rare and extremely negative alignment that could generate the largely decline of this upcoming period. I would not be surprised to see the market fall more than 10% in the week of October 5-9. I can see only a sustained recovery beginning in mid to late November, although it is unclear it that will coincide with the bottom of this correction.

Next week (Sep 21-25) will likely start very bearish on the Mercury-Saturn conjunction Monday and Tuesday but some kind of recovery is likely later in the week although Friday in particular also looks like a drop. The week looks bearish overall. The following week (Sep 28-Oct 2) also starts negatively as Mercury will end its retrograde cycle and turn direct in close aspect with Mars. This rest of the week is hard to read so some kind of rally attempt is likely, but again the Friday seems weak as Mercury’s velocity will match that of Mars and will probably move markets lower. After that, the bearishness is likely to accelerate as Mars conjoins Ketu while Mercury is in conjunction with Saturn and falls under Rahu’s aspect. This is a very rare and extremely negative alignment that could generate the largely decline of this upcoming period. I would not be surprised to see the market fall more than 10% in the week of October 5-9. I can see only a sustained recovery beginning in mid to late November, although it is unclear it that will coincide with the bottom of this correction.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish

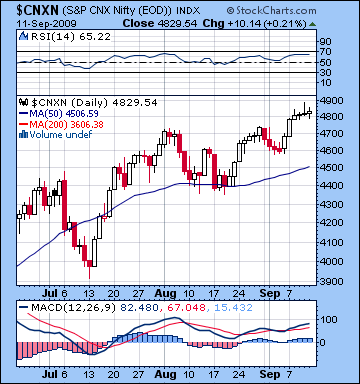

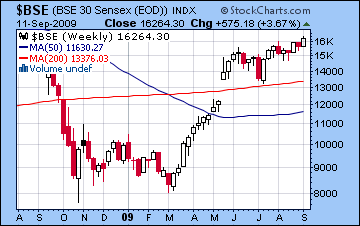

Stocks in Mumbai rose another 3% last week on positive industrial output data and favourable Asian market cues. Making new highs for the year, the Sensex closed Friday at 16,264 while the Nifty finished at 4829. While I had leaned towards some significant bullish moves last week, the market exceeded expectations as stocks did not experience any negative days. Monday saw the biggest gain of the week as the market broke above old highs with ease. While I had been bullish on the Pisces Moon, the extent of the buying was surprising. The Aries Moon on Tuesday and Wednesday did not produce any declines as stocks held steady and even managed small gains. Another source of error came on the late week Sun-Venus-Jupiter pattern which did not produce gains as forecast. Interestingly, the Nifty did open sharply higher Thursday to 4880 — perhaps as a result of this bullish alignment — but gains largely evaporated by the close. Even with Friday’s modest gain, the late week movement was somewhat puzzling given the favourable planets at work. Overall, we had a somewhat maddening week given the new highs and absence of any selling.

Stocks in Mumbai rose another 3% last week on positive industrial output data and favourable Asian market cues. Making new highs for the year, the Sensex closed Friday at 16,264 while the Nifty finished at 4829. While I had leaned towards some significant bullish moves last week, the market exceeded expectations as stocks did not experience any negative days. Monday saw the biggest gain of the week as the market broke above old highs with ease. While I had been bullish on the Pisces Moon, the extent of the buying was surprising. The Aries Moon on Tuesday and Wednesday did not produce any declines as stocks held steady and even managed small gains. Another source of error came on the late week Sun-Venus-Jupiter pattern which did not produce gains as forecast. Interestingly, the Nifty did open sharply higher Thursday to 4880 — perhaps as a result of this bullish alignment — but gains largely evaporated by the close. Even with Friday’s modest gain, the late week movement was somewhat puzzling given the favourable planets at work. Overall, we had a somewhat maddening week given the new highs and absence of any selling.

The technical view of the market has improved somewhat given the new highs, although the failure to hold onto Thursday’s early gain is perhaps indicative of a lot of overhead resistance as we move closer to 5000 on the Nifty. Despite the new highs, volume remains at unremarkable levels and does not provide a strong confirmation of this bullish trend. RSI is at 65 and moving toward overbought levels previously associated with corrections, as seen in early August. MACD is strongly positive both in terms of histograms and the moving averages turning up. But we note the continued negative divergence between the lower MACD high from week compared with the one from early August which was over 100. This is another potential signal of imminent weakness that undermines the importance of last week’s new high. While the move above 4800 was disappointing, it does nothing to change my basic bearish outlook for the market in the weeks to come. While I had focused on the mid-September to mid-October period as pivotal for establishing the correction, I expected weakening to occur ahead of this fundamental trend reversal. This has not happened, so it looks like the market will stay more or less bullish right up to the key Saturn-Uranus opposition aspect due to arrive this week. It is only once the aspect has past exactitude that the market will undergo a significant change in direction.

This week will be crucial for the market as the Saturn-Uranus opposition aspect (180 degrees) finally becomes exact. This occurs on Tuesday and could very well mark the end of the current rally that began back in March. While this aspect is generally bearish, it is important to remember that its effects may only be felt after its aspect comes exact. This is what happened on two previous oppositions of Saturn and Uranus in the current series. After the initial collapse in October 2008, the market bounced in late October and rose into the exact opposition on November 4, only to slide another 10% in the following weeks. Similarly, another opposition aspect occurred on February 5, 2009 and the market then fell almost 20% into the lows of early March. This is an important reason why I believe the market is due for a significant correction in the coming weeks. Nonetheless, this week may well begin with stocks moving higher on Monday as the Moon’s transit of late Gemini may activate the natal Jupiter in the NSE chart. Tuesday could go either way as the Moon is in Cancer in fairly close proximity to Ketu. At the same time, benefic Venus will form minor aspects to Saturn, Uranus, and Neptune and that could be enough to give bulls further encouragement. The Moon-Venus conjunction Wednesday afternoon could well be enough to move stocks higher again, although with the Sun moving ever closer to Saturn, I am not certain that any gains will hold here. Thursday would appear to display more obviously bearish characteristics as Mercury is in tense aspect with Pluto while the Sun conjoins Saturn in the first degree of Virgo. Friday also looks quite negative as Mercury comes under the growing influence of Rahu while the Moon bears down on Saturn. So generally, the first half of the week seems more bullish while the last two days seem more negative. Overall, I would lean towards a negative outcome for the week.

Next week (Sep 21-25) looks quite bearish, especially in the early going as Mercury will conjoin Saturn. This could move markets down substantially given Rahu’s continued influence on both. Despite some kind of midweek recovery, Friday may well be weaker again. The following week (Sep 28-Oct 2) also looks troublesome as Mercury will end its retrograde cycle in close aspect with Mars. The week will likely end on a negative note as that Mercury-Mars aspect will tighten while the Moon is in Saturn-ruled Aquarius. A very unusual and extremely negative pattern will form the week after from October 5-9 and could coincide with the worst week of this retracement period. Mercury will conjoin Saturn in very tight aspect with Rahu while Mars will conjoin Ketu. This pattern has the potential to push down stocks more than 10% for the week. Assuming we see the end of the rally this week (Sept 14-18), we could very well see 4000 tested on the Nifty by this time, perhaps lower. I am still uncertain if the retracement will end around mid-October or if we will see lower lows in November. Certainly another dip is likely in mid-November but it is unclear if it will be below the lows formed around October 9 or higher. A strong rally is likely to begin in late November and continue into December.

Next week (Sep 21-25) looks quite bearish, especially in the early going as Mercury will conjoin Saturn. This could move markets down substantially given Rahu’s continued influence on both. Despite some kind of midweek recovery, Friday may well be weaker again. The following week (Sep 28-Oct 2) also looks troublesome as Mercury will end its retrograde cycle in close aspect with Mars. The week will likely end on a negative note as that Mercury-Mars aspect will tighten while the Moon is in Saturn-ruled Aquarius. A very unusual and extremely negative pattern will form the week after from October 5-9 and could coincide with the worst week of this retracement period. Mercury will conjoin Saturn in very tight aspect with Rahu while Mars will conjoin Ketu. This pattern has the potential to push down stocks more than 10% for the week. Assuming we see the end of the rally this week (Sept 14-18), we could very well see 4000 tested on the Nifty by this time, perhaps lower. I am still uncertain if the retracement will end around mid-October or if we will see lower lows in November. Certainly another dip is likely in mid-November but it is unclear if it will be below the lows formed around October 9 or higher. A strong rally is likely to begin in late November and continue into December.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish

A brutal week for the dollar last week as US deficit fears combined with a renewed enthusiasm for equities as it closed Friday at 76.7. While I had been fairly bearish here on the Mars-Ketu aspect, I did not expect a selloff of this magnitude. Most of the problem can be traced back to Tuesday’s decline, which was the largest of the week. I had thought there would be more upward lift from the Venus trine to the ascendant but this failed to gain any traction whatsoever. There is no ready explanation for this decline, other than perhaps an earlier than expected manifestation of the Mars aspect. This is another reminder that astrology is very much a work in progress where knowledge is partial at best. Technically, the dollar is in a fairly negative situation with MACD falling along with most relevant moving averages. However, it is worth noting that even with the recent new low, MACD remains higher than its previous low in early August, possibly indicating a positive divergence and an incipient bottom. RSI at 32 is fast approaching the same oversold territory of early August and its previous lows. Given my generally bullish outlook for the dollar, I think we’re inching towards a solid bottom, probably one that will be put in around 76-76.5.

A brutal week for the dollar last week as US deficit fears combined with a renewed enthusiasm for equities as it closed Friday at 76.7. While I had been fairly bearish here on the Mars-Ketu aspect, I did not expect a selloff of this magnitude. Most of the problem can be traced back to Tuesday’s decline, which was the largest of the week. I had thought there would be more upward lift from the Venus trine to the ascendant but this failed to gain any traction whatsoever. There is no ready explanation for this decline, other than perhaps an earlier than expected manifestation of the Mars aspect. This is another reminder that astrology is very much a work in progress where knowledge is partial at best. Technically, the dollar is in a fairly negative situation with MACD falling along with most relevant moving averages. However, it is worth noting that even with the recent new low, MACD remains higher than its previous low in early August, possibly indicating a positive divergence and an incipient bottom. RSI at 32 is fast approaching the same oversold territory of early August and its previous lows. Given my generally bullish outlook for the dollar, I think we’re inching towards a solid bottom, probably one that will be put in around 76-76.5.

This week will probably see the beginning of some kind of meaningful reversal for the dollar as the Saturn-Uranus opposition will shift sentiment in a fundamental way. That said, I am still fairly bearish about the dollar at the start of the week as the Venus influence on Saturn-Uranus may temporarily raise the mood and further erode the dollar’s appeal. This positive Venus alignment could happen on either Tuesday or Wednesday and could well mark the low point, perhaps around 76. The dollar’s chance for a sudden and powerful rebound will increase as the week progresses. The Sun-Saturn-Uranus alignment on Thursday and Friday could reflect some unexpected world event that causes the market to look for safe haven. If we do get a reversal, it’s possible it could be a very sharp move. Overall, I think there is a good chance for the dollar to close higher on the week. Next week looks even more bullish, with steady gains likely well into October as Jupiter approaches its station October 15th. We could see further appreciation of the dollar into the second week of November, but I think the bulk of the rise will occur before mid-October.

The Euro soared to new highs for the year last week closing above 1.45. While I had been bullish on the Euro, I underestimated the size of the move. The Moon transiting the malefic 8th house was no match for Jupiter’s aspect on the natal Mars. With the Euro closing above its previous highs, it may empower bulls to take more liberties this week, but I am doubtful that they can push it much higher. Venus will conjoin natal Rahu on Monday and Tuesday, so that ought to be sufficient to tease out another cent or so on the upside. But once the Sun conjoins Saturn on Thursday, the full power of Saturn’s square aspect to the natal Moon will finally be felt. The result should be enough to erase any early week gains. For this reason, I believe there is more downside risk to the Euro here. With the potential for a big late week move, it’s hard to offer meaningful targets in the short term, although one would think 1.38-1.40 by October 9 would be a fairly doable. As predicted, the Indian Rupee gained ground last week closing below 48.5. Watch for more gains early this week with weakness later on. It will likely close in the 48.5-49 range by Friday.

Dollar

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bullish

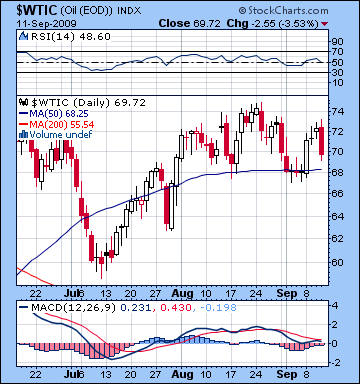

Despite a huge decline Friday, crude oil rose as expected last week closing just below $70. In last week’s newsletter I had forecast a significant run-up towards $72 on the Venus-Jupiter aspect late week and we were not disappointed as crude closed above $72 on Thursday. Friday’s profit taking also came off more or less as predicted, although I did not foresee the full extend of the decline as crude lost over 4%. Friday’s selloff was ominous because it was so much deeper than anything than occurred in equities. Technically, crude is diverging from stocks as it failed to make new highs last week. This is a sign that more investors are jumping off the commodity bandwagon. Even with the overall gain last week, MACD remains negative and its constituent moving averages are pointing south. We can also discern a bearish head and shoulders pattern forming from the August highs.

Despite a huge decline Friday, crude oil rose as expected last week closing just below $70. In last week’s newsletter I had forecast a significant run-up towards $72 on the Venus-Jupiter aspect late week and we were not disappointed as crude closed above $72 on Thursday. Friday’s profit taking also came off more or less as predicted, although I did not foresee the full extend of the decline as crude lost over 4%. Friday’s selloff was ominous because it was so much deeper than anything than occurred in equities. Technically, crude is diverging from stocks as it failed to make new highs last week. This is a sign that more investors are jumping off the commodity bandwagon. Even with the overall gain last week, MACD remains negative and its constituent moving averages are pointing south. We can also discern a bearish head and shoulders pattern forming from the August highs.

This week should start favourably enough for crude as Venus forms a nice sextile aspect with the Futures ascendant on Monday and Tuesday. Between those two days, there is a good chance that crude will move higher, although probably not back to $72. Wednesday could also see bulls dominate the scene, but that would appear to be their last opportunity to do so. The Sun-Saturn-Uranus alignment of Thursday and Friday has enormous power to move this market because it occurs exactly square the Futures ascendant. We could see a lot of volatility at that time, with the greatest risk being to the downside. While its not out of the realm of possibility that this alignment could produce a final spike higher, it whole pattern seems extremely tense and for that reason is more indicative of a decline. For the moment, I’m holding to my October target of $50.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish

Gold finally made it to $1000 last week as it closed Friday at $1006 on the continuous contract. This was in keeping with expectations as the Sun-Venus-Jupiter pattern delivered the goods on Friday, albeit a day later than forecast. As predicted, Tuesday and Wednesday were fairly weak although prices were somewhat stronger than anticipated as it closed above $990 on Wednesday. While gold rose last week, we can take some solace in the fact that gains never seriously challenged previous highs of $1020-1030. This is a sign of significant resistance in the market and that many traders are taking profits near this level. Technically, gold is in a strong position with MACD positive and turning upward. RSI stands at 74 and has moved into the overbought zone. While this needn’t indicate any imminent regression to the mean by itself, it nonetheless stands as a plausible piece of evidence for the bearish case. One can in fact make the argument that this break out above the resistance line ($960) of the pennant formation is one large, extended head fake that precedes a larger move down in the coming weeks. Unless and until gold makes a new high above $1030, that seems to be a more compelling analysis of the current situation.

Gold finally made it to $1000 last week as it closed Friday at $1006 on the continuous contract. This was in keeping with expectations as the Sun-Venus-Jupiter pattern delivered the goods on Friday, albeit a day later than forecast. As predicted, Tuesday and Wednesday were fairly weak although prices were somewhat stronger than anticipated as it closed above $990 on Wednesday. While gold rose last week, we can take some solace in the fact that gains never seriously challenged previous highs of $1020-1030. This is a sign of significant resistance in the market and that many traders are taking profits near this level. Technically, gold is in a strong position with MACD positive and turning upward. RSI stands at 74 and has moved into the overbought zone. While this needn’t indicate any imminent regression to the mean by itself, it nonetheless stands as a plausible piece of evidence for the bearish case. One can in fact make the argument that this break out above the resistance line ($960) of the pennant formation is one large, extended head fake that precedes a larger move down in the coming weeks. Unless and until gold makes a new high above $1030, that seems to be a more compelling analysis of the current situation.

This week may see gold add to its recent gains in the early going, perhaps as Venus aligns with Saturn, Uranus and Neptune into Tuesday and perhaps Wednesday. I would not rule out a rally towards $1020. But any positive sentiment on Wednesday may be overshadowed by the Sun’s entry into Virgo and its conjunction with bearish Saturn. The Sun is the primary significator for gold so the Sun’s conjunction with Saturn is likely to coincide with some kind of pullback. This may happen by Thursday or Friday as the Moon adds an extra dimension to the multi-planet alignment. There is enormous potential connected with this configuration so it could translate into a significant move. Given the tense nature of these aspects, the direction of this move should be down. That said, we cannot rule out the possibility of a sudden rise at the end of the week. This seems fairly unlikely given the Saturn influence, but markets are unpredictable and this one has confounded me on many occasions. Next week looks bearish for gold, so the retracement may begin in earnest then. With transiting Saturn aspecting the natal Sun in the ETF chart and Ketu bearing down on the natal Saturn, gold will likely stage a major correction here, very likely lower than its July lows of $910. Given the magnitude of those twin afflictions, that is a conservative target by mid-October. We could well fall below $860 by that time, but let’s first see how the market unfolds this week.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish.