- Another opportunity for a significant decline, especially early in the week

- Dollar poised to break out of doldrums

- Gold likely to slide

- Crude to retrace below 50 DMA

- Another opportunity for a significant decline, especially early in the week

- Dollar poised to break out of doldrums

- Gold likely to slide

- Crude to retrace below 50 DMA

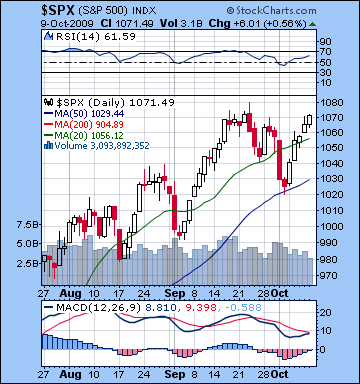

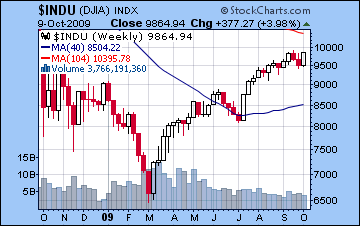

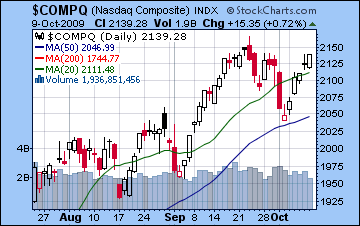

With the continued weakness of the dollar, investors once again opted for the relative security of equities last week as stocks rose 4%. In zombie-like fashion, the market drifted ever higher in all five sessions negating the previous week’s sell-off as the market matched the late September highs. The Dow closed at 9864 while the S&P finished at 1071. Given my very bearish outlook here, this week was particularly painful as I had expected the Mercury-Saturn conjunction to move prices lower. Instead, the latent strength of Mercury in Virgo, its sign of exaltation, seems to have been sufficient to not only protect it from the twin ravages of Saturn and Rahu, but also to transform it into useful energy that took the prices higher. While I noted Mercury’s strength in last week’s newsletter, I did not expect it could reverse the polarity of the entire planetary set-up. While this hard lesson in planetary valences offers little comfort to those on the short side, it nonetheless provides some measure of explanation. Monday was positive as I expected it might be on the Venus-Jupiter aspect, but Tuesday’s rise fatally wounded our weekly decline scenario since that coincided with the Mercury-Saturn conjunction. The bullishness prevailed as long as Mercury was within spitting distance of Saturn through the week. Friday saw yet another gain, and indeed I had anticipated that unfortunate eventuality given the nice Venus-Uranus-Neptune aspect and the approach of Sun-Jupiter. Nonetheless, it was a very tough week for bears, coming as it did after the promising decline of the previous week.

With the continued weakness of the dollar, investors once again opted for the relative security of equities last week as stocks rose 4%. In zombie-like fashion, the market drifted ever higher in all five sessions negating the previous week’s sell-off as the market matched the late September highs. The Dow closed at 9864 while the S&P finished at 1071. Given my very bearish outlook here, this week was particularly painful as I had expected the Mercury-Saturn conjunction to move prices lower. Instead, the latent strength of Mercury in Virgo, its sign of exaltation, seems to have been sufficient to not only protect it from the twin ravages of Saturn and Rahu, but also to transform it into useful energy that took the prices higher. While I noted Mercury’s strength in last week’s newsletter, I did not expect it could reverse the polarity of the entire planetary set-up. While this hard lesson in planetary valences offers little comfort to those on the short side, it nonetheless provides some measure of explanation. Monday was positive as I expected it might be on the Venus-Jupiter aspect, but Tuesday’s rise fatally wounded our weekly decline scenario since that coincided with the Mercury-Saturn conjunction. The bullishness prevailed as long as Mercury was within spitting distance of Saturn through the week. Friday saw yet another gain, and indeed I had anticipated that unfortunate eventuality given the nice Venus-Uranus-Neptune aspect and the approach of Sun-Jupiter. Nonetheless, it was a very tough week for bears, coming as it did after the promising decline of the previous week.

The bulls have gamely pushed the market back up to its previous highs, forming a potentially bearish double top. Failure to move above 1080 here would be a bearish signal that could spark significant selling. I don’t see higher highs as a likely scenario here, but one should be aware of that possible outcome should the market eclipse 1080 on the upside. While last week’s gains were impressive if only because they were so relentless, we do note that it was achieved on falling volume. Indeed, the volume of this current run-up to 1070 was lower than the previous rise to that level in mid-September. This should give bears some hope that the rally could finally be weakening, although we’ve jumped the gun several times already on that score. The bulls were strong enough to send in enough buyers at last week’s lows at the 50 DMA (1020) to push prices above their 20 DMA. As a result, the market is back up at the top of the rising wedge pattern as it encounters resistance at 1070-1080. Significantly, despite last week’s gains, MACD has yet to form a bullish crossover indicating that a reversal down is still a credible technical possibility. And we can still detect a bearish divergence as the this week’s highs have not been matched by the moving averages in MACD. The same bearish divergence occurs in the RSI as the current reading of 61 falls short of the September highs of 71. Since I am still bearish for this week, it will be very important to see how far the market corrects. If it only backs off to the 50 DMA (now at 1030), then would indicate that more rallies within the wedge pattern towards 1080 are possible. But if the market makes a new low that takes out the previous week’s low of 1020, then that would be a more bearish signal. This is still very possible. That outcome would make it more likely that we are in a larger retracement pattern from now until November that could revisit the 200 DMA of SPX 900 or the July lows of 880.

Like last week, the current planetary set-up contains significant downside risk. Jupiter ends its retrograde cycle and begins to move forward on Tuesday. This is more of a background influence but it may stimulate some kind of change in market direction. Since the trend has mostly been up during its retrograde cycle, it is conceivable that the trend could undergo some change. The ingresses of slow moving Uranus and Neptune are still in play this week so that remains a potential amplifying effect for any down move we might see. Moreover, Saturn and Rahu also move quite slowly and are therefore still in the same close aspect they were in last week. Last week’s rise coincided with fast moving Mercury acting as a triggering planet for the release pent-up energy. This week will see Venus in the same role as triggering planet for the Saturn-Rahu configuration. While Venus is considered a more positive planet than Mercury, I don’t think its contact this week will result in a similar upward move. In fact, I think there’s good reason to expect a decline here because Venus is seriously weakened by virtue of its debilitated state in Virgo. Whereas Mercury in Virgo gains strength, Venus in Virgo loses strength and this may generate more negative outcomes from malefic Saturn and Rahu. Monday will feature Venus just one degree away from Saturn with the Moon in Cancer with Mars and Rahu. Venus will make its exact conjunction on Tuesday, so both of those days are possible down days. After being badly burned last week, I’m uncertain what kind of decline we could expect here, but it could very well be big, and perhaps approach 10%. Given all the apparent bullishness out there, it could be less than that, but it’s very hard to say. Gains seem more likely towards the end of the week, perhaps on Thursday and Friday as the Sun forms aspects to Uranus-Neptune. Friday seems somewhat better of the two days since the Moon conjoins Venus during the trading day. So there is a good chance for declines this week, although the late week sentiment will likely mitigate their extent.

Like last week, the current planetary set-up contains significant downside risk. Jupiter ends its retrograde cycle and begins to move forward on Tuesday. This is more of a background influence but it may stimulate some kind of change in market direction. Since the trend has mostly been up during its retrograde cycle, it is conceivable that the trend could undergo some change. The ingresses of slow moving Uranus and Neptune are still in play this week so that remains a potential amplifying effect for any down move we might see. Moreover, Saturn and Rahu also move quite slowly and are therefore still in the same close aspect they were in last week. Last week’s rise coincided with fast moving Mercury acting as a triggering planet for the release pent-up energy. This week will see Venus in the same role as triggering planet for the Saturn-Rahu configuration. While Venus is considered a more positive planet than Mercury, I don’t think its contact this week will result in a similar upward move. In fact, I think there’s good reason to expect a decline here because Venus is seriously weakened by virtue of its debilitated state in Virgo. Whereas Mercury in Virgo gains strength, Venus in Virgo loses strength and this may generate more negative outcomes from malefic Saturn and Rahu. Monday will feature Venus just one degree away from Saturn with the Moon in Cancer with Mars and Rahu. Venus will make its exact conjunction on Tuesday, so both of those days are possible down days. After being badly burned last week, I’m uncertain what kind of decline we could expect here, but it could very well be big, and perhaps approach 10%. Given all the apparent bullishness out there, it could be less than that, but it’s very hard to say. Gains seem more likely towards the end of the week, perhaps on Thursday and Friday as the Sun forms aspects to Uranus-Neptune. Friday seems somewhat better of the two days since the Moon conjoins Venus during the trading day. So there is a good chance for declines this week, although the late week sentiment will likely mitigate their extent.

Next week (Oct 19-23) appears more bullish ahead of the Mercury-Jupiter aspect on Oct 20-21. I do not expect this to be a very powerful rally since there is a Mars-Pluto aspect on Monday and a Sun-Saturn aspect on Thursday that could limit positive sentiment. The following week (Oct 26-30) looks more bearish as a Sun-Mars square and Mercury-Saturn aspect early in the week are likely to outweigh the one or two up days resulting from the Venus-Jupiter aspect. November seems likely to continue the bearish trend, at least in the beginning of the month. Saturn will square Pluto by mid-November and there are several short term contacts that could trigger this larger aspect and keep prices depressed. The extended weakness of stocks here will likely coincide with a rebounding US dollar. So it’s possible we see the correction unfold gradually, with a less than 10% pullback this week, and then a week of short-lived or failed rallies before declining 10% in late October and early November. Despite the real prospect of a rally heading into December, the market looks like it will again move lower in late December and January. Depending on what kind of correction we see in the next four weeks, this early winter drop could even possibly retest the March lows. It’s still early days and many things would have to happen first before that outcome comes to pass, but it is not outside the realm of possibility. Indeed, it may be the popular sense that the market have finally bottomed in January 2010 that will spark another strong rally going into the spring.

Next week (Oct 19-23) appears more bullish ahead of the Mercury-Jupiter aspect on Oct 20-21. I do not expect this to be a very powerful rally since there is a Mars-Pluto aspect on Monday and a Sun-Saturn aspect on Thursday that could limit positive sentiment. The following week (Oct 26-30) looks more bearish as a Sun-Mars square and Mercury-Saturn aspect early in the week are likely to outweigh the one or two up days resulting from the Venus-Jupiter aspect. November seems likely to continue the bearish trend, at least in the beginning of the month. Saturn will square Pluto by mid-November and there are several short term contacts that could trigger this larger aspect and keep prices depressed. The extended weakness of stocks here will likely coincide with a rebounding US dollar. So it’s possible we see the correction unfold gradually, with a less than 10% pullback this week, and then a week of short-lived or failed rallies before declining 10% in late October and early November. Despite the real prospect of a rally heading into December, the market looks like it will again move lower in late December and January. Depending on what kind of correction we see in the next four weeks, this early winter drop could even possibly retest the March lows. It’s still early days and many things would have to happen first before that outcome comes to pass, but it is not outside the realm of possibility. Indeed, it may be the popular sense that the market have finally bottomed in January 2010 that will spark another strong rally going into the spring.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish

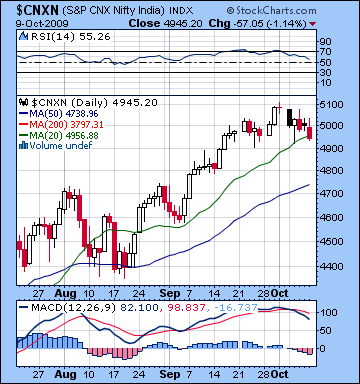

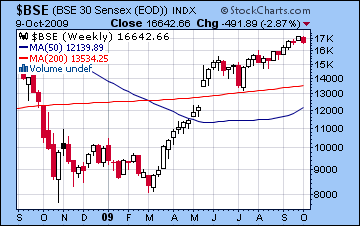

Despite some positive earnings news from Infosys, stocks in Mumbai lost 3% last week as traders took profits ahead of uncertain third quarter results. The long-awaited break in the rally finally arrived as the Nifty ended the week at 4945 while the Sensex closed at 16,642. While I had been bearish last week, the absence of any major declines on the Mercury-Saturn conjunction was disappointing. Monday saw a fall of just 1% as Mercury entered Virgo and Mars entered Cancer. Tuesday’s mild recovery may be attributed to the Moon’s relative strength in Venus-ruled Bharani. But Wednesday’s modest decline coincided exactly with the Mercury-Saturn conjunction. This outcome was perhaps less negative than expected because Mercury was strong in Virgo, its sign of exaltation, and hence better able to defend its portfolio in the face of hostile Saturn and Rahu. After Thursday’s gentle rise with the Moon in Rohini, Friday saw another middle range loss coinciding with the Mars-Ketu conjunction. I had wondered about the possibility of a rally then given the approaching Sun-Jupiter aspect and while it may have affected other global markets, but it never materialized in Mumbai.

Despite some positive earnings news from Infosys, stocks in Mumbai lost 3% last week as traders took profits ahead of uncertain third quarter results. The long-awaited break in the rally finally arrived as the Nifty ended the week at 4945 while the Sensex closed at 16,642. While I had been bearish last week, the absence of any major declines on the Mercury-Saturn conjunction was disappointing. Monday saw a fall of just 1% as Mercury entered Virgo and Mars entered Cancer. Tuesday’s mild recovery may be attributed to the Moon’s relative strength in Venus-ruled Bharani. But Wednesday’s modest decline coincided exactly with the Mercury-Saturn conjunction. This outcome was perhaps less negative than expected because Mercury was strong in Virgo, its sign of exaltation, and hence better able to defend its portfolio in the face of hostile Saturn and Rahu. After Thursday’s gentle rise with the Moon in Rohini, Friday saw another middle range loss coinciding with the Mars-Ketu conjunction. I had wondered about the possibility of a rally then given the approaching Sun-Jupiter aspect and while it may have affected other global markets, but it never materialized in Mumbai.

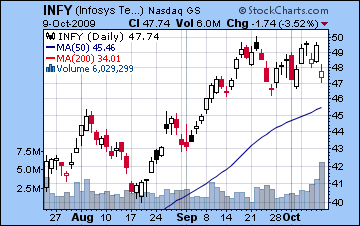

Technically, the market appears increasingly vulnerable to more declines. MACD has turned negative and exhibits a bearish crossover. The October 1 high of 5083 on the Nifty shows a bearish "doji" candlestick, which is a classic sign of a imminent reversal and decline. RSI stands at 55 and is falling since its fairly long residence around the 70 level. This is another bearish indicator. Even more worrisome is that volume seemed to rise during down days, as the New York INFY chart shows. Falling prices and higher volumes do not bode well for bulls and may signal further declines to come. The currently market sits on its 20 DMA which is the approximate support level of the bearish rising wedge that dates back to July. If it should fall below this level, then it might find some support at its 50 DMA at 4750. Given the planetary situation, I would be skeptical about the durability of the support there, but it’s conceivable it may hold it for another week or two. Beyond that, the 4400-4500 level seems to offer reasonable support which will likely be tested over the next four weeks.

This week also looks bearish, although with a greater prospect for steeper declines early in the week. Last week’s Mercury-Saturn-Rahu produced only limited downside, perhaps due to Mercury’s relatively strong condition in Virgo. As slow moving planets, Saturn and Rahu remain in fairly close aspect but Mercury’s place will be taken now by Venus. While Venus is normally a more benefic planet than Mercury, its current condition in Virgo is severely weakened. Venus in Virgo is in a debilitated state and therefore should be seen as much weaker than Mercury was last week. For this reason, Venus may bring out more of the bearishness in both Saturn and Rahu. Both Monday and Tuesday could both be negative, with Tuesday looking somewhat worse since the Venus-Saturn conjunction is exact on that day. Wednesday may be an in-between day with more downside probing possible. Gains are more likely to occur Thursday and Friday as the Sun aspects both Uranus and Neptune. Even with two up days possible late in the week, the early week does have the potential for sizable declines which should tilt the week towards the bears. The twin ingresses of Uranus and Neptune I alluded to last week are still very much in play this week since they are very slow moving planets. These ingresses add a "wild card" element to the mix, and could serve to amplify any moves we see here. Forecasting levels is extremely difficult, but I do believe that we are looking at a larger than normal pullback. I would not be surprised to see the market break below 4750 this week.

This week also looks bearish, although with a greater prospect for steeper declines early in the week. Last week’s Mercury-Saturn-Rahu produced only limited downside, perhaps due to Mercury’s relatively strong condition in Virgo. As slow moving planets, Saturn and Rahu remain in fairly close aspect but Mercury’s place will be taken now by Venus. While Venus is normally a more benefic planet than Mercury, its current condition in Virgo is severely weakened. Venus in Virgo is in a debilitated state and therefore should be seen as much weaker than Mercury was last week. For this reason, Venus may bring out more of the bearishness in both Saturn and Rahu. Both Monday and Tuesday could both be negative, with Tuesday looking somewhat worse since the Venus-Saturn conjunction is exact on that day. Wednesday may be an in-between day with more downside probing possible. Gains are more likely to occur Thursday and Friday as the Sun aspects both Uranus and Neptune. Even with two up days possible late in the week, the early week does have the potential for sizable declines which should tilt the week towards the bears. The twin ingresses of Uranus and Neptune I alluded to last week are still very much in play this week since they are very slow moving planets. These ingresses add a "wild card" element to the mix, and could serve to amplify any moves we see here. Forecasting levels is extremely difficult, but I do believe that we are looking at a larger than normal pullback. I would not be surprised to see the market break below 4750 this week.

Next week (Oct 19-23) looks more bullish on the Mercury-Jupiter aspect on the 20th, although the Mars-Pluto aspect on the 19th and the Sun-Saturn aspect on the 22nd may limit the upside. The following week (Oct 26-30) looks more mixed to negative with bearishness early in the week on the Mercury-Saturn aspect and Sun-Mars square. Some recovery is likely from midweek on as Venus aspects Jupiter but it does not seem like it will be enough to move markets higher. Early November also seems prone to weakness as Mercury squares Mars on the 2nd. With an interim bottom likely in November, the month should gradually turn more bullish and the rally could be quite strong on the Jupiter-Neptune conjunction as we move into December. This rally is likely to be greater than 10%, perhaps as much as 20-30%. So depending on how low we are in early November, it may well bring us back towards 2009 highs. At this point, I tend to think we’ve already seen the highs for the year although if we only retrace 20% by November then I will revisit that question later. If we do manage to match them in December, the market is likely to correct as we head towards the New Year once Mars turns retrograde on 19 December. This may well mark the beginning of another period of significant weakness that could extend into mid-January and the Saturn retrograde station.

Next week (Oct 19-23) looks more bullish on the Mercury-Jupiter aspect on the 20th, although the Mars-Pluto aspect on the 19th and the Sun-Saturn aspect on the 22nd may limit the upside. The following week (Oct 26-30) looks more mixed to negative with bearishness early in the week on the Mercury-Saturn aspect and Sun-Mars square. Some recovery is likely from midweek on as Venus aspects Jupiter but it does not seem like it will be enough to move markets higher. Early November also seems prone to weakness as Mercury squares Mars on the 2nd. With an interim bottom likely in November, the month should gradually turn more bullish and the rally could be quite strong on the Jupiter-Neptune conjunction as we move into December. This rally is likely to be greater than 10%, perhaps as much as 20-30%. So depending on how low we are in early November, it may well bring us back towards 2009 highs. At this point, I tend to think we’ve already seen the highs for the year although if we only retrace 20% by November then I will revisit that question later. If we do manage to match them in December, the market is likely to correct as we head towards the New Year once Mars turns retrograde on 19 December. This may well mark the beginning of another period of significant weakness that could extend into mid-January and the Saturn retrograde station.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish-neutral

Amidst rumour and continued weakness, the US dollar got butchered again last week. If it weren’t for Fed Chair Bernanke’s reassuring comments Friday, it may well have fallen through significant technical support. After trading well below 76 Thursday, it finally closed Friday at 76.43. My bullish forecast was eviscerated as Mercury’s formidable Virgoan defenses proved more than sufficient to stave off the Saturnine gloom. I had thought the dollar would receive more of a boost from the approaching Jupiter station next week which lines up fairly close to an aspect with the natal ascendant of the USDX chart. This has yet to show any results, except perhaps with Friday’s Sun-Jupiter trine which framed the ascendant quite nicely. It’s possible that the dollar will begin to trend higher only once Jupiter has changed direction. While that is plausible enough, the medium term offers diminishing returns since Jupiter will soon be moving out of range of the aspect and its supportive effects will be on the wane. Despite the sorry state of the dollar, MACD has yet to show a bearish crossover. Also we can see a positive divergence as lower prices have not been reflected in lower constituent moving averages. RSI sits at a listless 43 but is turning up. The dollar remains trapped in the bottom of the falling wedge pattern, with resistance level of the 50 DMA at 77.5 looking as far away as ever. Maybe 77.5 is just a mirage, like an palm-lined oasis in an endless desert of sun burnt bearishness. Let’s hope not.

Amidst rumour and continued weakness, the US dollar got butchered again last week. If it weren’t for Fed Chair Bernanke’s reassuring comments Friday, it may well have fallen through significant technical support. After trading well below 76 Thursday, it finally closed Friday at 76.43. My bullish forecast was eviscerated as Mercury’s formidable Virgoan defenses proved more than sufficient to stave off the Saturnine gloom. I had thought the dollar would receive more of a boost from the approaching Jupiter station next week which lines up fairly close to an aspect with the natal ascendant of the USDX chart. This has yet to show any results, except perhaps with Friday’s Sun-Jupiter trine which framed the ascendant quite nicely. It’s possible that the dollar will begin to trend higher only once Jupiter has changed direction. While that is plausible enough, the medium term offers diminishing returns since Jupiter will soon be moving out of range of the aspect and its supportive effects will be on the wane. Despite the sorry state of the dollar, MACD has yet to show a bearish crossover. Also we can see a positive divergence as lower prices have not been reflected in lower constituent moving averages. RSI sits at a listless 43 but is turning up. The dollar remains trapped in the bottom of the falling wedge pattern, with resistance level of the 50 DMA at 77.5 looking as far away as ever. Maybe 77.5 is just a mirage, like an palm-lined oasis in an endless desert of sun burnt bearishness. Let’s hope not.

This week is yet another opportunity for a break out as the debilitated Venus with Saturn offers up a potential equities correction that could make the dollar a safe haven play. That said, the dollar chart shows only lukewarm confirmation of it. On the positive side, Jupiter will still form an aspect with the ascendant (and hence Uranus and Mercury) and will now be moving forward. Also the Sun will transit the 11th house of gains, albeit past the strongest point of the house so that could diminish hopes somewhat. Mercury may also be able to lend a hand to the greenback this week since it will conjoin the Midheaven on Monday and Tuesday. All of these influences are supportive. But Saturn is forming a close aspect with the natal Sun, a very powerful and potentially nasty aspect. While it’s possible that we’ve seen most of the negativity from this aspect manifest already, we cannot rule out further downside here. Inferentially, the Euro chart looks weak this week so that should prove helpful for the dollar, but there is still room for doubt about the near term prospects for the dollar. Things seem to improve as time goes on, however, as Venus will conjoin the Midheaven on Oct 19-20. November also seems as if it will bring more bullishness to the dollar.

As investors dumped the dollar, the Euro gained ground closing at 1.473. I had expected more downside from the Mercury-Saturn conjunction at the ascendant on the natal chart, but Mercury’s surprising strength in Virgo was able to transform the situation. Saturn remains an ongoing problem for the Euro and once Mercury moves away from the ascendant there is some reason to believe that it will weaken once again. This week will see debilitated Venus conjoin the ascendant so that will be an important test of the Euro natal chart. The sheer fact of the double conjunction on the ascendant could send the Euro higher still, but I think the most likely outcome will be a decline. Some rebound is likely towards the end of the week as the Sun-Uranus aspect will set up on the natal Jupiter. Next week seems fairly mixed as Sun opposes the natal Saturn on Monday the 19th for a probable decline but it may be buoyed by the Mercury-Mars conjunction on Tuesday and Wednesday. Again, the outlook seems mixed at best for the Euro as the Jupiter-Mars aspect in November will be persistently undermined by the close Saturn-Pluto aspect near the ascendant. The Indian Rupee is coming off a very bullish week at it closed Friday at 46.4. I don’t expect this gain to hold, however, as the dollar seems poised for a comeback in the coming weeks. With Venus conjunct Saturn this week, we could see the Rupee fall to 47 in short order.

Dollar

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bullish

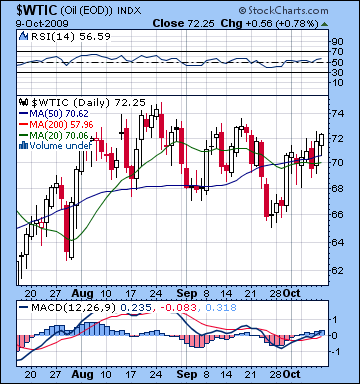

With the dollar so completely out of favour, commodities rebounded last week as crude once again rose over $70 to close at $72. We did see early gains as expected on the Sun-Mercury aspect and Wednesday was likewise in line with expectations as the pullback coincided with the Mercury-Saturn conjunction. But late week trading saw the bulls take control again which was an anomalous result given the Mars-Ketu conjunction. As disappointing as the rise was, some of my forecast was dependent on slow moving planets such as Saturn so there is a certain time ambiguity involved here. From a technical perspective, crude seems to be very much in flux here as it formed a lower high Friday, with each high made since August being lower than the previous one. Crude is currently trading very close to both its 20 and 50 DMA, a sign that there is indecision regarding future price direction. On the positive side, MACD is turning positive and features a bullish crossover. We can still discern a bearish divergence there since MACD levels have not kept up with prices. RSI is fairly bullish at 56 and rising. Overall, the technical picture seems very mixed and could go either way.

With the dollar so completely out of favour, commodities rebounded last week as crude once again rose over $70 to close at $72. We did see early gains as expected on the Sun-Mercury aspect and Wednesday was likewise in line with expectations as the pullback coincided with the Mercury-Saturn conjunction. But late week trading saw the bulls take control again which was an anomalous result given the Mars-Ketu conjunction. As disappointing as the rise was, some of my forecast was dependent on slow moving planets such as Saturn so there is a certain time ambiguity involved here. From a technical perspective, crude seems to be very much in flux here as it formed a lower high Friday, with each high made since August being lower than the previous one. Crude is currently trading very close to both its 20 and 50 DMA, a sign that there is indecision regarding future price direction. On the positive side, MACD is turning positive and features a bullish crossover. We can still discern a bearish divergence there since MACD levels have not kept up with prices. RSI is fairly bullish at 56 and rising. Overall, the technical picture seems very mixed and could go either way.

This week crude has another opportunity to sell-off as the Venus-Saturn conjunction will be in aspect with the natal Rahu. Venus could therefore serve as a trigger for the Saturn-Rahu aspect and take prices down sharply. The Mars aspect to the natal Pluto adds a small amount of bearish energy. By week’s end, the price is likely to bounce as the transiting Sun will aspect Uranus-Neptune and form an alignment with the ascendant. Again, I think $60 is possible this week, although $64-66 may be a more sensible target. The following week seems more mixed with increased volatility as price swings will be fairly large. Overall, it may well close higher. Late October and early November also look quite bearish so further declines are likely. After a decent rally probably starting in mid-November and extending into December, crude will again turn bearish once Mars turns retrograde on December 19. That early winter decline will likely be large enough to erase any gains we see in the autumn period and the Jupiter-Neptune conjunction.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish

As investors bailed out of the dollar, gold soared 5% before closing at $1049. The extreme bullishness was diametrically opposite from my bearish forecast and created a number of unanswered questions. Clearly the simultaneous four planet ingress was helpful to gold as the uncertainty it created in the dollar drove investors into bullion as a safe haven. Also the approach of the Sun-Jupiter aspect was another supportive force for prices. But more puzzling was the inability of the Saturn to natal Sun aspect in the ETF chart to push prices lower. Also the Mars-Ketu conjunction should have fueled more selling late in the week but Friday’s decline was very tepid. Gold is now trading well above its key moving averages and MACD has turned higher. We can still see a bearish divergence there, although with new highs its unclear how much relevance technical points may still have. RSI is once again over 70 although it, too, may be seen as exhibiting a negative divergence when compared with the previous high in September. Some support is possible around $1020, although I’m not sure how solid it would be. A more reliable support level might be the 50 DMA at $980. This may well be where gold is headed in the short term.

As investors bailed out of the dollar, gold soared 5% before closing at $1049. The extreme bullishness was diametrically opposite from my bearish forecast and created a number of unanswered questions. Clearly the simultaneous four planet ingress was helpful to gold as the uncertainty it created in the dollar drove investors into bullion as a safe haven. Also the approach of the Sun-Jupiter aspect was another supportive force for prices. But more puzzling was the inability of the Saturn to natal Sun aspect in the ETF chart to push prices lower. Also the Mars-Ketu conjunction should have fueled more selling late in the week but Friday’s decline was very tepid. Gold is now trading well above its key moving averages and MACD has turned higher. We can still see a bearish divergence there, although with new highs its unclear how much relevance technical points may still have. RSI is once again over 70 although it, too, may be seen as exhibiting a negative divergence when compared with the previous high in September. Some support is possible around $1020, although I’m not sure how solid it would be. A more reliable support level might be the 50 DMA at $980. This may well be where gold is headed in the short term.

This week is another opportunity for a decline in gold as the Saturn-Sun aspect gets another chance to show its stuff through the triggering effects of Venus. Again, we are more likely to see something sharp here, possibly taking it below $1000 by early next week. Monday and Tuesday could see gold decline on the Venus-Saturn conjunction. That would be the most likely scenario with some rebound late in the week. Further weakening also seems likely when Mars aspects the natal ETF nodes October 20, and the ETF natal Mars October 26. November has two potentially offsetting influences, with Jupiter in a bullish conjunction with the natal Moon while Saturn squares Pluto close to the natal ascendant. These could simply reflect range bound trading between $910 and $1020. A more likely outcome is seen through the Mars retrograde cycle that begins December 19. This looks quite bearish for gold and will continue into 2010. Gold seems likely to fall below most recent support levels at that time, so we should see it trade below $900 then at the latest. The trend seems negative until at least February.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish