- Declines more likely on Sun-Mars square aspect

- Dollar should strengthen, especially towards week’s end

- Gold will likely weaken

- Crude vulnerable to declines

- Declines more likely on Sun-Mars square aspect

- Dollar should strengthen, especially towards week’s end

- Gold will likely weaken

- Crude vulnerable to declines

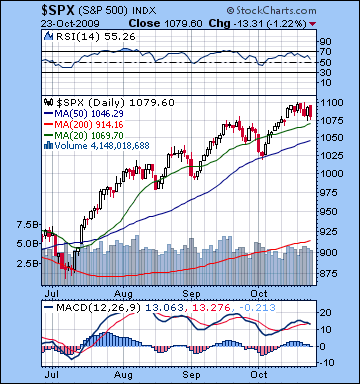

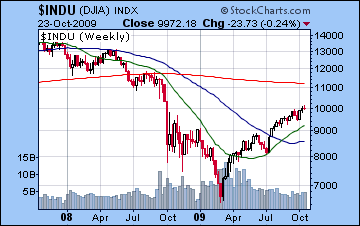

Despite generally positive earnings reports, stocks in New York edged lower on the week as investors were in the mood to take profits after the extended rally. After bouncing off the 1100 level a couple of times, the S&P closed 1% lower at 1079 while the Dow finished at 9972. This mildly bearish outcome was largely in keeping with expectations, mostly because I had been fairly neutral last week. There was a tug of war between planetary aspects that made it difficult to decide on a probable outcome, especially since it was unlikely to veer too far from the week’s opening price. So Monday ended up positive, presumably on the approaching Mercury-Jupiter aspect, while Tuesday and Wednesday were both down days as the bearishness of the Sun-Saturn aspect arrived a little early. Friday’s decline was a potentially important sign of furthering weakening of the market. In practical terms, the market sold off despite positive earnings news, a possible clue that more investors were "selling the news" and had discounted much of the earnings recovery story. In astrological terms, the approach of the positive Mercury-Uranus-Neptune pattern only managed to generate gains at the open as sellers took over for the rest of the day and pushed prices lower. This is an indication that the more negative medium term influences may be overriding the short term positive aspects going forward. This lends some support to the notion that further declines are more likely in the weeks ahead.

Despite generally positive earnings reports, stocks in New York edged lower on the week as investors were in the mood to take profits after the extended rally. After bouncing off the 1100 level a couple of times, the S&P closed 1% lower at 1079 while the Dow finished at 9972. This mildly bearish outcome was largely in keeping with expectations, mostly because I had been fairly neutral last week. There was a tug of war between planetary aspects that made it difficult to decide on a probable outcome, especially since it was unlikely to veer too far from the week’s opening price. So Monday ended up positive, presumably on the approaching Mercury-Jupiter aspect, while Tuesday and Wednesday were both down days as the bearishness of the Sun-Saturn aspect arrived a little early. Friday’s decline was a potentially important sign of furthering weakening of the market. In practical terms, the market sold off despite positive earnings news, a possible clue that more investors were "selling the news" and had discounted much of the earnings recovery story. In astrological terms, the approach of the positive Mercury-Uranus-Neptune pattern only managed to generate gains at the open as sellers took over for the rest of the day and pushed prices lower. This is an indication that the more negative medium term influences may be overriding the short term positive aspects going forward. This lends some support to the notion that further declines are more likely in the weeks ahead.

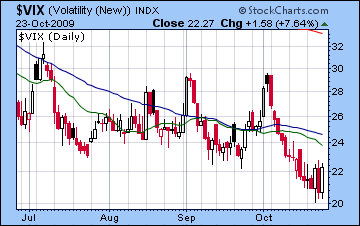

Interestingly, the market appeared a little more uncertain last week as we saw several intraday reversals, most notably Wednesday’s late day sell-off. While the volatility index ($VIX) remains very low at 22 and indicative of growing complacency, last week’s selling after good news increases the likelihood that the market may be ripe for correction. RSI is trending lower at 55 and still exhibits a bearish divergence from its highs in early August. MACD is also trending lower and is on the verge of a negative crossover. It, too, remains in an ongoing bearish divergence as higher highs are not being reflected in its current level of 13. Volume was fairly steady last week although we could note that the lowest volume day occurred with Monday’s gain while the highest volume day was Wednesday’s decline. Momentum is still quite bullish, however, as the 20 and 50 DMA are still rising and show no imminent signs of a bearish crossover. After the length of this rally, one wonders how quickly the market will turn south if and when the 20 DMA falls below the 50 DMA. The failure of the S&P to break above the 1100 level should be another source of concern for bulls since this is the resistance level in the rising wedge pattern. With more declines likely this week, the key support levels to watch are 1050-1060 which is an approximate support of the wedge and 1046 which is the 50 DMA. If the S&P breaks below both of these levels, it could well invite more selling that takes the market down closer to its 200 DMA at 914. With a large treasury auction due this week and the Fed no longer acting as a buyer, there is additional reason to suspect that the market will weaken. Just how much weakening remains an open question, although the astrology still points to something larger than a standard 10% correction.

This week features two aspects and both happen to come exact on Thursday. On the bullish side, Venus will come under Jupiter’s aspect much the same way that Mercury did last week. This is a fairly short-lived influence and may only produce one or, at most, two up days. Given the Moon will join Jupiter in Capricorn on Monday and Tuesday, those are the mostly likely days for gains here, although Tuesday’s close may be weak. On the bearish side, the Sun forms a square aspect with Mars also on Thursday. This is likely to be the more influential aspect this week since this will last longer owing to their relatively similar velocities. With both fiery planets involved in this aspect, we may see sudden shifts in mood and a tendency towards quick or even aggressive actions. Mercury forms a minor aspect with Saturn late Tuesday and early Wednesday so that is another indication for selling. Generally, declines may be more likely as the week goes on. Friday sees the Moon opposite Saturn so that may also see sellers dominate. With Rahu moving into the first degree of Capricorn this week, an activation of the September 18 Saturn-Uranus opposition is also possible. This is one of those bearish medium term influences that could override other temporary bullish considerations (e.g. the Venus-Jupiter aspect) and take the market lower. Overall, the planets look more bearish this week although I’m not certain if we will break below any significant support levels. If we see a decent gain on the Venus-Jupiter aspect, then it is possible we could remain trapped in the wedge somewhere between 1050 and 1080. Nonetheless, this week looks more bearish than last week.

This week features two aspects and both happen to come exact on Thursday. On the bullish side, Venus will come under Jupiter’s aspect much the same way that Mercury did last week. This is a fairly short-lived influence and may only produce one or, at most, two up days. Given the Moon will join Jupiter in Capricorn on Monday and Tuesday, those are the mostly likely days for gains here, although Tuesday’s close may be weak. On the bearish side, the Sun forms a square aspect with Mars also on Thursday. This is likely to be the more influential aspect this week since this will last longer owing to their relatively similar velocities. With both fiery planets involved in this aspect, we may see sudden shifts in mood and a tendency towards quick or even aggressive actions. Mercury forms a minor aspect with Saturn late Tuesday and early Wednesday so that is another indication for selling. Generally, declines may be more likely as the week goes on. Friday sees the Moon opposite Saturn so that may also see sellers dominate. With Rahu moving into the first degree of Capricorn this week, an activation of the September 18 Saturn-Uranus opposition is also possible. This is one of those bearish medium term influences that could override other temporary bullish considerations (e.g. the Venus-Jupiter aspect) and take the market lower. Overall, the planets look more bearish this week although I’m not certain if we will break below any significant support levels. If we see a decent gain on the Venus-Jupiter aspect, then it is possible we could remain trapped in the wedge somewhere between 1050 and 1080. Nonetheless, this week looks more bearish than last week.

Next week (Nov 2-6) looks more likely for a significant decline as Ketu will aspect Uranus while Saturn and Pluto move closer to their square aspect. This looks even more bearish than this week so a break below recent support is indicated. Monday will feature Mars squaring Mercury while Venus is in trine aspect with Neptune. Although these could be offsetting influences, the Ketu-Uranus and Saturn-Pluto seem sufficiently malicious to render them both negative. Thursday November 5 has a Sun-Mercury conjunction which may also mark a sizable move in either direction. If the market has sold off ahead of this aspect, then it may well signal a relief rally day. The close proximity of a bearish aspect involving Mercury and Saturn on Friday may see the bears once again take control. The following week (Nov 9-13) looks more mixed although there may still be a bearish bias. Gains may be more likely on the Sun-Mercury-Jupiter aspect but Mercury’s aspect with Ketu midweek could preclude a significant rally. Mercury falls under the bearish influence of Saturn on November 16 but some recovery seems more likely after that. Around this time we will likely a rally off the bottom which will carry into early December at least. The mid-December period seems more bearish with the start of Mars’ retrograde cycle on the 19th. At the point, it seems that the market is poised to fall again over Christmas and New Year’s. As I see it, there are basically two scenarios here: 1) We see a correction in November down to SPX 950-1000 then rally into early December back to 1000-1050 followed by a more drastic decline into January, say below 800; or 2) We get a steeper correction in November down to SPX 850-920 followed by a rally towards 950-1000 then another leg down to 800 or lower. Both scenarios end up in more or less the same place by January 2010 but they differ on the extent of the decline in November. The first scenario of a gentler November correction seems somewhat more likely at this point but let’s see what transpires this week. If we break below the wedge here, then that increases the chances of a greater decline in November.

Next week (Nov 2-6) looks more likely for a significant decline as Ketu will aspect Uranus while Saturn and Pluto move closer to their square aspect. This looks even more bearish than this week so a break below recent support is indicated. Monday will feature Mars squaring Mercury while Venus is in trine aspect with Neptune. Although these could be offsetting influences, the Ketu-Uranus and Saturn-Pluto seem sufficiently malicious to render them both negative. Thursday November 5 has a Sun-Mercury conjunction which may also mark a sizable move in either direction. If the market has sold off ahead of this aspect, then it may well signal a relief rally day. The close proximity of a bearish aspect involving Mercury and Saturn on Friday may see the bears once again take control. The following week (Nov 9-13) looks more mixed although there may still be a bearish bias. Gains may be more likely on the Sun-Mercury-Jupiter aspect but Mercury’s aspect with Ketu midweek could preclude a significant rally. Mercury falls under the bearish influence of Saturn on November 16 but some recovery seems more likely after that. Around this time we will likely a rally off the bottom which will carry into early December at least. The mid-December period seems more bearish with the start of Mars’ retrograde cycle on the 19th. At the point, it seems that the market is poised to fall again over Christmas and New Year’s. As I see it, there are basically two scenarios here: 1) We see a correction in November down to SPX 950-1000 then rally into early December back to 1000-1050 followed by a more drastic decline into January, say below 800; or 2) We get a steeper correction in November down to SPX 850-920 followed by a rally towards 950-1000 then another leg down to 800 or lower. Both scenarios end up in more or less the same place by January 2010 but they differ on the extent of the decline in November. The first scenario of a gentler November correction seems somewhat more likely at this point but let’s see what transpires this week. If we break below the wedge here, then that increases the chances of a greater decline in November.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish

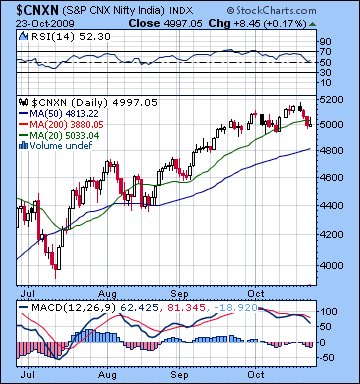

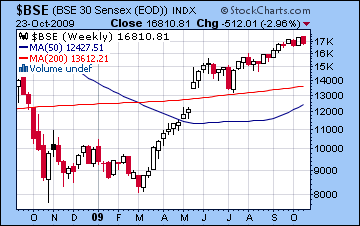

Stocks in Mumbai gave back 3% last week as investors took profits in the face of positive earnings reports. The Nifty once again closed below 5000 at 4997 while the Sensex finished at 16,810. This bearish outcome was in line with expectations as Tuesday’s admixture of aspects resulted in a decline that set the tone for the week. While stocks did move higher intraday on Tuesday on the Mercury-Jupiter aspect, the negative energy from the Mars-Pluto had the final say as equities closed in the red. Wednesday and Thursday were both down days as predicted by the Sun-Saturn aspect with Wednesday’s smaller loss perhaps a reflection of the Venus-Neptune boost. Friday’s marginal gain on the Mercury-Uranus-Neptune pattern was another sign that the rally may be weakening since this kind of combination would have produced a larger gain in previous weeks. It seems that some of the difficult medium term aspects may be exerting a greater influence on the market. This is a clue that the next few weeks may well produce greater selling pressure.

Stocks in Mumbai gave back 3% last week as investors took profits in the face of positive earnings reports. The Nifty once again closed below 5000 at 4997 while the Sensex finished at 16,810. This bearish outcome was in line with expectations as Tuesday’s admixture of aspects resulted in a decline that set the tone for the week. While stocks did move higher intraday on Tuesday on the Mercury-Jupiter aspect, the negative energy from the Mars-Pluto had the final say as equities closed in the red. Wednesday and Thursday were both down days as predicted by the Sun-Saturn aspect with Wednesday’s smaller loss perhaps a reflection of the Venus-Neptune boost. Friday’s marginal gain on the Mercury-Uranus-Neptune pattern was another sign that the rally may be weakening since this kind of combination would have produced a larger gain in previous weeks. It seems that some of the difficult medium term aspects may be exerting a greater influence on the market. This is a clue that the next few weeks may well produce greater selling pressure.

With the continued inability to break significantly above 5000, the technical condition of the market looks increasingly vulnerable. RSI is at 52 and trending downward. It also remains in a bearish negative divergence with higher prices poorly reflected in a series of lower RSI peaks. MACD also is stuck in a bearish crossover and is trending down. It, too, shows a negative divergence with higher prices not matching MACD peaks. BSE volume was a little lower last week, although on a down week that is perhaps less critical. The market also closed below its 20 DMA for the first time since August, a possible sign of flagging momentum. The 20 DMA also may be flattening here. We’re still a ways off of any crossover of the 20 and 50 DMAs, but the market is perhaps one big down week away from that bearish development. For the moment, prices are still trapped in the bearish rising wedge pattern, unable to move above resistance at 5100-5200 and yet insufficiently plagued by fear to break below 4800-4900. While the market seems poised to correct this week and next, it is still unclear which scenario it will follow over the next two months. 1) It could correct fairly mildly down to 4500-4700 in November before rallying again into early December to 5000 thus forming a double top which would spark stronger selling into late December and January. Or 2) A sharper correction into November to 4000 or below followed by a weaker rally in December to perhaps 4500, then down again below 4000. In both scenarios, the market winds up below 4000 by January, with the key difference being how much of the correction occurs in November. At the moment, I would lean towards the first scenario of an immediate but gentle correction but much will depend on this week. If we can break below the wedge support at 4800 here, then it increases the chances for the second scenario of a steeper pullback in November. If we remained trapped in the wedge this week, then that increases the probability of a more gentle November correction.

This week seems more bearish than last week as Sun forms a square aspect with Mars on Thursday. With both of these fiery planets having similar velocities, this aspect will be in effect over several days and is more likely to manifest with sudden or irrational actions that could spark selling. Monday may well be negative as the Moon will oppose Mars in early Capricorn. Some optimism seems more likely on Tuesday as the Moon conjoins Jupiter while Venus makes her approach within a couple of degrees. The Venus-Jupiter aspect actually comes exact on Thursday but it will be fairly fast moving and may not boost prices more than one day. Moreover, it may need an assist from the Moon, and Tuesday stands out in that regard as a possible up day. Wednesday may turn bearish again as Mercury forms a minor aspect with Saturn while the Moon enters cautious Aquarius. Thursday and Friday do not appear to have much in the way of obvious positive planetary support. Friday has the Moon entering Pisces opposite Saturn so that seems to indicate greater fear, although we should note that the aspect will not be exact until European and North American markets open. Overall, there is a good chance for declines here, although the prospect of gains on the Venus-Jupiter aspect early in the week may mitigate the losses.

This week seems more bearish than last week as Sun forms a square aspect with Mars on Thursday. With both of these fiery planets having similar velocities, this aspect will be in effect over several days and is more likely to manifest with sudden or irrational actions that could spark selling. Monday may well be negative as the Moon will oppose Mars in early Capricorn. Some optimism seems more likely on Tuesday as the Moon conjoins Jupiter while Venus makes her approach within a couple of degrees. The Venus-Jupiter aspect actually comes exact on Thursday but it will be fairly fast moving and may not boost prices more than one day. Moreover, it may need an assist from the Moon, and Tuesday stands out in that regard as a possible up day. Wednesday may turn bearish again as Mercury forms a minor aspect with Saturn while the Moon enters cautious Aquarius. Thursday and Friday do not appear to have much in the way of obvious positive planetary support. Friday has the Moon entering Pisces opposite Saturn so that seems to indicate greater fear, although we should note that the aspect will not be exact until European and North American markets open. Overall, there is a good chance for declines here, although the prospect of gains on the Venus-Jupiter aspect early in the week may mitigate the losses.

Next week (Nov 3-6) also seems quite bearish as the Ketu-Uranus aspect moves closer and may begin to impinge upon the natal Jupiter in the NSE chart. While it is possible that these slower moving aspects may not manifest at this time, other faster aspects may nonetheless activate them. Thursday will see a Sun-Mercury aspect and Friday will have both Sun and Mercury move into minor aspect with Saturn. The following week (Nov 9-13) looks more mixed with losses more likely early in the week on the Venus-Saturn-Pluto configuration. Some significant moves in either direction are possible midweek on the Mercury-Ketu aspect. This will be an important test for the correction to find a bottom. The Mercury-Saturn aspect on 17 November also looks bearish and it another possible date for a low. A recovery rally is likely to begin in the middle of the month as Jupiter begins to conjoin Neptune. As additional support for the rally, Jupiter will also aspect the natal Mercury in the NSE chart at the end of November. While transiting Ketu will still be afflicting the natal Jupiter in this chart, I believe it may only act to limit gains rather than prevent them. The post-correction rally is likely to fizzle in December, probably before the start of Mars’ retrograde cycle on 19 December. This will begin another period of bearishness that should last well into January until at least the Saturn retrograde station on 13 January.

Next week (Nov 3-6) also seems quite bearish as the Ketu-Uranus aspect moves closer and may begin to impinge upon the natal Jupiter in the NSE chart. While it is possible that these slower moving aspects may not manifest at this time, other faster aspects may nonetheless activate them. Thursday will see a Sun-Mercury aspect and Friday will have both Sun and Mercury move into minor aspect with Saturn. The following week (Nov 9-13) looks more mixed with losses more likely early in the week on the Venus-Saturn-Pluto configuration. Some significant moves in either direction are possible midweek on the Mercury-Ketu aspect. This will be an important test for the correction to find a bottom. The Mercury-Saturn aspect on 17 November also looks bearish and it another possible date for a low. A recovery rally is likely to begin in the middle of the month as Jupiter begins to conjoin Neptune. As additional support for the rally, Jupiter will also aspect the natal Mercury in the NSE chart at the end of November. While transiting Ketu will still be afflicting the natal Jupiter in this chart, I believe it may only act to limit gains rather than prevent them. The post-correction rally is likely to fizzle in December, probably before the start of Mars’ retrograde cycle on 19 December. This will begin another period of bearishness that should last well into January until at least the Saturn retrograde station on 13 January.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook –bearish

The dollar arrested its losing streak as it closed Friday mostly unchanged on the week at 75.5. Profit taking among equity traders seems to have produced some firmness in the greenback, albeit very tentative at this stage. I was fairly neutral last week and with good reason, as it turns out. Monday’s decline showed the lasting hangover of Saturn’s aspect to the natal Sun in the DX chart, in spite of some otherwise bullish aspects among fast moving planets. The fact that Tuesday’s modest gain came on the bearish Moon-Saturn aspect provides a possible clue that some of the bearish longer term influences may be losing their grip on the dollar chart. My prediction for a late week gain came to pass with Friday’s Venus to natal Jupiter aspect. The technical picture remains woeful, although one can find "green shoots" with the appropriate rose-coloured glasses. At 40, RSI is now turning up. Until it passes 50, however, this technical indicator will remain bearish. Previous rally attempts have all foundered around the 50-55 level and headed back down. For a dollar rally to get real traction, it will have to move above this RSI resistance. MACD is also turning up, although it has yet to form a bullish crossover. This week’s low of 75 may be a bullish divergence with previous higher lows, but given the absence of any divergences in the recent highs, we should not make too much of it. With the dollar still moving within the falling wedge, it will have to break out above the 50 DMA of 77-77.5 before it shows any real signs of life. Hopefully we can see some action this week that breaks this current trend.

The dollar arrested its losing streak as it closed Friday mostly unchanged on the week at 75.5. Profit taking among equity traders seems to have produced some firmness in the greenback, albeit very tentative at this stage. I was fairly neutral last week and with good reason, as it turns out. Monday’s decline showed the lasting hangover of Saturn’s aspect to the natal Sun in the DX chart, in spite of some otherwise bullish aspects among fast moving planets. The fact that Tuesday’s modest gain came on the bearish Moon-Saturn aspect provides a possible clue that some of the bearish longer term influences may be losing their grip on the dollar chart. My prediction for a late week gain came to pass with Friday’s Venus to natal Jupiter aspect. The technical picture remains woeful, although one can find "green shoots" with the appropriate rose-coloured glasses. At 40, RSI is now turning up. Until it passes 50, however, this technical indicator will remain bearish. Previous rally attempts have all foundered around the 50-55 level and headed back down. For a dollar rally to get real traction, it will have to move above this RSI resistance. MACD is also turning up, although it has yet to form a bullish crossover. This week’s low of 75 may be a bullish divergence with previous higher lows, but given the absence of any divergences in the recent highs, we should not make too much of it. With the dollar still moving within the falling wedge, it will have to break out above the 50 DMA of 77-77.5 before it shows any real signs of life. Hopefully we can see some action this week that breaks this current trend.

This week offers a real opportunity for dollar gains as the Sun-Mars aspect could increase anxiety that may produce more demand for the dollar as a safe haven. Monday could see a significant move as Venus conjoins Mars in the 11th house of gains. While Mars is a negative influence here, there is still a good chance that this will result in a gain since the Moon will conjoin the natal Jupiter in the DX chart. Tuesday or Wednesday could see declines as Saturn will aspect its natal position. This is a slow moving aspect so it could conceivably affect any day this week. It is more likely to take the dollar lower on days without offsetting bullish aspects, however. Gains are more likely towards the end of the week as Venus moves further into the 11th house. Next week looks more bullish for the dollar as the Sun and Mercury will conjoin atop the natal Venus in the DX chart on Friday November 6. The dollar should stay strong in an uptrend until November 16-20. Some kind of pullback is likely after that, although this will more than likely not return us to current levels. December looks generally bullish.

The Euro continued to strengthen last week as it traded over 1.50 before closing Friday slightly below that mark. I thought the Euro would stumble a bit more here, especially on the Sun-Saturn opposition. It refuses to go down despite Saturn sitting almost exactly on top of its ascendant. One possible residual source of strength is that Uranus is currently backing into a close conjunction with the natal Jupiter in the midnight chart. Uranus will only begin to turn away from natal Jupiter in early December, so that is something to keep in mind as potentially opening up the currency situation. Until that time, even if the Euro is prone to decline, it may not fall too much and could stay over 1.45. Nonetheless, the Saturn-Pluto square looks likely to make the Euro less desirable and it should fall over the next several weeks. This week could see some movement in both directions as the Sun-Mars square may increase anxiety while the Venus-Jupiter aspect will likely generate one or two up days for the Euro. Monday looks bearish on the Mercury-Saturn opposition but we could see gains Tuesday or Wednesday. I would lean towards a bearish week overall here, although I’m less confident of that outcome. Meanwhile, the Indian Rupee surrendered some of its recent gains last week before closing at 46.6. It may trade between 46.5 and 47 this week before moving lower next week.

Dollar

5-day outlook — neutral-bullish

30-day outlook — bullish

90-day outlook — bullish

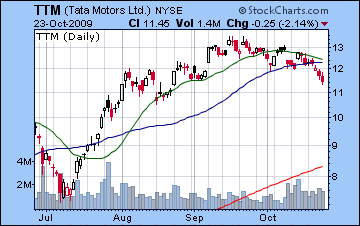

Crude oil continued its recent rally last week as it closed above $80. While I was leaning towards a lower outcome, this bullish result was not too surprising given the aspects in the mix. I was correct in identifying Wednesday as a day of a big move as crude rose over 3%. Perhaps the most significant anomaly was Monday which looked bearish on paper but actually saw a modest gain. Friday’s decline was not unexpected as I had noted possible offsetting aspects that made it more difficult to call. Technically, crude is in a very bullish trend as prices have moved well above their 20 DMA. All moving averages are rising and we can see a bullish crossover of the 20 and 50 DMA. RSI stands at 68 while MACD is solidly positive. Aside from taking a breather from its recent parabolic move, there is no obvious technical reason for a correction in crude. Much depends on the US dollar in the days ahead and as long as the dollar stays weak crude will stay at these levels. The dollar is very likely to rally sharply by next week at the latest, so that will spell the end of this recent uptrend.

Crude oil continued its recent rally last week as it closed above $80. While I was leaning towards a lower outcome, this bullish result was not too surprising given the aspects in the mix. I was correct in identifying Wednesday as a day of a big move as crude rose over 3%. Perhaps the most significant anomaly was Monday which looked bearish on paper but actually saw a modest gain. Friday’s decline was not unexpected as I had noted possible offsetting aspects that made it more difficult to call. Technically, crude is in a very bullish trend as prices have moved well above their 20 DMA. All moving averages are rising and we can see a bullish crossover of the 20 and 50 DMA. RSI stands at 68 while MACD is solidly positive. Aside from taking a breather from its recent parabolic move, there is no obvious technical reason for a correction in crude. Much depends on the US dollar in the days ahead and as long as the dollar stays weak crude will stay at these levels. The dollar is very likely to rally sharply by next week at the latest, so that will spell the end of this recent uptrend.

This week looks quite bearish for crude as the Sun-Mars square may prompt some investors to seek safety. Monday looks fairly negative as the Sun-Mars will set up near the Saturn-Rahu aspect in the ETF chart. There should be at least one up day Tuesday or Wednesday on the Venus-Jupiter aspect. Thursday and Friday seem bearish again as transiting Mercury will conjoin the natal Moon-Saturn conjunction in the Futures chart. Next week has the chance of starting favourably on the Venus-Uranus-Neptune alignment but the nodal aspects to the natal ascendant could well override other fast moving transits and move crude lower. One potential area of concern is that Jupiter (23 Capricorn) is now moving closer to an aspect with the natal ascendant, especially in the ETF chart (25 Taurus) and this could support prices. If this aspect manages to get some traction this week and next, then some of the pullback I had been forecasting here would be put off until December and January. At that time, Jupiter will no longer aspect the ascendant and Saturn will be stationing on the same degree as the ETF Ketu (10 Virgo).

5-day outlook — bearish-neutral

30-day outlook — bearish

90-day outlook — bearish

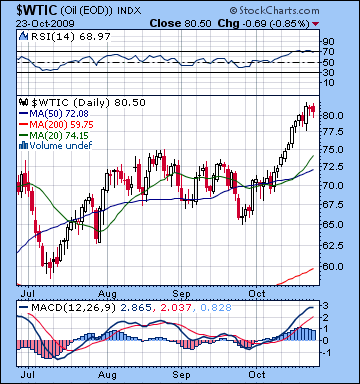

Gold mostly treaded water as it traded in a narrow range last week before managing a tiny gain to close at $1055. Last week I wondered if the early week jumble of aspects might simply offset each other and that is pretty much what happened as the Mercury-Jupiter aspect met the Mars-Rahu head-on. As expected, we ended Monday-Tuesday with a slightly upward bias. There was increasingly less movement as the week progressed, however, and the expected late week gain on the Venus to natal Jupiter aspect did not materialize. This is perhaps a clue of growing indecision amongst investors about gold and may stack the deck in favour of the bears going forward. But so far Jupiter’s conjunction with the natal Moon in the ETF chart has worked wonders to fend off all significant bearish influences over the past two months. This aspect has a few more weeks to go before it moves away so any pullback here may be fairly middling, even as Saturn-Pluto waits in the wings. Gold is still strong technically as RSI sits at a robust 61 although it is now in a downtrend. MACD is turning negative here and has only begun to form a bearish crossover. All major moving averages are still rising. Gold’s key support likely rests with the 50 DMA at $990-1000. Any correction will have a tough slog through that territory before it goes any lower.

Gold mostly treaded water as it traded in a narrow range last week before managing a tiny gain to close at $1055. Last week I wondered if the early week jumble of aspects might simply offset each other and that is pretty much what happened as the Mercury-Jupiter aspect met the Mars-Rahu head-on. As expected, we ended Monday-Tuesday with a slightly upward bias. There was increasingly less movement as the week progressed, however, and the expected late week gain on the Venus to natal Jupiter aspect did not materialize. This is perhaps a clue of growing indecision amongst investors about gold and may stack the deck in favour of the bears going forward. But so far Jupiter’s conjunction with the natal Moon in the ETF chart has worked wonders to fend off all significant bearish influences over the past two months. This aspect has a few more weeks to go before it moves away so any pullback here may be fairly middling, even as Saturn-Pluto waits in the wings. Gold is still strong technically as RSI sits at a robust 61 although it is now in a downtrend. MACD is turning negative here and has only begun to form a bearish crossover. All major moving averages are still rising. Gold’s key support likely rests with the 50 DMA at $990-1000. Any correction will have a tough slog through that territory before it goes any lower.

This week could see moves in both directions as the Venus-Jupiter aspect will set up on the natal Moon, most likely Tuesday or Wednesday. This ought to produce at least one solid up day. But the picture in complicated by the fact that the Sun-Mars square will set up on the natal Mars, a very volatile combination. As the planetary significator for gold, the Sun may not respond positively to Mars’ aspect from Cancer and this could produce significant selling. Mars may get its foot in the door first on Monday and produce some retreat for bullion before any midweek gains occur. It’s also possible that these two influences will offset each other to some extent. Thursday and Friday may incline towards the bears as Mercury will conjoin the natal Ketu. I doubt both of these days will be negative but the net result may well be. It’s possible that we could see significant declines in the next couple of weeks but we should be alert to the possibility that Jupiter’s influence on the Moon will provide a floor for prices as November progresses. Gold may therefore well stay fairly strong here — above $950 perhaps — until mid-December and then fall more precipitously into January. This week’s action will be helpful in isolating Jupiter’s potential bullish influence as it will have to cope with the Sun-Mars square.

5-day outlook — bearish-neutral

30-day outlook — bearish-neutral

90-day outlook — bearish