- Declines likely on Mercury-Uranus-Ketu aspect

- Dollar break out more likely

- Gold strong early with some weakness later

- Crude choppy with negative bias

- Declines likely on Mercury-Uranus-Ketu aspect

- Dollar break out more likely

- Gold strong early with some weakness later

- Crude choppy with negative bias

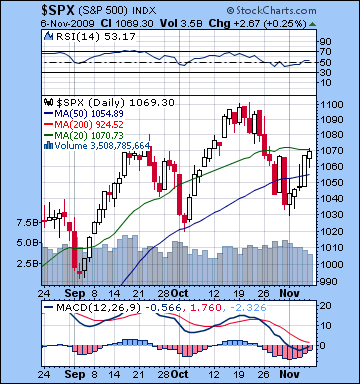

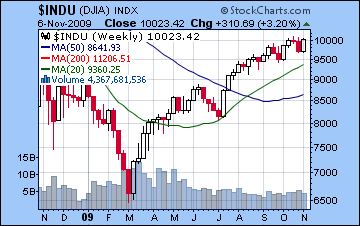

Wall Street bounced back last week on better than expected employment numbers and reassuring comments by the Fed as investors went bargain hunting. Encouraged by Fed Chair Bernanke’s promise of low rates for the foreseeable future at Wednesday’s FOMC meeting, stocks rallied 3% through the week as the Dow closed Friday at 10,023 while the S&P finished at 1069. While I had expected some kind of midweek gains on the Sun-Mercury conjunction, I had been more bearish in the anticipation of losses on Monday and Friday. These did not materialize, however, as the aspects in question were effectively countered by prevailing bullish energies. Monday saw a reversal occur a day earlier than forecast as the Mercury-Mars square was moving past exactitude and hence losing power. Once the negative influence began to dissipate, the bullish influence of the Sun-Mercury conjunction could begin to accrue and drew more buyers to the market. Tuesday’s gain was further evidence of the positive Sun-Mercury conjunction in Libra. Wednesday was an interesting reflection of the Neptune station (= hope unsubstantiated) I identified last week as stocks rallied into the FOMC meeting but sold off at the close and closed unchanged. Thursday was the strongest up day of the week as the Taurus Moon provided support to the already powerful Venus in Libra. Friday was another disappointment as the bearish Mercury-Saturn aspect never really got any traction as stocks edged higher. While the up move this week was somewhat surprising, it did not come out of left field given the obvious strength of the Sun-Mercury conjunction.

Wall Street bounced back last week on better than expected employment numbers and reassuring comments by the Fed as investors went bargain hunting. Encouraged by Fed Chair Bernanke’s promise of low rates for the foreseeable future at Wednesday’s FOMC meeting, stocks rallied 3% through the week as the Dow closed Friday at 10,023 while the S&P finished at 1069. While I had expected some kind of midweek gains on the Sun-Mercury conjunction, I had been more bearish in the anticipation of losses on Monday and Friday. These did not materialize, however, as the aspects in question were effectively countered by prevailing bullish energies. Monday saw a reversal occur a day earlier than forecast as the Mercury-Mars square was moving past exactitude and hence losing power. Once the negative influence began to dissipate, the bullish influence of the Sun-Mercury conjunction could begin to accrue and drew more buyers to the market. Tuesday’s gain was further evidence of the positive Sun-Mercury conjunction in Libra. Wednesday was an interesting reflection of the Neptune station (= hope unsubstantiated) I identified last week as stocks rallied into the FOMC meeting but sold off at the close and closed unchanged. Thursday was the strongest up day of the week as the Taurus Moon provided support to the already powerful Venus in Libra. Friday was another disappointment as the bearish Mercury-Saturn aspect never really got any traction as stocks edged higher. While the up move this week was somewhat surprising, it did not come out of left field given the obvious strength of the Sun-Mercury conjunction.

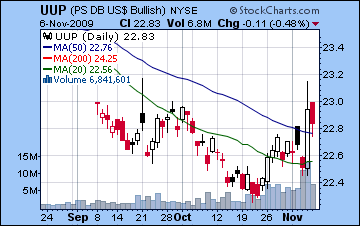

While I did not expect last week’s bounce to be as high as it was, the market still seems to be undergoing in a corrective phase. Friday’s close of SPX1069 marked a 50% retracement from Monday’s intraday low. This number may represent the top of this little rebound before the market again moves lower this week. It is also worth noting that the S&P may be forming a bearish head and shoulders pattern with a neckline around 1020-1030 and shoulders around 1070-1080. Any closes above 1080 would reduce the possibility of this pattern but if the market does not move higher from current levels, more traders will begin to take this bearish pattern seriously and a self-fulfilling prophecy would be initiated. Selling is therefore likely to accelerate if the market falls through the neckline at 1020-1030. Despite last week’s gains, MACD remains in a negative crossover, although it has begun to turn up. A comparison of recent lows reveals a bearish divergence as higher lows in price have corresponded with lower lows in MACD. If MACD fails to achieve a bullish crossover this week on any further rebound, then the market would be seen as weakening by many participants. RSI has again moved into bullish territory at 52 but we can clearly detect a divergence between the left shoulder (71) and the right shoulder (52) that may be in the process of forming. Volume decreased on successive trading days this week, another possible sign of lack of commitment to the bullish cause. The 20 DMA has leveled off here at 1070 and may become an additional layer of resistance for the market to negotiate. While no bearish 20 and 50 DMA crossover occurred last week, it is a technical development that bears watching in the coming days. All in all, I still believe we’re on course for more downside in the near term. There are growing signs that a major reversal of the US dollar is about to take place. While the dollar remained fairly weak last week, there was a major spike in the Dollar Bullish ETF (UUP; see chart) that suggests that some big players are seeking to take positions in advance of any move higher. If and when the dollar moves sharply higher, it will suck money out of the equity market as the lucrative carry trade that has given important support to this rally will come to an end. The next two weeks is therefore critical for the market to complete this correction before it attempts a rally into December. At this point, it seems more likely we will see a fairly mild correction to SPX 950-1000 with the possibility of lower lows in late December and January.

This week looks more volatile as the Uranus-Ketu trine aspect will be activated by Mercury. There is the opportunity for some big moves here as the sudden and unpredictable natures of both Uranus and Ketu will serve to amplify sentiment. On the strength of these three planets alone, it’s possible we could move sharply higher, but the overall planetary picture seems more inimical to an up move. Another move down therefore seems like a more likely scenario this week. The Saturn-Pluto square will be underlined by the minor aspect with Venus on Monday, a possible indication of a rise in fear and disappointment. However, Monday may well open higher as the Moon will aspect Jupiter in the morning. Tuesday’s open seems bearish as the Moon will align with Saturn and Pluto and the Mercury alignment with Uranus and Ketu will become more prominent at this time. Tuesday and Wednesday will also feature a Sun-Jupiter square which often connotes the notion of exaggeration, unrealistic expansion (e.g. new credit bubbles) or unhealthy optimism. I would therefore not rule out a run-up on either of these days, but it may be rooted in pumped up data or unfounded assumptions that will quickly reverse. Conversely, it could also correspond with a decline that reflects some of these notions, such as economic data that indicates inflation may becoming a problem. The Moon enters Virgo for Thursday and Friday just as Mercury enters Scorpio. While the Virgo influence is steadying, Scorpio is not and implies a defensive posture. In particular, Thursday afternoon bears closer scrutiny as the Moon conjoins Saturn and thereby activates its square aspect with Pluto. This combination symbolizing self-reliance and isolation may give support for bears as investors may begin to feel alone in the market. Friday has the Sun (27 Libra) approaching the Uranus-Ketu aspect so that may trigger another bout of uncertainty and sudden developments relating to the banking sector or government agencies. By itself, the Sun-Uranus influence is quite bullish but the presence of Ketu in the equation could well spell disappointment. Overall, we should be lower this week.

This week looks more volatile as the Uranus-Ketu trine aspect will be activated by Mercury. There is the opportunity for some big moves here as the sudden and unpredictable natures of both Uranus and Ketu will serve to amplify sentiment. On the strength of these three planets alone, it’s possible we could move sharply higher, but the overall planetary picture seems more inimical to an up move. Another move down therefore seems like a more likely scenario this week. The Saturn-Pluto square will be underlined by the minor aspect with Venus on Monday, a possible indication of a rise in fear and disappointment. However, Monday may well open higher as the Moon will aspect Jupiter in the morning. Tuesday’s open seems bearish as the Moon will align with Saturn and Pluto and the Mercury alignment with Uranus and Ketu will become more prominent at this time. Tuesday and Wednesday will also feature a Sun-Jupiter square which often connotes the notion of exaggeration, unrealistic expansion (e.g. new credit bubbles) or unhealthy optimism. I would therefore not rule out a run-up on either of these days, but it may be rooted in pumped up data or unfounded assumptions that will quickly reverse. Conversely, it could also correspond with a decline that reflects some of these notions, such as economic data that indicates inflation may becoming a problem. The Moon enters Virgo for Thursday and Friday just as Mercury enters Scorpio. While the Virgo influence is steadying, Scorpio is not and implies a defensive posture. In particular, Thursday afternoon bears closer scrutiny as the Moon conjoins Saturn and thereby activates its square aspect with Pluto. This combination symbolizing self-reliance and isolation may give support for bears as investors may begin to feel alone in the market. Friday has the Sun (27 Libra) approaching the Uranus-Ketu aspect so that may trigger another bout of uncertainty and sudden developments relating to the banking sector or government agencies. By itself, the Sun-Uranus influence is quite bullish but the presence of Ketu in the equation could well spell disappointment. Overall, we should be lower this week.

Next week (Nov 16-20) may also be fairly negative as the week begins on a nasty looking Mercury-Saturn-Pluto alignment. This will be closely followed by a Venus-Mars square aspect which may represent a wounding of positive sentiment. It’s very possible we’ll see an interim low during this week, perhaps on Thursday or Friday. The following week (Nov 23-27) will see lighter volumes due to Thanksgiving but some kind of rally may start. The week begins inauspiciously, however, with a Sun-Saturn-Pluto combination. A nicer Venus-Jupiter aspect quickly follows and may well move prices significantly higher. As we move into December, the approach of Jupiter to Neptune should bring optimism back to the fore. An important test of this optimism may occur Dec 3-4 when there is a potentially bearish Venus-Saturn-Pluto alignment. This could derail the rally, at least temporarily. The Mars retrograde on December 19 also may figure prominently as a potential rally killer. Overall, I think we’ll make some kind of interim low next week. Depending on how strong the Thanksgiving rally is, watch for the market to fall again in the first and second weeks of December. While some kind of bounce is likely over Christmas, the market looks very weak again in the first two weeks of January. Calling the bottom is difficult at this stage, but the January decline could mark a lower low if the Christmas rally gets sideswiped by the Mars retrograde station on December 19 and its immediate aftermath.

Next week (Nov 16-20) may also be fairly negative as the week begins on a nasty looking Mercury-Saturn-Pluto alignment. This will be closely followed by a Venus-Mars square aspect which may represent a wounding of positive sentiment. It’s very possible we’ll see an interim low during this week, perhaps on Thursday or Friday. The following week (Nov 23-27) will see lighter volumes due to Thanksgiving but some kind of rally may start. The week begins inauspiciously, however, with a Sun-Saturn-Pluto combination. A nicer Venus-Jupiter aspect quickly follows and may well move prices significantly higher. As we move into December, the approach of Jupiter to Neptune should bring optimism back to the fore. An important test of this optimism may occur Dec 3-4 when there is a potentially bearish Venus-Saturn-Pluto alignment. This could derail the rally, at least temporarily. The Mars retrograde on December 19 also may figure prominently as a potential rally killer. Overall, I think we’ll make some kind of interim low next week. Depending on how strong the Thanksgiving rally is, watch for the market to fall again in the first and second weeks of December. While some kind of bounce is likely over Christmas, the market looks very weak again in the first two weeks of January. Calling the bottom is difficult at this stage, but the January decline could mark a lower low if the Christmas rally gets sideswiped by the Mars retrograde station on December 19 and its immediate aftermath.

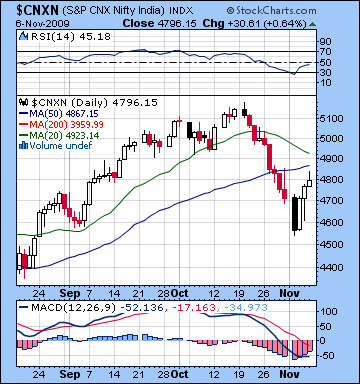

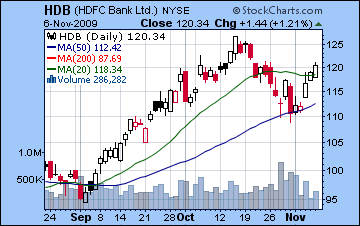

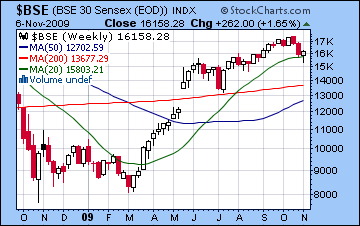

Bargain hunters ruled the roost last week as stocks in Mumbai moved higher led by banking shares on positive comments on new loan provisions from Standard & Poor’s. Rebounding after Tuesday’s decline, the Nifty gained 2% on the week closing Friday at 4796 while the Sensex finished at 16,158. While I had been more bearish, this outcome was not entirely unexpected since I had allowed for some midweek gains on the Sun-Mercury conjunction. Tuesday’s decline came off as expected as the lingering effects of the Mercury-Mars square activated some key planets in the NSE chart. Wednesday and Thursday were both positive as forecast, as the Moon’s transit into Taurus brought out the favourable Venus energy. Thursday’s Sun-Mercury conjunction helped create positive sentiment as the week progressed as modest gains were achieved on both Thursday and Friday. My primary interpretive error lay with Friday. I thought the approaching Mercury-Saturn aspect would cause more difficulties but since it was not yet exact, its power was fairly muted and easily offset by a fairly positive Moon-Venus aspect. The failure of stocks to fall Friday meant the week ended positively overall, as the market tried to break out of its recent corrective downtrend.

Bargain hunters ruled the roost last week as stocks in Mumbai moved higher led by banking shares on positive comments on new loan provisions from Standard & Poor’s. Rebounding after Tuesday’s decline, the Nifty gained 2% on the week closing Friday at 4796 while the Sensex finished at 16,158. While I had been more bearish, this outcome was not entirely unexpected since I had allowed for some midweek gains on the Sun-Mercury conjunction. Tuesday’s decline came off as expected as the lingering effects of the Mercury-Mars square activated some key planets in the NSE chart. Wednesday and Thursday were both positive as forecast, as the Moon’s transit into Taurus brought out the favourable Venus energy. Thursday’s Sun-Mercury conjunction helped create positive sentiment as the week progressed as modest gains were achieved on both Thursday and Friday. My primary interpretive error lay with Friday. I thought the approaching Mercury-Saturn aspect would cause more difficulties but since it was not yet exact, its power was fairly muted and easily offset by a fairly positive Moon-Venus aspect. The failure of stocks to fall Friday meant the week ended positively overall, as the market tried to break out of its recent corrective downtrend.

Despite the upswing in prices, stocks remain in a correction mode. MACD continues to be negative as the bearish crossover still predominates. It also features a negative divergence with the September lows which also occurred around this level of Nifty 4600. In fact, bullish investors may try to take some encouragement from the fact that prices bounced off these previous lows after Tuesday’s session. However, the technical picture is much more muddled now compared to then since the indices are now below their key 20 and 50 DMA. Also, the September lows did not coincide with a meaningful MACD crossover. Even with last week’s recovery, MACD is still negative, and thus points to the possibility of more downside. The 20 DMA is now falling towards the 50 DMA — a very bearish indication. If these cross, then that would provoke more selling and likely take stocks lower still. RSI is now rising but still bearish at 45. While it may move above 50 on one or two more up days, this is unlikely to provide persuasive data for investors who may be on the fence. So far, stocks have yet to retrace 50% off their Tuesday lows. That 50% retracement level is 4860, which roughly corresponds to the bottom of the rising wedge pattern. Since prices have fallen below the wedge, that previous support level is likely to act now as resistance. So even if we see more upside this week, it will be important to see if the market can actually break above 4800-4860 back up into the body of the wedge. I think this is an unlikely outcome. Although the market has already corrected significantly below 4600, I believe there could well be more downside over the next two weeks. It’s still a long way down to the 200 DMA at 3959 but we could get there soon if we see a resumption of the correction this week on a critical Mercury aspect. It’s not certain, of course, but it is a plausible outcome.

This week will hinge on effects of Mercury’s activation of the Uranus-Ketu aspect. Both Uranus and Ketu are planets that symbolize sudden changes and fast moving developments. For this reason, their aspect may coincide with unexpected news that could affect markets in either direction. Since they are slow-moving planets, they usually require faster moving planets like Mercury to release their energy. Mercury will enter into a symmetrical triangular pattern with both Uranus and Ketu this week and this should move markets significantly. If this was the only major aspect in the sky, I would lean towards a positive outcome. However, we also the Saturn-Pluto square lurking in the background which connotes difficulty, austerity, and cruelty and often involves some kind of power struggle. I interpret this combination of aspects to signal more selling. Monday will see the Moon conjoin Mars in Cancer near the open of trading. This promises to increase volume and may reflect a lot of urgency as investors take their positions. On balance, this seems like a bearish influence. The Moon enters Leo on Tuesday on the same day that Sun squares Jupiter so that could support prices. The Sun-Jupiter aspect may represent overspending or inflated expectations that could temporarily boost prices. Wednesday will see the exact aspect between Mercury, Uranus and Ketu. Again, this seems like a negative influence but there is an important caution: Mercury will come under Ketu’s aspect just as it conjoins the natal Jupiter of the NSE chart. As we know, Jupiter is a very positive influence and Mercury’s conjunction here complicates the situation. My sense is that the Ketu aspect will invert the effect and produce more selling, although I fully admit I can’t be sure of that. Mercury stays within range of Ketu into Thursday as it enters Scorpio so we could see a reversal that day. The Moon enters Virgo for Thursday and Friday, so that is another indication of a change in sentiment from previous days. So if we’re down going into midweek, then it increases the chances of some kind of rebound by week’s end.

This week will hinge on effects of Mercury’s activation of the Uranus-Ketu aspect. Both Uranus and Ketu are planets that symbolize sudden changes and fast moving developments. For this reason, their aspect may coincide with unexpected news that could affect markets in either direction. Since they are slow-moving planets, they usually require faster moving planets like Mercury to release their energy. Mercury will enter into a symmetrical triangular pattern with both Uranus and Ketu this week and this should move markets significantly. If this was the only major aspect in the sky, I would lean towards a positive outcome. However, we also the Saturn-Pluto square lurking in the background which connotes difficulty, austerity, and cruelty and often involves some kind of power struggle. I interpret this combination of aspects to signal more selling. Monday will see the Moon conjoin Mars in Cancer near the open of trading. This promises to increase volume and may reflect a lot of urgency as investors take their positions. On balance, this seems like a bearish influence. The Moon enters Leo on Tuesday on the same day that Sun squares Jupiter so that could support prices. The Sun-Jupiter aspect may represent overspending or inflated expectations that could temporarily boost prices. Wednesday will see the exact aspect between Mercury, Uranus and Ketu. Again, this seems like a negative influence but there is an important caution: Mercury will come under Ketu’s aspect just as it conjoins the natal Jupiter of the NSE chart. As we know, Jupiter is a very positive influence and Mercury’s conjunction here complicates the situation. My sense is that the Ketu aspect will invert the effect and produce more selling, although I fully admit I can’t be sure of that. Mercury stays within range of Ketu into Thursday as it enters Scorpio so we could see a reversal that day. The Moon enters Virgo for Thursday and Friday, so that is another indication of a change in sentiment from previous days. So if we’re down going into midweek, then it increases the chances of some kind of rebound by week’s end.

Next week (Nov 16-20) also seems fairly negative as Mercury comes into an alignment with Saturn and Pluto early in the week. Tuesday may be the most difficult day as the Moon conjoins Mercury in Scorpio. Towards the end of the week Mars will square Venus very close to the Mars-Rahu aspect in the NSE chart. This could also be a very telling influence. Generally, this seems like an overly conflictive influence that will not bode well for the market so we could see an interim low formed during this week. The following week (Nov 23-27) may begin with bearishness as the Sun enters into an alignment with Saturn and Pluto but the end of the week is much stronger on the Venus-Jupiter aspect. Some impressive gains are likely after that as we move into December, although towards the end of the first week there is a very difficult Venus-Saturn-Pluto aspect that may change the trend, at least for a few days. Aside from some specific bad aspects, December may see upward drift in prices at least until the Mars retrograde on 19 December. Actually, there is a very bullish configuration of Venus-Jupiter-Neptune on 21 December that could mark a significant top to the rally. That would mean that the fallout from the Mars retrograde may begin after that date. Early January looks quite negative at this point, so we may see a noteworthy leg down from whatever highs we see in December. My best guess is that January lows will be lower than anything we see here in November.

Next week (Nov 16-20) also seems fairly negative as Mercury comes into an alignment with Saturn and Pluto early in the week. Tuesday may be the most difficult day as the Moon conjoins Mercury in Scorpio. Towards the end of the week Mars will square Venus very close to the Mars-Rahu aspect in the NSE chart. This could also be a very telling influence. Generally, this seems like an overly conflictive influence that will not bode well for the market so we could see an interim low formed during this week. The following week (Nov 23-27) may begin with bearishness as the Sun enters into an alignment with Saturn and Pluto but the end of the week is much stronger on the Venus-Jupiter aspect. Some impressive gains are likely after that as we move into December, although towards the end of the first week there is a very difficult Venus-Saturn-Pluto aspect that may change the trend, at least for a few days. Aside from some specific bad aspects, December may see upward drift in prices at least until the Mars retrograde on 19 December. Actually, there is a very bullish configuration of Venus-Jupiter-Neptune on 21 December that could mark a significant top to the rally. That would mean that the fallout from the Mars retrograde may begin after that date. Early January looks quite negative at this point, so we may see a noteworthy leg down from whatever highs we see in December. My best guess is that January lows will be lower than anything we see here in November.

The dollar got thumped again last week mostly as a result of the Fed meeting and Bernanke’s commitment to keep rates low. The greenback lost half a cent and closed under 76 as it extended its residence in the falling wedge pattern for yet another week. I had been fairly lukewarm on the dollar’s prospects last week so this wasn’t completely unexpected, although I did not want to think it would actually lose ground. The early week was not as strong as I had expected, although we did see an intraday spike to the 50 DMA at 76.8. As predicted, the midweek Sun-Mercury conjunction spelled doom for the dollar as it lost a whole cent on the Fed’s promise of more cheap money. The absence of any rally Friday was puzzling, since the DX natal chart appeared to be positively impacted. Overall, the dollar still seems poised to break out, although one wonders what combination of planets will be required. Despite the decline, MACD is still in a bullish crossover although the averages are flattening out. The bullish divergence is also still in the mix as last week’s peak was the mirrored by lower price levels. RSI at 45 has slipped back into bearish territory and is holding steady. The 50 DMA is still falling and is still the key resistance level, now at 76.5 Any close above that level would be a bullish signal for the dollar and bring in a lot of buyers. Indeed, it may trigger a huge short squeeze as the carry trade in the greenback would come to a quick and potentially cataclysmic end. The 20 DMA may well have changed from a resistance level to support, now that prices are right in line with it. If the dollar moves up this week, then climbing that rung of the ladder would go a long way to reversing the direction on the dollar. As noted in the US stocks section above, the massive gain we saw in the Dollar Bullish ETF UUP last week also looks very promising for a dollar breakout in the days ahead. This gain followed the previous week’s volume spike in UUP.

The dollar got thumped again last week mostly as a result of the Fed meeting and Bernanke’s commitment to keep rates low. The greenback lost half a cent and closed under 76 as it extended its residence in the falling wedge pattern for yet another week. I had been fairly lukewarm on the dollar’s prospects last week so this wasn’t completely unexpected, although I did not want to think it would actually lose ground. The early week was not as strong as I had expected, although we did see an intraday spike to the 50 DMA at 76.8. As predicted, the midweek Sun-Mercury conjunction spelled doom for the dollar as it lost a whole cent on the Fed’s promise of more cheap money. The absence of any rally Friday was puzzling, since the DX natal chart appeared to be positively impacted. Overall, the dollar still seems poised to break out, although one wonders what combination of planets will be required. Despite the decline, MACD is still in a bullish crossover although the averages are flattening out. The bullish divergence is also still in the mix as last week’s peak was the mirrored by lower price levels. RSI at 45 has slipped back into bearish territory and is holding steady. The 50 DMA is still falling and is still the key resistance level, now at 76.5 Any close above that level would be a bullish signal for the dollar and bring in a lot of buyers. Indeed, it may trigger a huge short squeeze as the carry trade in the greenback would come to a quick and potentially cataclysmic end. The 20 DMA may well have changed from a resistance level to support, now that prices are right in line with it. If the dollar moves up this week, then climbing that rung of the ladder would go a long way to reversing the direction on the dollar. As noted in the US stocks section above, the massive gain we saw in the Dollar Bullish ETF UUP last week also looks very promising for a dollar breakout in the days ahead. This gain followed the previous week’s volume spike in UUP.

This week may well be showtime for the dollar as the Mercury-Uranus-Ketu grand trine aspect could generate sudden or surprising events that could move markets significantly. While this is an important aspect, it’s worth nothing it doesn’t make any close contacts with the USDX natal chart. Nonetheless, transiting Mars is in close aspect to the natal Jupiter, so it may be the "local" energy source that drives the dollar higher this week. This could begin as soon as Monday when the Moon joins Mars in Cancer. The late week period also looks fruitful as transiting Venus conjoins the natal Pluto. The dollar will get two golden opportunities to breakout this week and next by virtue of the slow velocity of Mars and its aspect to the natal Jupiter. After that, it may retrace somewhat in late November. The Mercury-Mars trine of November 25th falls exactly on the USDX ascendant so that will be an interesting test of the dollar going forward. This is an aspect that could manifest either way. If it’s negative then that would be in keeping with a standard correction after a rally. If it’s positive, however, then it could mean that the dollar’s appreciation may accelerate. Certainly, further gains are indicated in the December 3-8 period when the Sun conjoins the natal ascendant. At that point, we may well see the dollar above 80. 2010 continues to look bullish for the dollar, even with the mountains of government debt the Obama administration is creating. The dollar rally may be evidence of renewed global economic weakness that forces capital to seek greater safety, as well as deteriorating markets for competing currencies.

Thanks to the Fed, the Euro added a cent last week to close above 1.48 once again. This outcome was more bearish than expected, mostly because the late week sell-off on the Venus-Saturn aspect never happened. Mysteries abound in astrology and this is one that defies easy explanation. The most likely account involves the grand trine formed by the Moon and Jupiter to the natal Mars in the Euro chart. This is a positive aspect which may have had enough strength to offset the negativity of the Venus-Saturn. In any event, the gains last week do not preclude the obvious problem with the Euro chart: the Saturn-Pluto square is setting up just two degrees of the ascendant. This should produce some kind of major pullback over the next weeks. Monday is the first chance for this aspect to be activated by a faster moving inner planet, as Venus (7 Libra) will move into alignment. Tuesday could be bullish as the Sun squares Jupiter and may activate the natal Mars. After that, it may be more clearly bearish as Mercury moves into Scorpio. I am paying special attention to Thursday when the Moon will conjoin Saturn directly on the natal ascendant of the Euro chart. This ought to produce a decline, although one can’t be entirely sure that the bullish Jupiter-Mars aspect has relented. Monday and Tuesday of next week is another potentially bearish pattern setting up with Saturn and Pluto. If this week doesn’t take the Euro back under 1.46, then next week surely will. The Indian Rupee gained ground last week on dollar weakness and closed at 46.9. This was stronger than expected, but the next two weeks are more critical as the dollar seems set to breakout of a bearish pattern. The Rupee will likely move to 47 again this week and perhaps 48 by next week.

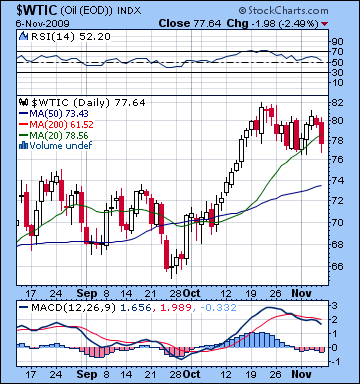

After a volatile week, crude finished slightly higher closing above $77 on the continuous contract. While I had allowed for some gains last week on the Sun-Mercury conjunction, this outcome was somewhat more bullish than expected. I had expected more weakness Monday but the market rallied 1%. Gains through Thursday were predicted, as was Friday’s huge sell-off of almost 3%. This corresponded with the Mars transit to the Sun-Uranus aspect in the Futures chart. The ability of one bad aspect to take down the market so sharply is a reminder of the fragility of crude at the moment. The medium term aspect in charge here is Rahu sitting on the 8th house cusp of the Futures chart. This is usually a bearish influence and is one reason why crude did not follow equities higher last week. Its vulnerability is evident through MACD which remains in a negative crossover and even with last week’s gain is still falling. RSI is still bullish at 52 but exhibits weakness as it gradually slips into negative territory. Both 20 and 50 DMA are still rising although Friday’s close was below the 20 DMA. This is a fairly minor fly in the ointment all things considered but the MACD issue seems to weigh more heavily than other positive considerations. We may also note that since the high on October 21, crude has never managed to equal it, despite repeated intraday attempts. It is trading in a very narrow range here and may be about to breakout.

After a volatile week, crude finished slightly higher closing above $77 on the continuous contract. While I had allowed for some gains last week on the Sun-Mercury conjunction, this outcome was somewhat more bullish than expected. I had expected more weakness Monday but the market rallied 1%. Gains through Thursday were predicted, as was Friday’s huge sell-off of almost 3%. This corresponded with the Mars transit to the Sun-Uranus aspect in the Futures chart. The ability of one bad aspect to take down the market so sharply is a reminder of the fragility of crude at the moment. The medium term aspect in charge here is Rahu sitting on the 8th house cusp of the Futures chart. This is usually a bearish influence and is one reason why crude did not follow equities higher last week. Its vulnerability is evident through MACD which remains in a negative crossover and even with last week’s gain is still falling. RSI is still bullish at 52 but exhibits weakness as it gradually slips into negative territory. Both 20 and 50 DMA are still rising although Friday’s close was below the 20 DMA. This is a fairly minor fly in the ointment all things considered but the MACD issue seems to weigh more heavily than other positive considerations. We may also note that since the high on October 21, crude has never managed to equal it, despite repeated intraday attempts. It is trading in a very narrow range here and may be about to breakout.

This week may see the malefic Rahu influence take over although some daily gains are still possible. Monday and Tuesday will feature Venus conjoining the natal Moon-Saturn conjunction. This is normally a negative influence although it will be closely followed up by a potentially positive Mars transit to the natal Jupiter. So the first two days of the week could conceivably end up being net positive, although I would incline towards bearishness here. Wednesday will see the Mercury-Ketu aspect hitting at full force since Mercury is the proverbial deer caught in the headlights of the malefic 6th house. This seems like a big move here, and while I am not certain it will be down, that does appear to be the most likely outcome. The July lows are within reach over the next two weeks. Once Rahu moves off the 8th house cusp in late November, much of the bearishness should be removed from the crude chart. This will allow the Jupiter trine to the ascendant to shine alone and boost prices significantly. One perplexing question concerns what happens after Jupiter enters Aquarius in mid-December. The Futures chart seems relatively unafflicted by the Mars retrograde and Saturn’s imminent station in January. While prices are unlikely to rise too much under those two afflictions and indeed should pullback further, one possible interpretation may be that crude oil may outperform equities then, possibly due to a cold winter in the northern hemisphere or geopolitical concerns. It will be a situation that bears further watching.

Gold soared to new, dizzying heights last week prompted by India’s purchase of 200 tonnes of gold from the IMF. With skepticism growing towards the long term viability of the US dollar, bullion added 5% to its ongoing rally before closing Friday at $1096. In last week’s newsletter I had noted that early week gains were very likely on the Venus aspect to the GLD ETF natal chart. Moreover, the current position of Jupiter in such a close conjunction to the natal Moon meant that gold would be largely resistant to any pullbacks in the near term. So both of those astrological indicators have largely borne fruit here, although I do wish I had been more forceful in my forecast. Gold has captured the investment world’s fancy at the moment, and the technicals support the notion that it is climbing into the stratosphere, uninhibited by such trifles as resistance levels. MACD saw a bullish crossover last week and has turned higher, although we may note a bearish divergence in that MACD highs which only match the previous October peak. RSI is very strong at 69 as it prepares to move up into overbought territory once again. Gold is very much riding positive momentum here as it rebounded off of its 20 DMA and now trades well above all key moving averages. It’s still possible to identify a bearish rising wedge dating back to late 2008, although given only two points of contact on the upper resistance line, one should be careful not to put too much stock in it. That wedge shows support around $1000, which now sits below the 50 DMA.

Gold soared to new, dizzying heights last week prompted by India’s purchase of 200 tonnes of gold from the IMF. With skepticism growing towards the long term viability of the US dollar, bullion added 5% to its ongoing rally before closing Friday at $1096. In last week’s newsletter I had noted that early week gains were very likely on the Venus aspect to the GLD ETF natal chart. Moreover, the current position of Jupiter in such a close conjunction to the natal Moon meant that gold would be largely resistant to any pullbacks in the near term. So both of those astrological indicators have largely borne fruit here, although I do wish I had been more forceful in my forecast. Gold has captured the investment world’s fancy at the moment, and the technicals support the notion that it is climbing into the stratosphere, uninhibited by such trifles as resistance levels. MACD saw a bullish crossover last week and has turned higher, although we may note a bearish divergence in that MACD highs which only match the previous October peak. RSI is very strong at 69 as it prepares to move up into overbought territory once again. Gold is very much riding positive momentum here as it rebounded off of its 20 DMA and now trades well above all key moving averages. It’s still possible to identify a bearish rising wedge dating back to late 2008, although given only two points of contact on the upper resistance line, one should be careful not to put too much stock in it. That wedge shows support around $1000, which now sits below the 50 DMA.

This week we may see some cracks in the euphoria that may set the stage for high drama next week. Transiting Jupiter (24 Capricorn) makes its exact conjunction with the Moon (24 Capricorn) early this week so that "price protection" will likely be in place, at least for the early part of the week. Tuesday in particular will be an important barometer of the gold fever as the Sun squares Jupiter. The Sun symbolizes gold and while Jupiter is usually favourable, the square aspect is not without its drawbacks and has the connotation of too much of a good thing, like eating too much, spending too much, or … speculating too much. A top is therefore possible here early in the week. Later in the week Venus conjoins the natal Mars, a thornier influence that could break the upward momentum. Next week could see some unfortunate developments for gold bugs, especially later in the week. Gold looks ready to go over a cliff in mid to late December as gold’s benefactor Jupiter moves off to greener pastures (hint: the US dollar) and Saturn and Pluto move in and cause an awful lot of trouble. Gold seems destined to retrace to its 20 DMA ($950) and then some. How low it can go is an open question. The next few months will offer some good buying opportunities for gold at a much reduced price. At this point, I would wait until February before being reasonably confident that a meaningful bottom might be in.