- Stocks generally stronger early with declines more likely towards Friday

- Dollar likely to resume ascent this week; Euro moving below 1.27

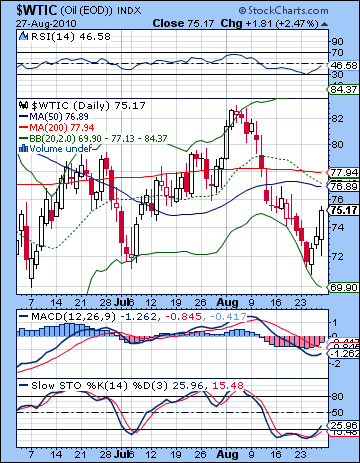

- Possible early gains in crude oil; weakness to return by end of the week

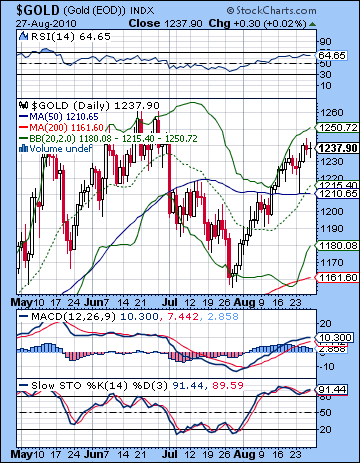

- Gold prices firm this week as Venus enters Libra but late week is more uncertain; pullback likely to gather strength after mid-September

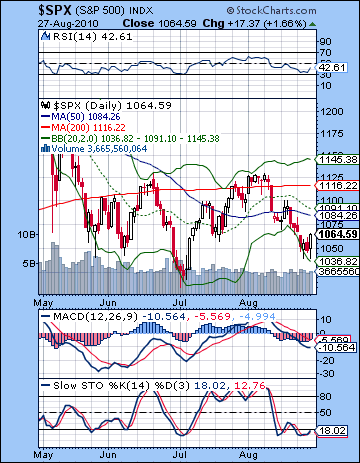

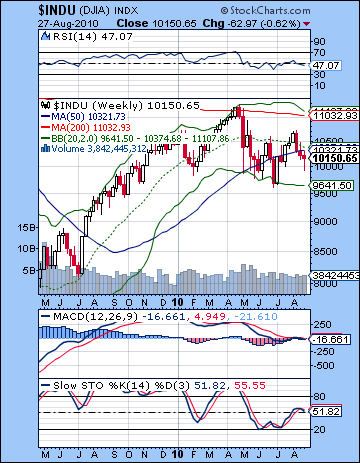

Even after Ben Bernanke’s latest attempts to reassure worried investors and goose a reluctant market, the market still finished lower on the week. After briefly trading below 10,000 a couple of times, the Dow ended above that psychological level to close at 10,150 while the S&P finished at 1064. Markets looked quite fragile ahead of Friday’s big rally as the previous low of 1056 was broken on the downside, thus giving bears the edge. While the overall outcome was generally in keeping with my bearish expectations, the intraweek dynamics left something to be desired. Monday’s decline was not too surprising given the latest Mercury retrograde cycle had begun the just three days prior. Venus was also still suffering from its close conjunction with Mars. More unexpected, however, was Tuesday’s major decline which saw the S&P trade below 1050 on a day when the Sun was in minor aspect with Jupiter. Wednesday at least saw a small technical bounce as Mercury and Venus exchanged meaningful glances in the sky. Thursday was negative as forecast with the Sun-Saturn aspect coinciding with the Mercury-Mars. The extent of the decline was underwhelming, however, and Friday turned positive in the aftermath of these negative transits. That Friday was better than Thursday was less surprising, although I never anticipated the extent of Friday’s GDP/Bernanke rally. The Fed’s renewed commitment to avoid deflation by any means necessary (including the use of helicopters apparently) provided assurance to the market that liquidity would not be problem going forward. This does not preclude more bad economic news from sideswiping the market, but it does mean there is a floor beneath which the market will not fall. Just where this level is in terms of prices remains a matter of speculation on Wall St. as some are bandying around SPX 900 as the point at which Bernanke would step in an introduce a new round of stimulus measures. At this point, he is likely trying to see how much mileage he is getting out of just talking up his role as backstop. If Friday’s rally is any test, his words are still worth something. But if September sees the bad news crowding out the good, then words may not work to prop up prices. Until that time, however, the market could well test the patience of both bulls and bears. With several of the Saturn aspects behind us, the next big aspect is the conjunction of Jupiter and Uranus. This is a more bullish pairing and could help to push prices higher or least temporarily reduce the speed and extent of the coming decline. The Mercury retrograde period from August 20 to September 12 is not a positive influence on stocks and given the negative outcome last week we will have to see how much of the drag this will be this week and next. My sense is these two celestial influences may be somewhat offsetting and produce a choppier market than we’ve seen through much of August. For this reason, I’m not expecting much significant downside for the first half of September and we may well test some resistance levels before heading down in earnest.

Even after Ben Bernanke’s latest attempts to reassure worried investors and goose a reluctant market, the market still finished lower on the week. After briefly trading below 10,000 a couple of times, the Dow ended above that psychological level to close at 10,150 while the S&P finished at 1064. Markets looked quite fragile ahead of Friday’s big rally as the previous low of 1056 was broken on the downside, thus giving bears the edge. While the overall outcome was generally in keeping with my bearish expectations, the intraweek dynamics left something to be desired. Monday’s decline was not too surprising given the latest Mercury retrograde cycle had begun the just three days prior. Venus was also still suffering from its close conjunction with Mars. More unexpected, however, was Tuesday’s major decline which saw the S&P trade below 1050 on a day when the Sun was in minor aspect with Jupiter. Wednesday at least saw a small technical bounce as Mercury and Venus exchanged meaningful glances in the sky. Thursday was negative as forecast with the Sun-Saturn aspect coinciding with the Mercury-Mars. The extent of the decline was underwhelming, however, and Friday turned positive in the aftermath of these negative transits. That Friday was better than Thursday was less surprising, although I never anticipated the extent of Friday’s GDP/Bernanke rally. The Fed’s renewed commitment to avoid deflation by any means necessary (including the use of helicopters apparently) provided assurance to the market that liquidity would not be problem going forward. This does not preclude more bad economic news from sideswiping the market, but it does mean there is a floor beneath which the market will not fall. Just where this level is in terms of prices remains a matter of speculation on Wall St. as some are bandying around SPX 900 as the point at which Bernanke would step in an introduce a new round of stimulus measures. At this point, he is likely trying to see how much mileage he is getting out of just talking up his role as backstop. If Friday’s rally is any test, his words are still worth something. But if September sees the bad news crowding out the good, then words may not work to prop up prices. Until that time, however, the market could well test the patience of both bulls and bears. With several of the Saturn aspects behind us, the next big aspect is the conjunction of Jupiter and Uranus. This is a more bullish pairing and could help to push prices higher or least temporarily reduce the speed and extent of the coming decline. The Mercury retrograde period from August 20 to September 12 is not a positive influence on stocks and given the negative outcome last week we will have to see how much of the drag this will be this week and next. My sense is these two celestial influences may be somewhat offsetting and produce a choppier market than we’ve seen through much of August. For this reason, I’m not expecting much significant downside for the first half of September and we may well test some resistance levels before heading down in earnest.

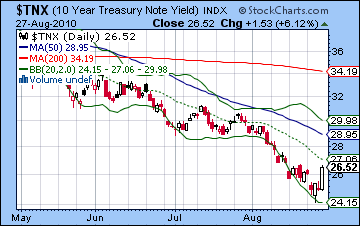

From a technical perspective, the short term market seems caught in tug of war between 1040 and 1065. Bears pushed the S&P as far as 1040 twice last week but this previous resistance level proved how important it still is as buyers re-entered the market and pushed prices higher. While bulls can rightly feel good about Friday’s confident rally, they need to be able to push prices above resistance in the falling channel off the August 9 high. A positive day on Monday would achieve this, and would set the stage for a further move higher, perhaps to the 50 DMA at 1084 or the 20 DMA at 1091. The 200 DMA at 1116 would also be possible if this 1065-1070 level was breached to the upside. But if bears can break below 1040, they will be off to the races again and we would likely retest 1010 quite soon afterward. If this downward channel holds, the support would be around 1030 on Monday and would fall at a rate of about 4 or 5 points a day. This would translate into support at about 1010 by Friday. Volume was decent on Friday’s rally which would generally suggest this move higher has more room to run. MACD is starting to turn higher although it is still a ways from a bullish crossover. Stochastics are oversold so they also would tend to support some kind of bounce in the near term. RSI (42) is also turning higher. Prices moved off the bottom Bollinger band this week and this would also add credence to a move higher, at least to the middle band around 1091. From a longer term perspective, the weekly Dow chart still looks moderately bearish. The 20 WMA is now pointing lower as prices are struggling to regain that level at 10,374. MACD has erased most of its bearish crossover but has yet to turn higher. For all of August’s bearishness, it has been quite an orderly decline. Not surprisingly, the $VIX even fell this week despite the market moving lower, closing at 24.45. Until we see the previous low of 1010 taken out, the $VIX will continue to languish here in the 20-30 range. That said, it is still above its 200 DMA and it has still officially broken out of the descending channel from its May high although the late week action suggests it is going beyond a back test to this line and may be sinking into it to some extent. As long as the VIX stays above its 200 DMA at 23.40, then the bears will still have good reason to be confident in the medium term. More worrying perhaps was the sharp reversal in bond yields on Friday. Predictably, Bernanke’s talk of inflating at any cost scared the bejesus out of bond holders as yields shot back up to 2.65, well up from their Tuesday low of 2.45. While some retracement is going to be inevitable after such a sustained run, yields may be moving higher in the short term. If they do, this will damage the bear case somewhat as inflationary pressures are generally bullish for equities. The horoscope for US Treasuries looks quite weak for the week upcoming, so there’s a good chance we could move toward the upper end of the Bollinger band fairly soon. This down trend in bonds is likely to end only in mid-September. That is another potential indication that stocks will remain choppy to positive until the middle of September.

From a technical perspective, the short term market seems caught in tug of war between 1040 and 1065. Bears pushed the S&P as far as 1040 twice last week but this previous resistance level proved how important it still is as buyers re-entered the market and pushed prices higher. While bulls can rightly feel good about Friday’s confident rally, they need to be able to push prices above resistance in the falling channel off the August 9 high. A positive day on Monday would achieve this, and would set the stage for a further move higher, perhaps to the 50 DMA at 1084 or the 20 DMA at 1091. The 200 DMA at 1116 would also be possible if this 1065-1070 level was breached to the upside. But if bears can break below 1040, they will be off to the races again and we would likely retest 1010 quite soon afterward. If this downward channel holds, the support would be around 1030 on Monday and would fall at a rate of about 4 or 5 points a day. This would translate into support at about 1010 by Friday. Volume was decent on Friday’s rally which would generally suggest this move higher has more room to run. MACD is starting to turn higher although it is still a ways from a bullish crossover. Stochastics are oversold so they also would tend to support some kind of bounce in the near term. RSI (42) is also turning higher. Prices moved off the bottom Bollinger band this week and this would also add credence to a move higher, at least to the middle band around 1091. From a longer term perspective, the weekly Dow chart still looks moderately bearish. The 20 WMA is now pointing lower as prices are struggling to regain that level at 10,374. MACD has erased most of its bearish crossover but has yet to turn higher. For all of August’s bearishness, it has been quite an orderly decline. Not surprisingly, the $VIX even fell this week despite the market moving lower, closing at 24.45. Until we see the previous low of 1010 taken out, the $VIX will continue to languish here in the 20-30 range. That said, it is still above its 200 DMA and it has still officially broken out of the descending channel from its May high although the late week action suggests it is going beyond a back test to this line and may be sinking into it to some extent. As long as the VIX stays above its 200 DMA at 23.40, then the bears will still have good reason to be confident in the medium term. More worrying perhaps was the sharp reversal in bond yields on Friday. Predictably, Bernanke’s talk of inflating at any cost scared the bejesus out of bond holders as yields shot back up to 2.65, well up from their Tuesday low of 2.45. While some retracement is going to be inevitable after such a sustained run, yields may be moving higher in the short term. If they do, this will damage the bear case somewhat as inflationary pressures are generally bullish for equities. The horoscope for US Treasuries looks quite weak for the week upcoming, so there’s a good chance we could move toward the upper end of the Bollinger band fairly soon. This down trend in bonds is likely to end only in mid-September. That is another potential indication that stocks will remain choppy to positive until the middle of September.

This week looks more mixed in terms of transits so that could translate into more upside at least into midweek. Venus gains some strength here as it begins to separate from Mars and will enter its home sign of Libra on Wednesday. Friday stands out also as the Sun and Mercury will come together in Leo. This is often a positive combination but this time there is a twist since the conjunction will occur in close aspect with Rahu, the North Lunar Node. The Rahu factor makes this alignment much more bearish and generally points to a more negative end of the week. The early part of the week is harder to call, however, given the absence of any close aspects. This does not necessarily mean the market will not make any significant moves — it just means that nothing stands out to me. Monday could well see a rise but this could be followed Tuesday by a reversal lower. The horoscope of the Nasdaq, for example, shows both strongly positive and negative aspects in play here so it’s possible they may offset each other to some extent. With Jupiter moving closer to Uranus here, there may be an upward bias kicking in over the next two weeks. This does not mean that we won’t have down days, but they may be more muted. The other possible manifestation we could see from this bullish combination is that technical support levels may hold up better than resistance levels. I don’t think there is much chance of 1010 this week, especially if Monday is higher. A more bullish unfolding of events would see a good rise into Monday and Tuesday that takes the S&P to 1080-1090. This would be followed by choppiness into Thursday then Friday seems unavoidably bearish so a revisiting of 1060 would be quite possible. That would translate into a mostly flat week. This would be a back test of the descending channel. A more bearish scenario needs to have either Monday or (more likely) Tuesday as strongly negative and the S&P trades around 1050-1070 until Wednesday. Then we get end of the week bearishness galore and break below 1040 by Friday. While I respect the bearishness of Mercury retrograde, I’m not entirely convinced its enough to offset the Jupiter-Uranus effect. For this reason, I would lean towards the bullish scenario here. But I would stress that a bearish outcome would not be at all surprising to me here. The difficulty is that the planets are just not clear enough to make an unambiguous call.

This week looks more mixed in terms of transits so that could translate into more upside at least into midweek. Venus gains some strength here as it begins to separate from Mars and will enter its home sign of Libra on Wednesday. Friday stands out also as the Sun and Mercury will come together in Leo. This is often a positive combination but this time there is a twist since the conjunction will occur in close aspect with Rahu, the North Lunar Node. The Rahu factor makes this alignment much more bearish and generally points to a more negative end of the week. The early part of the week is harder to call, however, given the absence of any close aspects. This does not necessarily mean the market will not make any significant moves — it just means that nothing stands out to me. Monday could well see a rise but this could be followed Tuesday by a reversal lower. The horoscope of the Nasdaq, for example, shows both strongly positive and negative aspects in play here so it’s possible they may offset each other to some extent. With Jupiter moving closer to Uranus here, there may be an upward bias kicking in over the next two weeks. This does not mean that we won’t have down days, but they may be more muted. The other possible manifestation we could see from this bullish combination is that technical support levels may hold up better than resistance levels. I don’t think there is much chance of 1010 this week, especially if Monday is higher. A more bullish unfolding of events would see a good rise into Monday and Tuesday that takes the S&P to 1080-1090. This would be followed by choppiness into Thursday then Friday seems unavoidably bearish so a revisiting of 1060 would be quite possible. That would translate into a mostly flat week. This would be a back test of the descending channel. A more bearish scenario needs to have either Monday or (more likely) Tuesday as strongly negative and the S&P trades around 1050-1070 until Wednesday. Then we get end of the week bearishness galore and break below 1040 by Friday. While I respect the bearishness of Mercury retrograde, I’m not entirely convinced its enough to offset the Jupiter-Uranus effect. For this reason, I would lean towards the bullish scenario here. But I would stress that a bearish outcome would not be at all surprising to me here. The difficulty is that the planets are just not clear enough to make an unambiguous call.

Next week (Sep 7-10) is shortened by Monday’s Labor Day holiday. After the long weekend, Tuesday has a good chance of being positive as Venus is in aspect with Jupiter. In the event that Friday is hit with a selloff, look for a reversal right from the open on Tuesday. Generally this week looks mostly bullish, although Friday is more of a question mark as Mercury forms an aspect with Saturn. The following week (Sep 13-17) is likely to begin bearish as Mercury is still aligning with Saturn in the aftermath of its retrograde cycle. I would say this could be mixed week as some gains are still likely with the approach of Jupiter-Uranus. Once we get the Sun-Jupiter aspect out of the way on Monday, September 20, things may start to unravel fairly quickly. Actually, the market may falter before that, but Sun-Jupiter aspects are usually bullish, so we have to allow for the possibility of an up day there. It’s even possible that could be a top. But that week of Sep 20-24 does look like it will create a significant percentage decline. A low is still possible in early October, possibly around the 7th and the start of the Venus retrograde cycle. We should see some violent, if short-lived, bounces after making this early October low. In terms of possible targets, we could see 920 by early October. It’s conceivable that the decline might halt at a higher level — say around 975 but the planets seem too negative for that. It may be that the only way we only go down to 975 would be if we see another significant rally into mid-September that again takes the S&P above 1100. I certainly wouldn’t rule this out given the Jupiter-Uranus energy. But a sizable decline of at least 15% does appear to be in the cards for late September and early October. Let’s see how all this unfolds. It’s likely that any decline will force the Fed into action in October, especially since the Democrats will be facing mid-term elections in November. I would expect markets to trend lower in November with another significant low likely in December. It’s quite possible this could be a lower low than what we see in October, but it’s uncertain.

Next week (Sep 7-10) is shortened by Monday’s Labor Day holiday. After the long weekend, Tuesday has a good chance of being positive as Venus is in aspect with Jupiter. In the event that Friday is hit with a selloff, look for a reversal right from the open on Tuesday. Generally this week looks mostly bullish, although Friday is more of a question mark as Mercury forms an aspect with Saturn. The following week (Sep 13-17) is likely to begin bearish as Mercury is still aligning with Saturn in the aftermath of its retrograde cycle. I would say this could be mixed week as some gains are still likely with the approach of Jupiter-Uranus. Once we get the Sun-Jupiter aspect out of the way on Monday, September 20, things may start to unravel fairly quickly. Actually, the market may falter before that, but Sun-Jupiter aspects are usually bullish, so we have to allow for the possibility of an up day there. It’s even possible that could be a top. But that week of Sep 20-24 does look like it will create a significant percentage decline. A low is still possible in early October, possibly around the 7th and the start of the Venus retrograde cycle. We should see some violent, if short-lived, bounces after making this early October low. In terms of possible targets, we could see 920 by early October. It’s conceivable that the decline might halt at a higher level — say around 975 but the planets seem too negative for that. It may be that the only way we only go down to 975 would be if we see another significant rally into mid-September that again takes the S&P above 1100. I certainly wouldn’t rule this out given the Jupiter-Uranus energy. But a sizable decline of at least 15% does appear to be in the cards for late September and early October. Let’s see how all this unfolds. It’s likely that any decline will force the Fed into action in October, especially since the Democrats will be facing mid-term elections in November. I would expect markets to trend lower in November with another significant low likely in December. It’s quite possible this could be a lower low than what we see in October, but it’s uncertain.

5-day outlook — neutral SPX 1050-1070

30-day outlook — bearish SPX 975-1020

90-day outlook — bearish-neutral 1000-1070

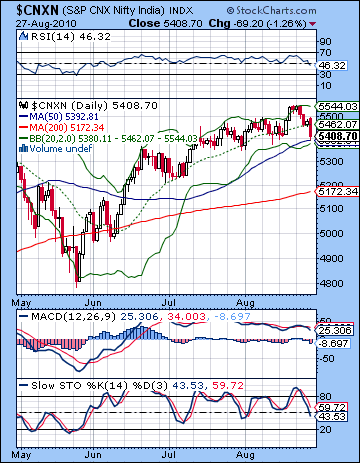

Stocks in Mumbai fell more than 2% last week as inflation fears had more investors considering the possibility of central bank rate hikes. The Sensex lost ground on three out five trading days closing at 17,998 while the Nifty finished at 5408. This was certainly a welcome outcome given our bearish forecast as the Mercury retrograde cycle fulfilled some of its negative potential. While the decline was in keeping with expectations, however, the intraweek activity did not quite conform to my forecast. I thought we would see some midweek gains on the Sun-Jupiter aspect but these were siphoned off and appeared in much mitigated form as Monday’s flat performance and Thursday’s modest recovery. The inability for the Sun-Jupiter aspect to deliver any gains on schedule was perhaps a sign of growing weakness in the market in general. The late week period was more reliably negative as Friday’s decline was the largest of the week. This played out mostly as anticipated as I thought that Friday would be worse than Thursday on the strength of the Moon’s conjunction with Jupiter opposite Saturn. After the recent reluctance of Indian market to mimic the bearish pattern in global equities, this was an important bit of catch up. Where the Saturn-Uranus aspect failed to create any bearishness through much of August, it appears as if the Mercury retrograde may have struck a chord more firmly. This is not to say that any correction will be entirely correlated with Mercury retrograde period from 20 August to 13 September, but it may turn out to be a key triggering factor that releases other negative sentiment that is contained within the various other aspects. Admittedly, Saturn’s closest aspects with Uranus, Jupiter and Pluto are now behind it, but these aspects are still close enough that they can do damage if the triggers are right. Certainly, Mercury’s retrograde cycle counts as one possible trigger, as does the Venus retrograde cycle which commences in early October. Between these two reversals involving normally bullish planets (bullish reversal = bearish), there will be considerably more bearish energy available for the market to digest. Alongside these negative influences, however, Jupiter is now approaching its conjunction with Uranus which is exact on 18 September. This is a decidedly bullish pairing which introduces an important positive energy into the mix. Jupiter symbolizes optimism and expansion while Uranus represents innovation and breaking with the status quo. Together they are a formidable combination and could generate significant increases in risk appetite. While some upside is likely from this combination between now and mid-September, it is also possible that this Jupiter influence may only serve to offset the negativity created by the Mercury retrograde cycle. Still, it is conceivable that we could see a momentary rally that pushes prices back up above 5500. In that sense, I am not certain that we have yet seen the high for the year. Probably we have, but it cannot be ruled out completely. I am more confident in the expectation for much lower prices starting in mid-September and extending into October. That is due to the next major Saturn aspect with Rahu/Ketu which is exact on 27 September. This is often a tumultuous blending of energies that corresponds with confusion and pessimism.

Stocks in Mumbai fell more than 2% last week as inflation fears had more investors considering the possibility of central bank rate hikes. The Sensex lost ground on three out five trading days closing at 17,998 while the Nifty finished at 5408. This was certainly a welcome outcome given our bearish forecast as the Mercury retrograde cycle fulfilled some of its negative potential. While the decline was in keeping with expectations, however, the intraweek activity did not quite conform to my forecast. I thought we would see some midweek gains on the Sun-Jupiter aspect but these were siphoned off and appeared in much mitigated form as Monday’s flat performance and Thursday’s modest recovery. The inability for the Sun-Jupiter aspect to deliver any gains on schedule was perhaps a sign of growing weakness in the market in general. The late week period was more reliably negative as Friday’s decline was the largest of the week. This played out mostly as anticipated as I thought that Friday would be worse than Thursday on the strength of the Moon’s conjunction with Jupiter opposite Saturn. After the recent reluctance of Indian market to mimic the bearish pattern in global equities, this was an important bit of catch up. Where the Saturn-Uranus aspect failed to create any bearishness through much of August, it appears as if the Mercury retrograde may have struck a chord more firmly. This is not to say that any correction will be entirely correlated with Mercury retrograde period from 20 August to 13 September, but it may turn out to be a key triggering factor that releases other negative sentiment that is contained within the various other aspects. Admittedly, Saturn’s closest aspects with Uranus, Jupiter and Pluto are now behind it, but these aspects are still close enough that they can do damage if the triggers are right. Certainly, Mercury’s retrograde cycle counts as one possible trigger, as does the Venus retrograde cycle which commences in early October. Between these two reversals involving normally bullish planets (bullish reversal = bearish), there will be considerably more bearish energy available for the market to digest. Alongside these negative influences, however, Jupiter is now approaching its conjunction with Uranus which is exact on 18 September. This is a decidedly bullish pairing which introduces an important positive energy into the mix. Jupiter symbolizes optimism and expansion while Uranus represents innovation and breaking with the status quo. Together they are a formidable combination and could generate significant increases in risk appetite. While some upside is likely from this combination between now and mid-September, it is also possible that this Jupiter influence may only serve to offset the negativity created by the Mercury retrograde cycle. Still, it is conceivable that we could see a momentary rally that pushes prices back up above 5500. In that sense, I am not certain that we have yet seen the high for the year. Probably we have, but it cannot be ruled out completely. I am more confident in the expectation for much lower prices starting in mid-September and extending into October. That is due to the next major Saturn aspect with Rahu/Ketu which is exact on 27 September. This is often a tumultuous blending of energies that corresponds with confusion and pessimism.

Not surprisingly, bulls took a hit from a technical perspective last week. Of critical importance was the break below support of the rising channel at 5450. So not only were new highs precluded and the 20 DMA violated, the recent channel-based trend was tossed aside as bears gained in strength. Volume was fairly low but it’s worth noting that it increased on down days (14k on Tuesday and Wednesday) when compared with flat or up days (11k). While their victories were hard-won, bears cannot afford to do much celebrating yet since Friday’s selloff put the Nifty at the bottom Bollinger band and above the 50 DMA at 5392. These are now looming as the next levels of resistance in any further move lower. And it is important to remember that the 20, 50 and 200 DMA are all still rising and hence good evidence of a bonafide rally. MACD has slipped into a bearish crossover, however, and is still locked in a negative divergence dating back several months. This is perhaps some of the more reliable evidence for the bearish case. Stochastics (43) are falling and appear to be headed below 20 and the oversold area. Previous minor pullbacks have made similar moves before trending higher again before reaching the 20 area. On all previous mini-pullbacks, prices only retraced to the middle Bollinger band, the 20 DMA. On this occasion, however, prices have fallen to bottom Bollinger band. So that is one reason why this retracement may be full blown and take the Stochastics indicator all the way below 20. The weekly chart of the BSE offers more evidence that the next move down is likely to be quite large. Prices have just moved down off the top Bollinger band. Support will first occur at the 20 WMA at 17,560 and then the bottom Bollinger band at 16,520. Despite last week’s bearish engulfing candle, MACD retains its bullish crossover for another week. But this doesn’t count for much given the negative divergence in this chart with respect to the previous high in April. Also, Stochastics on the weekly chart are well into the overbought area and are turning lower. ICICI Bank (IBN) confirms the gentle increase in bearishness here. So far that inverted hammer candlestick is holding true as prices have generally moved lower since then Actually, this chart is somewhat more bullish in the short term than the indices since IBN has yet to break below its rising channel. Any move below the 50 DMA around 39 would likely spur more investors to abandon ship and take profits from the recent run-up. Overall, then, the technical picture still defaults towards the bulls on a medium term basis although the tide may be turning in the short term. Prices are still following a bullish rising channel dating back to 2009 and a significant pullback to the bottom of this channel would amount to 4950 — fully a 10% decline from current levels. That would still be within range of a standard correction, however.

Not surprisingly, bulls took a hit from a technical perspective last week. Of critical importance was the break below support of the rising channel at 5450. So not only were new highs precluded and the 20 DMA violated, the recent channel-based trend was tossed aside as bears gained in strength. Volume was fairly low but it’s worth noting that it increased on down days (14k on Tuesday and Wednesday) when compared with flat or up days (11k). While their victories were hard-won, bears cannot afford to do much celebrating yet since Friday’s selloff put the Nifty at the bottom Bollinger band and above the 50 DMA at 5392. These are now looming as the next levels of resistance in any further move lower. And it is important to remember that the 20, 50 and 200 DMA are all still rising and hence good evidence of a bonafide rally. MACD has slipped into a bearish crossover, however, and is still locked in a negative divergence dating back several months. This is perhaps some of the more reliable evidence for the bearish case. Stochastics (43) are falling and appear to be headed below 20 and the oversold area. Previous minor pullbacks have made similar moves before trending higher again before reaching the 20 area. On all previous mini-pullbacks, prices only retraced to the middle Bollinger band, the 20 DMA. On this occasion, however, prices have fallen to bottom Bollinger band. So that is one reason why this retracement may be full blown and take the Stochastics indicator all the way below 20. The weekly chart of the BSE offers more evidence that the next move down is likely to be quite large. Prices have just moved down off the top Bollinger band. Support will first occur at the 20 WMA at 17,560 and then the bottom Bollinger band at 16,520. Despite last week’s bearish engulfing candle, MACD retains its bullish crossover for another week. But this doesn’t count for much given the negative divergence in this chart with respect to the previous high in April. Also, Stochastics on the weekly chart are well into the overbought area and are turning lower. ICICI Bank (IBN) confirms the gentle increase in bearishness here. So far that inverted hammer candlestick is holding true as prices have generally moved lower since then Actually, this chart is somewhat more bullish in the short term than the indices since IBN has yet to break below its rising channel. Any move below the 50 DMA around 39 would likely spur more investors to abandon ship and take profits from the recent run-up. Overall, then, the technical picture still defaults towards the bulls on a medium term basis although the tide may be turning in the short term. Prices are still following a bullish rising channel dating back to 2009 and a significant pullback to the bottom of this channel would amount to 4950 — fully a 10% decline from current levels. That would still be within range of a standard correction, however.

This week may be a range of influences at work, both positive and negative. Generally speaking, the early week tilts towards the positive while the late week seems more clearly negative. While Mercury retrograde is still in full force here, there is a possibility we could finish the week higher. There is some reasonably bullish energy available on Monday and Tuesday as transiting Venus conjoins the natal Mercury in the NSE chart. This looks good for producing a net positive outcome over the two days, possibly with an up move of greater than 1%. Late Tuesday could be more negative as the Moon falls under the aspect of Mars. I would not rule out an overall negative close although it may only manifest as a negative trend on an otherwise green day. Wednesday is tougher to call as bullish Venus enters the sign of Libra while the Moon is in aspect with Saturn. This are potentially offsetting energies that could produce a flat day. Thursday and Friday look more bearish, although Thursday is perhaps less reliably negative of the two days. Friday stands out in this respect because both the Sun and Mercury will come under Rahu’s troublesome influence. The Sun and Mercury are headed for a conjunction shortly after the close of trading but effect of Rahu is likely to upset this otherwise positive combination. In addition, the Moon will be aspected by Saturn during the Friday session. So if the bulls come through as expected with early week gains, then there is a reasonable chance for some of those gains to hold up through Friday and produce a positive week. However, the Friday combination does look quite noteworthy so a large down day is possible. Just how negative is hard to estimate but it seems like it could be more than 1%, and may well be more than 2%. So I would not be surprised to see the Nifty finish the week somewhere fairly close to its current level.

This week may be a range of influences at work, both positive and negative. Generally speaking, the early week tilts towards the positive while the late week seems more clearly negative. While Mercury retrograde is still in full force here, there is a possibility we could finish the week higher. There is some reasonably bullish energy available on Monday and Tuesday as transiting Venus conjoins the natal Mercury in the NSE chart. This looks good for producing a net positive outcome over the two days, possibly with an up move of greater than 1%. Late Tuesday could be more negative as the Moon falls under the aspect of Mars. I would not rule out an overall negative close although it may only manifest as a negative trend on an otherwise green day. Wednesday is tougher to call as bullish Venus enters the sign of Libra while the Moon is in aspect with Saturn. This are potentially offsetting energies that could produce a flat day. Thursday and Friday look more bearish, although Thursday is perhaps less reliably negative of the two days. Friday stands out in this respect because both the Sun and Mercury will come under Rahu’s troublesome influence. The Sun and Mercury are headed for a conjunction shortly after the close of trading but effect of Rahu is likely to upset this otherwise positive combination. In addition, the Moon will be aspected by Saturn during the Friday session. So if the bulls come through as expected with early week gains, then there is a reasonable chance for some of those gains to hold up through Friday and produce a positive week. However, the Friday combination does look quite noteworthy so a large down day is possible. Just how negative is hard to estimate but it seems like it could be more than 1%, and may well be more than 2%. So I would not be surprised to see the Nifty finish the week somewhere fairly close to its current level.

Next week (Sep 6-10) is likely to be positive overall. Monday could well begin negatively, however, as Mars joins Venus in Libra. A reversal higher should be underway by Tuesday at the latest as Venus forms a nice aspect with the Jupiter-Uranus conjunction. The positive sentiment may well extend into Wednesday, as the slower than normal velocity of Venus will draw out this favourable contact. Thursday looks more bearish as the Moon conjoins Saturn in Virgo and Mars aspects dissolute Neptune. Friday also has a question mark next to it as Mercury is very close to an aspect with Saturn. The close looks more difficult than the open. The following week (Sep 13-17) is likely to begin negatively as Mercury, now moving forward, is in close aspect with Saturn. Some improvement is likely going into midweek as Wednesday in particular stands out as positive. Friday looks negative as Venus is in aspect with Saturn while the Sun forms a minor aspect with Rahu. Overall, this week could well be positive. After that, the market will likely begin declining more decisively if it hasn’t already. The time around Sep 20-21 stands out as very negative so a big drop is possible there, and I would not rule out a crash. I think the market will generally trend lower into the first week of October and the Venus retrograde station. The rest of October looks more bullish, though, and if we’ve seen a major decline beforehand, then a sharp, snapback rally is likely. Late October and early November appear quite bearish and a new down trend seems likely to continue into December.

5-day outlook — neutral NIFTY 5300-5500

30-day outlook — bearish NIFTY 4800-5000

90-day outlook — bearish NIFTY 4500-5000

Skepticism returned to the US Dollar last week as more traders wondered if the bad economic data might ultimately undermine the currency. After brief forays above 83 early in the week, the Dollar closed just fractionally lower at 82.89 while the Euro inched higher closing just above 1.27. The Rupee was largely unchanged, although it did trade briefly around the 47 level. Interestingly, even Bernanke’s tough talk on deflation that gutted bond yields had little effect on the greenback as it was mostly unchanged in Friday’s session. This is perhaps another indication of the Dollar’s new-found strength. I had been more bullish here so this outcome was a little dismaying, but only a little since I had not expected a huge gain last week in any event. The Dollar met with considerable technical resistance from the 50 DMA at 83.13 and the upper Bollinger band line, now around 84. The period of consolidation has entered its second week after the major breakout of the declining channel. We can now see a new rising channel forming that points to 84 by the end of this week and early next week. Support in this rising channel is close at hand, however, perhaps around 82.5, so any more down moves would invalidate it quickly. But overall the technical picture remains bright for the Dollar. It is trading above the 20 DMA and that moving average is now rising. MACD has now crossed over the zero line and remains in a bullish crossover. RSI (54) is also bullish although it dipped a little from last week’s trading. More important, however, is that RSI shows a positive divergence with respect to previous highs on July 12 and 21. While prices are lower than they were at both of those interim highs, RSI is higher. This suggests that price will eventually follow suit in the near to medium term. Once price climbs over the 50 DMA, it should move significantly higher, in the 84.5-85 range.

Skepticism returned to the US Dollar last week as more traders wondered if the bad economic data might ultimately undermine the currency. After brief forays above 83 early in the week, the Dollar closed just fractionally lower at 82.89 while the Euro inched higher closing just above 1.27. The Rupee was largely unchanged, although it did trade briefly around the 47 level. Interestingly, even Bernanke’s tough talk on deflation that gutted bond yields had little effect on the greenback as it was mostly unchanged in Friday’s session. This is perhaps another indication of the Dollar’s new-found strength. I had been more bullish here so this outcome was a little dismaying, but only a little since I had not expected a huge gain last week in any event. The Dollar met with considerable technical resistance from the 50 DMA at 83.13 and the upper Bollinger band line, now around 84. The period of consolidation has entered its second week after the major breakout of the declining channel. We can now see a new rising channel forming that points to 84 by the end of this week and early next week. Support in this rising channel is close at hand, however, perhaps around 82.5, so any more down moves would invalidate it quickly. But overall the technical picture remains bright for the Dollar. It is trading above the 20 DMA and that moving average is now rising. MACD has now crossed over the zero line and remains in a bullish crossover. RSI (54) is also bullish although it dipped a little from last week’s trading. More important, however, is that RSI shows a positive divergence with respect to previous highs on July 12 and 21. While prices are lower than they were at both of those interim highs, RSI is higher. This suggests that price will eventually follow suit in the near to medium term. Once price climbs over the 50 DMA, it should move significantly higher, in the 84.5-85 range.

This week looks generally positive, although there are few unambiguously positive aspects in play so that may reduce the confidence in our expectation somewhat. Monday looks positive as transiting Mercury forms a minor aspect with the natal Venus in the USDX chart. Tuesday and Wednesday look unstable somehow as the Sun falls under the influence of natal Rahu. This isn’t a clearly bad influence, but it tilts the outcome more towards declines. The end of the week does look more clearly positive, however, as the Sun and Mercury will conjoin whilst in aspect with natal Jupiter. That should be enough fuel to take the Dollar higher on the week, perhaps significantly so. I would therefore expect the Euro to lose ground here, and fall below 1.27. The Rupee also seems vulnerable to pullbacks to the 47 level and beyond. Generally, the Dollar seems likely to continue its recent rally as Jupiter will conjoin Uranus in a very positive place in the USDX horoscope. The aspect to the natal Sun will be near exact on Sep 21 so that could be a meaningful high. At this point, it seems unlikely that previous high of 88 can be eclipsed but let’s first see what kind of gains occur this week. The Dollar should be stay fairly strong through most of October, although I would doubt we see new highs at this time. As we move into November, the chances of significant reversal in the trend increases. A corrective phase could begin any time in October, although the last week of October looks particularly negative. I would expect the downtrend to last well into December and perhaps later. Since I am also expecting the stock market to be weak at that time, this may represent a sea change in the ongoing relationships between asset classes. That will be something to watch for.

Dollar

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — neutral-bullish

Crude oil bounced back late last week as revised GDP numbers and the potential for more Fed support for demand pushed prices higher. After trading below $72 early in the week, crude finished above $75. While I had expected weakness, I did not foresee the extent of the late week recovery. Most of the declines corresponded with the Sun-Mars aspect while the late week gains appeared to come on the Moon’s transit of Pisces in conjunction with Jupiter. Since Pisces is a water sign, this may be providing added strength to oil. While the bounce may have improved the short term technical picture, the medium term technical situation of crude has worsened. The rebound off the bottom Bollinger band was good news for bulls, but it will encounter significant resistance near the 50 DMA at $77. This is also roughly where the 20 DMA is located, so that makes that wall twice as high. Stochastics (25) may be turning higher here so that is also fairly bullish but momentum indicators like MACD are less favourable. We can see a bearish divergence with respect to the previous low, although the crossover is definitely shrinking in the histograms. This negative divergence is clearly echoed in the RSI as the early July low shows a higher RSI reading than last week’s low. While this does not rule out a continuation of this bounce, it seems less likely it can continue very far. Perhaps most telling was that the Wednesday low was lower than the previous July low. This may suggest that bulls are getting weaker. The June low still needs to be taken out before a larger move lower, but this was an important first step towards that target. In the near term, more gains towards $77 may not mean much because of heavy resistance. It is only a breaking above those key moving averages that would signal renewed bullishness.

Crude oil bounced back late last week as revised GDP numbers and the potential for more Fed support for demand pushed prices higher. After trading below $72 early in the week, crude finished above $75. While I had expected weakness, I did not foresee the extent of the late week recovery. Most of the declines corresponded with the Sun-Mars aspect while the late week gains appeared to come on the Moon’s transit of Pisces in conjunction with Jupiter. Since Pisces is a water sign, this may be providing added strength to oil. While the bounce may have improved the short term technical picture, the medium term technical situation of crude has worsened. The rebound off the bottom Bollinger band was good news for bulls, but it will encounter significant resistance near the 50 DMA at $77. This is also roughly where the 20 DMA is located, so that makes that wall twice as high. Stochastics (25) may be turning higher here so that is also fairly bullish but momentum indicators like MACD are less favourable. We can see a bearish divergence with respect to the previous low, although the crossover is definitely shrinking in the histograms. This negative divergence is clearly echoed in the RSI as the early July low shows a higher RSI reading than last week’s low. While this does not rule out a continuation of this bounce, it seems less likely it can continue very far. Perhaps most telling was that the Wednesday low was lower than the previous July low. This may suggest that bulls are getting weaker. The June low still needs to be taken out before a larger move lower, but this was an important first step towards that target. In the near term, more gains towards $77 may not mean much because of heavy resistance. It is only a breaking above those key moving averages that would signal renewed bullishness.

This week looks mixed for crude as there are both positive and negative aspects in play. Generally, the early week may be more positive, while the late week may see a greater likelihood of declines. Transiting Venus forms a nice aspect with the natal ascendant in the Futures chart on Monday and Tuesday, so there is a good chance there will be net gains across those two days. Venus enters Libra on Wednesday and that may also provide some positive energy. However, Thursday and Friday seem more bearish as Mars takes up position in the Futures chart. And on Friday, the Moon will be in Gemini with Ketu in a close aspect with pessimistic Saturn. I would expect a net negative here, perhaps with two down days in a row. There is a good chance that any negativity will be strong enough to erase any gains made previously in the week. Crude looks quite vulnerable to declines through September and October. Not only will the late September Saturn-Rahu aspect take the wind out of risk appetite for commodities, but Saturn itself will oppose the natal Sun in the Futures chart through October. The Mercury-Saturn conjunction on October 7 is exactly opposite the natal Sun so that could well be a significant low.

5-day outlook — neutral

30-day outlook — bearish

90-day outlook — bearish

More currency uncertainty pushed gold higher last week as prospects for new stimulus raised expectations for inflation. After some early week pullback, gold roared back on Wednesday and closed 1% higher near $1237. More difficult times for my forecast unfortunately, as the GLD natal chart is not behaving in the way I thought it would. That said, the intraweek moves did adhere somewhat to expectations as Monday was lower on the Sun-Mars aspect but only a little bit, as prices stayed above $1220. Then, as expected, the Sun-Jupiter aspect pushes prices Tuesday and Wednesday. Thursday’s bearish forecast also came to pass as the Sun-Saturn aspect brought profit taking, although here, too, the retracement was woefully tiny. Friday was harder to call, and we ended flat and produced a doji. Gold seems to have found its mojo again as the 20 DMA is rising, although the 50 DMA is still flat. Prices have stepped back somewhat from the upper Bollinger band last week although it is unclear if this will prefigure a pullback to the middle or bottom band. While the sharply rising channel off the late July low has been broken, gold may have entered a wedge pattern that could mean more upside in the near term. MACD is still rising and in a bullish crossover but we can see a negative divergence in the histogram’s last week. An even bigger divergence is evident with the May low. RSI (64) is still very bullish and rising. Gold may be making a mad dash for its previous high at $1270 but these indicators would tend to suggest it won’t make it.

More currency uncertainty pushed gold higher last week as prospects for new stimulus raised expectations for inflation. After some early week pullback, gold roared back on Wednesday and closed 1% higher near $1237. More difficult times for my forecast unfortunately, as the GLD natal chart is not behaving in the way I thought it would. That said, the intraweek moves did adhere somewhat to expectations as Monday was lower on the Sun-Mars aspect but only a little bit, as prices stayed above $1220. Then, as expected, the Sun-Jupiter aspect pushes prices Tuesday and Wednesday. Thursday’s bearish forecast also came to pass as the Sun-Saturn aspect brought profit taking, although here, too, the retracement was woefully tiny. Friday was harder to call, and we ended flat and produced a doji. Gold seems to have found its mojo again as the 20 DMA is rising, although the 50 DMA is still flat. Prices have stepped back somewhat from the upper Bollinger band last week although it is unclear if this will prefigure a pullback to the middle or bottom band. While the sharply rising channel off the late July low has been broken, gold may have entered a wedge pattern that could mean more upside in the near term. MACD is still rising and in a bullish crossover but we can see a negative divergence in the histogram’s last week. An even bigger divergence is evident with the May low. RSI (64) is still very bullish and rising. Gold may be making a mad dash for its previous high at $1270 but these indicators would tend to suggest it won’t make it.

This week may well have more upside for gold as Venus enters Libra on Wednesday. Libra is usually a positive influence on Venus so that may act as a bullish influence. The wild card here is the late week Sun-Mercury conjunction that occurs in close aspect with Rahu. The Sun-Mercury conjunction is usually positive for gold, but the Rahu influence here could disturb that outcome. It could produce an increase in speculative actions that push gold up sharply, or it may disrupt the status quo sufficiently that prices drop precipitously. So there is a greater likelihood of a larger move late in the week. At the same time, the medium influences seem more bearish but thus far, they have yet to make a substantial appearance. Saturn, most notably, has been absent but it could reappear and drastically alter the general sentiment. The Jupiter-Uranus conjunction will occur in a positive place in the GLD horoscope so that may introduce another positive factor on prices as we head into September. These may be roughly offsetting, although the positive Jupiter influence would appear to win out in the short run, at least until the middle of September. After that time, the Sun will enter Virgo where it will join hands with Saturn so that may be a more reliable indicator of bearishness. The Sun enters Virgo on September 17 and remains there until October 17. One important question concerns the effect of the retrograde cycle of Venus which begins on October 7. While this may be seen as a negative influence, the previous Venus retrograde cycle in March and April 2009 did not see a large correction as prices had only a slightly bearish bias. A deeper correction may only occur starting in December and January ahead of the Saturn retrograde cycle.

5-day outlook — neutral-bullish

30-day outlook — bearish-neutral

90-day outlook — bearish