- Maintain overall bearish stance until mid-December

- Probable early week gains to Dow 8500/SPX 850

- Probable early week gains to Sensex 9500/Nifty 2850

- Stocks to move higher until December 1-3

- Gold rally to continue until December 1

- Maintain overall bearish stance until mid-December

- Probable early week gains to Dow 8500/SPX 850

- Probable early week gains to Sensex 9500/Nifty 2850

- Stocks to move higher until December 1-3

- Gold rally to continue until December 1

I expect the volatility to continue this week albeit with a better chance for gains, particularly early on in the week. Matters will be complicated somewhat by the Thanksgiving holiday in the US which will close markets Thursday and Friday afternoon. The Sun will conjoin with Mercury on Tuesday and this will likely push stocks significantly higher over Monday and Tuesday. Monday looks like it could go either way, but it is possible that we may see Dow 8500-8800 by Tuesday if we manage to avoid a significant down day on Monday. The rest of the week looks shakier, however, as Mercury applies to conjoin malefic Mars, so expect to see an erosion of early week gains by Friday, perhaps down towards 8000. I don’t think we’ll break much below that level and that may be the technical signal for more upward movement next week.

I expect the volatility to continue this week albeit with a better chance for gains, particularly early on in the week. Matters will be complicated somewhat by the Thanksgiving holiday in the US which will close markets Thursday and Friday afternoon. The Sun will conjoin with Mercury on Tuesday and this will likely push stocks significantly higher over Monday and Tuesday. Monday looks like it could go either way, but it is possible that we may see Dow 8500-8800 by Tuesday if we manage to avoid a significant down day on Monday. The rest of the week looks shakier, however, as Mercury applies to conjoin malefic Mars, so expect to see an erosion of early week gains by Friday, perhaps down towards 8000. I don’t think we’ll break much below that level and that may be the technical signal for more upward movement next week.

With the completion of the Jupiter-Saturn aspect on Friday, a somewhat more optimistic outlook may take hold since Jupiter’s next planetary coupling will be with benefic Venus on December 1. In fact, December 1st may well emerge as the final top before the last leg down in this first phase of the bear market. There is a rare triple conjunction of the Moon, Venus and Jupiter on December 1 that will coincide with a strong rally. The market will likely decline soon after that date. At this point, I believe the December lows are most likely to occur either on Friday December 12, or during the week of December 15-19. It is still an open question if this will be a lower low or another retesting of 7400. Saturn is stationing in tense aspect with Neptune at this time, and since these are extremely malefic planets, I think it is more likely that this will be a lower low, perhaps even below 7000. Moreover, the Sun and Mars will also form part of a larger alignment of planets at that time and this will add a more powerful and acute sense to the crisis. We can expect some panic selling at this time with T-bill yields probably dropping to zero.

Possible Trading Strategies: Investors looking to cover outstanding long positions may consider waiting until early next week (Dec 1-3) since prices are likely to peak at that time. Depending on individual risk/reward profiles, however, the early week highs may offer a quicker exit point albeit at somewhat lower levels. An excellent shorting opportunity will occur on December 1-3, as the market will likely head down at least 20% after that date. The next opportunity for going long will occur on December 15-19 as this will coincide with the start of a major bear market rally through most of January.

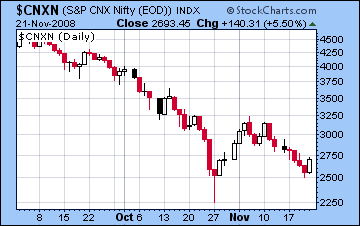

Dalal Street sold off once again last week as the bearish mood deepened in advance of the Jupiter-Saturn aspect. While Mumbai did retest key support levels on Thursday (2525/8300), the Nifty ended Friday’s session at 2693 while the Sensex closed at 8915. Even if Friday’s strong rally was most welcome, my forecast erroneously called the low for earlier in the week. This effectively pushed back the rally for the early part of this week. With the Sun-Mercury conjunction in Scorpio late Tuesday night (IST), we can expect stocks to advance on balance Monday and Tuesday. Major gains are possible here, with 9500/2850 as potential targets on an intraday basis. The outlook becomes more negative later in the week, especially as the Moon enters Scorpio, its sign of debilitation on Thursday and Friday. We can expect some retracement back towards 2700-2750 on the Nifty in advance of next week’s probable gains with the triple conjunction of Moon, Venus and Jupiter on December 1. A top of Sensex 10,000 and Nifty 3000 is possible at this time, although there is a good chance they may not quite get all the way there.

After the probable top in the first week of December, the market will begin another major move down. This will coincide with the tightening of the aspect between Saturn and Neptune and be punctuated by a larger malefic alignment with the Sun and Mars. I believe the low will occur in the week of December 15-19 and may retest the late October intraday lows of Sensex 7700/Nifty 2250. There is also a chance that the market will break through those lows and fall as low as Sensex 7000 and Nifty 2000. Since I am not certain about the ultimate level of the lows, the mid-December time frame will be a better guidepost for trading.

After the probable top in the first week of December, the market will begin another major move down. This will coincide with the tightening of the aspect between Saturn and Neptune and be punctuated by a larger malefic alignment with the Sun and Mars. I believe the low will occur in the week of December 15-19 and may retest the late October intraday lows of Sensex 7700/Nifty 2250. There is also a chance that the market will break through those lows and fall as low as Sensex 7000 and Nifty 2000. Since I am not certain about the ultimate level of the lows, the mid-December time frame will be a better guidepost for trading.

Possible Trading Strategies: Investors looking to cover outstanding long positions may consider waiting until early next week (Dec 1-3) as prices are likely to peak at that time. Depending on individual risk/reward profiles, however, the early week highs may offer a quicker exit point, albeit at somewhat lower levels. An excellent shorting opportunity will occur December 1-3 as the market will likely make another significant leg down soon after. I expect this decline to be at least 20%. Once the lows have been put in place, a major rally will begin by December 22 and will continue into mid to late January. This will be an outstanding trading opportunity since this will be a very powerful bear market rally that should be 30-40% above the December lows.

Against the prevailing bearish mood, the US dollar continued to strengthen against most world currencies last week. The Euro was largely unchanged on the week and closed Friday just below 1.26. With some recovery in stocks in the near term, we can expect some modest gains in the Euro this week but it is unlikely to be substantial. 1.26-1.27 seems like a reasonable price target. December will see further weakening of the Euro down below 1.20 but this should be very short lived. December will mark a key turning point in this financial crisis and it may well mark the high point of the US dollar. Even when stocks eventually resume their decline in 2009, the US dollar is very unlikely to return to its current levels.

The Rupee weakened last week to 49.91 amidst the growing pessimism about the global economy. Some strengthening is very likely this week and into next, perhaps between 48-49. December will see more declines, however, and so its October lows will likely be revisited as it may trade in the 52-54 range. A stronger Rupee is forecast for 2009.

The sell off in crude continued without mercy last week as it fell 12% and traded below $50. While some recovery is likely this week and into next, it is unlikely to move too far above $55. Transiting Ketu is tightening its aspect to the natal Jupiter in the Futures chart and this will limit the upside in the coming days. Once the early December top is reached, however, look for crude to plummet even further as December prices below $40 are likely.

Gold finally rallied strongly last week and even traded above $800 for a time before settling Friday at $791. It was up 7% for the week. With the Sun continuing its transit of Anuradha this week, we can expect further gains, although they may be more modest. With the triple conjunction of Moon, Venus and Jupiter occurring at 28 Sagittarius exactly conjunct the natal Venus in the Futures chart, look for a possible blow off top on Monday, December 1. This will likely be the top in gold for the next few months, so this may be a very good trading opportunity. Any pullbacks this week would be good entry points as gold could easily rise to $850, or possibly higher. The first week of December will also be an excellent shorting opportunity for gold as I expect prices to decline sharply through December.