- Early week gains likely on Venus-Ketu-Pluto; weakness builds into Mercury Rx later

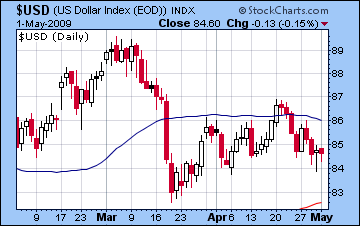

- Dollar may gain later in week

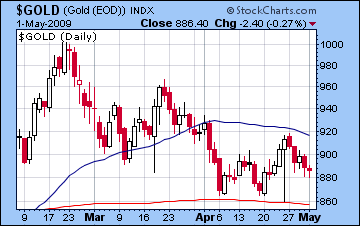

- Gold may rise over $900

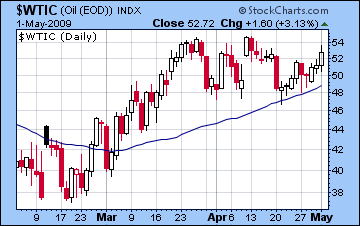

- Crude oil continues to yo-yo around $50

- Early week gains likely on Venus-Ketu-Pluto; weakness builds into Mercury Rx later

- Dollar may gain later in week

- Gold may rise over $900

- Crude oil continues to yo-yo around $50

Stocks in New York extended their spring rally last week as investors were cheered by a series of positive earnings reports. After overcoming some bearishness early in the week, the Dow ended at 8212, its highest level since early February, while the S&P stood at 877. The new highs were somewhat surprising, although the basic contours of the week were not, as we had forecast weakness for Monday and Tuesday on the Mars-Ketu-Pluto with gains later on. What was most disappointing is that the declines were quite mild, as the markets traded only briefly below 8000/850 on Tuesday and then bounced back after that. Wednesday was the big up day, with the bulls in control until Thursday morning. This largely coincided with our expectations for gains with the approach of the Venus configuration with Ketu and Pluto. Bulls asserted their primacy again on Friday as the Moon joined the positive Venusian energy by forming a trinal aspect. It seems that the main fuel for this market is still the favourable Jupiter-Uranus-Neptune alignment and it is largely overriding most other short lived negative aspects. Clearly, negative transits from fast moving planets such as Mars will do little to slow up the benefic juggernaut that has been in control for almost two months. What is required is negative energy that is longer lasting and therefore more powerful. And that is where we may find ourselves this week as Mercury turns retrograde early on Thursday before the trading day.

While Mercury is a fast moving planet, its velocity around its retrograde stations is much slower, as it actually comes to a full stop for several hours early on Thursday morning, May 7. Interestingly, the results of the banking stress tests will be finally released that day, so the Mercury factor here increases the chances for a negative market reaction. Retrograde stations often signal the beginning of difficult periods for stocks because investors start to second guess their thinking and assumptions. In astrology, the nature of retrograde Mercury (which will be in effect from May 7 – 31) symbolizes going back to tie up loose ends, revisiting problems that were never worked out properly the first time around, or indeed, retracing one’s steps. The analogy for stocks is obvious, so overall, the Mercury retrograde increases the likelihood for a significant retracement for stocks. As noted in previous newsletters, the start of this retrograde cycle is made somewhat more problematic for stocks because of the presence of the aspect from disruptive Rahu to Mercury. The Rahu influence can indicate distortions in information and misunderstandings, prominent rumours, and greater volatility. Ahead of Thursday’s potential for a mercurial reversal, however, stocks could rise further on Monday, as Venus forms an exact aspect with Ketu. Either Tuesday or Wednesday could see a significant decline (>1%) after Venus has left the scene and the Moon enters Virgo. The best opportunity for a significant pullback (>2%) should be on Thursday or Friday after Mercury has actually shifted directions. I don’t expect anything too huge, and we have to allow for the possibility that the week overall may not even be negative. The bullish energy has confounded my expectations too often lately, so we have to be aware of more upside potential. Nonetheless, my best guess is that Friday’s close will be lower than last week’s.

While Mercury is a fast moving planet, its velocity around its retrograde stations is much slower, as it actually comes to a full stop for several hours early on Thursday morning, May 7. Interestingly, the results of the banking stress tests will be finally released that day, so the Mercury factor here increases the chances for a negative market reaction. Retrograde stations often signal the beginning of difficult periods for stocks because investors start to second guess their thinking and assumptions. In astrology, the nature of retrograde Mercury (which will be in effect from May 7 – 31) symbolizes going back to tie up loose ends, revisiting problems that were never worked out properly the first time around, or indeed, retracing one’s steps. The analogy for stocks is obvious, so overall, the Mercury retrograde increases the likelihood for a significant retracement for stocks. As noted in previous newsletters, the start of this retrograde cycle is made somewhat more problematic for stocks because of the presence of the aspect from disruptive Rahu to Mercury. The Rahu influence can indicate distortions in information and misunderstandings, prominent rumours, and greater volatility. Ahead of Thursday’s potential for a mercurial reversal, however, stocks could rise further on Monday, as Venus forms an exact aspect with Ketu. Either Tuesday or Wednesday could see a significant decline (>1%) after Venus has left the scene and the Moon enters Virgo. The best opportunity for a significant pullback (>2%) should be on Thursday or Friday after Mercury has actually shifted directions. I don’t expect anything too huge, and we have to allow for the possibility that the week overall may not even be negative. The bullish energy has confounded my expectations too often lately, so we have to be aware of more upside potential. Nonetheless, my best guess is that Friday’s close will be lower than last week’s.

This bull leg is very real and should not be underestimated even with the prospect of a troubled Mercury retrograde cycle. From a technical perspective, the market is sending mixed signals. Volume in this rally has been fairly average but not really impressive and moreover has not increased over time, suggesting that participation has not broadened which one would expect in solid bull rally. It should also be noted that Friday’s modest rise came on decidedly below average volume. The SPX remains near some important resistance points, and has matched its February highs around 870-875. The Dow has performed less impressively and is currently below its February highs by about 3%. In both cases, the indexes have not yet broken to the upside in a clearly bullish signal. If they fail to do so this week as we think they might, then the market will likely sell off in response. Even if it manages to get as high as 8500/900 early this week, I would skeptical about its chances for staying above those levels for the rest of the week. I think this week will see the beginning of meaningful period of consolidation with an increase in downside risk. The direction is unlikely to be one-sided, however, as some gains looks likely for the early part of next week (May 11-13). Weakness will likely return towards the end of next week with an increased likelihood for more negative sentiment around the Saturn direct station on May 16. Therefore, the following week of May 18-22 may be bearish overall. The last week of May (25-29) when Jupiter conjoins Neptune is looks fairly bullish so we may be off to the races once again after that.. I will re-examine the question of the interim bottom here next week.

Last week stocks in Mumbai were mostly unchanged over the shortened three-day trading week, as the market showed more signs of topping. After slipping early in the week, markets bounced back strongly on Wednesday as the Nifty closed at 3473 and the Sensex at 11,403. This outcome was largely in keeping with expectations as we had forecast early weakness with strength re-emerging as the week went on. As it turned out, Tuesday was the big down day as the negative Mars-Ketu-Pluto configuration temporarily overshadowed bullish sentiment. We did not get to 3300 on the Nifty and as a result markets returned to the previous week’s level. Monday was less bearish than expected, perhaps due a positive feedback from the Moon in Rahu-ruled Ardra, since Rahu itself was in Moon-ruled Shravana. We expected gains later in the week, and they arrived a little ahead of schedule on Wednesday. I mistakenly thought the markets were open Friday (oops!) and certainly they would have risen above current levels. This potential outcome was also accounted for in last week’s forecast as the opportunity for new highs was not ruled out given the continuing strength of Indian markets on the Jupiter-Uranus-Neptune alignment.

This week looks like a better candidate for a pullback and the beginning of a period of consolidation before the market can turn higher once again. As previously noted, much depends on Mercury’s retrograde cycle which begins Thursday morning. These retrograde cycles are often correlated with sideways or negative movements as investor psychology reflects the inherent caution and ambivalence contained in the backward motion of Mercury, the planet of thinking, intellect, and trading. Since retrograde cycles are often characterized by rethinking assumptions and positions, this Mercury cycle (May 7 – 31) increases the likelihood of a correction in the market after this recent rally. On Monday Mumbai will probably play catch up and rise further and this is supported by the benefic Venus influence in its alignment with Ketu and Pluto. This rally may well extend into Tuesday but I am not certain if bulls will control at the end of that day. Some kind of bearish energy will likely be expressed either on Tuesday or Wednesday. Ahead of Thursday, therefore, the market will probably be higher than current levels, but I expect more declines to occur Thursday or Friday after Mercury changes direction. Overall this week, there is a better chance for a move down than last week, although even there, it is not certain. The market is running up against some strong resistance around Nifty 3500 and is in the process of forming a double top, so there are some good technical reasons to expect some move to the downside. The potential for election turbulence increases the chances for a bearish move here as the Mercury retrograde sits on a very sensitive point (the ascendant) in the Indian independence chart.

This week looks like a better candidate for a pullback and the beginning of a period of consolidation before the market can turn higher once again. As previously noted, much depends on Mercury’s retrograde cycle which begins Thursday morning. These retrograde cycles are often correlated with sideways or negative movements as investor psychology reflects the inherent caution and ambivalence contained in the backward motion of Mercury, the planet of thinking, intellect, and trading. Since retrograde cycles are often characterized by rethinking assumptions and positions, this Mercury cycle (May 7 – 31) increases the likelihood of a correction in the market after this recent rally. On Monday Mumbai will probably play catch up and rise further and this is supported by the benefic Venus influence in its alignment with Ketu and Pluto. This rally may well extend into Tuesday but I am not certain if bulls will control at the end of that day. Some kind of bearish energy will likely be expressed either on Tuesday or Wednesday. Ahead of Thursday, therefore, the market will probably be higher than current levels, but I expect more declines to occur Thursday or Friday after Mercury changes direction. Overall this week, there is a better chance for a move down than last week, although even there, it is not certain. The market is running up against some strong resistance around Nifty 3500 and is in the process of forming a double top, so there are some good technical reasons to expect some move to the downside. The potential for election turbulence increases the chances for a bearish move here as the Mercury retrograde sits on a very sensitive point (the ascendant) in the Indian independence chart.

Whether or not we will reach the interim high early this week depends on how bearish Thursday and Friday will be. Since I am expecting a bounce early next week (May 11-13), we have to expect some recovery then, perhaps on the order to 3-5%. At this point, I expect more bearishness to manifest around the Saturn direct station of May 16. That means that some declines are likely towards the end of next week (May 14-15) and into the following week of May 18-22. The extent of the retracement may take us back down to Nifty 3000. Just how long this bearish trend lasts and how far down we go will depend greatly on what transpires in the last week of May 25-29. At that time, Jupiter will come into exact conjunction with Neptune and then move past it. While this is probably a positive influence that could push markets higher once again, if it fails to do so, then the correction and choppiness could extend well into June.

After some early strength, the US dollar was mostly weaker last week as it again closed below 85. This was in keeping with expectations as we foresaw Monday’s gains on the Sun-Mercury aspect in the USDX chart. The declines afterwards also did not come as a surprise as the transiting Mars hit the natal IC as the appetite for risk grew and more investors pulled their money out of the greenback in search of better returns. The dollar remains in a technically precarious place as it has fallen through the short upward price channel off the March lows. Nonetheless, it remains above those March lows of 83 and can still be considered to be trading in a longer upward price channel formed from the lows of last July and December. This week may well see begin with more weakness in the dollar, and we can’t rule out a retest of 83 as Mercury will be slowing to crawl and oppose the natal Saturn. But there is a good chance of a rebound from Wednesday on, as Venus will conjoin the IC. This is usually a positive influence and may well offset the early week Mercury-Saturn gloominess. However, the dollar is likely to slump back towards 83-84 the following week. The best window for dollar strength appears to be May 18-22 when Venus will aspect the powerful Mercury-Uranus-Ascendant clustering in the natal chart. The near term chances for 90 appear remote indeed, but 88 is still within reach as long as it does not fall back to 84 next week.

After some early strength, the US dollar was mostly weaker last week as it again closed below 85. This was in keeping with expectations as we foresaw Monday’s gains on the Sun-Mercury aspect in the USDX chart. The declines afterwards also did not come as a surprise as the transiting Mars hit the natal IC as the appetite for risk grew and more investors pulled their money out of the greenback in search of better returns. The dollar remains in a technically precarious place as it has fallen through the short upward price channel off the March lows. Nonetheless, it remains above those March lows of 83 and can still be considered to be trading in a longer upward price channel formed from the lows of last July and December. This week may well see begin with more weakness in the dollar, and we can’t rule out a retest of 83 as Mercury will be slowing to crawl and oppose the natal Saturn. But there is a good chance of a rebound from Wednesday on, as Venus will conjoin the IC. This is usually a positive influence and may well offset the early week Mercury-Saturn gloominess. However, the dollar is likely to slump back towards 83-84 the following week. The best window for dollar strength appears to be May 18-22 when Venus will aspect the powerful Mercury-Uranus-Ascendant clustering in the natal chart. The near term chances for 90 appear remote indeed, but 88 is still within reach as long as it does not fall back to 84 next week.

The Euro rallied last week to close near 1.33 on the positive vibes emitted by the Venus-Ketu aspect and the building of the Jupiter influence on the Moon in the natal chart. This Jupiterian rise was very much expected after Monday’s weakness from the Mars-Ketu aspect had activated the angles in the natal chart. Jupiter is likely not quite done with its bullishness since the aspect has yet to move away from the Moon so we can look for more upside early this week, perhaps to 1.35 again. However, the Euro will be prone to corrections Thursday and Friday as Mars squares the natal Sun, and Mercury goes retrograde in close aspect to natal Neptune. Whatever declines it sees this week, the Euro is likely to erase them next week as the Sun will aspect the natal Jupiter. The Indian Rupee closed mostly unchanged on the week near 49.5 after trading above 50 earlier in the week. We may see it trade above 50 again by Friday after Mercury goes retrograde.

After some early losses, crude oil bounced back yet again and closed above $52 and was up overall on the week. This rubber ball-like action to crude was entirely expected, as Monday and Tuesday’s decline coincided with the Mars-Ketu aspect that pushed it under $50. The bearish role of Mars was also seen through its 8th house aspect to the Moon-Saturn conjunction in the natal chart. The rebound was a little stronger than expected, however, as the Venus influence was magnified by the Moon’s supportive aspect to Rahu. Wednesday’s rally in particular was the beneficiary of this highlighting of the water signs (Cancer and Pisces) which provided a boost to crude oil, that blackest of liquids.

After some early losses, crude oil bounced back yet again and closed above $52 and was up overall on the week. This rubber ball-like action to crude was entirely expected, as Monday and Tuesday’s decline coincided with the Mars-Ketu aspect that pushed it under $50. The bearish role of Mars was also seen through its 8th house aspect to the Moon-Saturn conjunction in the natal chart. The rebound was a little stronger than expected, however, as the Venus influence was magnified by the Moon’s supportive aspect to Rahu. Wednesday’s rally in particular was the beneficiary of this highlighting of the water signs (Cancer and Pisces) which provided a boost to crude oil, that blackest of liquids.

This week will likely see strength early on, and I would not be surprised to see crude take a run at its recent highs of $55. Venus conjoins the natal Rahu in the ETF chart so there may be a lot of speculative optimism. At the same time, we should see at least one big down day Tuesday or Wednesday as Mars conjoins the natal Sun in the Futures chart. Some weakness later in the week is also possible, although I wonder if the Mars-Mercury conjunction is enough to do the job. It will still be two degrees away from exact and given the proximity of the Jupiter aspect, it’s conceivable that crude may not see much negative price action this week. It is unlikely to reach $48, and I would also think it has a good chance to stay above $50 as long as it rises Monday. The following week (May 11-15) looks quite bullish for crude again, so most likely it will move back up to $55 and even above it. Even with another dip down under $50 likely May 18-22, the medium term outlook for crude continues to look mostly bullish.

Contrary to expectations, gold failed to rise last week, falling back to $886. While we had anticipated some early week losses to under $900 which did in fact occur, Wednesday’s modest gain was left twisting in the wind as the bears moved in later in the week. Despite the overall discrepancy with the forecast, the early week pullback was further proof that the GLD ETF chart works very well with standard transit interpretations such as Monday’s Mars quincunxed natal Mars. Our disappointment lay in the fact that the Jupiter aspect to the natal Venus did not deliver, or at least, not yet.

Contrary to expectations, gold failed to rise last week, falling back to $886. While we had anticipated some early week losses to under $900 which did in fact occur, Wednesday’s modest gain was left twisting in the wind as the bears moved in later in the week. Despite the overall discrepancy with the forecast, the early week pullback was further proof that the GLD ETF chart works very well with standard transit interpretations such as Monday’s Mars quincunxed natal Mars. Our disappointment lay in the fact that the Jupiter aspect to the natal Venus did not deliver, or at least, not yet.

This week holds the potential for those Jupiter-fueled gains once again, as the trine aspect to Venus is still very close and in fact is still yet to come exact even by Friday. That said, I think the early part of the week looks stronger for bullion since Mars will aspect the natal Jupiter later on. After some weakness early next week (May 11-13), look for a possible high in gold May 15 since there are some very favourable aspects forming that day in the ETF chart. I still think it has a good chance to reach its 50-day moving average ($923) and may even reach $950 in the near term on the strength of this Jupiter aspect to the natal Sun and Venus. This relative strength for gold may continue into early June at least.