- Declines early in the week with recovery midweek and later

- Dollar higher by midweek followed by profit taking

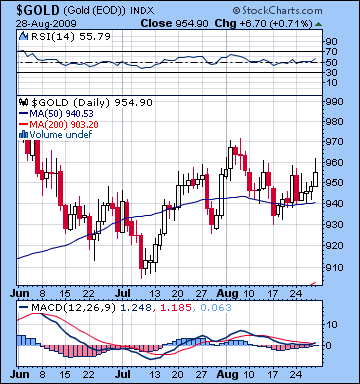

- Gold weaker early with recovery by Friday; possible top September 10

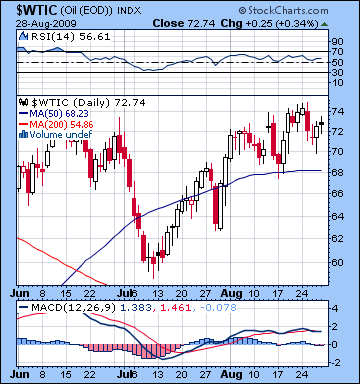

- Crude lower this week overall but with some rebound later

- Declines early in the week with recovery midweek and later

- Dollar higher by midweek followed by profit taking

- Gold weaker early with recovery by Friday; possible top September 10

- Crude lower this week overall but with some rebound later

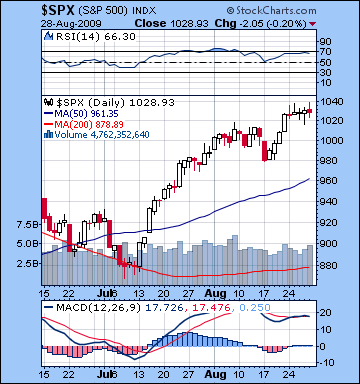

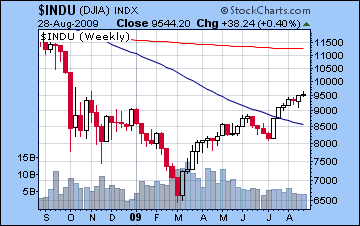

Despite a raft of fairly positive economic data, stocks were largely unchanged last week albeit with a slight upward bias. After trading as high as 9600 intraweek, the Dow finally settled at 9544 for Friday’s close while the S&P finished at 1028. Given my bearish forecast, this was a somewhat puzzling and frustrating week as stocks actually managed to make new yearly highs on Thursday. The central problem was the failure of the malefic Mercury-Mars square aspect forming into midweek to take markets significantly lower. Monday began more or less according to expectations as stocks weakened in the afternoon and ended lower across the board. Tuesday and Wednesday held steady with moderate bullishness, presumably on the strength of the Venus-Ketu conjunction. While I alluded to the bullish energy in this conjunction, I mistakenly believed it could not counteract the multi-planet alignment. Clearly I was wrong in this assessment, perhaps through an undervaluing of Mercury’s strength of its placement in its own sign of Virgo. The late week gains came off more or less as anticipated as Thursday was higher and Friday did indeed open higher on the Venus influence on Mercury although sellers moved in immediately and took the market lower.

Despite a raft of fairly positive economic data, stocks were largely unchanged last week albeit with a slight upward bias. After trading as high as 9600 intraweek, the Dow finally settled at 9544 for Friday’s close while the S&P finished at 1028. Given my bearish forecast, this was a somewhat puzzling and frustrating week as stocks actually managed to make new yearly highs on Thursday. The central problem was the failure of the malefic Mercury-Mars square aspect forming into midweek to take markets significantly lower. Monday began more or less according to expectations as stocks weakened in the afternoon and ended lower across the board. Tuesday and Wednesday held steady with moderate bullishness, presumably on the strength of the Venus-Ketu conjunction. While I alluded to the bullish energy in this conjunction, I mistakenly believed it could not counteract the multi-planet alignment. Clearly I was wrong in this assessment, perhaps through an undervaluing of Mercury’s strength of its placement in its own sign of Virgo. The late week gains came off more or less as anticipated as Thursday was higher and Friday did indeed open higher on the Venus influence on Mercury although sellers moved in immediately and took the market lower.

The continued drift higher here is at odds with the malefic energy that is inherent in the Mercury-Mars square. While last week’s failure to sell off was disappointing, it is important to remember that this energy has to be released very soon while the aspect is still within range. The market appears to be trading in an increasingly narrow range as rally attempts are often quickly brought to heel while selling rarely goes very far as buyers step in at the earliest opportunity. The inability of the market to move higher on some generally optimistic housing and consumer data is a possible sign that the market may find it difficult to make new highs this week. The RSI remains extremely bullish but still verging on overbought while MACD is ambiguous. Although slightly positive, its moving averages are flat indicating a possible move either way, while the lower high last week creates a negative divergence with respect to the MACD peak earlier in August. As the weekly Dow chart shows, volume continues to ebb with each passing week of this rally — not a reassuring sign for bulls. But does this mean the rally is finally over? I wish I could be more certain, but unfortunately I cannot. Even with the prospect of some early week selling this week, there remains enough potential up days from now until September 15 to allow for the possibility of fresh highs. Much depends on how bearish the down days are and whether they can offset the various daily bullish alignments that lie ahead. So far the negative days have been underwhelming to say the least. As a general guideline, I think it would be prudent to sell into (or short) any up moves in the coming two weeks. Perhaps the safest strategy would be waiting for September 10-11 and the Venus-Jupiter opposition which will likely to coincide with a small but noteworthy rally.

This week presents another opportunity for the Mercury-Mars square to manifest its bearishness, especially earlier in the week. While I had been previously bullish about this week, the inability for the Mercury-Mars square to initiate a sell off last week increases the chances of some kind of significant down day or days here. Monday has a very good chance for a decline as the Moon enters Capricorn and conjoins Rahu. Also Mercury is slowing ahead of its retrograde cycle and will match the velocity of Mars that day, thus adding to the negative potential. It’s very possible that we could see a 2-4% pullback here. In some way, Tuesday is an equally critical day because both Mercury and Mars will move under the influence of a minor Jupiter aspect which could take the market higher, especially in the afternoon. Since Mercury-Mars is a sort of incendiary energy, Jupiter’s beneficence could be sufficient to redirect the energy towards positive ends. If Tuesday ends higher, then it increases the likelihood for new highs this week. If not, then there’s a good chance that we will end the week lower. As the Moon conjoins Jupiter early Wednesday afternoon, we could see a sizable move in either direction. If Tuesday closes higher, then Wednesday likely will, too. If Tuesday is lower, then Wednesday could see a continuation of the trend. The late week period seems more positive as Friday’s Full Moon in Aquarius will draw upon the influence of Venus. Overall, this week may well be more volatile with larger price moves in both directions. I am uncertain of ultimate outcome this week, but investors should be prepared for higher prices just in case.

The holiday-shortened week next week (Sept 8-11) may begin bearishly with a decline Tuesday but a significant rally is likely Wednesday and Thursday as Sun-Venus-Jupiter form a bullish alignment. This has the potential to move markets 2-4% higher. A sell off Friday is also possible as the aspects begin to separate, and this could well be noteworthy as we move into the period of greater turbulence. The following week (Sep 14-18) looks to be the most bearish so far and will likely bring markets down to test key support levels. Depending where we are at that point, the mid-September period could test SPX 940 since a 10% decline is possible then. Sept 21-25 also appears to begin bearishly, perhaps extending the late week decline from the previous week, before some late week bounce. Early to mid-October still looms as another significant move down, presumably below the July lows and perhaps much lower. Late October and early November have the makings of a significant rally off the lows with another decline likely in the second week of November.

The holiday-shortened week next week (Sept 8-11) may begin bearishly with a decline Tuesday but a significant rally is likely Wednesday and Thursday as Sun-Venus-Jupiter form a bullish alignment. This has the potential to move markets 2-4% higher. A sell off Friday is also possible as the aspects begin to separate, and this could well be noteworthy as we move into the period of greater turbulence. The following week (Sep 14-18) looks to be the most bearish so far and will likely bring markets down to test key support levels. Depending where we are at that point, the mid-September period could test SPX 940 since a 10% decline is possible then. Sept 21-25 also appears to begin bearishly, perhaps extending the late week decline from the previous week, before some late week bounce. Early to mid-October still looms as another significant move down, presumably below the July lows and perhaps much lower. Late October and early November have the makings of a significant rally off the lows with another decline likely in the second week of November.

5-day outlook — neutral

30-day outlook — bearish

90-day outlook — bearish

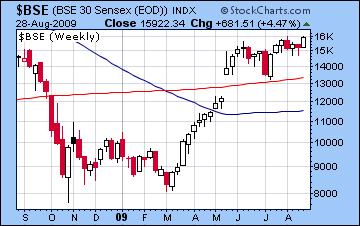

Stocks in Mumbai gained over 4% last week on improving prospects for the global economy. With the market rising in all five sessions, the Nifty reached a yearly high on Friday’s close at 4732 while the Sensex finished at 15,922. This was a puzzling and disappointing result given my bearish outlook for the week. It seems that much of the negative energy of the Mercury-Mars-Pluto-Rahu alignment was siphoned off by the midweek Venus-Ketu conjunction. It is perhaps noteworthy, however, that I did accurately suggest that the biggest gains for the week would come Monday and either Thursday or Friday. That is exactly what happened as both Monday and Friday saw the market rise by more than 1% each day. Nonetheless, the failure of the market to sell off on this Mercury-Mars square is another reminder that this rally phase isn’t quite done.

Stocks in Mumbai gained over 4% last week on improving prospects for the global economy. With the market rising in all five sessions, the Nifty reached a yearly high on Friday’s close at 4732 while the Sensex finished at 15,922. This was a puzzling and disappointing result given my bearish outlook for the week. It seems that much of the negative energy of the Mercury-Mars-Pluto-Rahu alignment was siphoned off by the midweek Venus-Ketu conjunction. It is perhaps noteworthy, however, that I did accurately suggest that the biggest gains for the week would come Monday and either Thursday or Friday. That is exactly what happened as both Monday and Friday saw the market rise by more than 1% each day. Nonetheless, the failure of the market to sell off on this Mercury-Mars square is another reminder that this rally phase isn’t quite done.

Last week’s strength obviously cannot be underestimated, as a new high on the Nifty merits considerable attention. At the same time, it was not significantly above the previous June high and therefore should only be seen as conditional. The Sensex has also yet to confirm this high and until it does, the bulls will still have something to prove. RSI is bullish at 62 although it is approaching the same overbought territory as it did in early August before pulling back. MACD is slightly positive and its constituent averages have turned higher, although please note the bearish divergence between the previous highs and last week. Therefore, despite some bullish indicators, one can make a case that the technical picture is somewhat more mixed where some kind of correction is in the cards. Even if we see some early week decline here, the key support level of 4400 will likely survive intact by Friday, and indeed into next week. So while the market is trading at somewhat higher than expected levels, it does not fundamentally change our expectation for a significant pullback in September and October. The failure to retest support levels last week only means that our price targets may be raised somewhat with 3500 on the Nifty as a plausible October bottom. The market could still surprise on the downside, but conservative targets are perhaps more appropriate given the recent market strength. Overall, the Sep-Oct decline should still break below the June lows.

This week may be more volatile with bigger price swings in both directions with a bearish bias. Generally the early part of the week looks more bearish with gains more likely to accrue later on. With the Mercury-Mars square tightening through the week, there is a possibility for large declines greater than 2% on any given day. Monday starts with the Moon in Sagittarius opposite Mars so that could create some anxiety and nervousness with some profit taking right off the bat. Tuesday may see more of the same as the Moon conjoins Rahu in Capricorn although some buying may occur near the close as the Moon approaches its opposition aspect with Venus. Sentiment may turn positive on Wednesday as the Moon conjoins Jupiter at the same time that Jupiter forms a minor aspect with Mercury and Mars. This is admittedly a bit of a wild card influence that could go either way, but given the recent market strength, a gain is very possible. Thursday sees the Moon enter Aquarius opposite Sun and Saturn, which may introduce more caution in the marketplace. Friday’s Full Moon could well be the most positive day of the week as the Moon forms a helpful aspect with both Sun and Venus. The close may see additional buying.

With the probability of some kind of pullback this week, next week (Sept 7-11) seems like another rally attempt on a very positive Sun-Venus-Jupiter alignment. The early part of the week looks fairly negative, but watch for gains on 9-11 September which could well represent another rally attempt to retest these highs. The following week (Sep 14-18) looks quite volatile on the Sun-Saturn-Uranus alignment. This is likely to produce larger moves in both directions with declines more likely towards the end of the week. The likelihood of significantly lower prices can be seen through the condition of Mercury over the next two months. Mercury goes retrograde on 7 September whilst in a square aspect with Mars, then comes under the disruptive influence of Rahu’s aspect on 19 September, and then a Saturn conjunction on 22 September. Once its retrograde cycle ends on 29 September, it will again cross over these same malefic planets in early October. The early October window looks somewhat more negative than the second half of September.

With the probability of some kind of pullback this week, next week (Sept 7-11) seems like another rally attempt on a very positive Sun-Venus-Jupiter alignment. The early part of the week looks fairly negative, but watch for gains on 9-11 September which could well represent another rally attempt to retest these highs. The following week (Sep 14-18) looks quite volatile on the Sun-Saturn-Uranus alignment. This is likely to produce larger moves in both directions with declines more likely towards the end of the week. The likelihood of significantly lower prices can be seen through the condition of Mercury over the next two months. Mercury goes retrograde on 7 September whilst in a square aspect with Mars, then comes under the disruptive influence of Rahu’s aspect on 19 September, and then a Saturn conjunction on 22 September. Once its retrograde cycle ends on 29 September, it will again cross over these same malefic planets in early October. The early October window looks somewhat more negative than the second half of September.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish

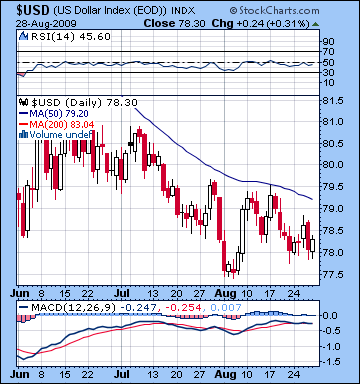

After an encouraging start to the week, the dollar barely managed a gain last week as it closed at 78.30. I had been much more bullish but Monday’s and Wednesday’s gains were fairly tepid, perhaps in keeping with the ongoing consolidation and bottom formation that is now underway. While I had been bearish late in the week, Thursday saw a bigger than expected selloff. Friday’s bounce only clawed back half of the previous day’s losses. The technical picture on the dollar is mixed as the 50 DMA is still declining and RSI remains slightly bearish. MACD is essentially flat but a potentially bullish divergence is still in the cards as lower highs have correlated with generally flat peaks. The 50 DMA has now moved below 80 and any close above that level would be a very bullish signal for the dollar. It’s unlikely that we will see that this week, but it’s conceivable we will next week.

After an encouraging start to the week, the dollar barely managed a gain last week as it closed at 78.30. I had been much more bullish but Monday’s and Wednesday’s gains were fairly tepid, perhaps in keeping with the ongoing consolidation and bottom formation that is now underway. While I had been bearish late in the week, Thursday saw a bigger than expected selloff. Friday’s bounce only clawed back half of the previous day’s losses. The technical picture on the dollar is mixed as the 50 DMA is still declining and RSI remains slightly bearish. MACD is essentially flat but a potentially bullish divergence is still in the cards as lower highs have correlated with generally flat peaks. The 50 DMA has now moved below 80 and any close above that level would be a very bullish signal for the dollar. It’s unlikely that we will see that this week, but it’s conceivable we will next week.

This week looks fairly positive for the dollar, so we are likely to see it trade above 79 again. Monday looks promising as Venus sextiles the natal MC. Tuesday also has a chance for a rise as the Moon-Venus opposition will come close to the natal Jupiter. As the week progresses, the Mercury-Mars square will tighten and become potentially more powerful. This ought to have a bullish effect on the dollar. At the same time, Mercury is approaching its retrograde station at 12 Virgo which will sit in a very sensitive and powerful position in the USDX chart — the Midheaven or 10th house cusp. This ought to produce a gain, but the Mars aspect makes this influence somewhat harder to interpret. The following week (Sep 8-11) looks like a see-saw as a good gain Tuesday on the Venus-Ascendant aspect may well be nullified by Sun-Venus-Jupiter pattern on the 9th and 10th that will increase risk appetite and move investors out of the greenback. The Sun-Saturn-Uranus aspect on September 17 should accelerate the dollar’s appreciation and help it break through key resistance levels 80 and 81.5 and move higher into October.

The Euro slipped back slightly last week closing a little below 1.43. I had expected more downside on the Mercury-Mars square midweek and the bounce on the Venus-Mercury aspect was stronger than I had anticipated. The Euro remains close to recent highs but it is unable to make new highs. This week could see more downside probing but some rebound is likely by week’s end. Monday has the potential for a decline as the Moon conjoins Rahu in close aspect to the natal Ascendant. Admittedly, this influence could go either way since Rahu tends to move unexpectedly and with force. The Euro should hold above 1.40 here until at least mid-September. My October target remains 1.30-1.35. Despite some late week gains, the Indian Rupee edged slightly lower last week closing at 48.7. We could easily see the Rupee trade at 49 this week although it should rally back somewhat by Friday. 50-51 is very possible by October.

Dollar

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bullish

As predicted, crude oil moved lower last week, although it proved much more resilient than expected closing above $72. I had believed we could see crude trade nearer to its 50 DMA, but it gamely stayed above $70 even after the midweek turbulence on the activation of the Ketu-Neptune conjunction in the Futures chart. Despite missing the size of the overall move, I took some solace in correctly forecasting the late week recovery on the Venus-Mercury aspect. While crude did not collapse, it is perhaps significant that it performed worse than equities, which is another sign of the growing fatigue in this bear market rally. Stocks made new highs for the year, but crude did not and closed Friday off almost 5% from its high of $75. Technically, crude oil is in a very mixed situation as the 50 DMA is flat lining –evidence of a possible top, while MACD has turned slightly negative.

As predicted, crude oil moved lower last week, although it proved much more resilient than expected closing above $72. I had believed we could see crude trade nearer to its 50 DMA, but it gamely stayed above $70 even after the midweek turbulence on the activation of the Ketu-Neptune conjunction in the Futures chart. Despite missing the size of the overall move, I took some solace in correctly forecasting the late week recovery on the Venus-Mercury aspect. While crude did not collapse, it is perhaps significant that it performed worse than equities, which is another sign of the growing fatigue in this bear market rally. Stocks made new highs for the year, but crude did not and closed Friday off almost 5% from its high of $75. Technically, crude oil is in a very mixed situation as the 50 DMA is flat lining –evidence of a possible top, while MACD has turned slightly negative.

This week crude may see further erosion in the early going again with its 50 DMA ($68) as a possible support level that will be retested. The Mercury-Mars square will set up the natal nodes in the ETF chart so this has the potential for a sizable decline. Some recovery is likely by Wednesday on the Moon-Jupiter conjunction. Thursday also holds the potential for gains as Venus aspects the Sun-Uranus trine in the Futures chart. This rebound should be significant and may well take crude back over $70, assuming that the prior decline comes off as expected. The week following Labor Day is likely to see the bulls return in force so there may be another rally attempt towards $75. It seems unlikely to succeed, but investors need to be aware of the possibilities. The Sun-Saturn-Uranus alignment of mid-September will set up square to the angles in the Futures chart so that is likely to correspond with a big move, most likely down.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish

Gold managed to stave off execution for yet another week as early week selling took it down to $940 before it rallied once again back to $954 to finish the week unchanged. This was a particularly baffling outcome given my bearish forecast. While I was correct in seeing Monday’s decline on the Venus-Saturn conjunction in the natal chart, the Mercury-Mars-Pluto alignment did nothing but see modest buying through the midweek. Mercury was perhaps better able to channel Mars’ energy in a more positive way given its strong placement in its own sign of Virgo. Also with transiting Jupiter closing in on the natal ETF Moon, there is a conceivable explanation for gold’s continued strength here although I was not clever enough to foresee it. Gold remains poised to break out above its recent pennant formation in the chart and this second recovery above $950 may give bulls a little more courage in the coming days. MACD is turning positive and the price remains above its 50 DMA at $940.

Gold managed to stave off execution for yet another week as early week selling took it down to $940 before it rallied once again back to $954 to finish the week unchanged. This was a particularly baffling outcome given my bearish forecast. While I was correct in seeing Monday’s decline on the Venus-Saturn conjunction in the natal chart, the Mercury-Mars-Pluto alignment did nothing but see modest buying through the midweek. Mercury was perhaps better able to channel Mars’ energy in a more positive way given its strong placement in its own sign of Virgo. Also with transiting Jupiter closing in on the natal ETF Moon, there is a conceivable explanation for gold’s continued strength here although I was not clever enough to foresee it. Gold remains poised to break out above its recent pennant formation in the chart and this second recovery above $950 may give bulls a little more courage in the coming days. MACD is turning positive and the price remains above its 50 DMA at $940.

Gold may be vulnerable to correction early on this week but the prospects for recovery later on means that it is likely to continue to trade in its current range of $930-960. Monday could well be down as the Moon-Rahu conjunction opposes natal Saturn. Tuesday and Wednesday could see a significant move either way. For the bears, the natal Mars will be activated by the transiting Mercury-Mars aspect but the bullish scenario has the Moon-Jupiter conjunction on top of the natal Jupiter on Wednesday. One possible outcome would be a down day Tuesday followed by a major bounce Wednesday. Thursday and Friday look generally positive although they could end up offsetting each other to some extent as both days are unlikely to be positive. Whatever gold may do this week, I think one can make a good case for the top arriving on Sept 10-11 when the Venus-Jupiter aspect sets up on the natal Moon. This is a very positive aspect that will likely highlight a short but powerful rally in gold off of whatever interim lows it may set this week. The Sun-Saturn-Uranus alignment is likely to interrupt this up trend very suddenly so gold may drop 5% in a single day. Again, we should see a significant low in gold in early October, most likely below $850.

5-day outlook — bearish-neutral

30-day outlook — bearish

90-day outlook — bearish