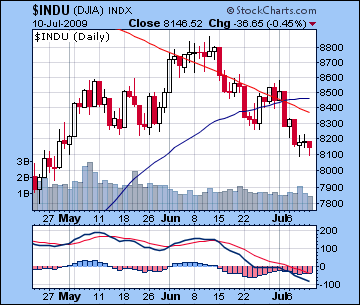

- Stocks may rise early, but prone to potentially large declines later in the week

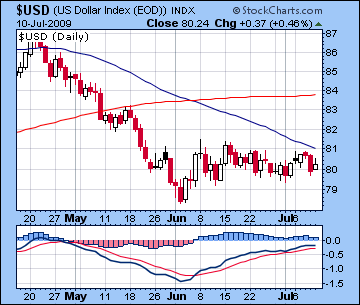

- Dollar trading in narrow range before heading higher

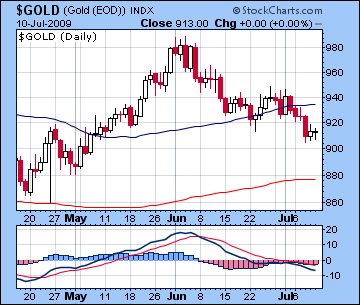

- Gold weaker by Friday before moving much lower next week

- Crude finding a bottom ahead of next week’s eclipse

- Stocks may rise early, but prone to potentially large declines later in the week

- Dollar trading in narrow range before heading higher

- Gold weaker by Friday before moving much lower next week

- Crude finding a bottom ahead of next week’s eclipse

This week looks quite mixed given the wide range of planetary aspects in effect. Monday could be volatile as Mars is in aspect with both Rahu and Pluto. This is a bearish influence which could push prices down further but it is important to note that it may not be very strong since the planets in aspect are past exactitude. The Moon in Pisces adds some extra energy to this aspect in the morning, so that increases the chance for declines then. However, once the Moon moves off, it is possible that we could see buyers return by afternoon. The best chance for gains would appear to be early to midweek as the Sun conjoins a very strong Mercury in late Gemini. This should boost volume and produce at least one significant up day, perhaps Tuesday or Wednesday. Wednesday morning looks especially positive as Mercury (1 Cancer) moves into aspect with powerful Uranus (2 Pisces) while the Moon (2 Aries) will aspect Jupiter (2 Aquarius). There is a chance some of the lift in any up move may fade by Wednesday afternoon, however. Thursday is somewhat puzzling since there are some clearly conflicting influences. Mercury moves closer to malefic Ketu by the end of the week, so I am less inclined to forecast much upside. The Sun enters Cancer which may also be considered bearish, however, it will form a partial aspect with Jupiter and Neptune. If anything, Friday looks more negative as Mercury will be sitting just one degree from Ketu so we could see a huge decline ahead of the weekend. Since we are in a consolidation phase, it seems that any daily gains this week will be quickly followed by profit taking. If Monday closes in the red, then could be in a position to see deeper losses than last week. In any event, the trend is down, and I’m doubtful that an up day (or two) will be enough to change that. Overall, there is a good chance we will test the 38% retracement level by next week — SPX 845/Dow7950. If we fall past that, then the next target would be 810/7650.

This week looks quite mixed given the wide range of planetary aspects in effect. Monday could be volatile as Mars is in aspect with both Rahu and Pluto. This is a bearish influence which could push prices down further but it is important to note that it may not be very strong since the planets in aspect are past exactitude. The Moon in Pisces adds some extra energy to this aspect in the morning, so that increases the chance for declines then. However, once the Moon moves off, it is possible that we could see buyers return by afternoon. The best chance for gains would appear to be early to midweek as the Sun conjoins a very strong Mercury in late Gemini. This should boost volume and produce at least one significant up day, perhaps Tuesday or Wednesday. Wednesday morning looks especially positive as Mercury (1 Cancer) moves into aspect with powerful Uranus (2 Pisces) while the Moon (2 Aries) will aspect Jupiter (2 Aquarius). There is a chance some of the lift in any up move may fade by Wednesday afternoon, however. Thursday is somewhat puzzling since there are some clearly conflicting influences. Mercury moves closer to malefic Ketu by the end of the week, so I am less inclined to forecast much upside. The Sun enters Cancer which may also be considered bearish, however, it will form a partial aspect with Jupiter and Neptune. If anything, Friday looks more negative as Mercury will be sitting just one degree from Ketu so we could see a huge decline ahead of the weekend. Since we are in a consolidation phase, it seems that any daily gains this week will be quickly followed by profit taking. If Monday closes in the red, then could be in a position to see deeper losses than last week. In any event, the trend is down, and I’m doubtful that an up day (or two) will be enough to change that. Overall, there is a good chance we will test the 38% retracement level by next week — SPX 845/Dow7950. If we fall past that, then the next target would be 810/7650.

Next week (July 20-24) sees the Solar Eclipse after Tuesday’s trading in New York. The Venus-Saturn square is the key aspect in this eclipse and it creates even more negative energy for the market to contend with. However, it is important to note that if we should be a big decline this week, next week may not see much more probing on the downside. Like most planetary patterns, eclipses are approximate measures that can manifest a few days either side of their exact angle. That said, the earlier part of next week seems to have less positive energy, so further declines or a narrow trading range would be more likely then. The following week (July 27 – 31) looks more positive as Venus will aspect Jupiter. August appears to be quite bullish so it seems there will be another rally then, at least in the first half of the month. The rally looks substantial, but whether the market can climb back to its June highs or even exceed them remains an open question. A double top is a possible outcome that would precipitate a major selloff for the late summer and fall season. Whatever levels the market ultimately reach, I am expecting a sizable drop (>10%) around in the last week of August or first week of September. This could coincide with a top, but more likely a emphatic decline that follows a top.

5-day outlook — bearish-neutral

30-day outlook — bullish

90-day outlook — bearish

1-year outlook — bearish

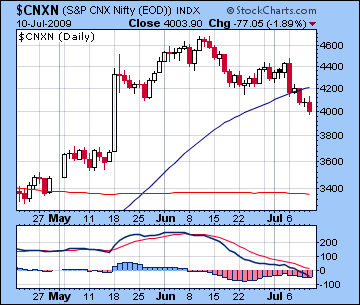

Stocks in Mumbai plunged 9% last week as worries over the global economy dovetailed with disappointment over the budget. After Monday’s post-budget sell off, the market continued to fall as the Sensex closed Friday at 13,504 while the Nifty ended at 4003. This outcome corresponded with our bearish early week forecast, although the extent of the decline was somewhat surprising as the market easily broke through Nifty 4150. Interestingly, the market did stage a minor rally as expected ahead of the budget announcement and the Mars-Jupiter aspect and sold off sharply after investors were disappointed by the lack of pro-market reforms and the promise of heavy government deficits. I had thought we might see more of a bounce later in the week but Friday’s late afternoon decline precluded any recovery. It is noteworthy that the market had been higher for much of Friday’s session and this coincided with the approach of the Moon-Jupiter aspect. Technically, the market remains quite negative as MACD is still very bearish and prices have fallen below their 50 day moving average. This current consolidation phase is likely to continue as the market attempts to find meaningful support. Now that it has fallen past its 25% retracement level as measured from the March lows to the June highs, the next possible retracements are 38% which is equivalent to about Nifty 3850 and 50% which translates to Nifty 3600. It seems likely we will test Nifty 3850 in the coming two weeks. Given an absence of other technical sources of support at that level, however, we cannot rule out the possibility of 3600-3700 by the time of the Solar Eclipse on July 22.

This week is likely to see the falling trend continue, although we should see at least one strong up day that might offset some of the declines. Monday features a very negative Mars-Rahu-Pluto aspect that could bring out the sellers but some buying is likely in the afternoon as the Moon forms a positive aspect with Jupiter. This may mitigate losses, perhaps in a significant way. Mercury will conjoin the Sun on Tuesday and into Wednesday and this is likely to lift prices for at least one of those days. Mercury is very strong in late Gemini so that should rekindle some appetite for stocks and perhaps produce a 2-4% gain. Watch for heavier than normal volumes at this time. Thursday looks quite volatile as Mercury will aspect Uranus while the Moon enters aggressive Aries. In normal circumstances, this would appear to be a positive influence but given the oncoming eclipse and the fact that Mercury is conjoining Ketu, I’m less certain about a positive outcome from this aspect. Indeed, since it is past exact by the afternoon, it may well coincide with a decline. Friday may also see a large price move (either up or down) as the Sun is in a minor alignment with Jupiter-Neptune. Although I am neutral to bearish this week, it is still possible that the market could finish higher. If Monday fails to take the market down, then that might be a signal that some of the other aspects may be less negative than forecast.

This week is likely to see the falling trend continue, although we should see at least one strong up day that might offset some of the declines. Monday features a very negative Mars-Rahu-Pluto aspect that could bring out the sellers but some buying is likely in the afternoon as the Moon forms a positive aspect with Jupiter. This may mitigate losses, perhaps in a significant way. Mercury will conjoin the Sun on Tuesday and into Wednesday and this is likely to lift prices for at least one of those days. Mercury is very strong in late Gemini so that should rekindle some appetite for stocks and perhaps produce a 2-4% gain. Watch for heavier than normal volumes at this time. Thursday looks quite volatile as Mercury will aspect Uranus while the Moon enters aggressive Aries. In normal circumstances, this would appear to be a positive influence but given the oncoming eclipse and the fact that Mercury is conjoining Ketu, I’m less certain about a positive outcome from this aspect. Indeed, since it is past exact by the afternoon, it may well coincide with a decline. Friday may also see a large price move (either up or down) as the Sun is in a minor alignment with Jupiter-Neptune. Although I am neutral to bearish this week, it is still possible that the market could finish higher. If Monday fails to take the market down, then that might be a signal that some of the other aspects may be less negative than forecast.

Next week (July 20-24) will feature the total Solar Eclipse that occurs before trading on Wednesday on July 22. With Venus in a tense aspect to Saturn at this time, the market will be prone to further declines ahead of this eclipse. These declines will tend to be larger if for some reason the market does not fall substantially this week. In that sense, we need to look at this lead up to the eclipse as a whole in which the bearishness will manifest but could be spread out over two weeks. Some bounce is possible Thursday or Friday. The following week (July 27 – 31) looks bullish, with Monday looking especially positive as Venus will aspect Jupiter and this will correspond with some very close aspect hits to the ascendant in the NSE chart. Also Thursday July 30 looks very bullish due to the close Mercury-Jupiter aspect. Both of these trading days (or the days on either side of them) should be powerful enough to produce major gains (>2%). August looks quite bullish, especially in the first half of the month. Therefore it seems likely we will see a resumption of the rally in earnest. Whether or not the market can return to its June highs is uncertain, although there will certainly be a lot of upward thrust available for the bulls. Declines will likely increase in frequency in the second half of August so we could see a top sometime in the middle of the month. Watch for significant declines to occur in the final days of August or early September. We could see 10% drop or more over a two or three day period at that time.

5-day outlook — bearish-neutral

30-day outlook — bullish

90-day outlook — bearish

1-year outlook — bearish-neutral

The dollar was largely unchanged last week as it continued to trade in a fairly narrow range around 80. Some moderate gains occurred early of the week courtesy of the Mars-Jupiter aspect and apparently the Sun moving into minor alignment with a series of planets at 21 degrees in the natal chart. I had expected a large move on the Mars opposition to the natal Sun and we did see a big drop Thursday on this aspect. Technically, the dollar seems likely to continue to trade around these levels. Despite the absence of any recent gains, MACD remains mildly positive, which is perhaps a sign of price stabilization. On the negative side, it is still trading below its 50 day moving average and unless it can make a move above, sentiment will stay cautious. This week looks like more of the same, although some big single day moves are possible. Monday may be bearish, at least to start, as the Mars-Rahu-Pluto aspect will be in the neighbourhood of the natal Saturn. Tuesday and especially Wednesday seem more promising given the Venus-Jupiter aspect. Thursday may be cautious or negative as the Moon transits the malefic 6th house while Friday has a chance for gains as Venus moves into aspect with the all-important ascendant. The dollar should stay around 80 this week, maybe slightly below.

The dollar was largely unchanged last week as it continued to trade in a fairly narrow range around 80. Some moderate gains occurred early of the week courtesy of the Mars-Jupiter aspect and apparently the Sun moving into minor alignment with a series of planets at 21 degrees in the natal chart. I had expected a large move on the Mars opposition to the natal Sun and we did see a big drop Thursday on this aspect. Technically, the dollar seems likely to continue to trade around these levels. Despite the absence of any recent gains, MACD remains mildly positive, which is perhaps a sign of price stabilization. On the negative side, it is still trading below its 50 day moving average and unless it can make a move above, sentiment will stay cautious. This week looks like more of the same, although some big single day moves are possible. Monday may be bearish, at least to start, as the Mars-Rahu-Pluto aspect will be in the neighbourhood of the natal Saturn. Tuesday and especially Wednesday seem more promising given the Venus-Jupiter aspect. Thursday may be cautious or negative as the Moon transits the malefic 6th house while Friday has a chance for gains as Venus moves into aspect with the all-important ascendant. The dollar should stay around 80 this week, maybe slightly below.

As expected, the Euro moved a little lower last week to close above 1.39. The Mars-Rahu aspect with the natal ascendant seemed to create an unease with the Euro that was enough to spark some selling. As the Sun conjoins Mercury opposite natal Venus this week, we should see the Euro move above 1.40 once again. Monday may be a toss-up, however, so if the Euro gains then, we could be looking at a bigger upside overall. Sun-Mercury will trine the natal Jupiter Tuesday so that seems like a good gain, and Thursday may also see a rise as Mercury will aspect the natal Venus in the Euro chart. Friday could be quite negative, however, as Mercury will conjoin Ketu on the 11th house cusp. Overall, it looks like a volatile week with some big moves both ways. Just as Indian equities sold off following the disappointing budget, so, too, did the Rupee as it closed last week at 48.9. This was in keeping with expectations. This week may see it fall below 49 as Mars transits the ascendant of the Indian independence chart, which is often a negative indicator.

Dollar

5-day outlook — neutral-bearish

30-day outlook — bearish-neutral

90-day outlook — bullish

1-year outlook — bullish

Closing just below $61 on the continuous contract, crude oil plunged over 10% last week as growing anxiety over the recovery drained speculative enthusiasm. I missed this big move thinking that the bigger midweek losses would be offset by late week gains. These gains proved to be much weaker than expected. I also had expected a higher close Monday in advance of the Mars-Jupiter aspect but the modest intraday gains did not hold into the afternoon. Crude remains in difficulty from a technical perspective as MACD is overwhelmingly negative and prices have now fallen below the 50 day moving average. The current level ($60) sits very close to the 38% retracement level from the Feburary lows and the June highs. The next level of support is the 50% retracement which equates to about $55.

Closing just below $61 on the continuous contract, crude oil plunged over 10% last week as growing anxiety over the recovery drained speculative enthusiasm. I missed this big move thinking that the bigger midweek losses would be offset by late week gains. These gains proved to be much weaker than expected. I also had expected a higher close Monday in advance of the Mars-Jupiter aspect but the modest intraday gains did not hold into the afternoon. Crude remains in difficulty from a technical perspective as MACD is overwhelmingly negative and prices have now fallen below the 50 day moving average. The current level ($60) sits very close to the 38% retracement level from the Feburary lows and the June highs. The next level of support is the 50% retracement which equates to about $55.

This week looks mixed but with more downward bias ahead of the solar eclipse. Some gains are possible earlier in the week on the Sun-Mercury conjunction so that could provide support near current prices and may even provide a temporary lift, perhaps back to $65. But as Mercury conjoins Ketu later in the week, prices may tend to fall back towards $60. Next week’s eclipse may well be the bottom of this retracement, with prices moving up again afterwards for much of August. I think there is a good chance we will see prices dip towards that $55-57 level at some point over the next two weeks before turning up again.

5-day outlook — neutral

30-day outlook — bullish

90-day outlook — bearish

1-year outlook — bearish-neutral

Continuing its recent correction from its June highs, gold fell another 2% last week to close at $913. I had been somewhat more bullish here, although I had correctly expected weakness early on with some kind of recovery later. However, I overestimated the extent to which gold could rally back on the strength of the Mercury-Jupiter aspect on Thursday and Friday. Gold remains in a fairly bearish technical situation as it is trading below its 50 day moving average and the MACD is solidly negative. Moreover, it appears to be trading in a narrowing triangle pattern that appears to suggest a significant price breakout in the next few weeks. Given the planetary energies in force, the direction of this price breakout will likely be down.

Continuing its recent correction from its June highs, gold fell another 2% last week to close at $913. I had been somewhat more bullish here, although I had correctly expected weakness early on with some kind of recovery later. However, I overestimated the extent to which gold could rally back on the strength of the Mercury-Jupiter aspect on Thursday and Friday. Gold remains in a fairly bearish technical situation as it is trading below its 50 day moving average and the MACD is solidly negative. Moreover, it appears to be trading in a narrowing triangle pattern that appears to suggest a significant price breakout in the next few weeks. Given the planetary energies in force, the direction of this price breakout will likely be down.

This week looks mixed as some strength is likely on the Venus-Jupiter aspect midweek. Monday is harder to call since no aspects appear to stand out one way or the other. Some late week weakness is very likely as Mercury and the Sun will conjoin the natal Saturn in the ETF chart. Assuming it manages to hold its own Monday, it could rise back to $930 by midweek before declining back to $910-920 by Friday. Next week looks very bearish with the solar eclipse and a drop all the way back to the April lows of $870 is definitely possible. This would be the price breakout from the triangle pattern that would begin a larger move down for gold over the next few months.

5-day outlook — neutral

30-day outlook — bearish-neutral

90-day outlook — bearish

1-year outlook — bearish-neutral