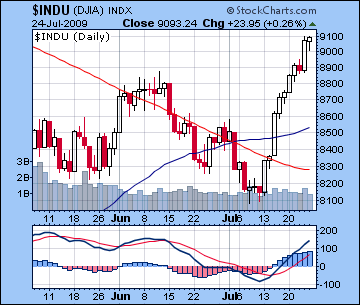

- Stock rally to continue to new highs for 2009

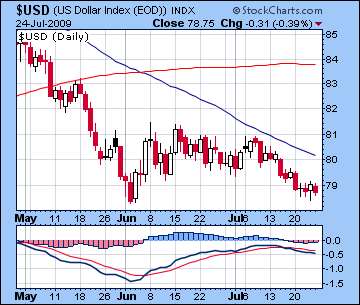

- Dollar slump jeopardizes technical support

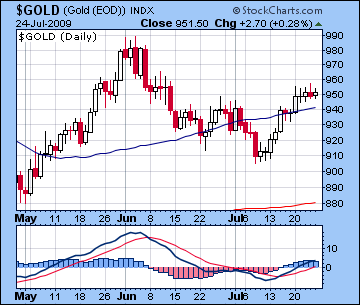

- Gold to rally towards June highs of $980

- Crude oil back over $70

- Stock rally to continue to new highs for 2009

- Dollar slump jeopardizes technical support

- Gold to rally towards June highs of $980

- Crude oil back over $70

This week has a couple of very positive aspects that should drive prices higher, even if we see a day or two of correction. Monday presents a mixed bag of potentially strong influences, so we could see a big price move in either direction. Mercury forms an exact minor aspect with bearish Saturn that will be punctuated by a Moon aspect in the morning. Although past exact by the open of trading, Venus will still be in close trine aspect to Jupiter-Neptune throughout the day and that has the potential to move markets higher. While it’s possible that these influences may negate one another, I think we will likely see a big move. While I am uncertain about the direction, one potential outcome is that we see a selloff Monday with a sharp recovery Tuesday (or even as soon as Monday afternoon) which continues into Wednesday. With a bullish Mercury-Jupiter forming for Wednesday and Thursday, the market is likely to offset any losses we see early in the week. But with the Moon debilitated in Scorpio on Friday, watch for some profit taking at the end of the week. Friday’s close may be weak as the Moon will oppose Mars while Venus is in aspect with Ketu. And Jupiter’s entry into sidereal Capricorn on Friday is another potentially bearish influence then and makes Friday perhaps the most difficult day for the market. Depending on when we see the pullbacks and how deep there are, it’s possible the SPX could rise to 1000 by Thursday or Friday. Overall, the market seems destined to continue to rise into August.

This week has a couple of very positive aspects that should drive prices higher, even if we see a day or two of correction. Monday presents a mixed bag of potentially strong influences, so we could see a big price move in either direction. Mercury forms an exact minor aspect with bearish Saturn that will be punctuated by a Moon aspect in the morning. Although past exact by the open of trading, Venus will still be in close trine aspect to Jupiter-Neptune throughout the day and that has the potential to move markets higher. While it’s possible that these influences may negate one another, I think we will likely see a big move. While I am uncertain about the direction, one potential outcome is that we see a selloff Monday with a sharp recovery Tuesday (or even as soon as Monday afternoon) which continues into Wednesday. With a bullish Mercury-Jupiter forming for Wednesday and Thursday, the market is likely to offset any losses we see early in the week. But with the Moon debilitated in Scorpio on Friday, watch for some profit taking at the end of the week. Friday’s close may be weak as the Moon will oppose Mars while Venus is in aspect with Ketu. And Jupiter’s entry into sidereal Capricorn on Friday is another potentially bearish influence then and makes Friday perhaps the most difficult day for the market. Depending on when we see the pullbacks and how deep there are, it’s possible the SPX could rise to 1000 by Thursday or Friday. Overall, the market seems destined to continue to rise into August.

Next week (Aug 3-7) also looks fairly positive as Mercury forms a slow moving aspect with Venus. Even with the approach of the Mars-Saturn square that comes exact the following week, the Mercury-Venus influence will have a protective effect and will reduce the possibility of significant declines. The following week (Aug 10-14) features the Mars-Saturn square on Monday and this is one possible turning point for the market since it represents a major break from the parade of triggering aspects of the Jupiter-Neptune conjunction that we’re seen in recent days. But by week’s end, Sun moves into aspect with Jupiter so some kind of significant rebound is likely by Friday if there is a selloff early in the week. After that, there is a crowded alignment of planets around Aug 17-19 that perhaps looks more important for shaping future directions. Mercury conjoins Saturn at 27 degrees of Leo and this will be in exact quincunx aspect with Jupiter (27 Capricorn). Moreover, Sun (2 Leo), Mars (2 Gemini) and Uranus (2 Pisces) will form a simultaneous pattern for added energy. While this may or may not correspond to a big market move at the time (but I think it may), it could very well indicate a reversal of this rally. I should also add that the Mercury-Saturn conjunction occurs very close to President Obama’s natal Mars (29 Leo) and underlines the potential importance of these planets for the country as a whole. Given that the Saturn-Uranus opposition in mid-September occurs just one degree away from Obama’s Mars, it is conceivable that the market may be reacting to disruptive geopolitical events as we go forward. Of course a major market retreat like the one I am expecting would be worrisome enough for the Obama administration and this would be reflected in his chart in such a way. In sum, the market’s current rally may well extend beyond SPX 1000/Dow 9300. I believe this is the most likely scenario. If we don’t see much in the way of pullbacks this week, then that would support the possibility that we could see the Dow edging towards 10,000 by mid-August.

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bearish

1-year outlook — bearish

Despite some modest midweek weakness on the solar eclipse, stocks in Mumbai rose another 4% last week on improved economic prospects for Asia and America. With the market fast approaching its June highs, the Sensex closed Friday at 15,378 while the Nifty finished at 4568. I had expected the eclipse to bring more sellers into the market but the immediate effect was much more muted. As I have previously noted, eclipse effects can manifest weeks or months after they occur, so the failure of the market to decline here is not completely at odds with expectations. I anticipated some strength Monday, but the positive close was a little surprising on the Mercury-Mars aspect. Obviously, whatever negative influences I had seen in the aspects had been largely neutralized by the ongoing bullish reservoir provided by the Jupiter-Neptune conjunction. Although it is now two weeks after exactitude, this slow moving benefic combination is still just one degree apart. Tuesday and Wednesday saw some declines with the arrival of the eclipse, but these were much milder than anticipated and did not even bring the market back down to Monday’s open. As Venus applied to Jupiter and the Moon conjoined Mercury, I correctly surmised that Thursday and Friday would be more solidly positive days, although Thursday turned out to be the most bullish day of the week rather than Friday. Despite overstating the downside potential last week, the market is following a more general up trend which is in keeping with expectations. Technically speaking, MACD remains in a positive crossover pattern and the Nifty is still trading above its rising 50 day moving average. The next level of resistance is the June high of 4700 and beyond that the psychological level of 5000 and then 5250 which corresponds to an interim high made in May 2008. Since the eclipse pullback was not that bad, it is more likely that we could see the Nifty go to 5000 now. The prices we see in August here will therefore likely correspond with the highs for 2009.

With two separate benefic aspects to Jupiter this week, the market seems to be headed higher. Monday features triggering aspects to both Jupiter and Saturn, so we could see a big move that day, in either direction. Mercury forms a close minor aspect with Saturn towards the end of the trading day and into the evening so that is one potentially bearish source of energy. However, the Venus-Jupiter aspect in the early part of the day seems strong enough to carry the day, particularly with the Moon in Virgo exchanging signs with Mercury in Cancer. Allowing for the possibility of some profit taking, especially later in the day, I think the most likely outcome is a gain. Tuesday seems like a more likely candidate for a decline, although I would default towards buyers on almost all days this week. Wednesday and Thursday are also likely to produce a net positive outcome as Mercury forms an aspect with Jupiter. The fact that this activates the ascendant in the NSE chart increases the likelihood of this favourable result. Thursday looks positive but there is a chance for some weakness towards the close after the Moon enters Scorpio. With Jupiter entering a state of debilitation in Capricorn on Friday, that is another possible down day with weakness again indicated at the close. But even with one or two days of pullbacks, the bulls should be able to take stocks higher as both Mercury and Venus will be activating the Jupiter-Neptune conjunction. Assuming the down days are spread out this week, there’s a good chance the market will close at or above its June highs.

With two separate benefic aspects to Jupiter this week, the market seems to be headed higher. Monday features triggering aspects to both Jupiter and Saturn, so we could see a big move that day, in either direction. Mercury forms a close minor aspect with Saturn towards the end of the trading day and into the evening so that is one potentially bearish source of energy. However, the Venus-Jupiter aspect in the early part of the day seems strong enough to carry the day, particularly with the Moon in Virgo exchanging signs with Mercury in Cancer. Allowing for the possibility of some profit taking, especially later in the day, I think the most likely outcome is a gain. Tuesday seems like a more likely candidate for a decline, although I would default towards buyers on almost all days this week. Wednesday and Thursday are also likely to produce a net positive outcome as Mercury forms an aspect with Jupiter. The fact that this activates the ascendant in the NSE chart increases the likelihood of this favourable result. Thursday looks positive but there is a chance for some weakness towards the close after the Moon enters Scorpio. With Jupiter entering a state of debilitation in Capricorn on Friday, that is another possible down day with weakness again indicated at the close. But even with one or two days of pullbacks, the bulls should be able to take stocks higher as both Mercury and Venus will be activating the Jupiter-Neptune conjunction. Assuming the down days are spread out this week, there’s a good chance the market will close at or above its June highs.

Next week (Aug 3-7) will likely be bullish enough to support stocks or move them higher still. Mercury is moving into a very nice minor aspect with Venus by Friday so pullbacks are less likely to occur and if they do they may not be very deep. The following week (Aug 10-14) also seems fairly positive, and sufficient to prevent any major declines. The Mars-Saturn square will likely move down prices for a day or two, but the Sun-Jupiter aspect by week’s end will see stocks rally once again. Perhaps the most pivotal alignment of planets will occur the week after (Aug 17-21) when Mercury conjoins Saturn and the Sun and Mars mutually aspect Uranus. Perhaps more importantly, Jupiter will form a tense quincunx (150 degree) aspect with Saturn. This seems like a very tense combination that will produce more bearishness and will likely be enough to disrupt the prevailing medium term energies and reverse the upward trend. September’s Saturn-Uranus opposition will therefore likely coincide with a significant decline that takes us lower in the fall.

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bearish

1-year outlook — bearish-neutral

The US dollar index slipped below 79 last week as risk appetite grew on positive economic news. Given my bullish outlook, this outcome was disappointing although I had expected more vulnerability for the next few weeks. Monday’s loss was particularly shocking, as it came on an apparently favourable aspect of Venus to the ascendant in the natal chart. Not only was there no upside here on the Venus influence, but the dollar actually lost half a cent. This result has compelled me to rethink some of my evaluation of the planetary influences for the dollar, most notably the effect of the Ketu (6 Cancer) aspect to the natal Saturn (6 Scorpio). For the past several weeks, I noted that while nominally malefic, this aspect could produce gains given Ketu’s positive placement in the USDX chart. But no gains have been forthcoming during this aspect and the dollar has been slowly weakening back towards it June low below 78. Clearly, this is an instance where the simple explanation was the correct one: nominal malefics delivered tangible maleficence. Since this aspect has a ways to go, it seems likely that this negative pattern will continue for dollar until Ketu moves away from Saturn. This will take several more weeks and in the meantime, things look pretty bearish for the dollar. While I had not expected much from the dollar during this stock rally in August, I’m now less likely to believe it can hang on to this current technical level. Therefore, I would not be surprised to see the dollar fall to 75 before it changes course in mid to late August. A gain is conceivable on Monday with the Mars transit to the natal Jupiter, but it’s nothing I would count on. I’m still quite bullish on the dollar once we head into the turbulence of the Saturn-Uranus aspect in September and October, but a steep plunge here is not out of the question and this will impact the extent to which it can rebound in the fall.

The US dollar index slipped below 79 last week as risk appetite grew on positive economic news. Given my bullish outlook, this outcome was disappointing although I had expected more vulnerability for the next few weeks. Monday’s loss was particularly shocking, as it came on an apparently favourable aspect of Venus to the ascendant in the natal chart. Not only was there no upside here on the Venus influence, but the dollar actually lost half a cent. This result has compelled me to rethink some of my evaluation of the planetary influences for the dollar, most notably the effect of the Ketu (6 Cancer) aspect to the natal Saturn (6 Scorpio). For the past several weeks, I noted that while nominally malefic, this aspect could produce gains given Ketu’s positive placement in the USDX chart. But no gains have been forthcoming during this aspect and the dollar has been slowly weakening back towards it June low below 78. Clearly, this is an instance where the simple explanation was the correct one: nominal malefics delivered tangible maleficence. Since this aspect has a ways to go, it seems likely that this negative pattern will continue for dollar until Ketu moves away from Saturn. This will take several more weeks and in the meantime, things look pretty bearish for the dollar. While I had not expected much from the dollar during this stock rally in August, I’m now less likely to believe it can hang on to this current technical level. Therefore, I would not be surprised to see the dollar fall to 75 before it changes course in mid to late August. A gain is conceivable on Monday with the Mars transit to the natal Jupiter, but it’s nothing I would count on. I’m still quite bullish on the dollar once we head into the turbulence of the Saturn-Uranus aspect in September and October, but a steep plunge here is not out of the question and this will impact the extent to which it can rebound in the fall.

The Euro rose above 1.42 last week as the eclipse failed to take it down as expected. Despite missing the early strength, the late week gains were reassuring at least in so far as they met with expectations on the Venus aspect to the natal Mercury. We can look for more upside this week as transiting Venus conjoins the natal Moon early in the week. There is a chance for a pullback Tuesday as Venus comes under the influence of natal Saturn but the end of the week bodes well as Venus lines up exactly on the Midheaven, square to the ascendant. With Mercury opposing Jupiter right across the natal nodes in the natal chart, we might see a significant move, probably midweek. I still think 1.50 may be out of reach for the Euro in August, but it seems certain to push past its June high of 1.43, perhaps as early as this week. The Indian Rupee gained ground last week to close near 48.2. A more decisive move below 48 seems likely this week as the rally is poised to continue. 47 is a definite possibility by mid-August, maybe higher.

Dollar

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bullish

1-year outlook — bullish

Crude continued its recovery back from recent lows as it closed above $68 last week. The prospect of the eclipse seemed to offer a more bearish outcome before it might turn higher, but the eclipse produced very little in the way of selling. Monday’s rise was also at odds with the forecast as the Venus-Saturn combination did not move prices down. In retrospect, I think a mitigating factor may have been the presence of Jupiter on the Midheaven. So instead of a bearish Venus-Saturn-Ascendant pattern, we also had Jupiter in the mix in the form of a "mundane square", a more bullish configuration which I did not expect this to push prices higher. In any event, the biggest gains occurred as expected later in the week and coincided with the approach of the Venus-Jupiter aspect. It seems that the rally I had expected for August got a head start last week and crude may have enough steam here to push to new highs.

Crude continued its recovery back from recent lows as it closed above $68 last week. The prospect of the eclipse seemed to offer a more bearish outcome before it might turn higher, but the eclipse produced very little in the way of selling. Monday’s rise was also at odds with the forecast as the Venus-Saturn combination did not move prices down. In retrospect, I think a mitigating factor may have been the presence of Jupiter on the Midheaven. So instead of a bearish Venus-Saturn-Ascendant pattern, we also had Jupiter in the mix in the form of a "mundane square", a more bullish configuration which I did not expect this to push prices higher. In any event, the biggest gains occurred as expected later in the week and coincided with the approach of the Venus-Jupiter aspect. It seems that the rally I had expected for August got a head start last week and crude may have enough steam here to push to new highs.

This week crude will likely climb back over $70 as the succession of Mercury and Venus aspects to Jupiter is likely to coincide with investors increased appetite for risk. Monday may see some kind of pullback with Sun conjoining the natal Saturn in the ETF chart. However, since this is past exact, and coincides with a favourable Mercury-Sun aspect, we cannot rule out the possibility of further gains. With Mercury opposing Jupiter on the natal Midheaven on Wednesday and Thursday, more significant gains seem very likely indeed. So even if Monday produces a correction, the gains later on the week will likely push crude towards $70 and beyond. The current planetary pattern bodes well for further gains into August which could see crude rise closer to $75-80.

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bearish

1-year outlook — bearish

Gold continued to tack on gains to its recent rally as it closed at $951. I had expected the solar eclipse to encourage sellers but gold tenaciously held on to its current levels as it traded in a narrow range. Monday’s rise was the most significant and unexpected move of the week as transiting Venus complemented the natal Mercury. While my assessment of the eclipse was dead wrong, what is also noteworthy here is that the favourable late week aspects really didn’t fuel many more gains for gold. This is a clue that even with some supporting aspects, there is some significant technical resistance above current levels. Nonetheless, MACD is in a bullish crossover pattern here while last week’s gains pushed gold above its 50-day moving average. However, the June highs of $980-990 loom large here so if the rally continues here, those levels would tend to be almost magnetic for the price of gold as it drifts higher.

Gold continued to tack on gains to its recent rally as it closed at $951. I had expected the solar eclipse to encourage sellers but gold tenaciously held on to its current levels as it traded in a narrow range. Monday’s rise was the most significant and unexpected move of the week as transiting Venus complemented the natal Mercury. While my assessment of the eclipse was dead wrong, what is also noteworthy here is that the favourable late week aspects really didn’t fuel many more gains for gold. This is a clue that even with some supporting aspects, there is some significant technical resistance above current levels. Nonetheless, MACD is in a bullish crossover pattern here while last week’s gains pushed gold above its 50-day moving average. However, the June highs of $980-990 loom large here so if the rally continues here, those levels would tend to be almost magnetic for the price of gold as it drifts higher.

Gold is likely to continue its recent strength this week as the Venus-Jupiter aspect sets up to activate the natal Venus in the ETF chart. Even with a possible pullback Tuesday, the Mercury-Jupiter aspect will once again trigger the potentially positive Venus energy in the natal chart on Wednesday and Thursday. Thursday has the added bonus of transiting Venus exactly aspecting the natal ascendant. These two combinations may provide some significant upward fuel which should outweigh any profit taking. It would not surprise me if we got to $980 this week. August will likely see further strength, although I’m skeptical of any more big gains after this week. Gold may well trade mostly sideways until it starts to decline in mid to late August.

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bearish

1-year outlook — bearish