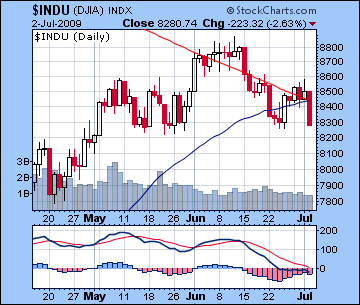

- Stocks mixed with possible rise late week

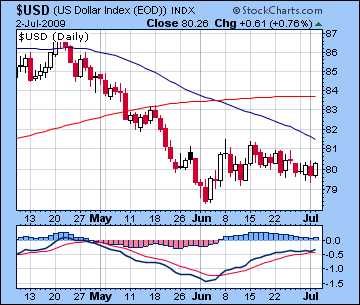

- Dollar trading in narrow range

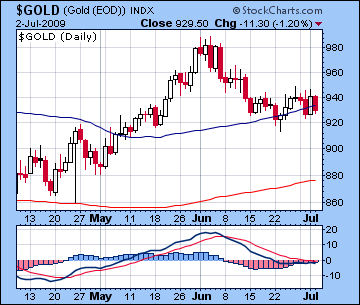

- Gold may strengthen later in the week

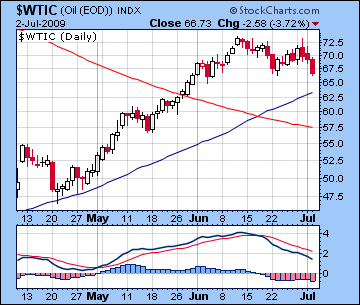

- Crude moving sideways

- Stocks mixed with possible rise late week

- Dollar trading in narrow range

- Gold may strengthen later in the week

- Crude moving sideways

This week looks quite volatile with the possibility of large price moves going both ways. Given last week’s bearish outcome, I think this week may lean towards greater selling although much will depend on the size of any early week gains. If we see a 2% move up Monday, then the net outcome will more likely be positive. Monday has a chance for gains with Mars moving into alignment with the Jupiter-Neptune conjunction and Venus near the aspect of Rahu. The Full Moon on Tuesday could see more sellers move into the market, however, so there is a chance for a major decline then. Wednesday has a good chance for a gain this week as the Moon joins Rahu in Capricorn and aspects both Venus and Mars. Thursday could be another significant move, with the direction more uncertain. The minor Sun-Saturn aspect introduces some bearish energy here and with the Moon transiting cautious Capricorn that may be enough to for sellers to prevail. With the Moon applying to the Jupiter-Neptune conjunction Friday morning, we may see a nice bounce then. The afternoon may be more tentative however, so some profit taking may be in the cards as the day progresses. The daily patterns this week are more complex than usual so the intraweek dynamics may be more prone to error. Overall, I think we will see more downside probing here and there is a good chance that the May support levels of 8200/880 will not hold, especially if the Mars-Jupiter-Neptune aspect does not produce significant gains in the early going.

This week looks quite volatile with the possibility of large price moves going both ways. Given last week’s bearish outcome, I think this week may lean towards greater selling although much will depend on the size of any early week gains. If we see a 2% move up Monday, then the net outcome will more likely be positive. Monday has a chance for gains with Mars moving into alignment with the Jupiter-Neptune conjunction and Venus near the aspect of Rahu. The Full Moon on Tuesday could see more sellers move into the market, however, so there is a chance for a major decline then. Wednesday has a good chance for a gain this week as the Moon joins Rahu in Capricorn and aspects both Venus and Mars. Thursday could be another significant move, with the direction more uncertain. The minor Sun-Saturn aspect introduces some bearish energy here and with the Moon transiting cautious Capricorn that may be enough to for sellers to prevail. With the Moon applying to the Jupiter-Neptune conjunction Friday morning, we may see a nice bounce then. The afternoon may be more tentative however, so some profit taking may be in the cards as the day progresses. The daily patterns this week are more complex than usual so the intraweek dynamics may be more prone to error. Overall, I think we will see more downside probing here and there is a good chance that the May support levels of 8200/880 will not hold, especially if the Mars-Jupiter-Neptune aspect does not produce significant gains in the early going.

This current consolidation phase will likely continue for much of July. Next week (July 13-17) will likely begin bullish with the Sun-Mercury conjunction in Gemini giving trading volumes a boost. Once the Sun and Mercury enter Cancer later in that week and join Ketu, however, stocks may be again prone to selloffs. The following week (July 20-24) may be volatile with a bearish bias given the solar eclipse late on July 21. Since am I expecting a significant up move in late July and continuing into early and mid-August, it is unclear to me just when we will see the interim lows. I had thought the May lows would hold here but last week’s action has called that into question. It may well be that we won’t see the lows until as late as the eclipse week (July 20-24). Another scenario may be that we only go sideways until the eclipse before moving substantially higher into August. The second half of August looks very negative so that would make the top occurring somewhere around August 11-15.

5-day outlook — bearish-neutral

30-day outlook — bullish

90-day outlook — bearish-neutral

1-year outlook — bearish

Stocks in Mumbai continued their cautious move upward as the markets rose a modest 1% for the week. With more buyers coming into the market Friday before Monday’s budget announcement, the Nifty closed Friday at 4424 while the Sensex finished at 14,913. While I had been fairly bullish last week, this outcome was somewhat underwhelming, mostly due to the failure of stocks to rally Tuesday near the Mercury-Venus aspect. While the aspect was close, the net effect of the Mars opposition aspect to the natal Jupiter in the NSE chart appeared to offset any underlying bullishness. Wednesday’s gain came along as expected, as did Thursday’s, and stocks did sell off in the afternoon on the Moon-Rahu aspect. Friday’s gain was unexpected and yet the market was largely flat for much of the day while the Moon was debilitated in Scorpio. Stocks rallied at the close just as the Moon (2 Scorpio) entered an alignment with Jupiter-Neptune (2 Aquarius). The technical situation is largely unchanged as MACD remains stuck in a negative crossover, even if prices have drifted higher in the past two weeks. More bearishly, a head and shoulders pattern has formed going back to the post-election May highs of 4400. From a technical perspective, this would increase the likelihood that the market should be moving lower in the coming days. Overall, the failure of the market to rally substantially higher toward the June highs on the positive Mercury-Venus aspect indicates that weakness is more likely in the next week or two.

This week looks mostly bearish, even if Monday begins with some possible buying ahead of the budget announcement from the Mars-Jupiter aspect. Tuesday’s Full Moon may see some heavy selling, particularly since it occurs at 21 Sagittarius which will fall under the exact aspect of natal Ketu (21 Leo) in the NSE chart. The afternoon looks more bearish here. Wednesday could see a bounce with the Moon joining Rahu in Capricorn and attaching itself to the bullish energy of Jupiter by minor aspect. Thursday seems neutral to bearish as the Moon moves through Capricorn while the Sun and Saturn form a minor aspect. Friday has a decent chance for a gain as the Moon approaches the Jupiter-Neptune conjunction. Overall, it looks as though the budget will bring out sellers and move the market down. It is very possible that we will test the May post-election lows of 4150 in the coming days before the market recovers.

This week looks mostly bearish, even if Monday begins with some possible buying ahead of the budget announcement from the Mars-Jupiter aspect. Tuesday’s Full Moon may see some heavy selling, particularly since it occurs at 21 Sagittarius which will fall under the exact aspect of natal Ketu (21 Leo) in the NSE chart. The afternoon looks more bearish here. Wednesday could see a bounce with the Moon joining Rahu in Capricorn and attaching itself to the bullish energy of Jupiter by minor aspect. Thursday seems neutral to bearish as the Moon moves through Capricorn while the Sun and Saturn form a minor aspect. Friday has a decent chance for a gain as the Moon approaches the Jupiter-Neptune conjunction. Overall, it looks as though the budget will bring out sellers and move the market down. It is very possible that we will test the May post-election lows of 4150 in the coming days before the market recovers.

July therefore looks sideways at best with downward bias until perhaps the solar Eclipse of July 22. Next week (July 13-17) looks fairly bullish on the Sun-Mercury conjunction and that promises to move markets up substantially. Later in the week, Mercury moves into Cancer, closely followed by the Sun where they will be influenced by the disruptive influence of Ketu. Some declines are therefore likely later in the week. The week of July 20-24 features the eclipse on the 22nd and the bearish Venus-Saturn square. This could be a significant turning point in the market as prices are more likely to move higher after this event. A possible market top could therefore occur in the week of August 11-15 and the Sun-Mars-Jupiter alignment.

5-day outlook — bearish

30-day outlook — neutral-bullish

90-day outlook — bearish-neutral

1-year outlook — neutral

The dollar index bounced back above 80 last week on fears the recession may be longer than expected. I had been more bearish, but allowed for the possibility of a rise Thursday which would minimize losses. As it happened, Thursday’s rise wiped out losses and then some. Tuesday’s rise was somewhat puzzling, although the Moon’s transit through late Virgo in the 11th house of the USDX chart was clearly a bullish indicator. Overall, the dollar remains fairly resilient here as MACD has stayed positive even with this narrow range of trading over the past two weeks. This week seems very mixed as Monday will see Venus passing through a bearish aspect with natal Saturn. Transiting Mars will aspect the natal Sun later in the week and produce a fairly large move although it could go either way since Mars is redeemed somewhat by virtue of being the chart ruler. I am leaning towards a net gain on the week but that is anything but certain. The dollar will likely continue to trade in a fairly narrow range here, although the July 22 eclipse may see some sizable if temporary gains as Venus will become angular in the natal chart.

The dollar index bounced back above 80 last week on fears the recession may be longer than expected. I had been more bearish, but allowed for the possibility of a rise Thursday which would minimize losses. As it happened, Thursday’s rise wiped out losses and then some. Tuesday’s rise was somewhat puzzling, although the Moon’s transit through late Virgo in the 11th house of the USDX chart was clearly a bullish indicator. Overall, the dollar remains fairly resilient here as MACD has stayed positive even with this narrow range of trading over the past two weeks. This week seems very mixed as Monday will see Venus passing through a bearish aspect with natal Saturn. Transiting Mars will aspect the natal Sun later in the week and produce a fairly large move although it could go either way since Mars is redeemed somewhat by virtue of being the chart ruler. I am leaning towards a net gain on the week but that is anything but certain. The dollar will likely continue to trade in a fairly narrow range here, although the July 22 eclipse may see some sizable if temporary gains as Venus will become angular in the natal chart.

The Euro again fell below 1.40 last week mostly due to Thursday’s selloff and the flight to safety. I had expected more upside early on given the Mercury-Venus aspect to the natal Jupiter, although the last week weakness coincided nicely with the Mars aspect to the nodes. This week looks mixed as some gains are likely Monday with Venus and Rahu moving into aspect with the natal ascendant. The situation gets murkier after that as malefic Mars moves into the same Rahu-Ascendant aspect. So we may see the Euro probe a little lower here, perhaps towards 1.39 but it may well bounce back by Friday or at least next week. Nonetheless, next week looks more unambiguously positive on the Sun-Mercury conjunction that should once again move it above 1.40. The Indian Rupee posted a marginal gain last week and closed just below 48. With a pullback in stocks likely in Mumbai, it seems destined to move towards 49 this week.

Dollar

5-day outlook — neutral

30-day outlook — neutral-bullish

90-day outlook — bullish

1-year outlook — bullish

Crude oil slipped back under $67 last week as it retested recent support levels. After a rise early in the week above $72, crude sold off sharply with Thursday’s decline making up most of the loss. While I expected some significant rise last week, I thought the rally might be enough to withstand any late week sell off. As it turned out, the rally fizzled by Tuesday and the sellers moved in on the Mercury-Rahu aspect in the Futures chart.

Crude oil slipped back under $67 last week as it retested recent support levels. After a rise early in the week above $72, crude sold off sharply with Thursday’s decline making up most of the loss. While I expected some significant rise last week, I thought the rally might be enough to withstand any late week sell off. As it turned out, the rally fizzled by Tuesday and the sellers moved in on the Mercury-Rahu aspect in the Futures chart.

This week looks volatile as the Mars-Jupiter aspect will activate the natal Mars in the Futures chart. Some gains are likely Monday and then again later in the week. Overall, I think crude seems likely to bounce higher off these levels and again move towards $70. Wednesday and Thursday appear most promising as Venus aspects Ketu in the ETF chart while the Sun aspects the natal Jupiter. Some further consolidation is likely throughout much of July until at least the week of the eclipse July 20-24, so we may see it trade mostly between $65-75. Early August looks quite favourable so that may be a major spike to a new high, perhaps near $80.

5-day outlook — neutral-bullish

30-day outlook — neutral-bullish

90-day outlook — bearish-neutral

1-year outlook — bearish

After a choppy week, gold fell 1% to close at $929 on the continuous contract. I had expected more upside given the multi-activation of the natal Venus in the ETF chart midweek. As it was, Tuesday’s loss negated any chance for midweek gains. This unanticipated decline presumably came as a result of the Sun-Mercury-Pluto alignment across the natal ascendant. Gold’s technical situation remains somewhat bearish given the persistence of the MACD crossover, although it can still claim to be trading at its rising 50 DMA.

After a choppy week, gold fell 1% to close at $929 on the continuous contract. I had expected more upside given the multi-activation of the natal Venus in the ETF chart midweek. As it was, Tuesday’s loss negated any chance for midweek gains. This unanticipated decline presumably came as a result of the Sun-Mercury-Pluto alignment across the natal ascendant. Gold’s technical situation remains somewhat bearish given the persistence of the MACD crossover, although it can still claim to be trading at its rising 50 DMA.

This week appears to be mixed with a possible weak start as Mars will oppose the natal Sun Monday and Tuesday. This aspect does not preclude a rise, but without any other supporting players here, it is hard to be optimistic about gold in the early going. A better chance for gains comes later on in the week, especially Thursday which has the Moon in Capricorn and Mercury at 18 degrees of Gemini forming a nice three-way alignment with the natal Jupiter. If gold manages to stay above $920 this week, next week will see a nice bounce on the Venus-Jupiter aspect in the early going that may take it back towards $950. The situation will change dramatically, however, during the eclipse week (July 20-24) as Sun and Mercury will join Ketu in early Cancer and will form a rather bearish gathering around the 8th house Saturn in the Gold ETF chart. Depending how high we go next week, I would not rule out a move below $900 then.

5-day outlook — neutral-bullish

30-day outlook — neutral-bearish

90-day outlook — bearish

1-year outlook — bearish