- Gains early but bearishness should predominate after

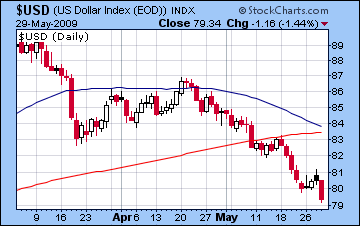

- Dollar revival likely

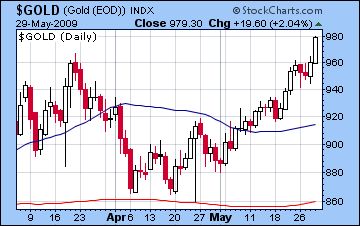

- Gold top possible early this week

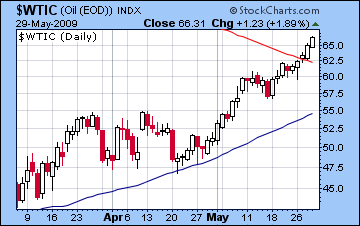

- Crude should weaken by week’s end

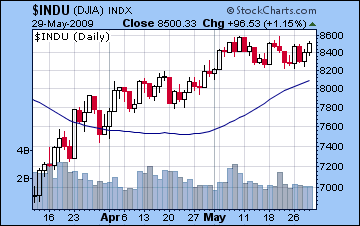

- Gains early but bearishness should predominate after

- Dollar revival likely

- Gold top possible early this week

- Crude should weaken by week’s end

This week seems more negative than last week, so I am somewhat more comfortable in making a bearish forecast. At the same time, it’s important to note that there are still the potential for gains, especially early on when Venus forms a close aspect with the prevailing bullish alignment of Jupiter-Neptune-Uranus. Monday and Tuesday is likely to see at least one significant up day, with Monday looking slightly more favourable of the two. Indeed, it is conceivable that both days may see gains, although with the market bumping up some fairly significant resistance here, I don’t know how much more upside we should expect. A brief fake out above 930 is certainly not out of the question. But we can construct a more compelling bearish case this week overall. First, Jupiter has now moved past Neptune so it may be slowly losing some of that default positive energy that has fueled this two month rally. Second, Mars forms a square aspect with Rahu starting on Tuesday and lasting perhaps into Thursday. This is often quite a negative influence and is associated with sudden and irrational action. As the Moon enters Libra on Wednesday, we are perhaps more likely to see a down day since it will oppose Mars. Thursday and Friday will feature the Sun squaring Saturn, so that is another hurdle for the market as this can be quite a bearish influence. Friday seems the worse day of the two. Overall, I think there is a reasonable chance of a decline, with perhaps a 50-50 chance of deeper lows than we’ve seen so far in May, say below 8200/880. Much of the extent of the bearishness will hinge on the early week action and how bullish the Venus aspect is. If the rally is weak on Monday and Tuesday, then it increases the odds that we could break below that 8200 support level on the Dow.

This week seems more negative than last week, so I am somewhat more comfortable in making a bearish forecast. At the same time, it’s important to note that there are still the potential for gains, especially early on when Venus forms a close aspect with the prevailing bullish alignment of Jupiter-Neptune-Uranus. Monday and Tuesday is likely to see at least one significant up day, with Monday looking slightly more favourable of the two. Indeed, it is conceivable that both days may see gains, although with the market bumping up some fairly significant resistance here, I don’t know how much more upside we should expect. A brief fake out above 930 is certainly not out of the question. But we can construct a more compelling bearish case this week overall. First, Jupiter has now moved past Neptune so it may be slowly losing some of that default positive energy that has fueled this two month rally. Second, Mars forms a square aspect with Rahu starting on Tuesday and lasting perhaps into Thursday. This is often quite a negative influence and is associated with sudden and irrational action. As the Moon enters Libra on Wednesday, we are perhaps more likely to see a down day since it will oppose Mars. Thursday and Friday will feature the Sun squaring Saturn, so that is another hurdle for the market as this can be quite a bearish influence. Friday seems the worse day of the two. Overall, I think there is a reasonable chance of a decline, with perhaps a 50-50 chance of deeper lows than we’ve seen so far in May, say below 8200/880. Much of the extent of the bearishness will hinge on the early week action and how bullish the Venus aspect is. If the rally is weak on Monday and Tuesday, then it increases the odds that we could break below that 8200 support level on the Dow.

Next week (June 8-12) seems mixed again, with the early part of the week hard to read, perhaps neutral, but with some fairly clear indicators for strength going into midweek on the Mercury-Jupiter aspect. The end of that week looks bearish again, so it’s unlikely to move the market significantly higher overall. The difficulty in forecasting the interim lows here is that the Mercury-Jupiter aspect around Wednesday June 10 is likely to provide a bounce of at least 2%. So the market could sink back after that and extend the bearish mood into the following week (June 15-19). So the bottom could either by June 5 or conceivably into mid-June (June 15 in particular) when Mercury forms a partial but exact aspect with Saturn and Rahu. Towards the middle or end of that week, the Sun moves into a very favourable alignment with Jupiter, Uranus and Neptune and that is likely to push markets sharply higher (>3%). That Sun aspect may spell the end of this phase of retracement. One additional bearish factor is the approaching conjunction of Venus to Mars. This occurs on June 22 in close aspect with Saturn, and will likely act as a drag on the market for at least a week prior so that may temper any bullish alignments we see in the middle of the month.

5-day outlook — bearish

30-day outlook — neutral to bullish

90-day outlook — bullish

1-year outlook — bearish

Mumbai continued its rally last week on better than expected GDP data as markets rose 5%. After some profit taking early in the week that saw the Nifty trade near 4100, the bulls returned and sent indices higher as the Nifty closed Friday at 4448 while the Sensex finished at 14,625. While the market’s intraweek dynamics were in accordance with expectations, the overall result was more bullish than I had anticipated. The Mars influence on Jupiter did correspond with Tuesday’s sell off, and stocks rose smartly thereafter on the approach of the Mercury-Venus aspect, but I underestimated the level of buoyancy that we might see later in the week. My bias has been consistently to the down side in recent weeks, so I have tended to overemphasize bearish aspects and underplay the influence of bullish factors. While forecasting the rally for this spring time period was fairly straightforward, accounting for the narrower effects of faster moving negative aspects has been a more daunting task. The underlying upward momentum of the market can be linked to the slow moving Jupiter-Neptune conjunction which came exact last week. Since positive aspects tend to lose their bullish influence soon after they move into exactitude, one could contend that the transit of Jupiter past Neptune may well signal a break in the immediate upward trend in the market. This is not the only factor to consider here, but certainly the fact that Jupiter is now moving away from Neptune is evidence that the bullish energy may be diminishing, if only for a short time. From a technical perspective, we can see that 4500 on the Nifty is a meaningful resistance level dating back to 2008 so this provides another obstacle to the market.

This week looks more negative as there are a couple of fairly bearish aspects for the market to confront. Perhaps the best opportunity for gains occurs early in the week when the Moon, Venus and Jupiter will form an alignment. By Wednesday, however, Mars will square Rahu and this could spark some significant selling. This will also form a potentially volatile pattern with Pluto that increases the likelihood that the sell off could be greater than 3%. This Mars influence will coincide with Mercury sitting on the 6th house cusp, which is another unhelpful factor for the market. Friday will see the Sun move very close to a square aspect with pessimistic Saturn, so that is another negative energy for the market. So overall there is a good chance for a down move this week, especially if the early week only sees a rise to 4500-4600.

This week looks more negative as there are a couple of fairly bearish aspects for the market to confront. Perhaps the best opportunity for gains occurs early in the week when the Moon, Venus and Jupiter will form an alignment. By Wednesday, however, Mars will square Rahu and this could spark some significant selling. This will also form a potentially volatile pattern with Pluto that increases the likelihood that the sell off could be greater than 3%. This Mars influence will coincide with Mercury sitting on the 6th house cusp, which is another unhelpful factor for the market. Friday will see the Sun move very close to a square aspect with pessimistic Saturn, so that is another negative energy for the market. So overall there is a good chance for a down move this week, especially if the early week only sees a rise to 4500-4600.

Next week (June 8-12) looks more mixed as Mercury’s aspect with Jupiter will likely move the market higher in the early part of the week. After that some profit taking will be likely which will likely erase any previous gains. This means that there is a good chance for lower lows as we move deeper into June. I had earlier speculated that June 5 was a plausible date for an interim low, but even with gains possible June 8-10, the most probable scenario is that the market will fall back to at least its lows of this week (June 1-5) and likely lower. June 15 is another possible date to watch as this will mark the bearish alignment between Mercury, Saturn and Rahu. It is likely going to coincide with another dip in the market and is another candidate for a significant low. The Sun-Jupiter aspect of June 17-18 will likely produce a strong rise, so that could end any consolidation phase we see over the coming two weeks. The Venus approach to Mars that comes exact on June 22 is another potentially bearish factor that will be weighing down stocks. The period around the exact conjunction is likely to be a bearish, and it may also exercise a limiting influence on gains before that time. Overall, I am not expecting any great pullback here in June. 4000 would be a possible target, although let’s first see how negative this week turns out. If we again touch 4100 here, then I believe that would set the stage for some closes below 4000 by June 15.

5-day outlook — bearish

30-day outlook — neutral

90-day outlook — bullish

1-year outlook — bearish-neutral

After some promising gains earlier in the week that saw it trade above 81, the dollar fell off a cliff Friday and closed at 79. While I thought it could reach 81 this week, I had also believed it would have more staying power. I also correctly forecast Friday’s weakness given the Mars-Sun combination, but I underestimated how difficult this influence would be on the greenback. This week we can expect more losses in the early going as Mars transits the natal Saturn in the index chart but these may be confined to Monday and at the outside, Tuesday. While it’s certainly conceivable the Mars-Rahu may sit poorly in the natal chart given the proximity of natal Saturn (6 Scorpio), I think the dollar is due for a reversal this week, if not Wednesday then more likely by Friday. Part of the problem of interpretation lies with the transit Sun-Saturn square which will align with the angles in the natal USDX chart. This is a very powerful configuration that will likely bring about a major move. Saturn often combines badly with the Sun, but here Sun and Saturn are conjoined in the natal chart in the first house, so this transit pattern is a kind of echoing of that energy which the natal chart may be better prepared to receive as support. I wonder if we might bounce off 77-78 this week before moving higher. If I wish I was more certain about this week, then the upcoming aspects involving Mercury’s and Ketu’s aspects to Saturn around June 12 present an even greater conundrum. A Ketu aspect is often — but not always — difficult, so this time should correspond with more losses for the dollar. And yet, the transit aspects themselves look bearish which would normally signal a positive move in the dollar since it is moving inversely to general investor sentiment. One possible explanation is that Ketu will actually be positive on this occasion given its favourable conjunction with Venus in Libra in the natal chart. At the moment, that bullish dollar outcome seems like the most likely scenario. Either way, it should indicate a fairly significant move.

After some promising gains earlier in the week that saw it trade above 81, the dollar fell off a cliff Friday and closed at 79. While I thought it could reach 81 this week, I had also believed it would have more staying power. I also correctly forecast Friday’s weakness given the Mars-Sun combination, but I underestimated how difficult this influence would be on the greenback. This week we can expect more losses in the early going as Mars transits the natal Saturn in the index chart but these may be confined to Monday and at the outside, Tuesday. While it’s certainly conceivable the Mars-Rahu may sit poorly in the natal chart given the proximity of natal Saturn (6 Scorpio), I think the dollar is due for a reversal this week, if not Wednesday then more likely by Friday. Part of the problem of interpretation lies with the transit Sun-Saturn square which will align with the angles in the natal USDX chart. This is a very powerful configuration that will likely bring about a major move. Saturn often combines badly with the Sun, but here Sun and Saturn are conjoined in the natal chart in the first house, so this transit pattern is a kind of echoing of that energy which the natal chart may be better prepared to receive as support. I wonder if we might bounce off 77-78 this week before moving higher. If I wish I was more certain about this week, then the upcoming aspects involving Mercury’s and Ketu’s aspects to Saturn around June 12 present an even greater conundrum. A Ketu aspect is often — but not always — difficult, so this time should correspond with more losses for the dollar. And yet, the transit aspects themselves look bearish which would normally signal a positive move in the dollar since it is moving inversely to general investor sentiment. One possible explanation is that Ketu will actually be positive on this occasion given its favourable conjunction with Venus in Libra in the natal chart. At the moment, that bullish dollar outcome seems like the most likely scenario. Either way, it should indicate a fairly significant move.

The Euro was the beneficiary of renewed economic optimism Friday and closed above 1.41. Like the dollar, I was largely on the money with my forecast for early weakness on from the Mars influence with strength later from the Venus aspect to natal Rahu. I had thought that the Mars influence would largely offset the Venus and the Euro would finish closer to 1.39-1.40. I do think that the Euro is poised for some kind of correction this week as Venus and Mars are transiting near the 8th house cusp, arguably one of the most difficult places in the horoscope. Even if we see 1.42 early in the week, I think Wednesday will likely see a shift in gears and the Euro will head down. The Indian Rupee held its own last week and again closed around 47 to the dollar. While I had been more bearish, I do believe that it is likely to correct here, at least back to 48. Dollar

5-day outlook — bullish

30-day outlook — neutral

90-day outlook — bearish

1-year outlook — bearish-neutral

The rally in crude continued unabated last week as it closed Friday above $66. I had been unsure about last week given the Mars-Jupiter aspect but crude motored higher as the Jupiter-Neptune conjunction ruled the day. Since Neptune is the modern ruler of oil, it is not surprising that we’ve seen this powerful rally unfold over the past two months as Jupiter has slowly moved within range of Neptune. Now that Jupiter has moved past Neptune, that positive energy of Jupiter is increasingly diffused and out of the reach of Neptune. Of course, they are still extremely close by any measure — just minutes of arc — but we need to be aware of any basic shifts in energy.

The rally in crude continued unabated last week as it closed Friday above $66. I had been unsure about last week given the Mars-Jupiter aspect but crude motored higher as the Jupiter-Neptune conjunction ruled the day. Since Neptune is the modern ruler of oil, it is not surprising that we’ve seen this powerful rally unfold over the past two months as Jupiter has slowly moved within range of Neptune. Now that Jupiter has moved past Neptune, that positive energy of Jupiter is increasingly diffused and out of the reach of Neptune. Of course, they are still extremely close by any measure — just minutes of arc — but we need to be aware of any basic shifts in energy.

Since the early week looks generally optimistic on the Venus-Jupiter-Neptune alignment, crude will likely rise further, perhaps to $70. Certainly, any weakness in the early going this week would signal a fundamental shift was underway but I think we will have to wait until Mars moves into a tighter aspect to the Moon-Saturn in the Futures chart on Wednesday before we have a reasonable expectation of declines. This could be a significant move down. The Sun-Saturn square late in the week also looks quite bearish for crude since it will activate the natal Moon in the Exxon-Mobil natal chart, which can be seen as a proxy for crude prices.

5-day outlook — bearish

30-day outlook — neutral

90-day outlook — bullish

1-year outlook — bullish

Gold continued its rally last week as it closed Friday at $979. I had been more bearish by virtue of the Mars to Sun aspect in the ETF chart early in the week. Indeed, this did take gold down somewhat by Wednesday but nowhere near as much as I had expected. Similarly, I had anticipated the nice boost from the Venus-Mercury aspect late in the week, but I did not correctly assess the extent of its impact.

Gold continued its rally last week as it closed Friday at $979. I had been more bearish by virtue of the Mars to Sun aspect in the ETF chart early in the week. Indeed, this did take gold down somewhat by Wednesday but nowhere near as much as I had expected. Similarly, I had anticipated the nice boost from the Venus-Mercury aspect late in the week, but I did not correctly assess the extent of its impact.

Some early week gains (especially Monday) are possible here as Venus aspects its natal position and Sun comes under the aspect of natal Jupiter. But by Tuesday or Wednesday we should see sizable moves down as Venus falls under the wheels of Saturn’s aspect and Mars conjoins natal Rahu. The Sun-Saturn aspect is also unlikely to do any favours for bullion given that the Sun is the planetary significator for gold and Saturn represents darkness, death and constraint — not necessarily in that order. Gold is likely to bounce early next week (June 8-12) but these gains may not hold. Once we top this week, gold is likely to consolidate through most of June. Another rally attempt is likely as transiting Jupiter will aspect the natal Venus in mid-July. At this point, I would say that September and October could see a more sustained rally. The first several months of 2010 look quite bearish.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish-neutral

1-year outlook — bearish