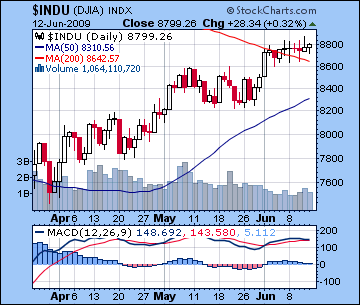

- Early week gains but declines later on

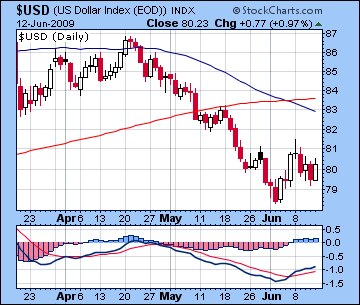

- Dollar under pressure early

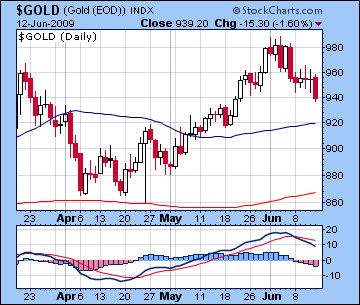

- Gold may rise to $960 before profit taking sets in

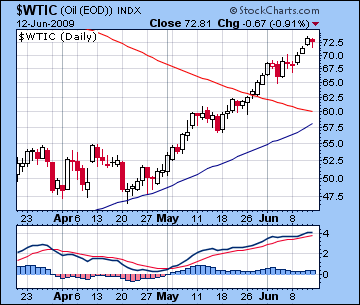

- Crude may hit $75

- Early week gains but declines later on

- Dollar under pressure early

- Gold may rise to $960 before profit taking sets in

- Crude may hit $75

This week begins with Jupiter, the Great Benefic, turning retrograde at 3 sidereal Aquarius on Monday. So much of this spring rally has depended on Jupiter and its alignment with Neptune and Uranus, any changes to its astrological condition need to be watched very carefully. While it is still in close quarters with Neptune (less than one degree), it is possible that a change in direction from forward to backward (as seen from our perspective on Earth, of course, since planets are always moving forward) may mean a reshuffling of the cosmic deck. The motion of slower moving planets such as Jupiter means that market consequences have a wider margin of error in terms of timing. Since the Sun is going to be forming a positive aspect with Jupiter early in the week, I think the market is going to rise a little further before it might reverse course. While my bias would be positive early in the week, Monday is somewhat ambiguous due to the position of Mercury with respect to Rahu. This is a weaker separating influence, but it still may be close enough to encourage sellers. The Moon is in a more favourable position as it is approaching Uranus in late Aquarius so that could well tilt the balance for the bulls, especially later in the day. The Moon moves into Pisces Tuesday and that should provide more solid footing for a gain into midweek. If for some reason we see a decline into Tuesday, that would be a very bearish signal for the market as it would be evidence that the Jupiter retrograde is taking hold very quickly and the reversal (albeit comparatively small) would be underway. As I said, however, I don’t expect Jupiter’s reversal to take hold quite that quickly. With Venus approaching a conjunction with Mars later in the week, the bears should have some planetary fuel to push down prices. Friday seems like the worst day of the week as Moon, Venus, and Mars will all conjoin at 19 degrees of Aries right at the open. Certainly, the move here looks significant. Thursday also has a reasonable chance of declines as the Moon will enter Aries that day and thereby activate the tension of the Venus-Mars conjunction. Since I think some significant up side is likely in the early going with Dow 9000 still possible, I’m not certain where the market will end up by Friday but it could well end up below where we are now.

This week begins with Jupiter, the Great Benefic, turning retrograde at 3 sidereal Aquarius on Monday. So much of this spring rally has depended on Jupiter and its alignment with Neptune and Uranus, any changes to its astrological condition need to be watched very carefully. While it is still in close quarters with Neptune (less than one degree), it is possible that a change in direction from forward to backward (as seen from our perspective on Earth, of course, since planets are always moving forward) may mean a reshuffling of the cosmic deck. The motion of slower moving planets such as Jupiter means that market consequences have a wider margin of error in terms of timing. Since the Sun is going to be forming a positive aspect with Jupiter early in the week, I think the market is going to rise a little further before it might reverse course. While my bias would be positive early in the week, Monday is somewhat ambiguous due to the position of Mercury with respect to Rahu. This is a weaker separating influence, but it still may be close enough to encourage sellers. The Moon is in a more favourable position as it is approaching Uranus in late Aquarius so that could well tilt the balance for the bulls, especially later in the day. The Moon moves into Pisces Tuesday and that should provide more solid footing for a gain into midweek. If for some reason we see a decline into Tuesday, that would be a very bearish signal for the market as it would be evidence that the Jupiter retrograde is taking hold very quickly and the reversal (albeit comparatively small) would be underway. As I said, however, I don’t expect Jupiter’s reversal to take hold quite that quickly. With Venus approaching a conjunction with Mars later in the week, the bears should have some planetary fuel to push down prices. Friday seems like the worst day of the week as Moon, Venus, and Mars will all conjoin at 19 degrees of Aries right at the open. Certainly, the move here looks significant. Thursday also has a reasonable chance of declines as the Moon will enter Aries that day and thereby activate the tension of the Venus-Mars conjunction. Since I think some significant up side is likely in the early going with Dow 9000 still possible, I’m not certain where the market will end up by Friday but it could well end up below where we are now.

Next week (June 22-26) looks fairly bearish as Monday we will still be in the throes of the Venus-Mars conjunction and then Friday will see the Mercury-Saturn square which often corresponds to sell offs. The following week (June 29 – July 3) seems mostly positive as both Mercury and Venus will again align with the Jupiter-Neptune, although I can see some selling on either side of the July 4th holiday weekend. Depending on the extent of the rally near July 1, possible intermediate lows would therefore be late June or early July. As before, I am not expecting a big pullback here, so the May lows of 8200/880 may be more prudent downside targets. Another factor to watch will be Uranus which turns retrograde on July 1. If the market is falling into that date, then its retrograde station would be a signal of a possible market reversal higher for July and August.

5-day outlook — bearish-neutral

30-day outlook — neutral-bullish

90-day outlook — neutral-bullish

1-year outlook — bearish

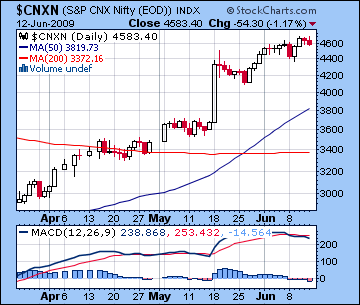

Stocks in Mumbai were mostly unchanged last week as caution over the new government’s policies offset more improved economic data. After trading below 4400 early Tuesday, the Nifty ended Friday’s session at 4583 while the Sensex finished at 15,237. Much of the intraweek dynamic came off as expected with the best gains coinciding with the Mercury-Jupiter-Neptune alignment on Tuesday and Wednesday. I had wondered about the possibility of Monday’s Venus-Pluto aspect producing a decline and that is exactly what happened, and that seemed to have precluded the possibility of a rise for the week. In retrospect, the negative impact of Mars (11 Aries) aspecting the NSE Moon (11 Libra) overshadowed the greed-inducing effects of Venus-Pluto. Thursday and Friday were both weak and that seems to have reflected the conservative bias of the Moon in Capricorn with Ketu. A technical view of the market shows increasing vulnerability since last week’s action failed to break the resistance at Nifty 4700, although one should acknowledge that this is a fairly recent resistance level. Upside momentum is clearly slowing as MACD shows a bearish crossover and growing negative histograms. A bearish divergence is also evident as new highs last week have not been matched in the MACD chart.

Jupiter turns retrograde on Monday so this may be a signal for an impending reversal. Jupiter has been at the core of this powerful rally through its conjunction with Neptune so any modifications of its planetary situation need to be carefully observed for anomalies. Planetary reversals are no guarantee of market reversals, of course, but there is a fairly decent track record there and hence they need to be taken seriously. Also as a slow moving planet, Jupiter’s retrograde station Monday may not exactly coincide with a peak in the market so we have to allow for some margin of error. The Sun enters Gemini also on Monday and will form a positive aspect with Jupiter early in the week and this should support prices generally. That said, Monday has a chance for a decline as the Moon opposes Saturn, with the market open in particular being more vulnerable to selling. Tuesday and Wednesday are perhaps the most bullish-looking days as the Sun-Jupiter aspect tightens while transiting Venus aspects the Sun in the NSE chart. The Moon in Pisces may also provide support since its dispositor Jupiter will be very strong by virtue of its station. However, once the Moon enters Aries on Thursday, I think there is a greater chance for pessimism as it will conjoin the Venus-Mars conjunction. Thursday morning may see positive trading as the Moon will still be in aspect with Jupiter but watch for selling to take over by the afternoon. Friday may be the most bearish day and we could see a significant move then, perhaps more than 2%. If Monday is down, then the week may be down overall, even with the probability of gains midweek. But if Monday is positive, then the bulls may well carry the day once again, even with the likelihood of late week pessimism.

Jupiter turns retrograde on Monday so this may be a signal for an impending reversal. Jupiter has been at the core of this powerful rally through its conjunction with Neptune so any modifications of its planetary situation need to be carefully observed for anomalies. Planetary reversals are no guarantee of market reversals, of course, but there is a fairly decent track record there and hence they need to be taken seriously. Also as a slow moving planet, Jupiter’s retrograde station Monday may not exactly coincide with a peak in the market so we have to allow for some margin of error. The Sun enters Gemini also on Monday and will form a positive aspect with Jupiter early in the week and this should support prices generally. That said, Monday has a chance for a decline as the Moon opposes Saturn, with the market open in particular being more vulnerable to selling. Tuesday and Wednesday are perhaps the most bullish-looking days as the Sun-Jupiter aspect tightens while transiting Venus aspects the Sun in the NSE chart. The Moon in Pisces may also provide support since its dispositor Jupiter will be very strong by virtue of its station. However, once the Moon enters Aries on Thursday, I think there is a greater chance for pessimism as it will conjoin the Venus-Mars conjunction. Thursday morning may see positive trading as the Moon will still be in aspect with Jupiter but watch for selling to take over by the afternoon. Friday may be the most bearish day and we could see a significant move then, perhaps more than 2%. If Monday is down, then the week may be down overall, even with the probability of gains midweek. But if Monday is positive, then the bulls may well carry the day once again, even with the likelihood of late week pessimism.

Next week (June 22-26) appears to start off bearish on the hangover of the Venus-Mars conjunction with the prospect of mixed trading for the rest of the week. This would therefore be a possible time for an interim low, especially given some bullish aspects that will follow in the first days of July and the Uranus retrograde station. Another probable pullback will occur in mid to late July after the Sun-Mercury conjunction. A potentially significant date to watch will be July 31 when retrograde Jupiter enters Capricorn, the sign in which it is debilitated. This could create a background weakening effect on the market since Jupiter will be leaving the supportive influence of Neptune in Aquarius. August 13 may also prove to be an important high since Mars is in good aspect with Jupiter that day, and both will positively aspect the natal Mercury in the NSE chart.

5-day outlook — bearish-neutral

30-day outlook — neutral-bullish

90-day outlook — neutral-bullish

1-year outlook — bearish-neutral

As predicted, the dollar fell last week and closed a little above 80 on worries over deficits and inflation. The midweek Mercury-Jupiter aspect provided the requisite boost of financial confidence and the dollar declined in kind below 80. Thursday’s move down was a little puzzling since the USDX natal chart did not show any clear affliction. Perhaps the Moon-Venus t-square with natal Pluto was enough of a signature, although the Euro chart was admittedly stronger and thus provided more inferential evidence for dollar weakness. Friday’s decline was on the money as Mars conjoined with the natal Rahu and Mercury aspected the natal Sun. This week is likely to start off negatively for the dollar as Mercury will still be within range of the natal Saturn on Monday. With the Sun-Jupiter likely to boost optimism generally Tuesday and maybe into Wednesday, the dollar may well sell off further. I would not rule out a retest of the early June lows of 78.5 here. This would form a short term double bottom and would create a better technical signal for a more enduring rise starting later in the week. Thursday and Friday look fairly solid, but here I am assuming the Ketu influence on the natal Saturn is going to be positive which admittedly requires a certain measure of faith. Whatever the outcome, it is more likely to be volatile. I am looking for a possible peaking of this mini-rally around June 29 at the 82-83 level. A more robust rally is likely in the fall with a possible top in late October, perhaps near the 88-90 level.

As predicted, the dollar fell last week and closed a little above 80 on worries over deficits and inflation. The midweek Mercury-Jupiter aspect provided the requisite boost of financial confidence and the dollar declined in kind below 80. Thursday’s move down was a little puzzling since the USDX natal chart did not show any clear affliction. Perhaps the Moon-Venus t-square with natal Pluto was enough of a signature, although the Euro chart was admittedly stronger and thus provided more inferential evidence for dollar weakness. Friday’s decline was on the money as Mars conjoined with the natal Rahu and Mercury aspected the natal Sun. This week is likely to start off negatively for the dollar as Mercury will still be within range of the natal Saturn on Monday. With the Sun-Jupiter likely to boost optimism generally Tuesday and maybe into Wednesday, the dollar may well sell off further. I would not rule out a retest of the early June lows of 78.5 here. This would form a short term double bottom and would create a better technical signal for a more enduring rise starting later in the week. Thursday and Friday look fairly solid, but here I am assuming the Ketu influence on the natal Saturn is going to be positive which admittedly requires a certain measure of faith. Whatever the outcome, it is more likely to be volatile. I am looking for a possible peaking of this mini-rally around June 29 at the 82-83 level. A more robust rally is likely in the fall with a possible top in late October, perhaps near the 88-90 level.

The Euro gained ground last week as closed above 1.40. This was in keeping with expectations as the Mercury-Jupiter aspect sat nicely in the Euro natal chart activating the natal Ascendant-Venus pattern. Friday’s down day exactly coincided with the transiting Sun t-square with the natal Mercury-Jupiter aspect. This week looks quite bullish early on as the Sun conjoins the natal Moon while the transiting Moon conjoins the natal Jupiter. It’s very hard to see the Euro going anywhere but up with those influences. Tuesday could see more gains as Venus trines the natal Sun, but after that, the Euro may face tougher headwinds and could finish below 1.40 overall. Looking further ahead, I’m becoming less convinced the Euro can reach 1.50 this summer. The progressions seem less than positive, and Rahu’s transit influence on the natal ascendant looks difficult. A possible top may occur with the Venus-Jupiter trine aspect on July 27. The Indian Rupee finished mostly unchanged last week at 47.4. While it did trade near 47 a couple of times, it ended the week slipping back. The natal Venus in the India chart (= money) looks afflicted over the next two weeks so it is hard to imagine how the Rupee will avoid some declines here, perhaps to the 48-49 range.

Dollar

5-day outlook — neutral

30-day outlook — bullish

90-day outlook — neutral

1-year outlook — neutral

Crude maintained its upward momentum last week as it closed over $72. This was mostly in keeping with our forecast, although I had expected the peak to occur a little earlier in the week rather than on Thursday. Friday’s decline was modest, no doubt the product of the ongoing support offered by the Jupiter-Neptune conjunction. Although Jupiter moved a little past Neptune, it has not slowed up the crude rally one iota.

Crude maintained its upward momentum last week as it closed over $72. This was mostly in keeping with our forecast, although I had expected the peak to occur a little earlier in the week rather than on Thursday. Friday’s decline was modest, no doubt the product of the ongoing support offered by the Jupiter-Neptune conjunction. Although Jupiter moved a little past Neptune, it has not slowed up the crude rally one iota.

With Jupiter turning retrograde on Monday this week, we have another substantial opportunity for a reversal. Neptune is perhaps the best significator for oil, but Jupiter’s close conjunction with Neptune means that Jupiter’s condition can translate into trading outcomes. The early week could see further rises on the Sun-Jupiter aspect and the Moon transiting through the positive10th and 11th houses of the ETF chart. Tuesday is perhaps the best day of the bunch. Watch for signs of weakness by Wednesday as Mercury falls under the aspect of natal Ketu. This could be a volatile day capable of going either way. On Thursday, the Moon enters Aries which is the natal 12th house of loss so the last two days may be prone to some sharp sell offs. If we see $75 by midweek, then we could well finish near $68-70 by Friday, or next Monday at the latest. I am expecting weakness in crude until at least the Mercury-Saturn square aspect on June 25.

5-day outlook — bearish

30-day outlook — neutral-bullish

90-day outlook — neutral-bullish

1-year outlook — neutral

Gold continued its retreat last week as it closed below $940. This was not unexpected, but the extent of Friday’s sell off was a little surprising. I had thought we would see Thursday as the most negative day on the Sun-Pluto opposition so our forecast was a day off. Gold had been largely flat before that with some midweek rally attempts all failing to take hold by the end of the day. I had forecast a little more upside on the Venus-Pluto aspect but the only possible manifestation of apparently bullish planetary energy was some of the intraday trading saw the highs outpace the lows.

Gold continued its retreat last week as it closed below $940. This was not unexpected, but the extent of Friday’s sell off was a little surprising. I had thought we would see Thursday as the most negative day on the Sun-Pluto opposition so our forecast was a day off. Gold had been largely flat before that with some midweek rally attempts all failing to take hold by the end of the day. I had forecast a little more upside on the Venus-Pluto aspect but the only possible manifestation of apparently bullish planetary energy was some of the intraday trading saw the highs outpace the lows.

Monday and Tuesday could see some gains for gold as the Sun trines the natal Venus in the ETF chart. A rally back to $960 is possible here, but as the transiting Sun moves into harmonic aspect with natal Saturn by Thursday, I think gold may weaken — perhaps substantially. Mercury will fall under the quincunx aspect of natal Mars here so there’s really a double whammy of bearish energy that gold will have to contend with. Thursday looks to be the worst day of the week, although Friday may also see losses. Next week also looks very challenging for gold on the Sun-Pluto opposition which will activate the natal Ketu in the ETF chart near the 23rd. This could represent a big drop, although I note a simultaneously bullish grand trine aspect forming with Mercury to natal Jupiter and Neptune. This could minimize the losses, but I tend to think it is more likely to be an adjectival descriptor of "bigness" to the decline.

5-day outlook — bearish-neutral

30-day outlook — bearish

90-day outlook — bearish

1-year outlook — bearish