- Monday may see large move up or down; weakness later on

- Dollar to rise later in week

- Gold likely to decline after Tuesday

- Crude to slide below $70

- Monday may see large move up or down; weakness later on

- Dollar to rise later in week

- Gold likely to decline after Tuesday

- Crude to slide below $70

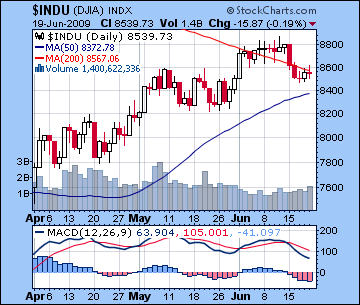

This week again inclines towards the negative, although I’m somewhat less confident that the Venus-Mars-Saturn pattern can push the market significantly lower on Monday. The lack of selling Friday as the conjunction approached was disappointing, so the early week direction seems more ambiguous here, although I would still lean towards a decline but not by much. The added difficulty here is that this pattern of planets is more likely to produce a sizable move up or down so not knowing the direction will increase anxiety for investors with open positions. Tuesday features the Sun exactly opposite Pluto which could spell trouble for leaders and large corporations and this aspect increases the possibilities for selling, especially if Monday turns out to be positive. From Wednesday to Friday, Mercury will move closer to a tense square aspect with Saturn and this will likely move markets lower. Thursday could be the worst day of the three given the placement of the Moon in late Cancer. It may be useful to note that any significant down move later in the week will be more likely if we see a bounce back rally on Monday or Tuesday. Even if markets rally early on, the Friday close will likely put us lower than current levels, although I doubt if we will hit 8200/880 this week. That said, if the market happens to sell off sharply on Monday, then the bearish promise of Mercury-Saturn later in the week could well bring those May lows of 8200/880 into play.

This week again inclines towards the negative, although I’m somewhat less confident that the Venus-Mars-Saturn pattern can push the market significantly lower on Monday. The lack of selling Friday as the conjunction approached was disappointing, so the early week direction seems more ambiguous here, although I would still lean towards a decline but not by much. The added difficulty here is that this pattern of planets is more likely to produce a sizable move up or down so not knowing the direction will increase anxiety for investors with open positions. Tuesday features the Sun exactly opposite Pluto which could spell trouble for leaders and large corporations and this aspect increases the possibilities for selling, especially if Monday turns out to be positive. From Wednesday to Friday, Mercury will move closer to a tense square aspect with Saturn and this will likely move markets lower. Thursday could be the worst day of the three given the placement of the Moon in late Cancer. It may be useful to note that any significant down move later in the week will be more likely if we see a bounce back rally on Monday or Tuesday. Even if markets rally early on, the Friday close will likely put us lower than current levels, although I doubt if we will hit 8200/880 this week. That said, if the market happens to sell off sharply on Monday, then the bearish promise of Mercury-Saturn later in the week could well bring those May lows of 8200/880 into play.

Next week (June 29 – July 3) generally looks more bullish as both Mercury and Venus will move into alignment with the Jupiter-Neptune conjunction. Even with Jupiter-Neptune weakening due to Jupiter’s retrograde motion, there still should be some positive energy left there to move markets higher off any lows we put in this week. Monday could see a little more selling, while Tuesday (July 1) and possibly Wednesday look like the best days of that week and could well produce a major gain (>3%). Even if the following week (Jul 6-10) is more mixed, there is a good chance that the lows we see this week may well hold up for the next month or two as the rally seems poised to resume. The question is: how confident am I that this rally still has much further to go? It’s not a certainty (nothing ever is), but perhaps 80-90% likely. Given we are now in Jupiter’s retrograde cycle, we need to acknowledge the possibility that Jupiter may not have the same amount of bullish energy to offer Neptune as it had when it was moving forward. In addition, we should caution against any complacency on the long side here as the Total Solar Eclipse of July 22 looks quite difficult given the close square between Venus (money, happiness) and Saturn (pessimism, loss). This doesn’t mean that the market will begin to fall immediately on that date, but it is a warning that the rally’s days are numbered as it increases the chances that this medium term rally will reverse — presumably within four weeks of that date. For example, we had a solar eclipse on September 11, 2007 and the market peaked about one month after that date. Investors with long positions may consider taking any medium or long term profits as the market moves higher.

5-day outlook — bearish

30-day outlook — bullish

90-day outlook — neutral-bullish

1-year outlook — bearish

The ongoing rally was dealt a serious blow as stocks in Mumbai fell almost 5% last week as more investors took profits on uncertain economic news. After trading near 4200, the Nifty closed Friday at 4313 while the Sensex ended the week at 14,521. Jupiter’s retrograde station on Monday manifested quite clearly as the expected reversal in the market trend arrived more or less on schedule. I had thought we might see the bulk of the declines later in the week on the Venus-Mars conjunction but as it happened the selling spanned most of the week. Monday did in fact turn out to be negative as we thought it might as Moon opposed Saturn. The Sun-Jupiter aspect only delivered one clear up day on Tuesday, however, and this was perhaps indicative that the bullish strength of Jupiter was becoming less reliable as a planetary support for these high levels. Thursday was down as forecast but Friday saw a significant rally into the close after being down well into midday. In retrospect, the negativity of the Venus-Mars may have been temporarily offset by the transit of the Moon into a particularly bullish zone in the NSE natal chart. Technically, the Indian market seems vulnerable to more declines here since the MACD remains solidly negative. Perhaps more importantly, it is currently poised at a key support level of the upward price channel that dates back to the March lows. Of course, it could bounce off these levels and move back up in the price channel but it is nonetheless in a critical position where any breach below could add to downward momentum.

This week should see more declines, although there is a chance for significant gains along the way. Monday sees the end of the Venus-Mars-Saturn alignment. I had thought this pattern would have produced more bearishness than it did, so it’s less clear that Monday will see losses. Monday will also feature a New Moon so that may increase the day’s volatility and eventual size of the price move. The NSE chart seems very afflicted by the Mars to Mars square aspect but there is a good chance of some late buying as the Moon enters Gemini in the afternoon which may tap into some Jupiter optimism. Tuesday’s Sun-Pluto aspect looks less conducive to gains, especially with the Moon transiting turbulent Ardra. Wednesday could see a fairly strong open as the Moon prepares to enter Cancer, although the market may be prone to selling in the afternoon. Thursday and Friday may see more weakness as Mercury moves into square aspect with Saturn. Friday may be the worst of these two days as the Moon enters Leo, although investors should be prepared for strength near the close Friday as Moon will move into an opposition alignment with Jupiter-Neptune. While this is a less positive aspect than some Moon-Jupiter aspects, any harmonic contact between these two benefic bodies can produce buying. So even if we do happen see some early week strength, I think the market is likely to close lower overall.

This week should see more declines, although there is a chance for significant gains along the way. Monday sees the end of the Venus-Mars-Saturn alignment. I had thought this pattern would have produced more bearishness than it did, so it’s less clear that Monday will see losses. Monday will also feature a New Moon so that may increase the day’s volatility and eventual size of the price move. The NSE chart seems very afflicted by the Mars to Mars square aspect but there is a good chance of some late buying as the Moon enters Gemini in the afternoon which may tap into some Jupiter optimism. Tuesday’s Sun-Pluto aspect looks less conducive to gains, especially with the Moon transiting turbulent Ardra. Wednesday could see a fairly strong open as the Moon prepares to enter Cancer, although the market may be prone to selling in the afternoon. Thursday and Friday may see more weakness as Mercury moves into square aspect with Saturn. Friday may be the worst of these two days as the Moon enters Leo, although investors should be prepared for strength near the close Friday as Moon will move into an opposition alignment with Jupiter-Neptune. While this is a less positive aspect than some Moon-Jupiter aspects, any harmonic contact between these two benefic bodies can produce buying. So even if we do happen see some early week strength, I think the market is likely to close lower overall.

Next week (June 29 – July 3) looks more positive as Mercury and Venus will aspect each other and join Jupiter-Neptune. This configuration is likely to produce significant gains midweek and that will probably be enough to make that week net positive even with some selling Thursday and Friday. The following week (July 6-10) seems bullish in the early going as Mars aligns with Jupiter-Neptune but trading may be more mixed after that. With the budget due for release at that time, I don’t anticipate any huge moves either way. The July 22 Solar Eclipse may well foretell the end of this rally as Venus is heavily afflicted by Saturn in that chart. Eclipses are only approximate in their timing of reversals, but they are nonetheless extremely useful in highlighting periods of change in the market. August continues to look like a time when the bears may finally overtake the bulls and push prices down more convincingly.

5-day outlook — bearish

30-day outlook — neutral-bullish

90-day outlook — neutral -bullish

1-year outlook — neutral

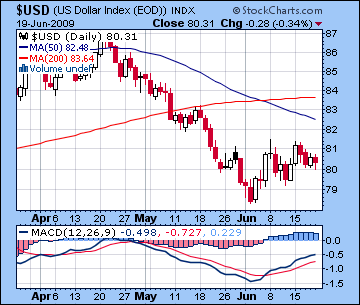

The US dollar was mostly unchanged on the week as Monday’s gains were gradually erased through the week. While I had been more bearish for the early week, the final outcome was not far from our expectations. Monday’s gain was the biggest anomaly, although in retrospect I probably read too much into the Mercury-Saturn opposition and not enough in the Venus-Rahu conjunction. Thursday did see a modest gain but Friday wiped it out, presumably on the Mars opposition to the natal Venus in the USDX chart. Overall, there was no substantive change in the technical position of the dollar as it continues to trade in an upward price channel formed off the early June lows. And while its 50 and 200 DMA formed a bearish ‘death cross’ two weeks ago, I note that the 200 DMA has yet to turn negative. If it does, then that would be a bearish signal, but one can still argue that, while largely negative, the momentum is not yet carved in stone. This week begins with a crucial alignment of Venus and Mars at 22 degrees of Aries, exactly on the 6th house cusp of the USDX natal chart. This should be a negative indicator for the early week but given Saturn’s current position at 22 Leo which forms a square aspect with the natal Ascendant-Mercury-Uranus, it is conceivable that this could manifest positively. Given the tightness of the aspects involved, this is likely to produce a major move. Certainly, the Mercury-Saturn square later in the week looks more reliably positive for the dollar, but if Monday-Tuesday ends up positive, then we could see the dollar climbing sharply higher. Since I have my doubts about the effects of this Venus-Mars conjunction, out of caution I would tend to lean towards a dollar decline in the early week with recovery later on, possibly still in the current 80-81 range. Nonetheless, we appear to be in a more favourable period for the dollar here so a little pop up to 83 is definitely not out of the question.

The US dollar was mostly unchanged on the week as Monday’s gains were gradually erased through the week. While I had been more bearish for the early week, the final outcome was not far from our expectations. Monday’s gain was the biggest anomaly, although in retrospect I probably read too much into the Mercury-Saturn opposition and not enough in the Venus-Rahu conjunction. Thursday did see a modest gain but Friday wiped it out, presumably on the Mars opposition to the natal Venus in the USDX chart. Overall, there was no substantive change in the technical position of the dollar as it continues to trade in an upward price channel formed off the early June lows. And while its 50 and 200 DMA formed a bearish ‘death cross’ two weeks ago, I note that the 200 DMA has yet to turn negative. If it does, then that would be a bearish signal, but one can still argue that, while largely negative, the momentum is not yet carved in stone. This week begins with a crucial alignment of Venus and Mars at 22 degrees of Aries, exactly on the 6th house cusp of the USDX natal chart. This should be a negative indicator for the early week but given Saturn’s current position at 22 Leo which forms a square aspect with the natal Ascendant-Mercury-Uranus, it is conceivable that this could manifest positively. Given the tightness of the aspects involved, this is likely to produce a major move. Certainly, the Mercury-Saturn square later in the week looks more reliably positive for the dollar, but if Monday-Tuesday ends up positive, then we could see the dollar climbing sharply higher. Since I have my doubts about the effects of this Venus-Mars conjunction, out of caution I would tend to lean towards a dollar decline in the early week with recovery later on, possibly still in the current 80-81 range. Nonetheless, we appear to be in a more favourable period for the dollar here so a little pop up to 83 is definitely not out of the question.

The Euro slipped back under 1.40 last week as expected, but its path down bore little resemblance to the map I had previously drawn. Monday saw significant selling while late week trading saw gains accrue as the Sun approached the natal Midheaven. Monday will see a New Moon occur near the Midheaven which is likely to focus more attention on the Euro and its long term viability given the problems of conflicts among member states. This New Moon occurs in opposition to Pluto, so it seems that political meddling may become more of a concern that in the past. Generally, this pattern seems bearish for the Euro although this is not at all certain. The prospect of both Venus and Mars coming under the quincunx aspect of natal Mars later in the week makes a better bearish case here, with further net downside likely this week. As predicted, the Indian Rupee lost ground last week and closed at 48 to the dollar. There seems to be too much Mars energy in the India chart at the moment, so the outlook for the Rupee would seem to be fairly bearish.

Dollar

5-day outlook — bullish

30-day outlook — neutral-bullish

90-day outlook — bullish

1-year outlook — bullish

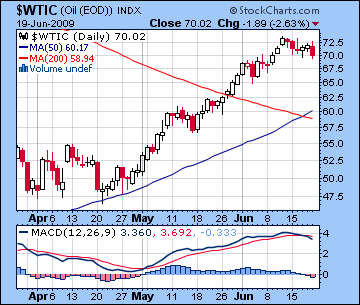

Crude oil extended its correction last week as it closed down 3% to $70 on the continuous contract. This result was not unexpected given the bearish potential of Monday’s Jupiter retrograde station, although we were somewhat taken aback by the size of Monday’s pullback which effectively precluded the $75 target. Nonetheless, we did see some modest gains midweek as the Sun-Jupiter aspect did bring out the speculators once again. Friday saw another large decline as the Moon’s entry into the malefic12th house in the Futures chart followed the script admirably. While we see a bullish ‘golden cross’ involving the 50 and 200 DMA in the chart, the MACD remains pretty negative.

Crude oil extended its correction last week as it closed down 3% to $70 on the continuous contract. This result was not unexpected given the bearish potential of Monday’s Jupiter retrograde station, although we were somewhat taken aback by the size of Monday’s pullback which effectively precluded the $75 target. Nonetheless, we did see some modest gains midweek as the Sun-Jupiter aspect did bring out the speculators once again. Friday saw another large decline as the Moon’s entry into the malefic12th house in the Futures chart followed the script admirably. While we see a bullish ‘golden cross’ involving the 50 and 200 DMA in the chart, the MACD remains pretty negative.

This week will probably see more profit taking in advance of the Mercury-Saturn square on Friday. Monday and Tuesday have the potential for gains, however, as there are favourable contacts involving Jupiter forming in both the Futures and USO ETF chart. Wednesday’s Moon-Ketu conjunction in Cancer may see markets weaken, especially in the afternoon. By Thursday, Mercury will be within two degrees of the Saturn influence, so we could greater down movement. Nonetheless, the Moon forms a positive aspect with natal Jupiter near the open Thursday which might offer some temporary price support. Friday could well be the worst day of the week as the Moon enters Leo and comes under the influence of Ketu in the Futures chart. Assuming we see a rise Monday, I am still expecting a lower close, perhaps in the $68-70 range at some point this week.

5-day outlook — bearish

30-day outlook — bullish

90-day outlook — neutral-bullish

1-year outlook — neutral

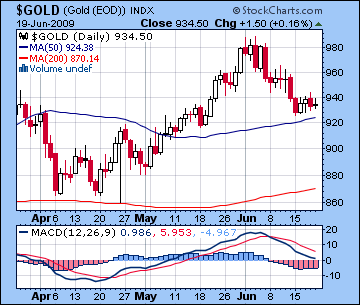

Gold bulls gamely tried to put a halt to the recent negative trend as gold retreated only modestly last week to close at $934. This was mostly in keeping with expectations although I mistakenly thought that the gains might begin to accrue Monday. As it turned out, Monday saw more declines with buyers only moving in cautiously on Tuesday and Wednesday. As a result, gold traded within a fairly narrow trading range for the rest of the week. The fact that gold is hanging in here at these levels despite a tense aspect involving its natal Saturn could translate into a little more strength than I had previously anticipated. I don’t think $1000 is in the cards here, but it could stay above $900 for a while.

Gold bulls gamely tried to put a halt to the recent negative trend as gold retreated only modestly last week to close at $934. This was mostly in keeping with expectations although I mistakenly thought that the gains might begin to accrue Monday. As it turned out, Monday saw more declines with buyers only moving in cautiously on Tuesday and Wednesday. As a result, gold traded within a fairly narrow trading range for the rest of the week. The fact that gold is hanging in here at these levels despite a tense aspect involving its natal Saturn could translate into a little more strength than I had previously anticipated. I don’t think $1000 is in the cards here, but it could stay above $900 for a while.

This week may well start bullishly for gold as Mercury forms a very nice grand trine with the Jupiter-Neptune in the ETF chart. I would not rule out trades above $950. At the same time, the Gemini New Moon occurs opposite Pluto so this does not portend good things for gold in the weeks ahead. The gold situation looks increasing untenable after Tuesday as the Moon will join Ketu in Cancer conjunct the 8th house Saturn. Thursday could be worse for gold as Mars will aspect the natal Mercury in the ETF chart with the Moon forming a tense square aspect. Overall, I think there’s a good chance that gold ends this week lower. We should see another rally attempt in early July, however, so the resistance near $955 may be retested.

5-day outlook — bearish

30-day outlook — bearish-neutral

90-day outlook — bearish-neutral

1-year outlook — bearish