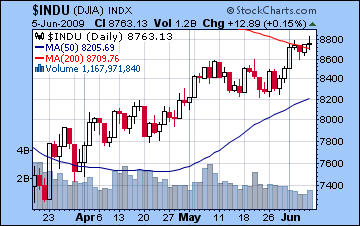

- More upside likely early in the week, Dow 9000 possible

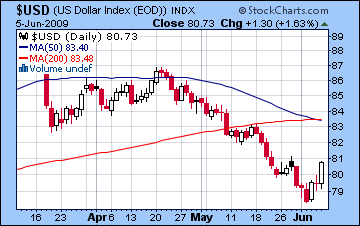

- Dollar pullback under 80 probable

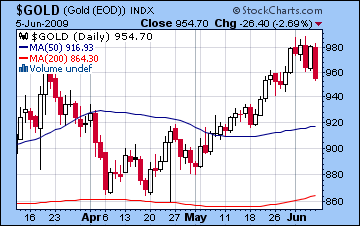

- Gold may attempt early rally but unlikely to continue

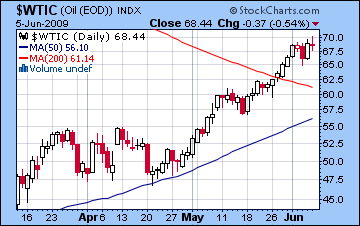

- Crude to stay strong

- More upside likely early in the week, Dow 9000 possible

- Dollar pullback under 80 probable

- Gold may attempt early rally but unlikely to continue

- Crude to stay strong

This week is likely to start off fairly positively as there are two probable bullish aspects in the sky. First, Venus trines Pluto on Monday and with the Moon along for the ride in Sagittarius, there is the possibility for a significant move up. One caveat here is that Venus will have passed its exact aspect near midday, so it’s conceivable that stocks may peak in the morning and fall after that. On Tuesday and Wednesday, Mercury (3 Taurus) will assume a similar position that Venus occupied last Monday that sent stocks higher as part of the larger Jupiter-Neptune-Uranus alignment. This is a more reliable indicator for at least one solid (>2%) up day midweek. As the week progresses, the sources of available planetary fuel for the bulls appears to dry up. In fact, a distinctly bearish indicator could occur as soon as Wednesday as Mercury and Mars will be moving at the same velocity. This is likely to result in some downward pressure, although the Mercury-Mars velocity measurement occurs very close in time to the Mercury-Jupiter-Neptune alignment so there may be some offsetting there. Overall, I think the early part of the week looks bullish, with Dow 9000 as a possibility. But later in the week seems less positive, so expect some profit taking. If Monday is positive from the Venus-Pluto aspect, then we could well be positive overall for the week.

This week is likely to start off fairly positively as there are two probable bullish aspects in the sky. First, Venus trines Pluto on Monday and with the Moon along for the ride in Sagittarius, there is the possibility for a significant move up. One caveat here is that Venus will have passed its exact aspect near midday, so it’s conceivable that stocks may peak in the morning and fall after that. On Tuesday and Wednesday, Mercury (3 Taurus) will assume a similar position that Venus occupied last Monday that sent stocks higher as part of the larger Jupiter-Neptune-Uranus alignment. This is a more reliable indicator for at least one solid (>2%) up day midweek. As the week progresses, the sources of available planetary fuel for the bulls appears to dry up. In fact, a distinctly bearish indicator could occur as soon as Wednesday as Mercury and Mars will be moving at the same velocity. This is likely to result in some downward pressure, although the Mercury-Mars velocity measurement occurs very close in time to the Mercury-Jupiter-Neptune alignment so there may be some offsetting there. Overall, I think the early part of the week looks bullish, with Dow 9000 as a possibility. But later in the week seems less positive, so expect some profit taking. If Monday is positive from the Venus-Pluto aspect, then we could well be positive overall for the week.

Next week (June 15-19) will begin on another positive note as the Sun forms a strong aspect with Jupiter-Neptune. With Jupiter turning retrograde on the 15th, this influence looks like it will carry the day and may well coincide with a short term high, assuming any pullback late this week isn’t too dramatic. After Tuesday the 16th the market will be more prone to sell offs. This is in keeping with our understanding of the role of stationing planets, i.e. planets that change direction with respect to the Earth. Planetary stations show a significant (but not law-like) correlation with reversals in market direction. As we know, Saturn’s May direct station failed to coincide with any clear market manifestation. Jupiter is another possibility, however, and its imminent station of the 15th is another clue that we could see a pullback soon. While we can’t time the reversal exactly from the planetary station, it is a useful piece of data. The market will likely slip back the following week (June 22- 26) with the Venus-Mars conjunction at 22 Aries which will be channeling the negative energy of Saturn (22 Leo). At this point, this late June period appears to be the leading candidate for an intermediate low. I am not expecting too much downside here, perhaps 10%, which may only take us down to the May lows of 8200. This bull leg seems to have more left in the tank to rally again in July, so there is a good chance for higher highs then.

5-day outlook — neutral to bullish

30-day outlook — neutral to bullish

90-day outlook — bullish

1-year outlook — bearish

Stocks in Mumbai rose another 3% last week as optimism grew over the prospects for economic reforms in the upcoming Union Budget set for July. The Sensex broke through the 15K level to close at 15,103 while the Nifty finished the week at 4586. Monday was higher as the Venus-Jupiter-Neptune aspect suggested. However, the midweek sell off on the Mars-Rahu aspect never arrived as the negative energy was largely offset by the underlying influence Jupiter-Neptune conjunction. The result was the market largely treaded water. In the current hothouse investment climate that prevails in India, a flat day may be all one can expect when fast moving malefic transits are in play. The market managed to eke out a small gain later in the week in the face of the tense Sun-Saturn square aspect, again perhaps demonstrating how the rules of the game may have recently shifted somewhat. Technically, the market is moving up against resistance levels dating back to August 2008, so the market looks like it will test 4600-4700 over the coming two weeks.

There is a good chance for more gains early this week as Venus forms a positive aspect with Pluto on Monday and then Mercury aligns with Jupiter and Neptune on Tuesday and Wednesday. It should be noted that Mercury (3 Taurus) will occupy the same place in the sky as it did on May 18-19 when Dalal Street experienced its post-election rally. It won’t be anywhere near as powerful here since the Sun is not co-present, but it is a positive pattern nonetheless. A complicating factor is that Mars will be aspecting the natal Moon in the NSE chart early in the week and this can often release too much energy which send markets lower. This is likely to reduce the upside over these three trading days, and we may well see at least one day that closes in the red. Thursday has a chance for gains, at least intraday, as transiting Venus aspects the natal Moon in the NSE chart. Friday could see more caution as the Moon transits Capricorn with Ketu. Overall, I think there is a good chance for gains this week but much will depend how bullish Monday and Tuesday are. If for some reason Monday sells off on the Venus-Pluto aspect, then that would be a sign that the week will not be as positive.

There is a good chance for more gains early this week as Venus forms a positive aspect with Pluto on Monday and then Mercury aligns with Jupiter and Neptune on Tuesday and Wednesday. It should be noted that Mercury (3 Taurus) will occupy the same place in the sky as it did on May 18-19 when Dalal Street experienced its post-election rally. It won’t be anywhere near as powerful here since the Sun is not co-present, but it is a positive pattern nonetheless. A complicating factor is that Mars will be aspecting the natal Moon in the NSE chart early in the week and this can often release too much energy which send markets lower. This is likely to reduce the upside over these three trading days, and we may well see at least one day that closes in the red. Thursday has a chance for gains, at least intraday, as transiting Venus aspects the natal Moon in the NSE chart. Friday could see more caution as the Moon transits Capricorn with Ketu. Overall, I think there is a good chance for gains this week but much will depend how bullish Monday and Tuesday are. If for some reason Monday sells off on the Venus-Pluto aspect, then that would be a sign that the week will not be as positive.

Next week we may well see an interim high put in as the Sun forms a very positive aspect with the Jupiter-Neptune conjunction. This will coincide with Jupiter going retrograde on Monday, June 15th. With a change in direction in the planet Jupiter, there is an increased chance for a change in the direction of the market, if only temporarily. Declines are more probable from the 17th onwards, as Venus will conjoin malefic Mars on June 22. Again, I am not expecting a huge pullback in late June and into early July, perhaps 10-15% is possible. At this point, I think we will see another rally attempt in late July and August before the market undergoes a larger decline.

5-day outlook — bullish

30-day outlook — neutral

90-day outlook — bullish

1-year outlook — bearish – neutral

The US dollar managed to get up off the mat last week as it again rose above 80. As forecast, the early week saw declines with Tuesday seeing the low at 78.5 on the Venus-Jupiter aspect. The Wednesday rise coincided with the Mars-Rahu aspect and Friday’s even bigger gain was the perfect expression of the Sun-Saturn aspect that hit the angles in the USDX natal chart. I’m a little less bullish on the dollar this week due to an absence of clear hits to the natal chart. It seems very likely to decline in the early week with some recovery later on as Mars conjoins the natal Rahu on Friday. Perhaps that may indicate early week trades near 79 with some bounce back later towards 80. Overall, I see the dollar declining this week. In addition, Mercury will once again moving into a tense opposition aspect with the natal Sun-Saturn conjunction late in the week. Readers should note that when Mercury was retrograde in mid to late May, this aspect saw the dollar tumble from 83 to 80 in very short order. The influence is unlikely to be as negative this time around, but it is definitely a bearish influence. On the bright side, it is only exact over the weekend (Jun 13-14) when markets are closed so most of the damage may happen in the after hours market. After that, we will have to wait and see what the effects are of the Ketu-Saturn aspect. Ketu is associated with suddenness, so a large move is possible. As I have explained previously, this is negative more often than not, but on this occasion there is good reason to think that Ketu will flip and turn positive.

The US dollar managed to get up off the mat last week as it again rose above 80. As forecast, the early week saw declines with Tuesday seeing the low at 78.5 on the Venus-Jupiter aspect. The Wednesday rise coincided with the Mars-Rahu aspect and Friday’s even bigger gain was the perfect expression of the Sun-Saturn aspect that hit the angles in the USDX natal chart. I’m a little less bullish on the dollar this week due to an absence of clear hits to the natal chart. It seems very likely to decline in the early week with some recovery later on as Mars conjoins the natal Rahu on Friday. Perhaps that may indicate early week trades near 79 with some bounce back later towards 80. Overall, I see the dollar declining this week. In addition, Mercury will once again moving into a tense opposition aspect with the natal Sun-Saturn conjunction late in the week. Readers should note that when Mercury was retrograde in mid to late May, this aspect saw the dollar tumble from 83 to 80 in very short order. The influence is unlikely to be as negative this time around, but it is definitely a bearish influence. On the bright side, it is only exact over the weekend (Jun 13-14) when markets are closed so most of the damage may happen in the after hours market. After that, we will have to wait and see what the effects are of the Ketu-Saturn aspect. Ketu is associated with suddenness, so a large move is possible. As I have explained previously, this is negative more often than not, but on this occasion there is good reason to think that Ketu will flip and turn positive.

The Euro fell back under 1.40 last week as Venus and Mars transited through the malefic 8th house in the Euro natal chart. This was more or less in keeping with expectations as the early week rise coincided with the Venus-Jupiter aspect. This week looks very bullish as Mercury will form a trine aspect with the natal Venus while it moves into the sweet spot of the 9th house. Some declines are more likely Thursday and Friday when the Sun forms a t-square with natal Mercury and Jupiter and falls under the aspect of natal Ketu. While these are indicative of difficulties, they are less clearly bearish than last week’s aspects. The Indian Rupee was lower last week as it closed at 47.4. I had thought it would lose more ground to the dollar, but it has proven to be quite resilient here. It is likely to strengthen this week back towards 47.

Dollar

5-day outlook — bearish

30-day outlook — bullish

90-day outlook — neutral – bullish

1 year outlook — neutral

The rally in crude continued last week as it closed above $68. While I had anticipated the early week rise on the Venus-Jupiter aspect, the late week strength was surprising, especially since crude managed to trade over $70 on the continuous contract. Thursday’s rise followed the Venus aspect to the natal Ketu aspect and this offset the negativity of the otherwise harsh Mars to Saturn aspect. While it lost a bit of ground Friday, the lack of a significant pullback on the Sun-Saturn aspect was disappointing.

The rally in crude continued last week as it closed above $68. While I had anticipated the early week rise on the Venus-Jupiter aspect, the late week strength was surprising, especially since crude managed to trade over $70 on the continuous contract. Thursday’s rise followed the Venus aspect to the natal Ketu aspect and this offset the negativity of the otherwise harsh Mars to Saturn aspect. While it lost a bit of ground Friday, the lack of a significant pullback on the Sun-Saturn aspect was disappointing.

This week looks generally bullish in the early going as Venus aspects Pluto and Mercury moves into aspect with the Jupiter-Neptune aspect. If Monday is positive, a close over $70-72 by Wednesday is very possible here. But once Mercury moves out of range, crude will be susceptible to correction later in the week. More gains are likely early next week (June 15-19) with the Sun-Jupiter-Neptune aspect but some consolidation may follow on the Venus-Mars conjunction. Prices are likely to rise further in the summer. Picking price targets is difficult, but $80 seems possible over the coming weeks.

5-day outlook — bullish

30-day outlook — neutral — bullish

90-day outlook — bullish

1-year outlook — neutral

Gold slumped to $954 last week as investors took profits from the recent rally. Even the Venus-to-Venus aspects weren’t enough to keep prices up as the Saturn influence from the ETF chart pushed gold down by Wednesday. Thursday’s bounce was somewhat unexpected although we may speculate that this was due in part to the Moon’s transit of the 11th house of gains. The Sun-Saturn square was bearish as expected, and reaffirmed the status of the Sun as the primary significator for gold.

Gold slumped to $954 last week as investors took profits from the recent rally. Even the Venus-to-Venus aspects weren’t enough to keep prices up as the Saturn influence from the ETF chart pushed gold down by Wednesday. Thursday’s bounce was somewhat unexpected although we may speculate that this was due in part to the Moon’s transit of the 11th house of gains. The Sun-Saturn square was bearish as expected, and reaffirmed the status of the Sun as the primary significator for gold.

This week seems quite mixed for gold as Monday sees the tail end of the Mars to Mars opposition aspect in the ETF chart. This is quite a bearish influence but it’s past exact and with the Venus-Rahu aspect building, there is good reason to think gold can rise. Some support is possible through to Wednesday but Thursday looks very bearish as transiting Venus opposes natal Mars while the Sun opposes Pluto. Next Monday the 15th looks very positive as Sun will trine the natal Venus. But after that, things get murky. With Jupiter stationing in tense aspect to natal Saturn, gold may be prone to more declines in June. With Ketu moving into a sensitive place in the ETF chart, gold does not look very strong this summer, with larger declines perhaps coming in September and October. It seems the dreams of $1000 gold will have to go on hold until next year.

5-day outlook — neutral

30-day outlook — bearish

90-day outlook — bearish-neutral

1-year outlook — bearish