- Markets likely to fall this week, perhaps significantly

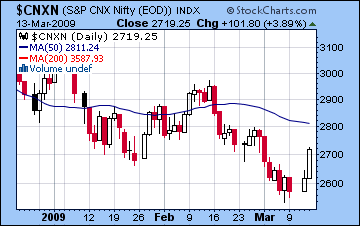

- Dow below 7000; Nifty 2600-2650

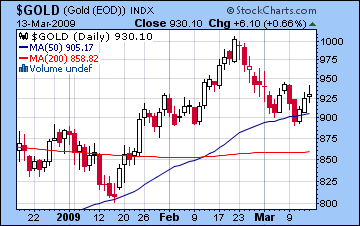

- Gold will move lower perhaps to $900; chance of late week recovery

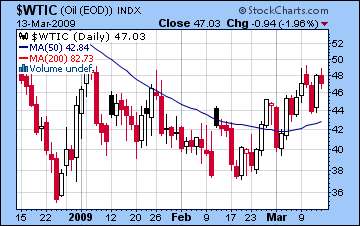

- Crude oil set to fall below $45

- Markets likely to fall this week, perhaps significantly

- Dow below 7000; Nifty 2600-2650

- Gold will move lower perhaps to $900; chance of late week recovery

- Crude oil set to fall below $45

This week looks bearish as there will be several potentially negative influences. The most important aspect this week will be the opposition of Mercury and Saturn on Wednesday. This is rarely favourable and its alignment with Jupiter in the same degree may only serve to magnify the downside. Wednesday may well be the worst day of the week. As a generically negative influence, the Moon will be debilitated in Scorpio on Monday and Tuesday. Monday may not be negative, however, due to the close harmonic aspect between Mercury and Venus which should give some price support. The market may tend to weaken towards Monday’s close as the Moon moves under the influence of Ketu. Tuesday looks more bearish as the Moon forms a square aspect with Saturn. Thursday looks more mixed and Friday has a chance to be positive as Mercury applies to a conjunction with Uranus. There is the possibility that the declines this week will be significant, so we may well see Dow below 7000 and the SPX below 730 by Friday.

This week looks bearish as there will be several potentially negative influences. The most important aspect this week will be the opposition of Mercury and Saturn on Wednesday. This is rarely favourable and its alignment with Jupiter in the same degree may only serve to magnify the downside. Wednesday may well be the worst day of the week. As a generically negative influence, the Moon will be debilitated in Scorpio on Monday and Tuesday. Monday may not be negative, however, due to the close harmonic aspect between Mercury and Venus which should give some price support. The market may tend to weaken towards Monday’s close as the Moon moves under the influence of Ketu. Tuesday looks more bearish as the Moon forms a square aspect with Saturn. Thursday looks more mixed and Friday has a chance to be positive as Mercury applies to a conjunction with Uranus. There is the possibility that the declines this week will be significant, so we may well see Dow below 7000 and the SPX below 730 by Friday.

On the burning question of the bottom, I remain agnostic but am now leaning towards a somewhat higher low in the coming weeks. Certainly, there is good reason to think we will have to go lower here before going higher. We may see a lot of volatility with increased downside risk as the Sun and retrograde Venus will conjoin in exact aspect to Ketu at the end of March. And the approaching opposition aspect of Mars to Saturn in early April remains a significant obstacle for the market. The strength of last week’s rally did make the case for a lower low in early April somewhat harder to sustain, although I think it is still very possible. It seems more likely that there will be a retest of the March 6 lows, but the market may not quite make it all the way back down to those levels. Perhaps SPX 680-700 is the most likely outcome (Dow 6600-6800).

Trading Outlook: Any early week strength may be an opportunity for speculative shorting. More generally, the declines in the next three weeks will be good buying opportunities for the medium term. This week may not see prices low enough to be attractive, but anything below Dow 6800 and SPX 700 might represent good value.

In a holiday-shortened week, stocks in Mumbai followed global markets higher last week as confidence in the financial system got a boost from Citigroup. After a negative Monday that saw averages fall almost 2%, investors piled in Thursday and Friday as the Sensex closed at 8756 and the Nifty at 2719, up 4% for the week. This was mostly in keeping with our forecast as the Sun-Uranus conjunction fit together nicely with the natal Jupiter in the NSE chart and pushed prices higher. I had thought that we might see the Nifty a little higher (2760) but Monday’s bearishness was worse than anticipated. As it turned out the Mars-Neptune conjunction was activated by the transiting Moon and this was sitting across the 3rd/9th house cusps and hence resonated rather more strongly with Indian stock markets.

This week looks difficult with the Mercury-Saturn opposition aspect that comes exact on Thursday. The presence of Jupiter in the same degree is probably not helpful here so we may see some significant declines midweek. Ahead of that, Monday and Tuesday could see some gains as the Moon moves into aspect with Jupiter and Venus. However, Tuesday will feature Mercury moving into a potentially tense aspect with the natal Rahu of NSE chart . This is one reason why any upward move is likely to be fairly small this week. Wednesday will likely be negative as Mercury takes up its position against Saturn. Thursday may see some relief buying, but even there, the Moon will conjoin Pluto in the morning so that might induce greater fear and create more selling, particularly since Pluto will be in close 3rd house aspect with Mars. Friday may see some gains as Mercury moves towards Uranus, but it will still be far enough away to not generate much positive sentiment. Even if we see some early week gains, I think the markets will be down overall this week. Possible price targets are Sensex 8300-8500 and Nifty 2600-2650.

This week looks difficult with the Mercury-Saturn opposition aspect that comes exact on Thursday. The presence of Jupiter in the same degree is probably not helpful here so we may see some significant declines midweek. Ahead of that, Monday and Tuesday could see some gains as the Moon moves into aspect with Jupiter and Venus. However, Tuesday will feature Mercury moving into a potentially tense aspect with the natal Rahu of NSE chart . This is one reason why any upward move is likely to be fairly small this week. Wednesday will likely be negative as Mercury takes up its position against Saturn. Thursday may see some relief buying, but even there, the Moon will conjoin Pluto in the morning so that might induce greater fear and create more selling, particularly since Pluto will be in close 3rd house aspect with Mars. Friday may see some gains as Mercury moves towards Uranus, but it will still be far enough away to not generate much positive sentiment. Even if we see some early week gains, I think the markets will be down overall this week. Possible price targets are Sensex 8300-8500 and Nifty 2600-2650.

With markets searching for a solid bottom here, we are likely looking at another three weeks of testing of the 2008 lows. There is still a very good chance that the Nifty will go back to 2525, although the Sensex may yet avoid its intraday low of 7700. Next week (Mar 23- 27) looks mixed at best and the following week tilts towards the negative as the Mars-Mercury-Saturn alignment comes very close on Friday April 3. Soon after that alignment passes, we may see more lift in the markets paving the way for an enduring rally.

Trading Outlook: If we see some early week gains, there may be an opportunity to enter into speculative short positions. However, investors primary focus should be on building long positions on any significant declines that we see over the next three weeks. If there is a major decline this week (e.g. below Nifty 2600), then it may be worth taking some long positions. This may be done in stages in case we see lower prices in the coming weeks.

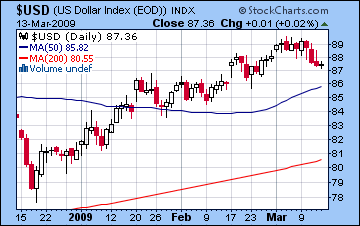

As the appetite for risk returned last week, the US dollar retreated from its recent highs and traded below 88. This was in keeping with our bearish forecast, although it remained somewhat stronger than expected. The Mars square aspect to the Sun-Saturn natal conjunction did indeed appear to take the dollar down after Monday’s rise and the lingering effects of the Venus station. This week the dollar may rally again as Jupiter transits the 3rd house cusp and aspects the natal first house Uranus. On Monday, the Moon will have passed by the Sun-Saturn aspect just as Mercury is applying to the natal Moon so it could go either way. Tuesday looks more solidly bullish as the Moon transits the ascendant and Wednesday will likely also be favourable as the planets line up favourably against the ascendant. Thursday and Friday may be more mixed, however, as the positive influence of Mercury begins to ebb. I think we may see the dollar rise to 89 this week.

As the appetite for risk returned last week, the US dollar retreated from its recent highs and traded below 88. This was in keeping with our bearish forecast, although it remained somewhat stronger than expected. The Mars square aspect to the Sun-Saturn natal conjunction did indeed appear to take the dollar down after Monday’s rise and the lingering effects of the Venus station. This week the dollar may rally again as Jupiter transits the 3rd house cusp and aspects the natal first house Uranus. On Monday, the Moon will have passed by the Sun-Saturn aspect just as Mercury is applying to the natal Moon so it could go either way. Tuesday looks more solidly bullish as the Moon transits the ascendant and Wednesday will likely also be favourable as the planets line up favourably against the ascendant. Thursday and Friday may be more mixed, however, as the positive influence of Mercury begins to ebb. I think we may see the dollar rise to 89 this week.

The Euro rose sharply last week as investors left the safe haven of the dollar. After a slow start, the Euro was soon trading above 1.29 by Wednesday where it largely remained through the rest of the week. While it didn’t quite hit 1.30, the rise was in keeping with expectations as the Sun-Uranus conjunction activated the natal Jupiter. This week the Euro is likely to fall back as Mars and Mercury are in tense aspect with the natal Mars in the Euro chart. This appears to be most powerful later in the week, so perhaps weakeness will be more likely Wednesday and after. An added negative energy would be the Sun in aspect to the natal Saturn that perfects on Tuesday, so that should also be seen as a bearish influence. Monday and Friday may well be the best days for the Euro. The Rupee rallied back somewhat last week closing at 51.44, although it fell short of our expectations. With the US dollar strength this week, we may see the Rupee around 52 once again.

After a volatile week, crude oil closed higher on the week, finishing Friday near $47. While I had thought $50 might be possible last week, the gain was mitigated by Wednesday’s big drop that coincided with the Moon in square aspect with the natal Ketu-Neptune conjunction in the Futures chart. Thursday saw the largest rise just as the Sun-Uranus conjunction was occurring on the 10th house cusp. As an added plus, the Moon was in aspect to the Mercury-Sun conjunction, thus drawing in the near stationary Venus. Friday’s potentially negative alignment of the Moon, Mars and Rahu did indeed push down crude.as we thought it might.

After a volatile week, crude oil closed higher on the week, finishing Friday near $47. While I had thought $50 might be possible last week, the gain was mitigated by Wednesday’s big drop that coincided with the Moon in square aspect with the natal Ketu-Neptune conjunction in the Futures chart. Thursday saw the largest rise just as the Sun-Uranus conjunction was occurring on the 10th house cusp. As an added plus, the Moon was in aspect to the Mercury-Sun conjunction, thus drawing in the near stationary Venus. Friday’s potentially negative alignment of the Moon, Mars and Rahu did indeed push down crude.as we thought it might.

This week looks more negative as Venus is no longer in close contact with natal Mercury. The early week may still see some strength, particularly Tuesday when the Moon conjoins natal Jupiter. By Wednesday, however, the Sun will be in square aspect to the natal nodes, a potentially bearish influence which may carry over into Thursday. Some gains are likely on Friday as Venus is in close trine aspect to natal Jupiter. Overall, I think crude will trade below $45 by Thursday, perhaps closer to $42 if the early week does not produce significant gains.

Gold fell $13 last week, briefly dipping below $900 before finishing at $930. Our bearish forecast largely came to pass largely on the strength of the difficult Mars to Sun aspect. Once this aspect was completed, gold rallied with Thursday providing the biggest gain as the Moon came under the favourable influence of natal Jupiter. This prediction was also included in last week’s forecast.

Gold fell $13 last week, briefly dipping below $900 before finishing at $930. Our bearish forecast largely came to pass largely on the strength of the difficult Mars to Sun aspect. Once this aspect was completed, gold rallied with Thursday providing the biggest gain as the Moon came under the favourable influence of natal Jupiter. This prediction was also included in last week’s forecast.

As Mars comes under the aspect of natal Ketu, we can expect gold to move lower this week. Monday and Tuesday look the most negative here so we could see gold move towards $900. Later in the week Venus will come under the favourable aspect of natal Jupiter and this will spark a rally. The rally will likely continue into early next week as Jupiter will conjoin the natal Moon. If that energy begins to take hold late this week, then gold may finish near current levels. In all likelihood, much of the rise will occur next week, so by Friday, we may see it back around $910-920. With more upside likely early next week, I would not be surprised to see gold trade at $950 at that time.