- Rally to end this week; Dow 7500/SPX 780; Nifty 2950/Sensex 9500

- Dollar likely to continue to rise

- Gold to move higher

- Crude oil will trend lower

- Rally to end this week; Dow 7500/SPX 780; Nifty 2950/Sensex 9500

- Dollar likely to continue to rise

- Gold to move higher

- Crude oil will trend lower

This week we will likely see the end to the rally ahead of the Mars-Saturn opposition that comes exact on Saturday April 4. These sorts of powerful aspects don’t always manifest when are at their closest so there is some leeway here. The other key aspect this week is Monday’s Sun-Mercury conjunction. This is nominally bearish because the Sun combusts or burns up Mercury, the planet of trading. Perhaps more importantly, this conjunction will mark the beginning of the separation of the triple conjunction of planets that have been part of the reason for the recent gains. By Tuesday, both Sun and Mercury will enter Mercury-ruled Revati and thus will turn off the bullish feedback loop that focused on Saturn and its connection with exalted Venus. This will further weaken the market because instead of Sun and Mercury being boosted by Saturn in their transit of Uttara Bhadra, the Sun and Mercury will move into the nakshatra of Revati that is ruled by a debilitated Mercury. So Monday could go either way as the Sun-Mercury conjunction occurs in close harmonic aspect with Neptune, indicating possible weakness. It may however manifest instead as continuing dreams (Neptune) of a bull market that sends stocks higher still. Tuesday looks more negative, however, as the Moon forms a t-square with Mars and Saturn. Wednesday has a good chance at an up day, as retrograde Venus moves into harmonic aspect with Jupiter. Potentially offsetting this positive influence is the aspect between Mercury and Mars. Thursday looks negative as Mercury forms an aspect with Saturn with the Moon completing the aspect in the afternoon. Friday seems the most bearish day of the week, not only because of the proximity of the Mars-Saturn aspect but also due to the a number of declinational parallels that are forming between Sun and Venus with Saturn. While we could see another rally attempt to reach or even slightly exceed last week’s highs of 7900/835 on Monday or Wednesday, I think the overall momentum will take the market down, perhaps hard. If Monday does not see a big rise, there is a real opportunity for 7200/750 by Friday. Much of the extent of the decline will depend on when the bulk of the fallout from the Mars-Saturn aspect will occur. If it spreads into early next week (April 6-10), then our declines this week will be more modest, perhaps only to 7500/785.

This week we will likely see the end to the rally ahead of the Mars-Saturn opposition that comes exact on Saturday April 4. These sorts of powerful aspects don’t always manifest when are at their closest so there is some leeway here. The other key aspect this week is Monday’s Sun-Mercury conjunction. This is nominally bearish because the Sun combusts or burns up Mercury, the planet of trading. Perhaps more importantly, this conjunction will mark the beginning of the separation of the triple conjunction of planets that have been part of the reason for the recent gains. By Tuesday, both Sun and Mercury will enter Mercury-ruled Revati and thus will turn off the bullish feedback loop that focused on Saturn and its connection with exalted Venus. This will further weaken the market because instead of Sun and Mercury being boosted by Saturn in their transit of Uttara Bhadra, the Sun and Mercury will move into the nakshatra of Revati that is ruled by a debilitated Mercury. So Monday could go either way as the Sun-Mercury conjunction occurs in close harmonic aspect with Neptune, indicating possible weakness. It may however manifest instead as continuing dreams (Neptune) of a bull market that sends stocks higher still. Tuesday looks more negative, however, as the Moon forms a t-square with Mars and Saturn. Wednesday has a good chance at an up day, as retrograde Venus moves into harmonic aspect with Jupiter. Potentially offsetting this positive influence is the aspect between Mercury and Mars. Thursday looks negative as Mercury forms an aspect with Saturn with the Moon completing the aspect in the afternoon. Friday seems the most bearish day of the week, not only because of the proximity of the Mars-Saturn aspect but also due to the a number of declinational parallels that are forming between Sun and Venus with Saturn. While we could see another rally attempt to reach or even slightly exceed last week’s highs of 7900/835 on Monday or Wednesday, I think the overall momentum will take the market down, perhaps hard. If Monday does not see a big rise, there is a real opportunity for 7200/750 by Friday. Much of the extent of the decline will depend on when the bulk of the fallout from the Mars-Saturn aspect will occur. If it spreads into early next week (April 6-10), then our declines this week will be more modest, perhaps only to 7500/785.

Given the strength of the March rally, April is shaping up to be a generally negative month. The direction is likely to be down through April 10. Some gains are likely after that for the next 5-7 days, but the period around April 18-25 also appears to be mixed at best, but with significant down days. Assuming we top out near SPX 840 this week, a conservative 50% retracement here would mean 750, with a 62% retracement translating into 735. I believe there are enough negative planetary energies out there to take the markets down to 735 or perhaps even lower here in early April. Perhaps more uncertain is how the rest of April will play out. The Venus retrograde cycle will end April 18. Stationing planets are very powerful and Venus will station just a few degrees away from malefic Mars and unpredictable Uranus at this time. This is one reason why we could see more bearishness then. Given the pullbacks likely in the second half of the month, it is not yet clear to me if we might move down even further, perhaps to 700. This is a possible scenario particularly if this week’s planets produce a sea change in popular sentiment. Right now, there is a prevailing sense that a bull run is inevitable but this may quickly change back into gloom if earning disappoint or some other bad news occurs. With earnings coming out now, a quickly darkening mood is possible. That said, I think the March 6 lows are solid but if we fall harder than expected this week, then I will revisit the question in next week’s newsletter. A close near 700 here would put the March 6 lows in some jeopardy, although even then, I would not put it as a probability only a possibility. As for the whole question of a new bull market, I don’t believe it for a second. This March rally is the early stage of a bear market rally which may last several months, is nonetheless very likely to collapse in the fall and early winter. Assuming the SPX 666 holds here, we will likely break through that level in early 2010.

Trading Outlook: Any rally attempts this week will be a tempting short target. With some downside pressure likely to extend into the week of April 6, it may be worth considering holding on to short positions until then. Investors seeking to add to long positions may wait until April 6-10 after the markets have hopefully retraced significantly. An additional entry opportunity is likely around April 20, although the price level is uncertain.

Stocks in Mumbai surged 11% last week on improving global economic data and heavy buying from foreign institutional investors. By Friday, the indices had approached key resistance levels last seen in early January as the Nifty closed at 3108 and the Sensex at 10,048. As I thought that the rally was running into planetary resistance, last week’s forecast was mistakenly bearish. While some of last week’s aspects appeared tense, I did not give sufficient weight to the triple conjunction of Sun, Mercury and Venus in Pisces. Moreover, the extra fuel for this bull run may have derived from the fact that this conjunction occurred in Saturn-ruled Uttara Bhadra. While Saturn is considered a malefic planet, it is currently very strong due to its placement in Venus-ruled Purva Phalguni, with Venus is exalted in Pisces. So planets that are transiting Saturn ruled nakshatras are boosted by this channeled energy and thereby the markets can rise. With the key indices pushing up against some important resistance levels, it seems unlikely that they can extend this rally much further at this point. The key question is how far back down will they retrace and when will the rally resume?

This week’s planets look mostly bearish. The Mercury will finally catch up to the Sun on Tuesday as the conjunction occurs before trading begins. Generally this is a negative influence for the market since Mercury, the planet of trading is considered damaged and combusted by its close proximity to the Sun. In addition, Ketu continues to cast its aspect on both planets so this is another layer of potential affliction. Ketu may be seen as a planet of escape and distortion, so this may be another sign that investors may head for the exits. Furthermore, both Sun and Mercury will move out of Uttara Bhadra and into Revati. This may well break the positive planetary feedback loop that partially fueled the March rally. Now that both Sun and Mercury are no longer gaining energy from this powerful and supportive Saturn, the market may be more prone to weakness. Revati is ruled by Mercury itself, and since it is debilitated, this bodes poorly for the Sun. So some early week declines are very possible here. In all likelihood, there will be some attempt to rally on either Wednesday or Thursday as Venus forms a positive harmonic aspect with Jupiter. This is unlikely to be very significant because Mercury will be in tense aspect with Mars for both of those days, although the potential for decline is greater on Wednesday. With the holiday closure on Friday and the presence of some down days this week, Thursday could well turn out to be negative as nervousness makes profit taking a more appealing strategy. Overall, I think we will finish lower on the week, although less so than most global markets as the Friday closing will postpone some of the negativity from the approaching Mars-Saturn opposition until next week. Possible price targets are Nifty 2950 and Sensex 9500.

This week’s planets look mostly bearish. The Mercury will finally catch up to the Sun on Tuesday as the conjunction occurs before trading begins. Generally this is a negative influence for the market since Mercury, the planet of trading is considered damaged and combusted by its close proximity to the Sun. In addition, Ketu continues to cast its aspect on both planets so this is another layer of potential affliction. Ketu may be seen as a planet of escape and distortion, so this may be another sign that investors may head for the exits. Furthermore, both Sun and Mercury will move out of Uttara Bhadra and into Revati. This may well break the positive planetary feedback loop that partially fueled the March rally. Now that both Sun and Mercury are no longer gaining energy from this powerful and supportive Saturn, the market may be more prone to weakness. Revati is ruled by Mercury itself, and since it is debilitated, this bodes poorly for the Sun. So some early week declines are very possible here. In all likelihood, there will be some attempt to rally on either Wednesday or Thursday as Venus forms a positive harmonic aspect with Jupiter. This is unlikely to be very significant because Mercury will be in tense aspect with Mars for both of those days, although the potential for decline is greater on Wednesday. With the holiday closure on Friday and the presence of some down days this week, Thursday could well turn out to be negative as nervousness makes profit taking a more appealing strategy. Overall, I think we will finish lower on the week, although less so than most global markets as the Friday closing will postpone some of the negativity from the approaching Mars-Saturn opposition until next week. Possible price targets are Nifty 2950 and Sensex 9500.

Although this week looks negative, I think the bulk of the retracement here will take place next week (April 6-10). There is a chance that Monday the 6th could see a very sharp fall on the order of 5%. With the bias shifting to the downside, I think that second week of April could see the Nifty again approaching 2800 and the Sensex 9000. To be honest, I would not be surprised to see a larger decline to 2700 but that is not at all certain. April 13-17 may see some major bounce perhaps as much as 10% but the end of the Venus retrograde cycle on April 18 will likely push prices down again. Normally a forward moving Venus is positive for markets, but in this case it will stop and change its direction in close conjunction with malefic Mars and unpredictable Uranus. This time period near April 18 and in particular in the early part of the week of April 20-24 may therefore see sudden declines. It therefore seems possible that the lows for the month may actually occur later in April. I don’t think this is a likely outcome, but it is something to keep in mind.

Trading Outlook: Any up days this week will provide possible shorting opportunities, as prices are likely to trend lower for the next two weeks. The short term lows should occur sometime in the week of April 6-10. Investors seeking entry points to taking longer term long positions may wait for down days in the week of April 6-10. A second opportunity to take advantage of pullbacks will occur in the second half of April, most likely in the week of April 20-24.

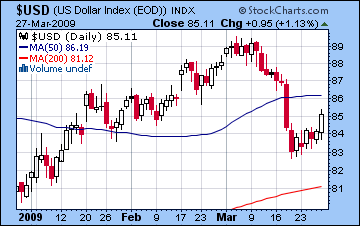

The US dollar recovered somewhat last week as the dollar index closed above 85. This was largely in keeping with our previous forecast which noted the auspicious placement of the transiting Sun, Mercury and Venus to the 4th house cusp of the natal chart. In fact, it was only the presence of these planets late in the week that resulted in a positive week for the dollar. Monday may be negative for the dollar as Mars conjoins the natal Moon in the index chart. At the same time, the Sun-Mercury conjunction at 16 Pisces will be in close harmonic aspect with the natal Jupiter at 17 Capricorn, so any decline is likely to be modest or even offset completely by the bullishness of the Jupiter influence. Generally, it looks mostly up for the dollar this week with a price target above 86. The approach of the Mars-Saturn aspect on Saturday is something of an unknown quantity since it will occur astride the 4th and 10th house cusps. This is a re-enactment of the Mercury-Saturn opposition two weeks ago that coincided with a major sell off in the dollar. I don’t think that’s going to happen this time because of other more favourable factors, but it is still something to watch for.

The US dollar recovered somewhat last week as the dollar index closed above 85. This was largely in keeping with our previous forecast which noted the auspicious placement of the transiting Sun, Mercury and Venus to the 4th house cusp of the natal chart. In fact, it was only the presence of these planets late in the week that resulted in a positive week for the dollar. Monday may be negative for the dollar as Mars conjoins the natal Moon in the index chart. At the same time, the Sun-Mercury conjunction at 16 Pisces will be in close harmonic aspect with the natal Jupiter at 17 Capricorn, so any decline is likely to be modest or even offset completely by the bullishness of the Jupiter influence. Generally, it looks mostly up for the dollar this week with a price target above 86. The approach of the Mars-Saturn aspect on Saturday is something of an unknown quantity since it will occur astride the 4th and 10th house cusps. This is a re-enactment of the Mercury-Saturn opposition two weeks ago that coincided with a major sell off in the dollar. I don’t think that’s going to happen this time because of other more favourable factors, but it is still something to watch for.

After its recent stunning rally, the Euro fell back somewhat last week closing below 1.33. This was largely expected given the indifferent transits in the Euro natal chart. This week may also feature more weakness, especially early on as the Sun-Mercury conjunction occurs in a negative place in the Euro chart. Some midweek strength is likely as Venus approaches the natal ascendant. We may see the Euro trade near 1.30 at some point this week, although it may finish somewhat higher, say around 1.31-1.32. The Indian Rupee was mostly unchanged last week as it closed Friday near 50.5. I think it should weaken somewhat this week, perhaps moving above 51. Look for this downward bias to continue through much of April as the Rupee may again reach 52 by April 22.

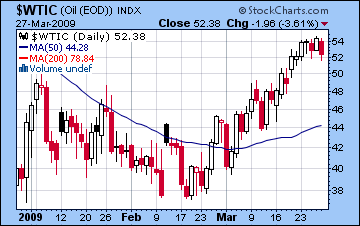

After undertaking a formidable rally for March, crude oil took a breather last week as it closed mostly unchanged near $52. As I suggested last week, crude did in fact trade as high as $55 midweek before falling back in Friday’s session. The early strength fit nicely with transiting Venus still fairly close to the natal Sun in the Futures chart. The Mars aspect to the natal Sun on Thursday and Friday pushed prices down as forecast with Friday being singled out as the most likely down day. This turned out to be the correct call. Thursday ended with a significant gain which was not unexpected, due in part to the favourable position of the Moon.

After undertaking a formidable rally for March, crude oil took a breather last week as it closed mostly unchanged near $52. As I suggested last week, crude did in fact trade as high as $55 midweek before falling back in Friday’s session. The early strength fit nicely with transiting Venus still fairly close to the natal Sun in the Futures chart. The Mars aspect to the natal Sun on Thursday and Friday pushed prices down as forecast with Friday being singled out as the most likely down day. This turned out to be the correct call. Thursday ended with a significant gain which was not unexpected, due in part to the favourable position of the Moon.

This week looks mostly bearish for crude, although some early week gains are likely. Monday’s Sun-Mercury conjunction will form a close aspect with the natal Jupiter in the Futures chart so a one or two day rise is possible. This may push prices back towards $55. Later in the week, the impact of the Mars-Saturn opposition may be felt in the oil market as Saturn is significator for oil and the Mars influence is likely to make this market less attractive. Friday or next Monday (April 6) may see a sharp sell off that will force down crude towards $50. $45 is very possible by next week, although picking the low from this retracement is quite speculative. The planetary energies seems very negative here, so any kind of decline from 10-20% is possible.

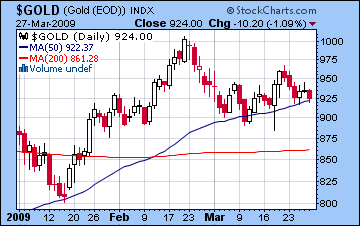

Gold continued to pullback last week as it fell 3% to $924. It now sits precariously on its 50-day moving average and is in danger of breaking below it. I expected gold to be more positive in the early going but it seemed that most of the upward thrust of from the Jupiter-Moon aspect in the GLD chart had been spent in the previous week. Friday was negative as forecast as the Moon came under the bearish influence of the natal Saturn in the Futures chart. Nonetheless, the overall down bias comes as no surprise as we had forecast weakness for this week.

Gold continued to pullback last week as it fell 3% to $924. It now sits precariously on its 50-day moving average and is in danger of breaking below it. I expected gold to be more positive in the early going but it seemed that most of the upward thrust of from the Jupiter-Moon aspect in the GLD chart had been spent in the previous week. Friday was negative as forecast as the Moon came under the bearish influence of the natal Saturn in the Futures chart. Nonetheless, the overall down bias comes as no surprise as we had forecast weakness for this week.

Gold looks mixed to bullish this week with some strength possible on Monday and Tuesday. This may result due to the Sun-Mercury conjunction coming under the close aspect of natal Jupiter in the GLD chart. Tuesday may be the more bullish of the two days as the transiting Moon comes under closer influence of the natal Jupiter. There is a chance that this rise may be sizable, perhaps on the order of 3-5%. The end of the week looks more bearish, however, as Mercury will fall under the aspect of Saturn in the Futures chart. Thursday may be worse than Friday. Overall, I think there’s a chance gold will finish only slightly above its current price by Friday. If gold rises to $950 by Wednesday, then $930-935 is possible by Friday. If it goes higher than $950 in the early going, then it may only pullback to $950. April 6-7 also looks quite weak for gold. Gold should be fairly mixed for April trading mostly between $880-950. It will likely move higher through May and June and probably topping out above $1000.