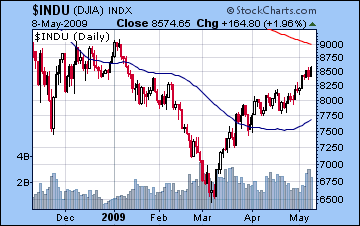

- Rally may stay intact this week until Saturn reverses direction on Saturday

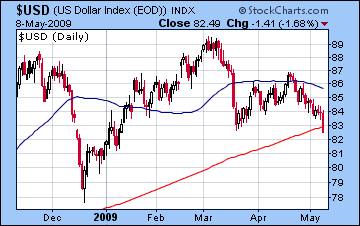

- Dollar still prone to weakness until next week

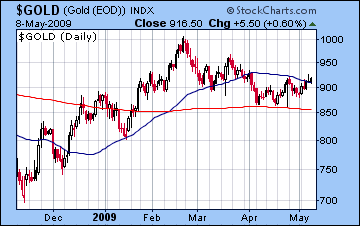

- Gold may add to recent gains

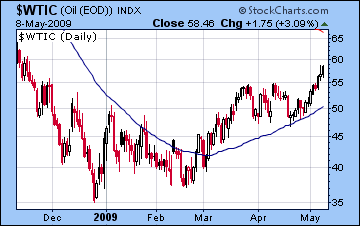

- Crude oil to rally above $60

- Rally may stay intact this week until Saturn reverses direction on Saturday

- Dollar still prone to weakness until next week

- Gold may add to recent gains

- Crude oil to rally above $60

If Mercury retrograde wasn’t enough by itself to make a dent this bear market rally, a second potential bear ingredient will be introduced into the mix after this week as Saturn reverses its direction as it turns forward on Saturday May 16. In advance of Saturn’s station, this week seems likely to extend the gains, at least in the early part of the week after which the market may become increasingly susceptible to profit taking. Mars forms a potentially tense aspect with Saturn on Monday and Tuesday, so that may account for one down day. My sense is Monday may be more positive which would mean that Tuesday may see bearishness prevail as the Moon conjoins Pluto. Wednesday and Thursday look more mixed as Moon transits Sagittarius, although there I would lean towards Wednesday (especially in the morning) as the more negative day given the harmonic aspect between Mercury and Mars. Friday could go either way as the Sun enters Taurus. One would think this could be bullish since it will form an alignment with Jupiter, Uranus, and Neptune but there are a couple of anomalous placements in the natal charts that do not confirm this prediction. Overall, the outlook for this week depends on how negative the Mars-Saturn and the Mercury-Mars aspects are on Tuesday-Wednesday. If the losses outweigh Monday’s probable gains, then there is a good chance that the week close lower. If the early week ends up as net positive, then the market will likely move higher and make new highs, probably retesting the January highs. Given the strength of the current rally, I think higher highs is the most likely scenario.

If Mercury retrograde wasn’t enough by itself to make a dent this bear market rally, a second potential bear ingredient will be introduced into the mix after this week as Saturn reverses its direction as it turns forward on Saturday May 16. In advance of Saturn’s station, this week seems likely to extend the gains, at least in the early part of the week after which the market may become increasingly susceptible to profit taking. Mars forms a potentially tense aspect with Saturn on Monday and Tuesday, so that may account for one down day. My sense is Monday may be more positive which would mean that Tuesday may see bearishness prevail as the Moon conjoins Pluto. Wednesday and Thursday look more mixed as Moon transits Sagittarius, although there I would lean towards Wednesday (especially in the morning) as the more negative day given the harmonic aspect between Mercury and Mars. Friday could go either way as the Sun enters Taurus. One would think this could be bullish since it will form an alignment with Jupiter, Uranus, and Neptune but there are a couple of anomalous placements in the natal charts that do not confirm this prediction. Overall, the outlook for this week depends on how negative the Mars-Saturn and the Mercury-Mars aspects are on Tuesday-Wednesday. If the losses outweigh Monday’s probable gains, then there is a good chance that the week close lower. If the early week ends up as net positive, then the market will likely move higher and make new highs, probably retesting the January highs. Given the strength of the current rally, I think higher highs is the most likely scenario.

If last week and this week has the potential but not the probability for a decline, then next week (May 18-22) looks more reliably bearish as Venus forms a tense aspect with the now forward moving Saturn. Of course, with Jupiter still will moving towards its conjunction with Neptune on May 27, any pullback over next couple of weeks will likely be fairly small. There is likely another period of mostly bearish energy in the first half of June so that may take the market down further although I can’t be sure it will be lower than any lows we see in May. At this point, I would lean toward the retracement low occurring in mid June since the week of May 25-29 is likely to be positive. Assessing possible retracement levels is speculative at best, but I don’t foresee anything larger than a 50% retracement from the March 6 lows to whatever top the market makes here over the next couple of weeks. As we’ve seen, this rally is a juggernaut and can withstand most bearish indications the planets might offer. After the low is put in, the rally should continue through July and into August, possibly forming a double top with the May highs, or perhaps even exceeding them. I would not rule out 10,000 on the Dow and 1050 on the S&P. The planets look increasingly afflicted starting in late August, so that will likely mark the beginning of a significant down trend that will take markets down to retest the March 6 lows and then some.

Stocks in Mumbai continued their bullish ways last week by adding another 4% as the key indices traded comfortably above their 200-day moving average. The Nifty ended Friday’s session at 3620 while the Sensex stood at 11,876. While the outcome for the week was more bullish that forecast, it is perhaps important to note that most of the gains occurred on Monday as a result of the Venus-Ketu-Pluto alignment. That rise was very much in keeping with expectations, and the market was mostly flat for the rest of the week. I thought we would see more downside as a result of Mercury turning retrograde on Thursday, but the positive Moon aspect to Jupiter-Neptune offset the immediate bearish impact of the weakened Mercury. Friday’s decline was therefore perhaps more in keeping with our expectations. So while the start of the Mercury retrograde cycle was less bearish than expected, it remains in effect until May 31 and should be regarded as a drag on the market that will tend to limit any upside potential.

Stocks will likely be volatile ahead of the announcement of election results on Saturday May 16. There is a fairly tense alignment forming with Mercury, Mars, and Saturn early in the week that is likely to push stocks lower for at least one day. Monday may be somewhat more favourable than Tuesday or Wednesday, although Tuesday’s open may well be solidly positive as the Moon enters Sagittarius and forms a helpful aspect with Jupiter and Neptune. Thursday is more of a toss-up, although given the bullish trend, it makes sense to assume an up day there. Friday may well see significant gains as the Sun enters Taurus and forms a positive alignment with Jupiter and Neptune. But Friday also contains a Moon-Rahu conjunction which has the potential to upset the situation and produce unexpected results. This introduces a certain level of uncertainty into the otherwise bullish pattern on Friday. A significant price move is likely but the outcome remains in doubt. Certainly a negative Friday would increase the likelihood that the market was embarking on a noteworthy retracement. Overall, I think the chances for a negative week are greater than last week but it is by no means a sure thing.

Stocks will likely be volatile ahead of the announcement of election results on Saturday May 16. There is a fairly tense alignment forming with Mercury, Mars, and Saturn early in the week that is likely to push stocks lower for at least one day. Monday may be somewhat more favourable than Tuesday or Wednesday, although Tuesday’s open may well be solidly positive as the Moon enters Sagittarius and forms a helpful aspect with Jupiter and Neptune. Thursday is more of a toss-up, although given the bullish trend, it makes sense to assume an up day there. Friday may well see significant gains as the Sun enters Taurus and forms a positive alignment with Jupiter and Neptune. But Friday also contains a Moon-Rahu conjunction which has the potential to upset the situation and produce unexpected results. This introduces a certain level of uncertainty into the otherwise bullish pattern on Friday. A significant price move is likely but the outcome remains in doubt. Certainly a negative Friday would increase the likelihood that the market was embarking on a noteworthy retracement. Overall, I think the chances for a negative week are greater than last week but it is by no means a sure thing.

Saturn’s shift in direction from retrograde to direct will coincide with the announcement of the election results on Saturday. This increases the likelihood that next week (May 18-22) will be more bearish than this week might be. Whatever the results, Saturn’s change in direction may be sufficient to temporarily shift the market orientation from rally to correction. While we could run up as high as 3750 this week, there’s a significant amount of negative energy over the next two weeks to push the market down 10% or more, say, back towards the 3300-3400 range. The last week of May may be positive, however, so the consolidation of the market may be somewhat protracted and extend into June. At this point, I expect the rally to resume in late June or early July and continue into August before the bears gain the upper hand again for the rest of the year. A retest of Nifty 2525 is still very much in the cards for the autumn season.

The US dollar got hammered last week and ended Friday’s session below 83 as bond yields rose. This weakness was not unexpected as we speculated that the March lows might get retested and they were. Clearly, the Mercury-Saturn aspect played its bearish role to the hilt as investors dumped the greenback in droves. I did not, however, foresee that the weakness would extend into the late week. I had expected the Venus hitting the IC in the USDX chart to be more protective of the dollar but it was no match for the slowing Mercury that opposed the natal Saturn. We can expect more weakness early this week — especially Monday as Mercury again opposes Saturn — but there’s a chance that the Mars transit to the natal Mars-Mercury alignment on Tuesday and Wednesday may produce a rebound. This is by no means a sure thing, though, as Mars aspects can be quite unreliable but it is possible. Friday also has the potential for a gain as transiting Venus will form a sextile aspect with natal Jupiter just as the Moon conjoins that Jupiter. If Monday’s damage isn’t too severe and the Mars aspect is positive for the dollar, then it might bounce higher this week overall. Of course, if Mars’ aspect on Tuesday ends up driving it lower, then we may see 80-81. Next week looks more bullish for the dollar, so perhaps 84-85 is achievable by then.

The US dollar got hammered last week and ended Friday’s session below 83 as bond yields rose. This weakness was not unexpected as we speculated that the March lows might get retested and they were. Clearly, the Mercury-Saturn aspect played its bearish role to the hilt as investors dumped the greenback in droves. I did not, however, foresee that the weakness would extend into the late week. I had expected the Venus hitting the IC in the USDX chart to be more protective of the dollar but it was no match for the slowing Mercury that opposed the natal Saturn. We can expect more weakness early this week — especially Monday as Mercury again opposes Saturn — but there’s a chance that the Mars transit to the natal Mars-Mercury alignment on Tuesday and Wednesday may produce a rebound. This is by no means a sure thing, though, as Mars aspects can be quite unreliable but it is possible. Friday also has the potential for a gain as transiting Venus will form a sextile aspect with natal Jupiter just as the Moon conjoins that Jupiter. If Monday’s damage isn’t too severe and the Mars aspect is positive for the dollar, then it might bounce higher this week overall. Of course, if Mars’ aspect on Tuesday ends up driving it lower, then we may see 80-81. Next week looks more bullish for the dollar, so perhaps 84-85 is achievable by then.

As expected, the Euro gained substantially last week as it traded above 1.36 by Friday’s close. Much of the astrological credit lies in Jupiter’s aspect to the natal Moon which came exact last week. This aspect was so powerful that it easily offset any negativity from the Mars squaring the natal Sun. This week is likely to start off very well for the Euro as the Sun aspects the natal Jupiter, and we may see it trade near 1.38. However, those levels are unlikely to last much past Tuesday as transiting Mars gradually opposes its natal position by the end of the week. Some midweek losses are likely so overall there’s a good chance the Euro will be mostly unchanged or lower by Friday. Much will depend on Friday’s trading since the Sun forms a positive aspect with natal Venus while Mars is bearing down (literally) on natal Mars. These aspects may offset each other and produce no change, although I would lean towards a positive Friday for the Euro. The Indian Rupee put up some modest but significant gains last week as it traded at 49.15 at Friday’s close. I am expecting it to trade closer to 50 once the election is behind us.

The powerful rally in crude oil had another explosive move to the upside last week as it closed above $59 for the first time since November. While I expected prices to rise above $55 early in the week, I did not expect the rally to continue straight through until Friday. I wondered if the Mars-Mercury aspect in the ETF chart would be enough of the bearish influence to change the basic uptrend and as it turned out, it wasn’t.

The powerful rally in crude oil had another explosive move to the upside last week as it closed above $59 for the first time since November. While I expected prices to rise above $55 early in the week, I did not expect the rally to continue straight through until Friday. I wondered if the Mars-Mercury aspect in the ETF chart would be enough of the bearish influence to change the basic uptrend and as it turned out, it wasn’t.

This week looks like it will continue the winning streak as crude will likely push north of $60, at least in the early going. Some midweek declines are possible as Mars aspects the natal Jupiter in the ETF chart. However, with Venus transiting under the aspect of Jupiter in the Futures chart, it seems that crude is moving higher here. We can expect to see more of a pullback in crude next week (May 18-22) which will likely continue into June. Depending on how high we go this week, I think there’s a lot of support at $48 that will hold for the first phase of the retracement. By mid-June, it’s conceivable crude could sink down towards $40, but let’s first see how low it goes next week.

On growing signs of a recovering economy and rising inflation fears, gold rose 4% last week as it climbed to $916 in Friday’s session. This confirmed our bullish forecast as the Jupiter aspect to the natal Venus in the ETF finally delivered. As forecast, the high for the week occurred on Friday as a number of aspects activated natal planets. Gold is now trading above its 50-day moving average and is in a favourable technical position by virtue of its placement in an upward price channel that follows April’s double bottom.

On growing signs of a recovering economy and rising inflation fears, gold rose 4% last week as it climbed to $916 in Friday’s session. This confirmed our bullish forecast as the Jupiter aspect to the natal Venus in the ETF finally delivered. As forecast, the high for the week occurred on Friday as a number of aspects activated natal planets. Gold is now trading above its 50-day moving average and is in a favourable technical position by virtue of its placement in an upward price channel that follows April’s double bottom.

This week again looks fairly positive for gold, as some residual early week bullishness from the Jupiter-Venus aspect may spark more gains Monday. Midweek sell offs are possible, however, as Mars forms a harmonic aspect with the natal ascendant. The end of the week is likely to erase any midweek losses though, as Venus aspects natal Jupiter and the Sun forms a positive alignment with Jupiter, Uranus, and Neptune. Gold may well take a run at $950 here before profit taking sets in in earnest. As it looks now, June may be a difficult month for gold as transiting Jupiter will station at 3 Aquarius in tense aspect to the natal Saturn (3 Cancer) in the ETF chart. This is often a recipe for selling, although I should note that the picture is somewhat complicated by the co-presence of the natal Sun (2 Scorpio). The Sun may act to mitigate some of the bearishness implied in the Jupiter-Saturn aspect.