(4 January 2026) Stocks ended lower in the final week of 2025 as investors elected to take profits ahead of the turn in the calendar. I had been uncertain about last week given the mix of active influences. The bearish effect of the Mars-Neptune square was at the end of its active range last week but could have played a role in the pullback. However, the upcoming Sun-Mars-Venus conjunction on January 9 offered the possibility of offsetting other negatives, and that may well have boosted sentiment on Friday, the first trading day of 2026.

(4 January 2026) Stocks ended lower in the final week of 2025 as investors elected to take profits ahead of the turn in the calendar. I had been uncertain about last week given the mix of active influences. The bearish effect of the Mars-Neptune square was at the end of its active range last week but could have played a role in the pullback. However, the upcoming Sun-Mars-Venus conjunction on January 9 offered the possibility of offsetting other negatives, and that may well have boosted sentiment on Friday, the first trading day of 2026.

The triple conjunction of Sun, Mars and Venus may well play a more bullish role this week. My analysis showed it had a statistically significant bullish influence on stocks both before and after the exact conjunction. The average gain for this conjunction was close to 4% over a 60-day period — 30 days before and 30 days after. Since the standard deviation was about 3% for most intervals, this yielded p-values much less than the threshold of 0.05. Therefore, the bullish effect was statistically significant, especially during the period after the exact conjunction (Jan 9 in our current scenario). Of course, the relatively small sample size of 15 cases should give us pause but the low p-values reflect the consistently bullish effect.

As an added bullish influence, this triple conjunction will exactly oppose Jupiter on January 9. While backtesting showed Jupiter’s generally positive influence on this conjunction, there was also a slightly elevated risk of a interim top at the time of the Jupiter alignment. This was not a consistent pattern, however.

Sun conjunct Venus; sextile Saturn (SU-0-VE-60/300-SA)

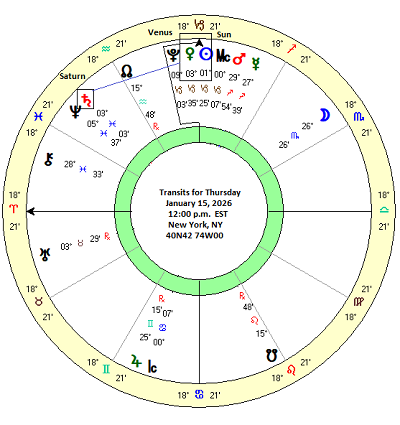

So it would seem there are good planetary reasons to expect some upside in early January. Just how long the gains will last is unclear, however. One possible stumbling block could be the upcoming alignment of Sun, Venus and Saturn on January 15. On that day, the Sun will conjoin Venus and form a near-exact 300-degree sextile alignment with Saturn. Actually, the Sun is already conjunct Venus now and will remain within a degree or two until about Jan 15 or so. Since Sun and Venus move at approximately the same speed, their conjunctions can last for 2-3 weeks. Venus is the faster of the two, however, and it will eventually pull away from the Sun in the second half of January.

But the Sun-Venus conjunction will form an exact sextile aspect with Saturn. Saturn’s bearish reputation should always keep us on guard as all of its alignments carry an underlying risk. And yet the 60-degree sextile aspect is seen as a “soft” aspect that can be more benign. But is this really true? Let’s look at the data.

Method

First, a word about the sextile aspect. This is a 60-degree angular separation between planets (or the circle’s 360 degrees divided into 6 parts). The sextile comes in two types: a 60-degree angle by standard astrological counterclockwise reckoning as the faster planet moves away from the slower planet or a 300-degree angle in which the faster planet is approaching the slower planet. The upcoming Sun-Venus-Saturn sextile is a 300-degree alignment as the Sun and Venus enter its final sixth segment of its synodic cycle with Saturn.

While the Sun typically conjoins Venus two or three times a year depending on the Venus retrograde cycle, the additional factor of the sextile with Saturn makes this three-planet alignment fairly rare. Scanning the Dow Jones Industrials database dating from 1896, this alignment has only occurred 20 times. This produces a fairly small sample size which likely limits our ability to extrapolate to the current setup. Nonetheless, if the effect size is large enough, then it could still produce statistically significant results.

Results

The table below shows the closing prices of the DJIA at 3-day intervals before and after the exact alignment. The first recorded price was 30 days before the alignment (“-30d”) and continued through to the day of the alignment (“0d”) until the final recorded price 30 days the alignment “(30d”). This 60-day window is probably overkill since the Sun and Venus would be 30 degrees away from the sextile by the time of the last recorded price (i.e. the Sun and Venus travel at a rate of about 1 degree per day). This is well beyond any normal analysis which typically uses a 5 or 6 degree orb (range). But you can never have too much data.

The summary statistics table below compares the average and median at various intervals to the long-term benchmark of 5.4% average annual return for the years 1897 to 2021. Overall, there is not much going on here. No interval reached statistical significance (p<0.05) and there was considerable divergence between the average and the median. This usually happens when the data is very mixed and does not send a strong signal. This also weakens the explanatory power of this alignment when the sample size is quite small (n=20). Not surprisingly, the standard deviations were very large for all intervals and reflected the wide distribution in the data. As a rule of thumb, whenever the standard deviation exceeds the average or median price change, the result is less likely to be significant.

The absence of any clear effect is evident in the cumulative price chart shown below. Averages and medians were calculated from an initial price 30 days before the exact alignment. Both 60 degree and 300 degree sextiles were included in the sample. Except for the sharp decline in the median after the alignment (15d -24d), the price trend broadly follows the long term benchmark. The divergence between the average and the median after the alignment is a puzzle. However, with such a small sample, it may make more sense to lean towards the median as the more representative indicator. But without statistical significance, we cannot assume a bearish follow through after the alignment based on this chart alone.

Disaggregation: Sun-0-Venus-300-Saturn only

But if we separate the sample into subsets of 300-degree and 60-degree alignments a clearer picture emerges. Since the January 15 alignment will be a 300-degree sextile between Sun-Venus and Saturn, we will focus on that batch. This cumulative trend chart is much more bearish than the aggregated sample as both the average and median are mostly below the benchmark line for most of the intervals. But none of the intervals are statistically significant although a couple came fairly close. The standard deviations for most intervals was around 5% and thus exceeded the average change in price which was closer to -2 or -3%. This is clearly not a strong effect. And with only 10 cases in this sub-sample, we should be extra careful about drawing any conclusions about the effects of this 300-degree alignment.

The bottom line is that this upcoming January 15 alignment introduces some uncertainty about the prospect for a durable rally in January. While it may not translate into a sharp sell-off in the second half of January, it could offset some of the strong upside bias of the Sun-Mars-Venus conjunction that we noted last week. In other words, gains may be more limited and price movements could be choppy.

The DJIA price chart below highlights these two competing influences. The green rising channel from the Sun-Mars-Venus conjunction is still very much in play into early February, but the potential negative effects of the Sun-Venus-Saturn alignment have been overlaid in the red falling channel. I have drawn the green channel to be darker than the red channel in order to reflect the more reliable statistical significance of that bullish pattern. One possible outcome would be that the DJIA remains within the range of both red and green channels. Given the potentially offsetting nature of both alignments, perhaps price will tend to occupy the lower half of the green channel and upper half of the red channel. But that is very much a guess.

Implications for this week

Even allowing for some negative influence from this approaching Sun-Venus-Saturn alignment, it seems more likely that stocks will rally as we approach the exact Sun-Mars-Venus alignment on Friday, January 9. The bullish influence may diminish somewhat after that as the triple conjunction separates from its alignment with Jupiter. But an outright bearish reversal after Jan 9 seems less likely.

N.B. There will be no newsletter next weekend as I will be traveling.

Disclaimer: Not intended as investment advice. For educational purposes only.