- Acceleration of declines likely, especially later in the week.

- Dollar may finally break above 78

- Gold may test support at $950

- Crude at risk of larger sell-off

- Acceleration of declines likely, especially later in the week.

- Dollar may finally break above 78

- Gold may test support at $950

- Crude at risk of larger sell-off

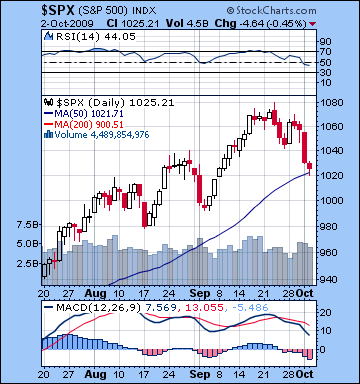

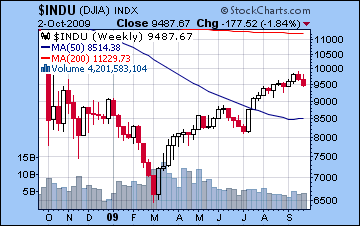

Stocks in New York fell for the second straight week amidst growing signs of protracted economic weakness as equities slipped 2%. After Monday’s strong gain, the market closed in the red four days in a row with the Dow closing at 9487 and the S&P at 1025. Markets have now put up losses in seven out of the last eight sessions. This outcome was largely in keeping with expectations as the slow moving Mercury-Mars aspect did its part to deliver the bearish goods. As predicted, Monday was higher before the Mars negativity took hold. It was all downhill after that, however, as the Mercury direct station allowed for its extended exposure to the difficult Mars influence that lasted until Friday. The worst day of the week was Thursday as stocks lost 2%. This was a little later than forecast, but still a fairly acceptable outcome given our bearish stance. I had also suggested that Friday might be fairly bullish and indeed there was a midday rally attempt that took the market into positive territory, but there was a fair amount of resistance at SPX 1030 (i.e. the bottom of the rising wedge pattern) and the rally faltered by the close. Overall, a good week for our general thesis that a significant correction will follow the Saturn-Uranus aspect of September 18. The high closely correlates to that exact aspect date and with the exception of an intraday spike to 1080 a few days later, the market has been in retreat ever since.

Stocks in New York fell for the second straight week amidst growing signs of protracted economic weakness as equities slipped 2%. After Monday’s strong gain, the market closed in the red four days in a row with the Dow closing at 9487 and the S&P at 1025. Markets have now put up losses in seven out of the last eight sessions. This outcome was largely in keeping with expectations as the slow moving Mercury-Mars aspect did its part to deliver the bearish goods. As predicted, Monday was higher before the Mars negativity took hold. It was all downhill after that, however, as the Mercury direct station allowed for its extended exposure to the difficult Mars influence that lasted until Friday. The worst day of the week was Thursday as stocks lost 2%. This was a little later than forecast, but still a fairly acceptable outcome given our bearish stance. I had also suggested that Friday might be fairly bullish and indeed there was a midday rally attempt that took the market into positive territory, but there was a fair amount of resistance at SPX 1030 (i.e. the bottom of the rising wedge pattern) and the rally faltered by the close. Overall, a good week for our general thesis that a significant correction will follow the Saturn-Uranus aspect of September 18. The high closely correlates to that exact aspect date and with the exception of an intraday spike to 1080 a few days later, the market has been in retreat ever since.

Given the strength of the recent run-up, most analysts have expected a correction of some kind and we indeed are in the middle of one right now. But how far will the market correct? Given the difficult planetary patterns over the next several weeks, I have held to the view that a major pullback is the most likely outcome, perhaps around 15-20%. The technical evidence also gives some support that we are facing something larger than a standard 10% correction. The bearish rising wedge pattern was breached on the downside late last week. The support level of this pattern was 1040, with a secondary support level of around 1030. Both of these levels were broken on Thursday and Friday. Friday’s inability to generate a rally above 1030 was a classic sign that support had become resistance in a reversing market. It’s still possible for bulls to argue that the violation of 1030-1040 was a false break out, but other technical indicators are similarly bearish. RSI at 44 has fallen below 50 and is turning down. Note how in previous corrections in August and September the RSI got to 50 but then reversed back up. This is a possible signal that this correction will be deeper than previous ones. MACD is turning sharply negative in all areas, while volume was mostly in line with recent weeks, although we can detect a slightly rising trend in the past two down weeks as compared to the two weeks ahead of the top. Volume can sometimes rise right in the final week of a bearish rising wedge before prices break support. More generally, rising volume in down weeks is a bearish signal. In terms of possible downside targets, the 200 DMA sits at SPX 900 so that is one possible area of attraction for the market. This is in fairly close proximity to the July lows of 880/8100.

This week will likely tell the tale about the extent of the correction through October and November. The planets are potentially explosive here, so it is difficult to make meaningful price targets. For the moment, I will stick with my expectation of a downward move of 10% on the week, if only for consistency’s sake. I would not be surprised to see something larger than that. And if it’s smaller than 10%, that may only mean that the correction may be more gradual and drawn out, with a second leg down in late October and early November. There are several reasons to expect a major move this week. First, we will have no less than four planets changing their sidereal signs in the same week. Last week’s bearish culprits, Mercury and Mars, are moving forward together now and will both change signs Sunday October 4 ahead of the trading week. While Mercury moves back into Virgo where it gains some strength, Mars enters Cancer, its sign of debilitation where it is weak and therefore more prone to violent and uncontrolled outbursts of energy. And to make matters worse, Mars will conjoin unpredictable Ketu on Friday. While we should be careful about expecting too much gloom and doom here, I note that the 9/11 attacks occurred during a Mars-Ketu conjunction. This conjunction happens every two years or so, so it’s not always catastrophic, but it is nonetheless a negative factor. In addition, both Uranus and Neptune are also changing signs this week, as Uranus retrogrades into Aquarius on Monday and Neptune retrogrades into Capricorn on Thursday. These slow moving distant planets only change their zodiac signs once every several years, so the prospect of having them enter new signs at the same time (and at the same time as Mercury and Mars!) is very unusual indeed and could mark a major change in world attitudes, sentiment and outlook. While there are no certainties in astrology, I would say this collective change in planetary resonance definitely increases the chances for either 1) a newsworthy market decline or 2) a significant geopolitical event that may have major market implications. Of course, Saturn comes under the disruptive influence of Rahu more completely this week so that is another reason for extreme caution here. Saturn signifies caution and pessimism, and its contact with Rahu may mean an overabundance or distortion of pessimism that could induce more selling as investors turn fearful. Monday could possibly be higher as Venus is departing its aspect with Jupiter, but it seems mostly negative after that. Friday may paradoxically end positively, as Venus forms aspects with both Uranus and Neptune while the Sun approaches a supportive aspect from Jupiter. The exact Mars-Ketu aspect at the same time promises a volatile end to the week so would not be surprised by any outcome there, but just to say there is some reason to think there could be a snap back rally at that time.

Next week (Oct 12-16) also looks volatile as Venus conjoins Saturn Tuesday while still under the influence of malefic Rahu so we could well see more downside to the correction. I’m not certain if it will equal the size of this week’s pullback but it may well be close. The most bullish day of the week seems to be Friday as the Sun aspects both Uranus and Neptune. The following week (Oct 19-23) looks quite bullish on Tuesday’s Mercury-Jupiter aspect so we can expect a significant rally attempt at that time. Friday also looks quite positive as Mercury approaches Uranus and Neptune. After that rally attempt which could push prices up 5-10%, the subsequent two weeks look more bearish on the approaching Saturn-Pluto square, as if the markets will try to find a bottom. As I see it, there are two scenarios. First, it’s very possible that we will see a lower low made in early November, after which the market can stage a rally going into December. The second scenario is that the bottom will be formed in mid-October and any decline we see going into early November will form a double bottom or even a somewhat higher low which will then spark a rally into December. Either scenario is possible, although I would lean slightly towards the first one. This is what happened in the Shanghai market during its correction in August. It declined 18% in the first two weeks of the correction, rallied 6% in the next week, then declined further for another week for a total correction of 25%. As an astute newsletter reader reminds me, Shanghai may not exactly foreshadow what will happen in the US, but it may well seen as something of a leading indicator since it bottomed ahead of the US in November 2008 and was quicker to rebound.

Next week (Oct 12-16) also looks volatile as Venus conjoins Saturn Tuesday while still under the influence of malefic Rahu so we could well see more downside to the correction. I’m not certain if it will equal the size of this week’s pullback but it may well be close. The most bullish day of the week seems to be Friday as the Sun aspects both Uranus and Neptune. The following week (Oct 19-23) looks quite bullish on Tuesday’s Mercury-Jupiter aspect so we can expect a significant rally attempt at that time. Friday also looks quite positive as Mercury approaches Uranus and Neptune. After that rally attempt which could push prices up 5-10%, the subsequent two weeks look more bearish on the approaching Saturn-Pluto square, as if the markets will try to find a bottom. As I see it, there are two scenarios. First, it’s very possible that we will see a lower low made in early November, after which the market can stage a rally going into December. The second scenario is that the bottom will be formed in mid-October and any decline we see going into early November will form a double bottom or even a somewhat higher low which will then spark a rally into December. Either scenario is possible, although I would lean slightly towards the first one. This is what happened in the Shanghai market during its correction in August. It declined 18% in the first two weeks of the correction, rallied 6% in the next week, then declined further for another week for a total correction of 25%. As an astute newsletter reader reminds me, Shanghai may not exactly foreshadow what will happen in the US, but it may well seen as something of a leading indicator since it bottomed ahead of the US in November 2008 and was quicker to rebound.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish-neutral

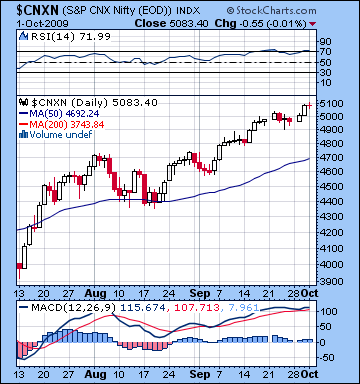

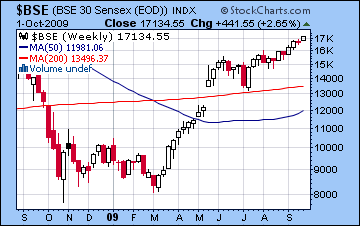

The bulls retained control of Dalal Street for yet another week as stocks rose a further 2%. Indian markets swam upstream against the bearish global current as the Nifty closed the holiday-shortened week above 5000 at 5083 while the Sensex finished at 17,134. This bullish outcome was particularly frustrating given the importance I had placed in the Mercury-Mars aspect to take markets lower. While the aspect did coincide with a correction in most world bourses, Mumbai was somehow immune to the negative energies from this combination. Why? The short answer is that the aspect occurred in a very close angle to the natal Jupiter in the NSE chart. So while the transit Mercury-Mars aspect was bearish, its was converted into further gains by virtue of the positive glance of Jupiter. I noted this benefic possibility in my preparations for last week’s newsletter, but thought that the negativity of the pure transit influence would outweigh it. Alas, ascertaining the relative weight of transit influences versus natal influences is more interpretive art than science. With Tuesday and Thursday mostly flat, Wednesday’s gain perhaps deserves some explanation besides the NSE Jupiter. It is interesting to note that on that day the transiting Moon (28 Aquarius) reinforced the aspect between Mercury (28 Leo) and Mars (28 Gemini) which in turn activated the natal Jupiter (28 Libra) in the NSE chart. Of course, hindsight is always 20/20.

The bulls retained control of Dalal Street for yet another week as stocks rose a further 2%. Indian markets swam upstream against the bearish global current as the Nifty closed the holiday-shortened week above 5000 at 5083 while the Sensex finished at 17,134. This bullish outcome was particularly frustrating given the importance I had placed in the Mercury-Mars aspect to take markets lower. While the aspect did coincide with a correction in most world bourses, Mumbai was somehow immune to the negative energies from this combination. Why? The short answer is that the aspect occurred in a very close angle to the natal Jupiter in the NSE chart. So while the transit Mercury-Mars aspect was bearish, its was converted into further gains by virtue of the positive glance of Jupiter. I noted this benefic possibility in my preparations for last week’s newsletter, but thought that the negativity of the pure transit influence would outweigh it. Alas, ascertaining the relative weight of transit influences versus natal influences is more interpretive art than science. With Tuesday and Thursday mostly flat, Wednesday’s gain perhaps deserves some explanation besides the NSE Jupiter. It is interesting to note that on that day the transiting Moon (28 Aquarius) reinforced the aspect between Mercury (28 Leo) and Mars (28 Gemini) which in turn activated the natal Jupiter (28 Libra) in the NSE chart. Of course, hindsight is always 20/20.

From a technical perspective, the Indian market remains in a strong position. New highs were made above the key psychological resistance level of 5000 on the Nifty, as prices stayed well north of the bearish rising wedge pattern. The failure of the market to test any support no doubt gave bulls some confidence that the rising wedge may be resolved to the upside and increased the chances for a sustained rally over the long term. However, one may wonder how long the Indian markets can stave off the growing bearishness in other world markets as corrections appear to have begun in Europe and the US. On another skeptical note, volume continued to ebb last week thus undermining the technical significance of the new highs. RSI is again above 70 and is once again in the overbought area although until it falls decisively through 70 one cannot make a bearish case. MACD is also strong as the previous week’s near crossover was postponed by last week’s gains. With the increased prospect for a decline this week, the 4800 level is still crucial for the sustainability of this rally. Breaks below 4800 could be very negative for the market as it would offer a confirmation of the bearish rising wedge pattern. We may also discern a secondary and more recent rising wedge pattern dating back to July that offers support at 5000 and resistance at 5150. A break down through this line would also be a bearish signal for the markets which would set up the test of 4800 in the larger rising wedge dating back to the March lows.

The planets this week offers another critical test for the bulls as a number of potentially negative configurations are in play. First, we note that no less than four planets will be changing signs this week. When planets change signs it is possible indicator of new energy and change in the status quo. To have four planets enter new constellations so close together is extremely unusual and greatly increases the chances for major developments and reversals. Mercury, Mars and Uranus will enter new signs on Monday while Neptune enters Capricorn on Wednesday. Mercury will strengthen somewhat as it enters Virgo but Mars is more likely to create havoc as it enters Cancer, its sign of debilitation. The odds for trouble increase since Mars will conjoin unpredictable Ketu on Friday. This is a volatile and potentially violent conjunction that may well coincide with a major geopolitical development and/or significant market pullback. I would also note that the 9/11 attacks on the US occurred during a Mars-Ketu conjunction. This is not to say that this combination necessarily brings strife, but it is definitely a negative factor that warrants caution. Saturn, the planet of pessimism and loss, falls under the distorting aspect of Rahu this week, so that is another possible bearish influence on investors. The clustering of planets near the same degree of their respective signs makes intraweek moves more difficult to forecast than usual. While the week generally seems to favour the bears, Friday offers an interesting situation where a big move is likely on either side. For the bears, Mars is tightly conjoined with Ketu, but Venus will aspect Uranus and Neptune while the Sun moves fairly close to an aspect from Jupiter. If we’ve seen a major sell-off ahead of Friday, then it might set the stage for some kind of relief rally, especially towards the close. Volatility will be the watchword, however. As for possible price targets, I think we could see a 10% decline back to 4500 this week very easily, with further downside probing next week. I’ve been far too bearish on this market recently, so I admit it’s hard to imagine it falling all the way back to 4000 by November. And yet, it is still a distinct possibility. Let’s first see how this week’s planets play out.

Next week (Oct 12-16) also looks fairly bearish as Venus will conjoin Saturn on Tuesday and both come under the disturbing influence of Rahu. Gains seem more likely towards the end of the week on Thursday and Friday as the Sun moves into aspect with Uranus and Neptune. So we could see some kind of interim low formed ahead of that aspect around the 14th. The following week (Oct 19-23) looks more clearly bullish so some kind of rally attempt off the lows is likely to continue. Mercury forms a nice aspect with Jupiter on 20 October and then moves on to a similarly positive configuration with Uranus and Neptune by the end of that week. The planets appear to turn bearish again after that, however, so we should see a retesting of the mid-October lows. Whether or not we see lower lows in November remains an open question. At this point, I would say it’s an even money proposition. I would note that the Shanghai market recently corrected in August and did make lower lows following an initial move down and then a relief rally attempt. This Shanghai scenario would be analogous to a November low here. For investors seeking to establish new long positions, I would think it makes more sense to wait until November just in case the market keeps falling until then. For investors on the short side, the situation may require more finesse and be dependent on personal investment circumstances.

Next week (Oct 12-16) also looks fairly bearish as Venus will conjoin Saturn on Tuesday and both come under the disturbing influence of Rahu. Gains seem more likely towards the end of the week on Thursday and Friday as the Sun moves into aspect with Uranus and Neptune. So we could see some kind of interim low formed ahead of that aspect around the 14th. The following week (Oct 19-23) looks more clearly bullish so some kind of rally attempt off the lows is likely to continue. Mercury forms a nice aspect with Jupiter on 20 October and then moves on to a similarly positive configuration with Uranus and Neptune by the end of that week. The planets appear to turn bearish again after that, however, so we should see a retesting of the mid-October lows. Whether or not we see lower lows in November remains an open question. At this point, I would say it’s an even money proposition. I would note that the Shanghai market recently corrected in August and did make lower lows following an initial move down and then a relief rally attempt. This Shanghai scenario would be analogous to a November low here. For investors seeking to establish new long positions, I would think it makes more sense to wait until November just in case the market keeps falling until then. For investors on the short side, the situation may require more finesse and be dependent on personal investment circumstances.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish-neutral

Closing a bit above 77, the dollar managed a second week of gains last week, modest though they were. This positive dollar outcome was in keeping with expectations, although I was nonetheless frustrated that it failed to break above its critical resistance level of 78. As predicted, the early week was bullish as the Sun-Midheaven aspect generated some decent buying. Wednesday’s decline was disappointing as the Venus-Moon aspect appeared to manifest early. Thursday’s gain made up for the previous day’s loss and coincided with a minor Venus-Venus aspect. Friday’s pullback was less surprising given the Venus-Mercury square we noted last week. Even with the inability of the dollar to breakout above the falling wedge resistance level, its technical picture continues to improve. MACD has turned higher since the bullish crossover and promises further gains. RSI now stands at 47 and continues to edge closer to the bullish 50 level. 78 represents its 50 DMA and the resistance level in its current price pattern so once it breaks above that level, it may move quickly to the upside.

Closing a bit above 77, the dollar managed a second week of gains last week, modest though they were. This positive dollar outcome was in keeping with expectations, although I was nonetheless frustrated that it failed to break above its critical resistance level of 78. As predicted, the early week was bullish as the Sun-Midheaven aspect generated some decent buying. Wednesday’s decline was disappointing as the Venus-Moon aspect appeared to manifest early. Thursday’s gain made up for the previous day’s loss and coincided with a minor Venus-Venus aspect. Friday’s pullback was less surprising given the Venus-Mercury square we noted last week. Even with the inability of the dollar to breakout above the falling wedge resistance level, its technical picture continues to improve. MACD has turned higher since the bullish crossover and promises further gains. RSI now stands at 47 and continues to edge closer to the bullish 50 level. 78 represents its 50 DMA and the resistance level in its current price pattern so once it breaks above that level, it may move quickly to the upside.

This week looks very positive for the dollar, particularly toward the end of the week. This may finally be the time when the dollar bulls get their wish and it rises above 78. The late week Sun-Jupiter aspect will set up very close to the USDX ascendant and that ought to propel the dollar sharply higher. I am expecting more gains the following week as Mercury comes under the positive energy of the natal Jupiter. More strength is likely the following week as Venus conjoins the Midheaven and the Mercury-Jupiter aspect will set up on the ascendant. This takes place on the 19-20th and could mark a interim high in the dollar. After some consolidation, look for the bullishness to return by Oct 26 when Venus receives Jupiter’s aspect while activating the ascendant. The dollar could well stay on a winning streak into November. It’s difficult to specify targets here but much will depend on what kind of boost it gets this week. If it explodes upward to 80, then we could well get to 83 by November. If, however, we only see 78 by Friday, then 80-81 might be a more realistic target by November.

The Euro fell back under 1.47 last week as investors showed signs of losing confidence in the recovery. While I fully expected some pullback here, the modest nature of the decline was disappointing. The Saturn aspect wasn’t enough to really shake things up, perhaps because as a slow moving planet, it enjoys a certain leeway when it will release its energy. Much the same patterns are in place this week, so there is even more reason to expect a significant decline in the Euro here. Mercury will conjoin the ascendant in close proximity to Saturn while the Mars-Ketu conjunction will occur in a very tight square with natal Saturn. There is very little chance of the Euro bouncing back as long as Saturn is parked on its ascendant. Saturn will eventually move off in November while Jupiter will assume the reigns through its aspect to Mars so some gains are likely as we move later into November. The longer term problem for the Euro is that Saturn will remain fairly close to the ascendant for the next several months. Saturn’s influence is decidedly negative and this pattern suggests a bearish bias until well into 2010. Meanwhile, the Rupee put on an impressive show of strength last week as it closed at 47.6. I had been mistakenly bearish but the consensus view of the Indian economy seems to be quite bullish as it is less dependent on exports than China. Nonetheless, as financial turmoil seems set to increase here, I still think the Rupee is likely to weaken in the coming weeks.

Dollar

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bullish

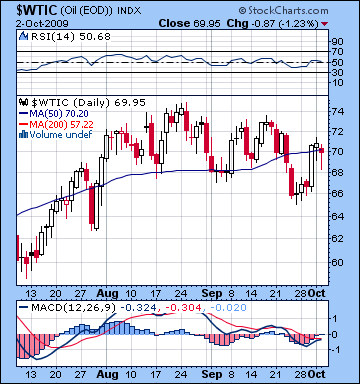

With geopolitical anxiety over Iran’s nuclear program trumping other factors, crude oil once again traded over $70 before closing at $69.95. This was a missed call for me, as I thought crude would feel the direct impact of the Mercury-Mars aspect. While I had allowed for some strength Monday or Tuesday (and Monday saw a small gain), I did not expect Wednesday’s huge rally. And what is more puzzling, I cannot find a ready astrological explanation for it, post facto or otherwise. This is all to say that many gaps remain in astrology, and even more so in my interpretation of it. Technically, crude’s position is still under pressure as MACD remains negative, although it is poised for a bullish crossover. As if to underline the tentativeness of last week’s up move, RSI sits on the fence at 50, albeit with an upward bias. Crude closed right on its 50 DMA and while that was an achievement of sorts, if it can’t move higher, it may become a significant resistance level.

With geopolitical anxiety over Iran’s nuclear program trumping other factors, crude oil once again traded over $70 before closing at $69.95. This was a missed call for me, as I thought crude would feel the direct impact of the Mercury-Mars aspect. While I had allowed for some strength Monday or Tuesday (and Monday saw a small gain), I did not expect Wednesday’s huge rally. And what is more puzzling, I cannot find a ready astrological explanation for it, post facto or otherwise. This is all to say that many gaps remain in astrology, and even more so in my interpretation of it. Technically, crude’s position is still under pressure as MACD remains negative, although it is poised for a bullish crossover. As if to underline the tentativeness of last week’s up move, RSI sits on the fence at 50, albeit with an upward bias. Crude closed right on its 50 DMA and while that was an achievement of sorts, if it can’t move higher, it may become a significant resistance level.

This week looks bearish again as the Mars-Ketu conjunction falls under the aspect of the natal Mars in the Futures chart. This is a very destructive aspect and it points to a sharp sell-off later in the week. I would not rule out a gain early on, perhaps on Monday or Tuesday, as the Sun forms an aspect to the natal Mercury. But any gains are likely to be short-lived as the Mars influence will more than make up for it. The outlook for crude looks very negative for October as Saturn aspects natal Rahu and the nodes aspect the natal Mars. All four of these planets are malefics, so that increases the likelihood that a steep decline is imminent. I still think $50 is possible before all is said and done with this pullback. After finding a bottom in November, there should be a sizable rally into December as Jupiter will aspect the ascendant of the Futures chart. While there is good reason to expect some bullish moves into 2010, some setbacks are likely in May and June on the Saturn station. The second half of 2010 looks increasingly bearish.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish-neutral

Last week gold resisted any further moves to the downside as it added 1% to close at $1003 on the continuous contract. I had been decidedly bearish on gold here, but I noted a certain ambiguity in the key natal horoscope that lessened my confidence in predicting a negative outcome. The minor bullishness I saw for Tuesday actually arrived a little late, as Wednesday saw a healthy gain sending it back above $1000. Friday’s small up move was also within expectations as the Sun approached natal Jupiter. Technically, gold seems unstable since MACD is still clearly negative and has not succeeded in demonstrating any upward signals yet. RSI is still fairly bullish at 57 and managed to stay above 50, a sign perhaps that it has not quite entered bearish territory. But its failure to match last week’s highs is not positive for gold. Each week has seen lower highs, albeit with flattening lows. Support may be around $950, and after that, perhaps $910.

Last week gold resisted any further moves to the downside as it added 1% to close at $1003 on the continuous contract. I had been decidedly bearish on gold here, but I noted a certain ambiguity in the key natal horoscope that lessened my confidence in predicting a negative outcome. The minor bullishness I saw for Tuesday actually arrived a little late, as Wednesday saw a healthy gain sending it back above $1000. Friday’s small up move was also within expectations as the Sun approached natal Jupiter. Technically, gold seems unstable since MACD is still clearly negative and has not succeeded in demonstrating any upward signals yet. RSI is still fairly bullish at 57 and managed to stay above 50, a sign perhaps that it has not quite entered bearish territory. But its failure to match last week’s highs is not positive for gold. Each week has seen lower highs, albeit with flattening lows. Support may be around $950, and after that, perhaps $910.

This week will be a fascinating one for gold. The Mars-Ketu conjunction late in the week occurs on the Saturn of the ETF chart. This is extremely negative and should take gold down quite a bit. Next week also looks shaky for gold, although I’m less confident of a big down move. Friday October 16 could see a big rebound as Mercury conjoins the natal Jupiter while the Sun conjoins the natal Midheaven. There is a mixed picture going into November as the Saturn-Pluto square will set up close to the ascendant. This is a very negative influence. At the same time, once Jupiter turns direct (October 13) it will begin to influence the natal Moon once again and this could offset much of the losses that would otherwise occur. Gold may well benefit from the Jupiter-Neptune conjunction in early December but it seems poised to correct again once Mars turns retrograde on December 19. This will likely mark the beginning of a more severe correction in gold that should last at least two months. I would not rule out $700 at some point during the first half of 2010.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — neutral