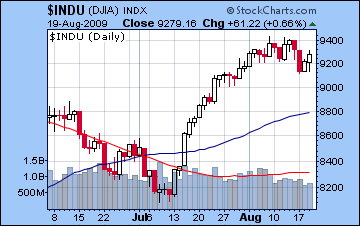

Markets move higher on Venus-Jupiter-Saturn alignment

Stocks in New York moved higher for the second straight day as the Dow closed at 9279 and the S&P at 996. In Mumbai, a somewhat different story as Tuesday’s bounce was wiped away from more worries over prospects for recovery in Asia. After climbing towards 4480 on Tuesday, the Nifty closed at 4394 while the Sensex ended Wednesday at 14,809.

Monday’s global sell off pretty much arrived on cue, although it wasn’t as deep I thougth it might be in the US — just 2%. The bounce we’re seeing here also is more or less in keeping with the improving planetary aspects as benefic Venus moves into to buoy sentiment. As Mercury enters a harmonic aspect with both Uranus and Neptune tomorrow and into Friday, it seems that we will see more upside here, perhaps back to the highs made last week.

Eclipse has no immediate effect on markets

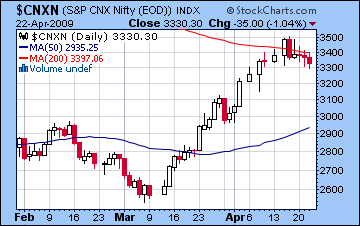

Wednesday July 22, 2009

On the heels of the longest solar eclipse of the 21st century, stocks took a breather after several days of gains to finish mostly flat in New York. The S&P closed unchanged at 951 and the Dow finished at 8881 after trading a hair under 9000 at one point (8991). At the actual site of the eclipse, Indian stocks lost some ground as the Nifty ended the day at 4398 while the Sensex finished at 14,843.

I thought we might see more declines around eclipse so the strength here increases the chances for some kind of post-eclipse pullback. Eclipses often foretell the interruption of the status quo and can be important indicators of trend reversals. So by itself the eclipse could conceivably mark a high in this rally. But with a number of favourable planetary aspects due in the coming week or two, I wonder if the rally still has a ways to go. Monday will see Venus aspect Jupiter which could represent a minor culmination of an upward trading pattern up to that point, while the Sun and Mars will aspect Jupiter in mid-August.

Stocks continue strength on positive earnings reports

Wednesday July 15, 2009

Stocks in New York rose sharply after Intel reported stronger than expected earnings. The Dow closed up 3% and closed at 8616 while the S&P ended trading at 932. The rally got started in Asia as Mumbai also bounced off last week’s lows as the Nifty closed at 4233. So much for the much-ballyhooed head-and-shoulders pattern that was portending lower prices. Markets have broken above the "neckline" at Dow 8550 and are rapidly approaching their June highs.

This uptrend is largely in keeping with our weekly outlook given the Sun-Mercury conjunction and the Mercury-Jupiter aspect, although I admit it’s somewhat stronger than I expected. I still see a good chance some significant profit taking for tomorrow and especially Friday on the bearish Mercury-Ketu conjunction, although it seems that we will end higher on the week.

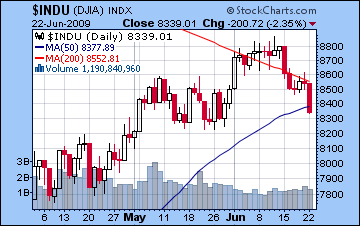

Monday June 22, 2009

Stocks tumble on Venus-Mars-Saturn alignment

Stocks fell across the board today on a bleak World Bank forecast for economic growth for 2009. The Dow dropped over 2% to 8339 while the S&P closed at 893. In Mumbai, profit taking was also the order of the day as the Nifty closed down at 4235 and the Sensex finished at 14,326. While I thought we might see a big move here on the Venus-Mars-Saturn aspect, I was unsure what direction it was in. With the outlook pretty bearish here, it wasn’t too surprising that the market ended down.

Given Friday’s Mercury-Saturn aspect it seems that the May 15 lows for US stocks may well be tested this week. I am expecting this period of consolidation to continue in the short term.

Monday, June 1, 2009

Venus gives the market that loving feeling

Stocks rose globally today as Venus formed a positive alignment with Jupiter, Neptune and Uranus. Both US and Indian stocks rose more than 2% as both markets achieved new highs with the Dow closing above 8700 and the Nifty pushing past 4500. This outcome was very much expected since Venus, the planet of all things good, activated the Jupiter-Neptune conjunction. The US market traded at its 200-day moving average, a potentially significant level of resistance. A rise tomorrow is possible as Venus may show a little more love to the bulls, but the rest of the week looks more like a minefield that could see profit taking and then some.

Mumbai’s Magnificent Monday

Stocks in Mumbai soared a record 17% in Monday’s session as investors poured into equities on the heels of the stunning victory by the pro-market Congress Party in the election. The Nifty surpassed 4300 while the Sensex jumped above 14,000. While I have been generally bullish on Indian stocks for the spring period, I completely missed this explosive rally both in terms of its exact timing and its unprecedented scope. It is a humbling experience to be confronted with one’s errors is such a stark fashion. Days such as these are difficult reminders of the limits of my own knowledge as a financial astrologer.

The fact that I had been forecasting a brief but significant correction here makes this doubly awkward. Nevertheless, there were some clues that we might see some extra strength in this period. For example, the National Stock Exchange of India chart(NSE) shows a very positive pattern involving the secondary progressed and transit charts. Progressed charts are a staple in Western astrology and they form part of my toolkit as an integrative neo-Vedic astrologer. Here we can see that progressed Sun is closely conjunct progressed Jupiter at 1 Scorpio. This is perhaps one of the most positive contacts imaginable but since progressions are quite slow moving (the Sun moves just one degree per year), it can be difficult to know when the positive energy will be manifest. When I looked at this pattern, I assumed that it represented the current bull phase which I had forecast to extend into the summer, perhaps into July or August.

But look at the transits to those progressed positions. Jupiter (1 Aquarius), Uranus (1 Pisces), Neptune/Chiron (2 Aquarius) all form harmonically significant aspects to that progressed Sun-Jupiter conjunction. There is some debate among astrologers whether transits to progressed planets have the same power as transits to natal positions. I think this chart is makes a good case that they are significant since they highlight the progression. My mistake was that I didn’t place enough importance on them and focused too much on the trees instead of the forest. The Sun-Mercury transit conjunction today at 3 Taurus was the immediate trigger for these other contacts between slow moving planets and the progressions. While it might possibly have triggered a similar rise when either one transited 1 Taurus, thus setting up a stronger resonance with all the other planets at 1 degree, the conjunction at 3 Taurus combined their energies and was still within range.

I would expect the optimism may continue until Mercury moves through 1 Taurus around midweek, although much of the energy has obviously been released already.

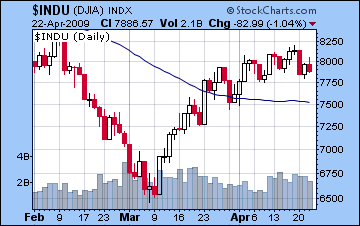

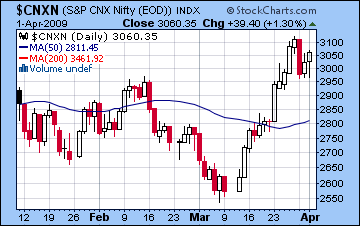

Bank fears stops rally in its tracks

After being up most of the day, stocks in New York fell sharply at the close as renewed fears over the banks took hold. The Dow ended the day at 7886 while the S&P closed at 843 after trading as high as 860 at midday. Meanwhile Indian stocks slumped for the third day in a row as the Nifty closed at 3330 and the Sensex at 10,817.

The expected early week Mars to Venus bearishness has largely come to pass, although I would have expected a little more strength today. Even if tomorrow sees some recovery in New York on the vestiges of the Mercury-Jupiter aspect, I think the outlook isn’t very positive as we move into Monday’s Mars-Ketu-Pluto alignment.

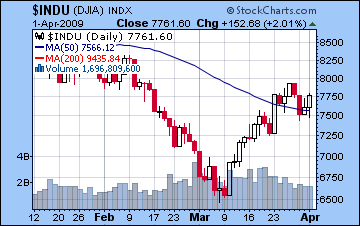

Stocks continue rebound

Wall St woke up on the right side of the bed this morning as markets rose 2% on some encouraging economic data. After a negative open, the Dow closed at 7761 and the S&P ended the session near the highs of the day at 811. Mumbai also moved back towards last week’s levels as the Nifty ended at 3060 and the Sensex at 9901.

So the midweek rally I wondered about seems to have come to pass here, although bulls should note that we’re still off last week’s highs. Failure to move beyond those levels would be a bearish signal. I do think we’re headed mostly down here in the next few sessions. In fact, given the prominence of malefics Mars and Saturn, it could be a BIG move down, possibly over 5%.

I would also point out that sidereal Uranus will enter Pisces over the weekend. Outer planet sign changes often correlate with major developments in the financial and geopolitical world. Readers will note that the largest single day decline in US stock market history in October 1987 occurred two days after sidereal Uranus changed signs. That doesn’t mean we’re looking at a drop of that magnitude (>20%) but it does add an extra amount of planetary energy to the mix. Since Uranus is the planet of surprises and sudden changes, expect the unexpected!

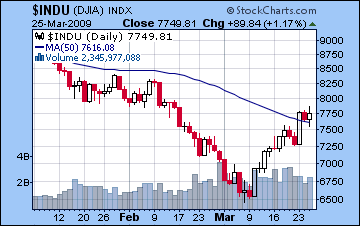

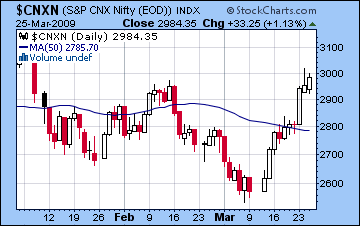

Stocks continue rally

After a volatile day, stocks in New York ended higher as the bulls pushed prices further. The Dow closed at 7749 and the S&P at 813. Mumbai also built on Monday’s gains as the Nifty closed at 2984 and the Sensex at 9667. Obviously, the market is exhibiting far more bullishness than expected ahead of the Sun-Venus-Ketu alignment on Friday.

Despite the strength of this rally, I still believe the bias is down in the near term. It’s possible we may see another 3-5% on the upside, but some kind of significant retracement down is beckoning. The New Moon is tomorrow so that may hold some important clues for the next couple of weeks.

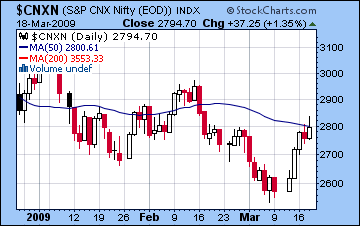

Stocks move higher on Fed buy back plan

Investors cheered the Fed’s plan to buy treasuries as stocks rallied from an morning loss as the Dow closed at 7486 and the S&P at 794. Stocks also rose in Mumbai as the Nifty ended the day at 2794 and the Sensex at 8976. The US dollar moved sharply lower as the increased debt burden from the Fed plan made the greenback less attractive.

The market is extending this bull run further than expected as the negativity from the Mercury-Saturn opposition appears to have been offset by the presence of Jupiter near the same degree. It’s possible the up trend may squeeze a few more percent gain before the bears take control again.

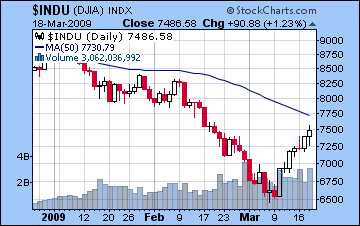

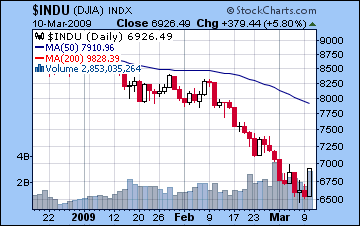

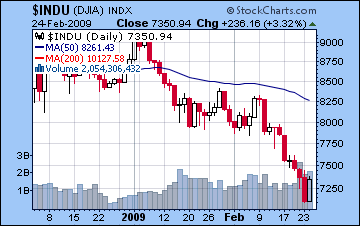

Massive rally in New York

Stocks staged their biggest one day gain of the year as the key indexes rose 6% today on a favourable earnings report from Citigroup. The Dow closed up almost 400 points to 6926 while the S&P catapulted to 719.

The gains came a little earlier than expected this week with the approach of the Sun-Uranus conjunction. It seems that the more immediate source of bullish energy may have derived from the Venus-Jupiter aspect. We could look for this rally to continue through the week, although we cannot rule out some profit taking along the way, possibly Thursday or Friday. This is not likely to be a one-day wonder so we could easily see 7300 on the Dow at some point here. Tomorrow should see more gains.

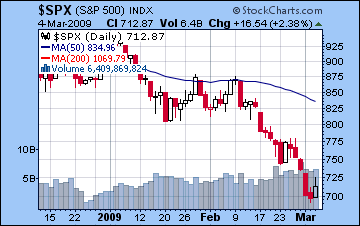

Stocks bounce after Dow falls below 7000

Buyers returned to Wall St today breaking a five day losing streak as the Dow closed at 6875 and the S&P ended the day at 712. Indian stocks also found their legs Wednesday as equities rose 1%. The Sensex closed at 8446 and the Nifty at 2645.

After Monday’s bloodbath, the relief rally was not unexpected, especially given the alignment of Sun, Venus and Jupiter around the same degree of their respective signs. This was enough to negate the bearishness of the Venus-Saturn aspect, at least temporarily. Another up day is possible this week from this positive alignment but once it begins to dissolve, the bears will likely return.

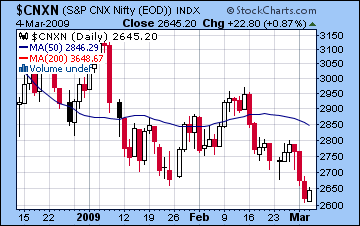

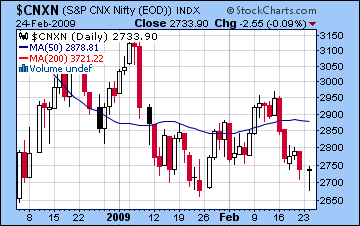

Stocks in NY bounce back after scary Monday

After Monday’s descent into an extreme danger zone near 7100, the bulls returned looking for bargains as the Dow ended the day at 7350. The S&P also recovered from from Monday’s near-death experience below the November lows at 743 and closed at 773. In Mumbai, trading followed a similar pattern as the Nifty retested the January lows at 2675 near the open before ending the day largely unchanged at 2733.

It’s hard to see the market falling much more this week, as the Aquarius New Moon has now kicked in. Still the approaching Mercury-Mars-Saturn alignment next week does not look very favourable for share prices. The larger question of course concerns the fate of the market after the Venus retrograde cycle begins on March 6. Many observers feel the market is doomed for another leg down towards SPX 600/Dow 6000, while the more bullish view sees the current lows as largely holding as the market undergoes a process of consolidation before turning higher. I tend towards the latter view, although there are a few key astrological pressure points that we need to get behind us before the bullish scenario can win the day. The Jupiter-Saturn aspect of March 23 may well determine if the market can hang on here or move lower.

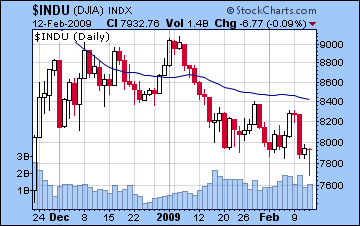

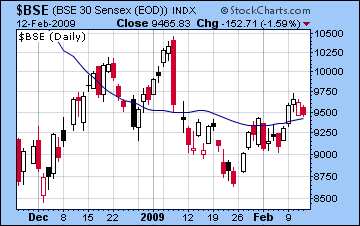

NY Stocks finish flat after another deep plunge

US markets ended flat after after a huge final hour rally erased deep losses that saw the indexes move closer to their November lows. After trading below 7700, the Dow closed at 7932 while the SPX ended at 835 after touching 810 around 3 p.m. In Mumbai, the Sensex closed at 9465, down 1.5% on the day while the Nifty ended at 2893.

An interesting point about today’s rollercoaster action: the Moon moved from Mars-ruled section of Hasta to Rahu’s section in the early afternoon. Given Rahu’s strength from the Jupiter conjunction, this may have been one factor that allowed sentiment to improve for the rally in the last hour. Of course, the sublord shift occurred while the market was still falling at 1 pm so we can’t take this influence too far. The relief rally will likely continue tomorrow in New York, although I’m less optimistic about the Indian market.

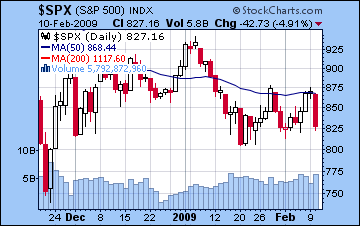

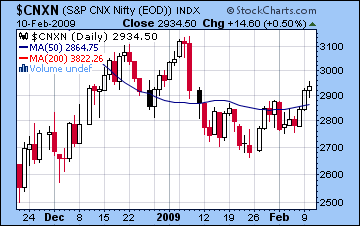

New York plunges almost 5%

on bailout anxietyI had thought we would see more upside this week, but Monday’s failure to generate any new highs above SPX 870 convinced enough investors that the time to sell was nigh. A couple of planetary observations here may suffice as an explanation. First, I had wondered if the movement of several planets into Jupiter-ruled sectors of nakshatras might change the overall equation. It did change the equation, and for the worse. Even though I called for some early week upside, I knew that the Jupiter influence here was a little shaky due to Jupiter’s close conjunction with malefic Rahu and its debilitated state in sidereal Capricorn.

An additional negative factor was the 135 degree aspect between Mars and Saturn. Given my discussion in the weekly forecast of the potential role of Mars as a trigger in releasing the Saturn-Uranus energy, it seems that some of that energy has now been realized. My previous hypothesis focused on Mars’ full strength quincunx aspect that will become stronger towards the end of February. Certainly, the drop today suggests that some of that energy has been manifested with today’s trading.

The best the bulls can hope for is probably not much more than a fairly weak technical bounce for the rest of the week. Tomorrow may well start out fairly negative as well. Asia should be quite negative also tomorrow since the Mars-Saturn aspect does not perfect until after the trading day in Mumbai. The trend continues to be down, so next week still looks worse, so we could retest the Fall 2008 lows then.

Posted by Christopher Kevill at 02/10/2009 05:57:00 PM EST

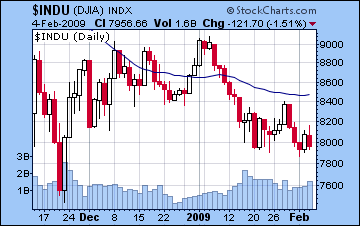

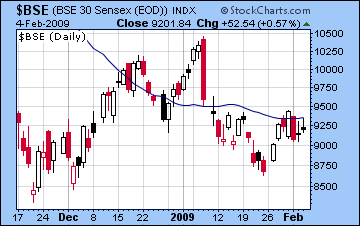

US rally runs out of gas

Stocks closed lower today after the rally fizzled in the morning. After hitting 850, the SPX ended the day at 832 while the Dow finished at 7952. In Mumbai, the market continues to struggle higher after Monday’s sell off. The Nifty closed at 2803 after trading as high as 2840 and the Sensex ended the day at 9201.

We might see some morning gains in Mumbai but generally I think the mood will grow increasingly bearish over the rest of the week as we move into the Saturn-Uranus opposition. SPX 800 may well hold on Friday, while the recent lows on the Nifty (2700) look safe for now.

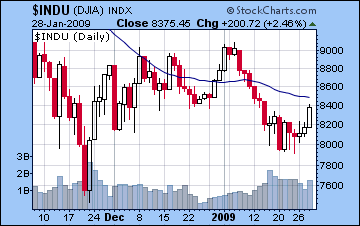

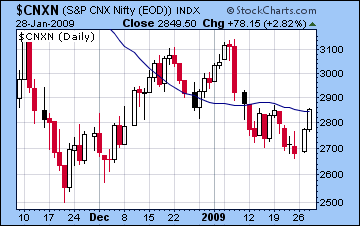

Stock rally continues

Wall St rose sharply today on expectation of the bank bailout and the passing of the stimulus plan. Stocks gained 3% as the Dow closed at 8375 and the S&P at 874. Indian markets also extended Tuesday’s gains as the Nifty closed at 2849 and the Sensex at 9257.

So far the rally is ahead of schedule, as I had expected declines earlier in the week and for gains at the end of the week. The market has risen on the heels of the Mercury-Mars conjunction, perhaps as the negativity of Mars moves out of the picture. While Mercury approaches its direct station on the weekend, we can still wonder how long this rally will last. There will be a lot of resistance around 8500 on the Dow and 880 on the SPX. The Nifty may similarly have a tough time going over 2950 and staying there.

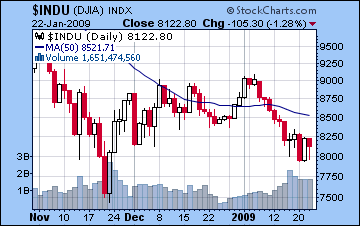

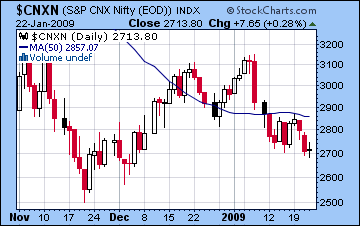

Stocks close lower

— againWall St continued to be plagued by bearishness amidst more bad earnings and no new initiatives from the incoming Obama administration. The Dow fell one percent to 8122 and the S&P ended the day at 827. In Mumbai, stocks were largely flat, providing little relief for the negative week. The Nifty was slightly higher at 2713, while the Sensex closed at 8813.

I had thought we’d see more of a rally this week, but the markets seem to have other plans. Tomorrow sees the Sun-Jupiter conjunction come exact, but there’s no guarantee that an up day is in store. Even if there is some buying tomorrow, there isn’t much upward momentum here. As ever, caution is the watchword for the coming weeks as we will likely move lower.

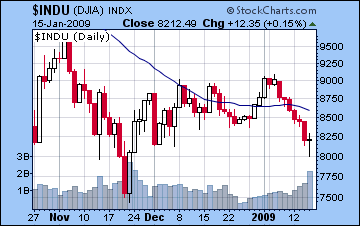

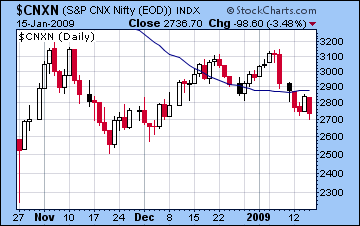

Dow tests 8000

Stocks in New York broke their losing streak today after the Dow briefly touched 8000 at midday, ending the day at 8212. The SPX ended the day unchanged at 843 after probing 820. In Mumbai, stocks lost 3% as the Nifty closed at 2736 and the Sensex at 9046.

This week is unfolding bearishly as was indicated by the Mercury-Saturn aspect. Admittedly, I did not expect Dow 8000 to be in the mix but today’s afternoon reversal is an indication of the Obama rally that lies ahead for next week. Indian markets may well finish in the red tomorrow, however as transiting Mars may cause havoc with the NSE natal chart.

Posted by Christopher Kevill at 01/15/2009 06:19:00 PM EST

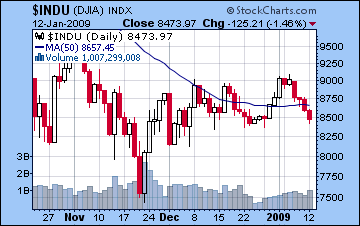

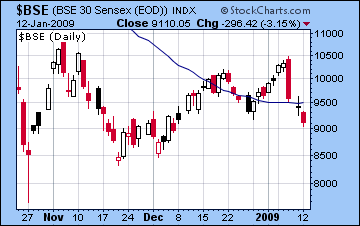

Gloom deepens on Wall St in fourth straight losing session

Stocks fell further today on fears that corporate earnings would fall far short of expectations. The Dow finished at 8473 and the SPX at 870 as stocks slipped further below their 50 day moving average. In Mumbai, the arrest of Satyam CEO Raju did little to calm investors as stocks fell 3%. The Nifty ended trading at 2773 and the Sensex at 9110.

Even if the market bounces back tomorrow — and that is a very big if — I think there’s a good chance that the Dow will fall below 8400 this week. It may stay above 8200 before turning around, but I think the market has to move lower before it can make a sustainable rally. The Mercury-Saturn aspect is close enough to get the blame for today’s bearishness but I think there’s more pessimism left in that aspect that remains to be made manifest. Similarly, the Indian markets are looking to pull back further this week, perhaps by a greater proportion than US markets.

Posted by Christopher Kevill at 01/12/2009 04:53:00 PM EST

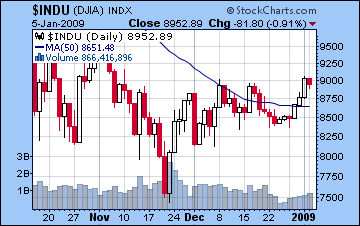

Stocks slip back

No big sell off today but there was at least a mood of caution as some investors took some money off the table after the string of gains last week. The Dow fell back to 8952 and the S&P to 927. Mumbai fared better as stocks added another 3% with an impressive end of the day rally. The Sensex closed at 10,275 and the Nifty at 3121.

I think we will see more caution come into the market this week as the influence of Jupiter wanes and the disruptive influence of Mercury-Rahu builds towards Friday. I wouldn’t rule out some gains tomorrow in the US, but they are unlikely to be anything major. Gold fell $20 today so that is also a welcome development as the US dollar made up some lost ground as the Euro lost 3 cents. Hopefully we will see these trends continue further and watch gold really being to fall back towards longer term support levels in the coming weeks.

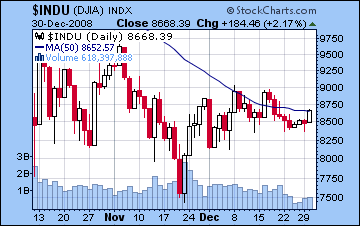

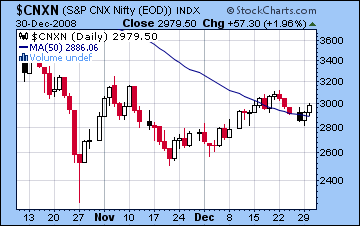

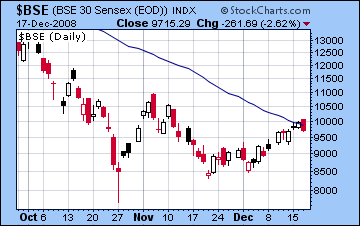

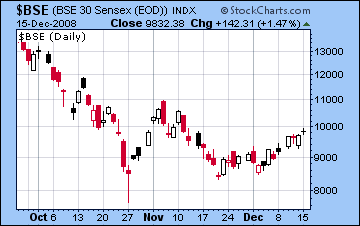

Markets in year end rally

Stocks in New York rose 2% on renewed hopes that government support for the auto industry would stave off bankruptcy. The Dow closed at 8668 and the S&P at 890. The rally in the US followed world markets higher as Mumbai was also up 2% with the Sensex at 9716 and the Nifty at 2979.

This rally was expected in advance of the Mercury-Jupiter conjunction, although the Indian markets have been extra strong, perhaps as a result of the end of Indo-Pak tensions. Tomorrow may well see another up day, although with the Mercury-Jupiter conjunction coming exact before trading in the US, it is possible that the rally may sputter somewhat.

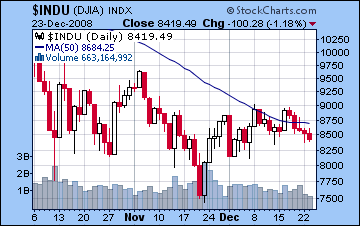

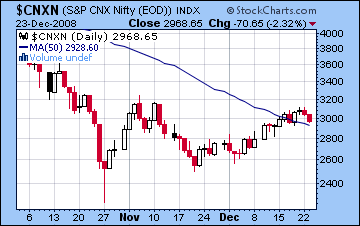

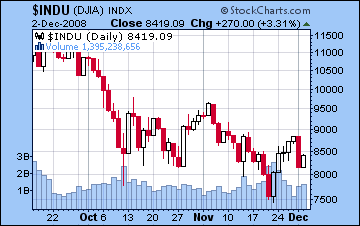

Stocks slump further

New York continued its listless mood as the outlook for 2009 weighed on investors’ minds. The Dow managed to stay above the 8400 support level but closed down 1% at 8419 while the S&P ended the day at 863. Stocks in Mumbai were negative from the open and fell over 2% as the Nifty closed at 2968 and the Sensex at 9686. Indian stocks remain above their 50 day moving average but seem ripe for a sell off.

I had thought we would see more upside by now with the Mercury-Venus-Uranus aspect. Time is running out for any last ditch rally before we head decisively lower. New York could rise Wednesday, but I’m less optimistic about Mumbai’s chances. It will be interesting to see the effect of the midday (IST) Moon-Mars-Jupiter alignment. Given that Mumbai went higher in the December bounce, it is more vulnerable to profit-taking. Nifty 2525 is now very much on the table.

___________________

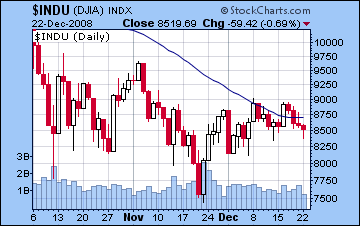

Stocks fall on bad outlook

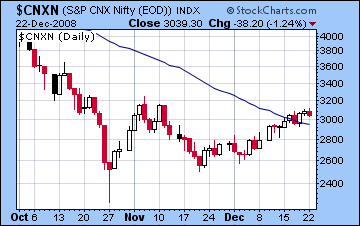

Stocks in New York fell almost 2% today on the broader averages as a growing number of forecasts indicated another tough year for 2009. The Dow bounced off its intraday lows and closed at 8519 and the S&P ended at 871. Indian stocks also lost ground today as the Nifty weakened at the end of the day to close at 3039 and the Sensex at 9928. The pullback was no real surprise, especially in the US with the Moon squaring the nodes.

We may see a bounce tomorrow however. India looks quite negative at the open, so the Nifty will likely trade below 3000 before noon. However, a close in the green is still possible. And it’s possible that sentiment will fully reverse by the close in New York with more upside possible by Wednesday.

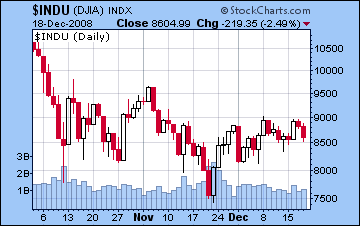

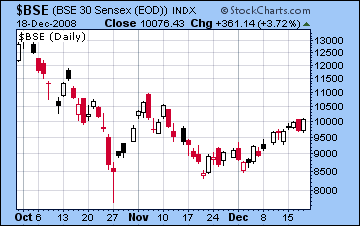

US stocks fall for second day

Wall St. sold off amidst news of a GE debt downgrade and the increased possibility of an auto bankruptcy. The Dow was down over 2% to 8605 while the S&P closed at 885. Earlier in the day, Indian stocks rallied 3% as the Sensex closed at 10,076 and the Nifty at 3060.

I think we’re likely to see another negative day tomorrow worldwide in advance of the Sun-Pluto conjunction. There is a good chance that it will be larger than today’s decline in the US. These are December’s dark days to be sure. While next week may be somewhat better, I get the feeling that the market still hasn’t finished testing the downside here. Saturn’s station on the 31st looms large.

Posted by Christopher Kevill at 12/18/2008 06:44:00 PM EST

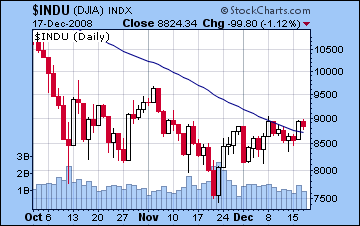

Stocks slip back

Stocks in New York fell about 1% as traders took some profits after yesterday big run-up. The Dow closed at 8824 and the S&P at 904. In Mumbai, the major indices fell 3% as the winning streak came to an end. The Sensex ended the day at 9715 and the Nifty at 2954. The US dollar sell off continued as the Euro and Gold rose 3%.

In the wake of the Sun-Jupiter aspect, this decline was not unexpected as the positive energy was no longer available to push up prices. I had thought the US dollar might have turned around by now, but the Euro chart does show a couple of obviously positive contacts in effect today amidst all the tense ones: tr Venus conjunct the natal Uranus and tr Jupiter still conjunct the natal Venus. The Euro (and gold) may squeeze one more day out of this rally before coming back down to earth. Tomorrow could be a big down day for US stocks as Moon conjoins Saturn during the trading day. India may avoid the worst of it until Friday.

Posted by Christopher Kevill at 05:11:00 PM EST

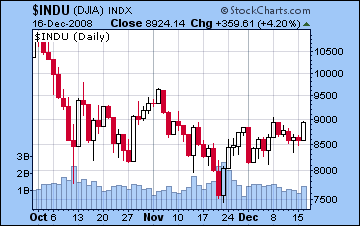

US stocks rally on Fed rate cut

Ben Bernanke provided the fuel for a big 5% rally on Wall St as the Fed chair cut rates to as low as zero. The Dow closed at 8924 and the S&P at 913. Indian stocks were also higher as the Sensex closed at 9976 and the Nifty at 3041.

While the up day in New York was not surprising, the strength of the rally was. I think tomorrow may see a shift however and the end of the week still looks bearish to me. I’m not convinced that this rally is for real. There will be still significant declines before January.

Posted by Christopher Kevill at 12/16/2008 05:52:00 PM EST

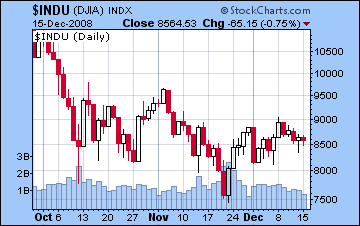

US stocks fall; Mumbai continues rally

Worries over manufacturing pushed stocks 1% lower in New York today as the Dow closed at 8564 and the S%P at 868. Mumbai continued its winning ways as the Nifty ended the session at 2981 and the Sensex at 9832.

The modest decline in New York was somewhat disappointing given the harash planetary architecture in effect. Even if we see some buoyancy tomorrow, I’m sticking to my basic position that the downside this week will be greater than any upside. Mumbai looks relatively stronger, but it, too, will eventually succumb. How much lower it will fall remains an open question, however.

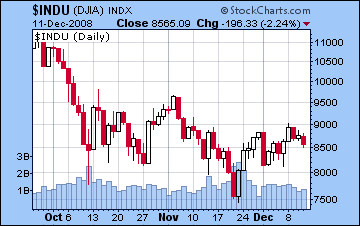

US stocks fall on auto bailout worries

New York shares fell over 2% as worries over the possibility that no auto bailout would be reached in Congress prompted an afternoon sell off. The Dow closed at 8565 and the S&P at 873. Asian stocks were mixed and Mumbai was largely unchanged after a strong rally at the close as the Nifty ended the session at 2920 and the Sensex at 9645.

It looks as though all that negative planetary energy is finally catching up to the market here. Asia should be down significantly Friday (probably below 2850 on the Nifty) and New York will probably continue to move lower. There’s some support at Dow 8100 so it may not breach that level until early next week. It’s still possible we could see a huge sell off Friday in New York, but I wouldn’t bet the farm on it. Let’s see what transpires.

Posted by Christopher Kevill at 12/11/2008 08:47:00 PM EST

US makes modest gains; Mumbai rallies strongly

Wall St managed to rally near the close today and closed up about 1%. The Dow ended at 8761 while the S&P finished at 899. Mumbai resumed trading after the holiday closure and added 5% as the Nifty closed at 2928 and the Sensex at 9654.

It may be that the bulk of the forecast decline to 8000 or below will have to wait until early next week. Friday still looks very bearish, but tomorrow is more ambiguous.

Posted by Christopher Kevill at 12/10/2008 06:53:00 PM EST

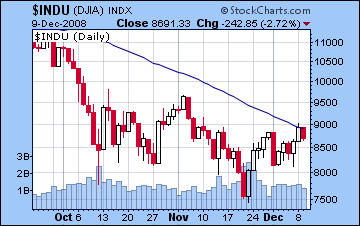

US stocks fall on earnings worries

Not even Jupiter entering sidereal Capricorn could buoy the market today as stocks fell more than 2% as stock indices bounced off the 50-day moving average. The Dow ended the session at 8691 while the S&P closed at 888. Mumbai was shut for a holiday.

I think the applying square aspect between the Sun and Uranus took precedence over any Jupiter bullishness. With Mars following close behind the Sun, it’s hard to see much upside this week, although I would not rule out an up day along the way. Some kind of intraday rally may be possible towards the close tomorrow with the Moon moving into a trine aspect with Jupiter.

Posted by Christopher Kevill at 12/09/2008 06:39:00 PM EST

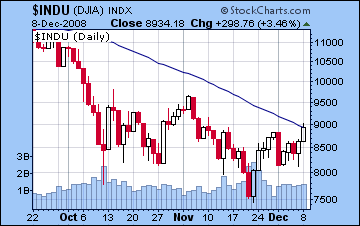

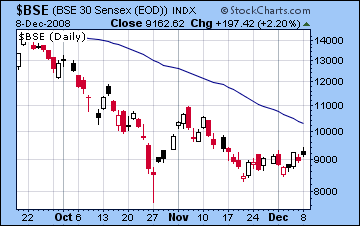

US stocks move higher; Mumbai halves gains at the close

Stocks in New York rallied over 3% today as the Dow closed at 8934 and the S&P at 909. The Dow also finally managed a potentially significant technical achievement by rising to its 50-day moving average for the first time in two months as it briefly traded above 9000. The gain in America followed optimism worldwide as stocks in India also ended significantly higher. The Nifty closed at 2784 although it had traded as high as 2850 in the morning. The Sensex ended the day at 9162.

The Mercury ingress to sidereal Sagittarius has proven to be a bullish influence and so we await the exact ingress of Jupiter into sidereal Capricorn tomorrow (EST). It is possible that the markets will manage another up day here although I am not certain of the outcome.

Posted by Christopher Kevill at 12/08/2008 07:04:00 PM EST

Afternoon rally in New York

After spending most of the day under water, US stocks rallied 3% in the afternoon as the Dow closed at 8635 and the S&P at 876. The gain followed losses in Asia as Indian markets fell 3% with the Sensex closing at 8965 and the Nifty at 2714.

American stocks continue to flirt with a final rally attempt towards 9000. As the 50-day moving average has now fallen below 9000 for the first time, that may be a sign that stocks may approach that level early next week. Stocks closed higher than expected today although much of the early trading was below 8200. I had thought the First Lunar Quarter might have yielded more bearishness but it was offset by the positive influence of the aspect from Mars, which was exalted in Capricorn in the navamsa.

Posted by Christopher Kevill at 12/05/2008 05:35:00 PM EST

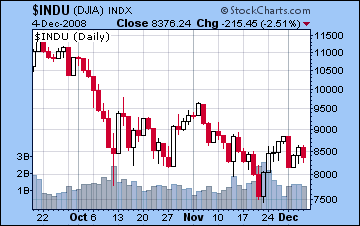

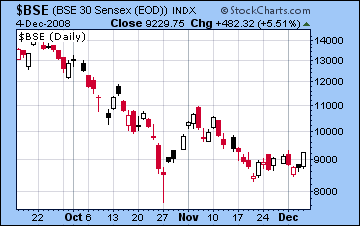

Rally ends in New York; Mumbai rises

US stocks slid 3% today on fears that GM may have moved one step closer to bankruptcy. The Dow traded above 8600 a couple of times today but sold off in the afternoon as sentiment buckled on the weight of a barrage of bad economic news. Earlier in the day, Indian stocks had moved 4% higher as the Nifty closed at 2788 and the Sensex at 9229.

The market is now quickly running out of time to make a move higher towards 9000 which now seems quite remote. I had thought today might be higher, but in all likelihood this downward afternoon move was a foreshadowing of a larger move down over the next two weeks. Tomorrow may be another big down day.

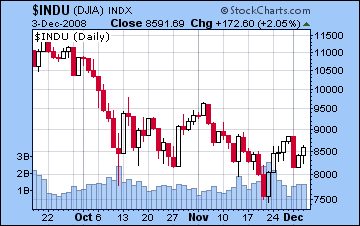

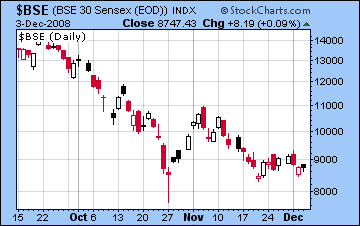

US stocks continue rally

Stocks in New York added another 2% to this fledgling rally as the Dow ended the day at 8591 while the S&P closed at 870. Shares were largely unchanged in India as the Nifty closed at 2656 and the Sensex at 8747.

Look for more gains tomorrow as the Dow makes a run at 9000. I doubt it will get there but it could well be close based on the strong navamsa conjunction of the Sun and Jupiter. I am expecting Thursday’s gain to be bigger than today’s, so that might mean something on the order of 3-5%. India will likely enjoy the lion’s share of gains on Friday (IST).

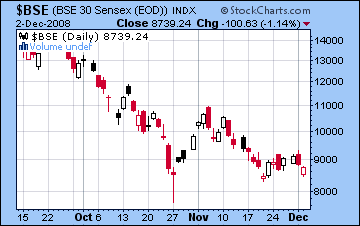

US Stocks bounce back 4%

Markets in Europe and America bounced back after yesterday’s big sell off. The Dow closed at 8419 while the S&P ended the session at 848. In a fairly bullish move, the market retested the 8100 level twice and rallied at the close. Indian markets rallied off their morning lows and closed down only 1% as the Nifty ended at 2657 and the Sensex at 8739.

I think there’s more positive planetary energy this week, although I think Thursday in the US may be better than Wednesday owing to the closer Sun-Jupiter conjunction in the navamsa chart then. Also Wednesday’s US close may be bearish as the Moon approaches Neptune.

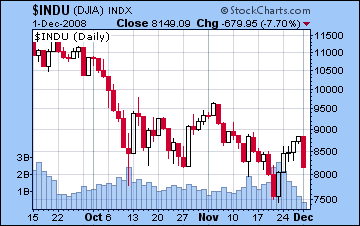

US Stocks plunge 8%

The recent rally in stocks came to an abrupt end today as stocks sold off sharply. The Dow opened gap down and kept falling through the day to end at 8149 while the S&P closed at 816. Indian stocks enjoyed decent gains early on as the Nifty rose above 2800 but fell through the afternoon and lost 2% over the day. The Nifty ended the session at 2682 while the Sensex stood at 8839.

As it turned out, the Venus-Jupiter conjunction lost its benefic strength a litttle earlier than expected. I had thought that we would see more upside today just as the aspect was perfected. However, the negative energy of the Mars-Ketu aspect took precedence and put an end to the rally. I don’t think we’re headed straight down from here and we should see some significant up days later on in the week. But Dow 9000 and Nifty 3000 looks increasingly improbable now as the shadow of that Scorpio New Moon is looking very foreboding.

Posted by Christopher Kevill at 12/01/2008 05:48:00 PM EST

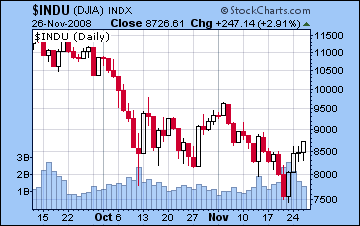

US stocks rise 3% to extend rally

The rally continued on Wall St today as the Dow shook off a negative open and finished at 8726 while the S&P ended at 887. Asian stocks were also up by 3% as the Nifty ended at 2752 and the Sensex at 9026.

Wall St is closed for Thanksgiving Thursday but stocks globally seemed destined to pullback somewhat Thursday and into Friday. Given the shocking terrorist attacks in central Mumbai, one can’t be sure if that market will even open Thursday. If it does, it will certainly move down. All in all, the rally is well under way here and will continue into next week.

Posted by Christopher Kevill at 11/26/2008 05:53:00 PM EST

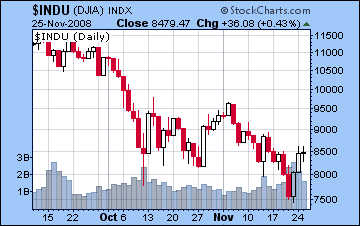

US Stocks higher for third straight day

Stocks in New York were modestly higher today on news of new government bailout money for the economy. The Dow again traded near 8600 today and ended at 8479 while the S&P closed at 857. Most Asian markets were higher, but India sagged towards the close and the Nifty was down over 2% to 2654 while the Sensex finished at 8695. This is the second day that markets in Mumbai failed to hold onto significant gains.

Wednesday is shaping up negatively both in India and in North America. The Nifty may even retest 2525 at some point in the next couple of days. The US is likely finished its winning streak and may probe below 8200 Wednesday.

Posted by Christopher Kevill at 11/25/2008 10:41:00 PM EST

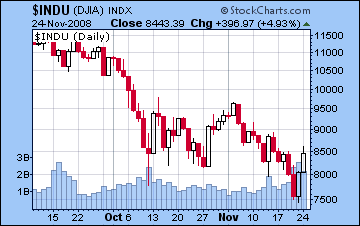

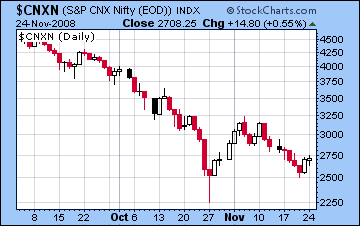

US Stocks soar on Citigroup bailout

Stocks in New York rose 6% today on news that beleaguered banking giant Citigroup would receive government assistance. The Dow closed at 8443 while the S&P ended the session at 851. The rally was more modest in Asia as the Nifty was only up 0.5% to 2708 while the Sensex was actually fractionally down at 8903.

The trend appears to be up here and tomorrow may well build on today’s gains in advance of the Sun-Mercury conjunction.

Posted by Christopher Kevill at 11/24/2008 05:45:00 PM EST

Stocks rally 6% on Geithner appointment

US stocks rallied strongly at the close on news that Timothy Geithner would be the new Treasury Secretary in the incoming Obama administration. The Dow ended the day at 8046 and the SPX closed at 800. The rally followed a similarly strong rally in Asia that saw Indian stocks rise 5% as the Nifty rose to 2693 and the Sensex at 8915.

While I expected this bounce earlier in the week, better late than never. This sets up the prospect for more gains next week.

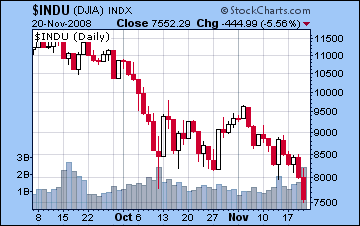

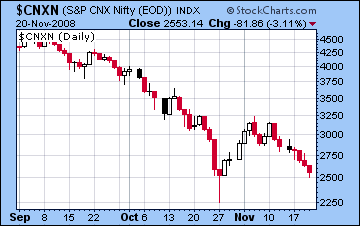

Swimming in a sea of red

US stocks slid another 6% today to 5-year lows as the Dow closed at 7552 and the SPX at 752. Asian markets were similarly bearish as the Nifty closed down 3% to 2553 while the Sensex closed at 8451.

So is this the low for the 2008? That is the question now that the Jupiter-Saturn aspect will become exact tomorrow at 9 a.m. EST just before the open in New York. Since most energy is released in advance of major aspects, there is even more reason to believe that we are on the verge of another bear market rally. As the aspect separates during Friday’s session in the US, there is a very good chance that sentiment will finally shift.

Posted by Christopher Kevill at 11/20/2008 06:27:00 PM EST

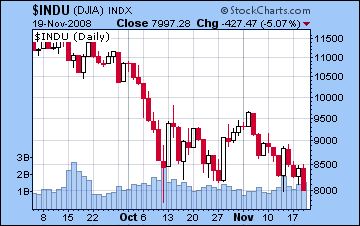

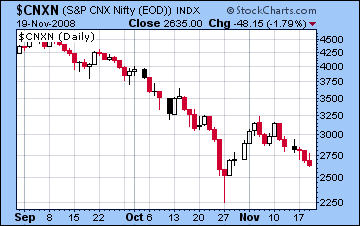

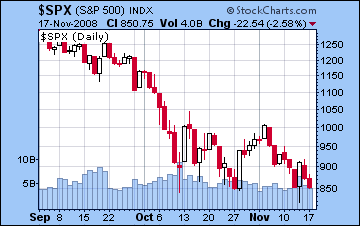

US stocks plunge 6%; Dow trades below 8000

US markets remained in retest mode today as the Dow broke the 8000 level and closed at 7997 while the SPX probed lower and closed at 806. Asian bourses started the day in the red as the Nifty sank to 2635 and the Sensex to 8773.

It was an ugly day on Wall St, and the extent of the downside was surprising. While I had expected a Dow retest, I had hoped we would have been done with it yesterday. Tomorrow is therefore the probable reversal day. Depending on how low we go at the open, the strength in the afternoon should push prices in New York significantly higher.

Posted by Christopher Kevill at 11/19/2008 06:11:00 PM EST

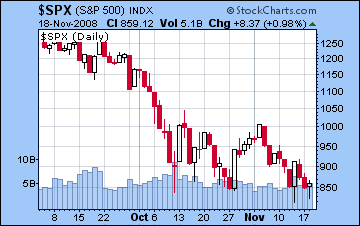

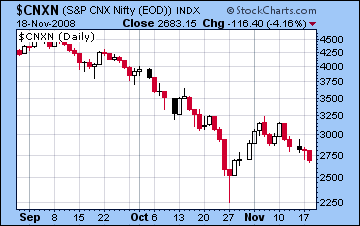

US stocks move higher

With a strong rally at the close, US stocks moved 1% higher after venturing into retest territory in the early afternoon. The Dow finished at 8424 and the SPX at 859. Asian markets were lower as stocks in Mumbai lost 4%. The Sensex ended trading near the lows of the day at 8937 and the Nifty at 2683.

While the Dow did not quite match its October low, the SPX did and in fact almost matched Thursday’s low of 820. The rally near the close is an indication of things to come this week. There’s a chance for Dow 9000 by Friday and Nifty 3000. Let’s see if enough market participants believe that he have had a retest to push prices higher.

Posted by Christopher Kevill at 11/18/2008 08:54:00 PM EST

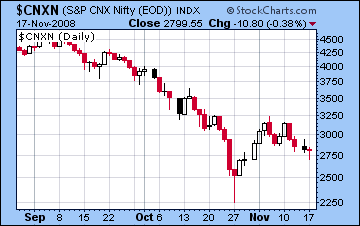

US stocks fall on Citigroup cuts

Stocks in New York fell over 2% after massive job cuts at Citigroup and news that Japan had slipped into recession. The Dow closed near its lows for the day at 8273 while the SPX ended at 850. Indian markets staged an impressive afternoon rally and only closed marginally down. The Nifty ended trading at 2799 and the Sensex finished at 9291.

So no retest in New York today but the real possibility for a lower open tomorrow. I’m doubtful we will see Dow 8000 here but it’s still possible. Nifty 2700 is very likely tomorrow. After that, perhaps a lift.

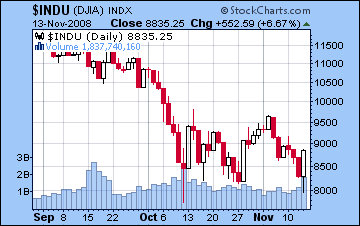

Wild ride on Wall St

US stocks swung wildly in a 10% range today before finally closing up 6%. After a midday testing of 8000, the Dow closed at 8835 and the S&P ended at 911. Indian markets were shut for a holiday.

The huge swings this week speak to the ongoing struggle between Uranus and Saturn who are both competing for Jupiter’s attention. All three are in close aspect with each other hence the rapid movement between Saturn’s pessimism and Uranus’ exuberance. The earlier down move this week was so strong, I assumed Saturn was edging out Uranus. After today’s action, I’m not so sure. We could start lower in the morning tomorrow, but move up in the afternoon after the Moon moves away from Rahu’s influence.

In any event, I still think there is some significant negative energy that needs to be released over the next few sessions. Let’s see how it plays out.

Posted by Christopher Kevill at 11/13/2008 06:33:00 PM EST

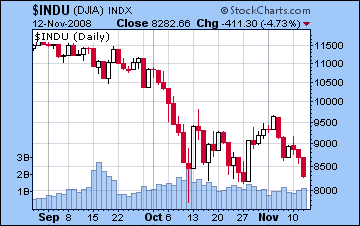

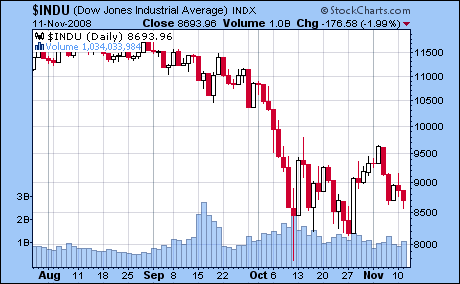

US stocks slump 5%

Stocks in New York fell further today on the usual array of gloomy economic news. The Dow ended the day at 8282 while the S&P closed at 852. Indian markets also declined 3% as the Sensex closed at 9536 and the Nifty ended the session at 2848. Mumbai is closed for trading tomorrow so it will have to play catch up on the downside Friday.

My bullish prediction for the week notwithstanding, it’s clear that momentum has shifted and we’re likely headed down until early next week when we may form a temporary bottom. Even if we manage an up day tomorrow or Friday, we will still likely break below 8000 on the Dow and perhaps 8800 on the Sensex. While I have been stunningly wrong about the market this week, the silver lining is that the trend is down and that is still very much going according to plan.

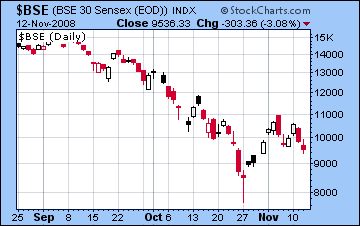

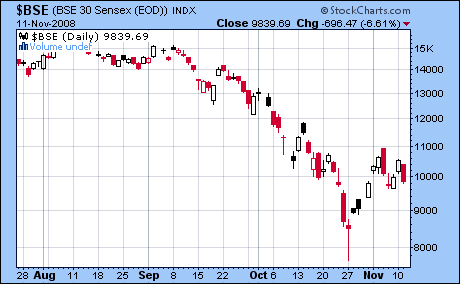

Markets slide on economic worries

Markets worldwide succumbed to plethora of bad economic news today. In New York stocks fell 2% as the Dow closed at 8693 while the S&P ended the session at 898. Asian losses were steeper, as Indian markets slumped over 6% as the Sensex closed at 9839 and the Nifty at 2938.

Tomorrow should finally see some significant gains in the US in advance of the Full Moon, although the outlook may be less positive for Asia. November is shaping up to be a mixed month within a fairly narrow trading range.

Posted by Christopher Kevill at 11/11/2008 07:21:00 PM EST

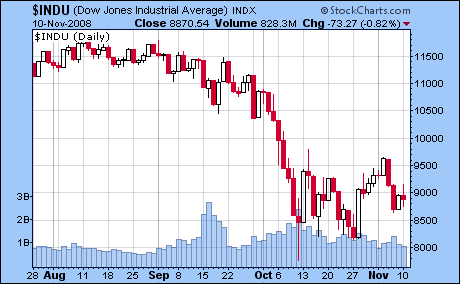

Asia rallies; US stocks slip

US stocks failed to hang on to gains made earlier in the day in Asia on the heels of China’s stimulus package. The Dow closed down abotu 1% to 8870 and the SPX ended the day at 919. In India, The Sensex was up 5% to 10,536 while the Nifty climbed to 3148.

One notes that the shift in sentiment may have been related to the changing Moon nakshtra from Saturn-ruled Uttara Bhdrapada to Mercury-ruled Revati. Saturn is aspected by benefic Jupiter, while Mercury occupies the often troublesome nakshatra of Swati. Tomorrow, the Moon enters Ashwini during the North American trading day.

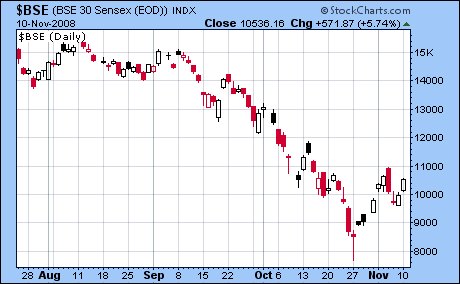

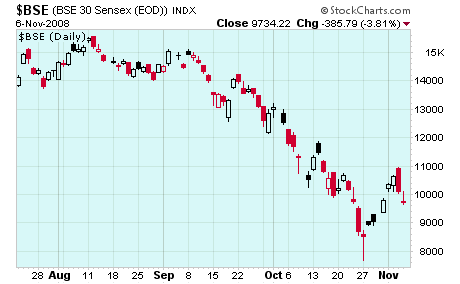

Stocks slide another 5%

US stocks fell sharply on increased jobless claims and poor earnings. The Dow ended the day at 8695 while the S&P stood at 904. Today’s decline began in Asia, as Indian markets also lost another 3% as the Sensex finished trading at 9734 and the Nifty at 2893.

So far, this most recent move down is fulfilling our expections for a negative week overall. Tomorrow’s trading should be another negative day both in India and the US, although we may see the intraday low occur at some point in the middle of the day rather than at the close, as we’ve seen lately. 2800 on the Nifty is very possible, and 850 on the S&P is a sort of worst case scenario, with an 880-890 close perhaps more likely. It may be a good day to consider covering shorts with a rally possible sometime next week.

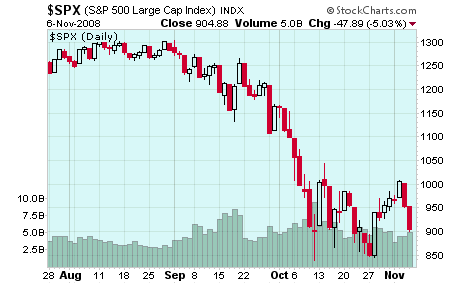

Stocks fall sharply

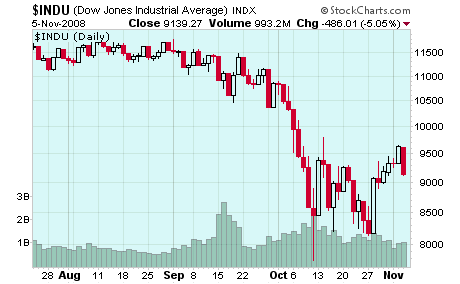

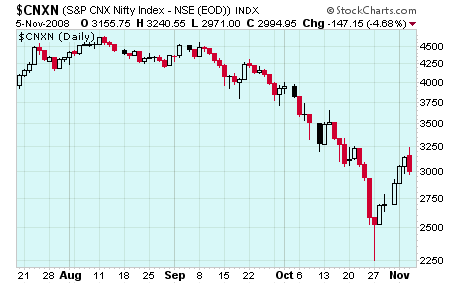

US stocks fell 5% on bad jobs numbers in the wake of the Obama victory. The Dow closed at 9139 and the S&P ended the day at 952. While some Asian bourses extended their rally yesterday, Mumbai also closed lower by 5% on a negative oulook for Reliance. The Sensex ended trading at 10,120 and the Nifty finished at 2994.

As suggested in my weekly forecast, I think this downturn can be tied to Mercury’s entrace into Swati. Look for the negative trend to continue at least until Friday, and most likely into Monday, at least in Asia.

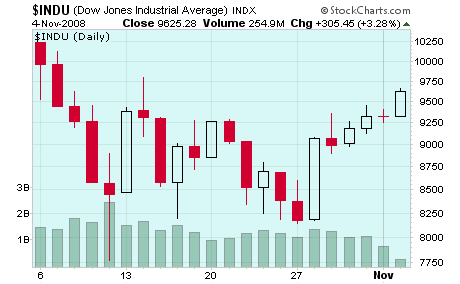

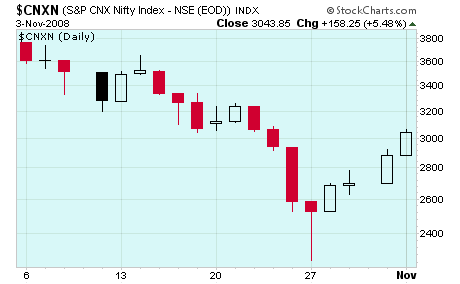

Stocks rally 3% before US election

US stocks rallied 3% today as optimism surrounding the impending Obama win boosted sentiment albeit on very weak volume. The Dow closed the session at 9625 and the S&P at 1005. Asian stocks also built on recent gains and closed up strongly with the Sensex finishing at 10,631 and the Nifty at 3142.

Although I had expected the early part of the week to be more bearish, this rally has not changed by basic outlook here. Look for a change in market direction tomorrow, perhaps as a result of a refocusing on economic fundamentals, or maybe because of political developements. A McCain win seems increasingly remote, so it seems that the most likely expression of the Saturn-Uranus aspect is the end to the neo-con worldview in the United States in the wake of a Democratic sweep. Whatever ends up happening, a significant decline is imminent. This will spread to world markets and will begin a leg down of about 10% over the next few days. In light of the extent of this rally, a retest of recent lows seems quite unlikely here. An early December retest looking more probable.

Posted by Christopher Kevill at 11/04/2008 04:34:00 PM EST

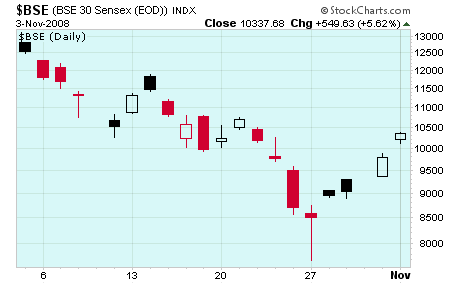

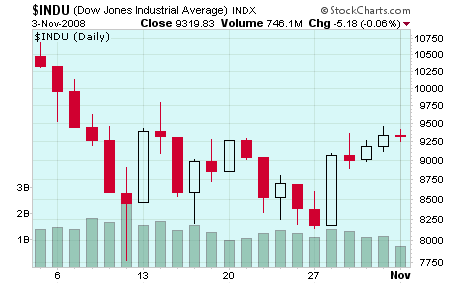

US Stocks flat before election

Stocks in New York traded within a narrow range as investors were cautious before the US election on Tuesday. The Dow ended the day down frationally at 9319 and the S&P closed at 966. Asian stocks continued last week’s rally as the Sensex closed up 5% to 10,337 while the Nifty climbed to 3043.

While I am bearish this week, today’s session was not a surprise, particularly as some investors are waiting for the outcome of the election. It is conceivable that the market will not find a clear direction until Wednesday.