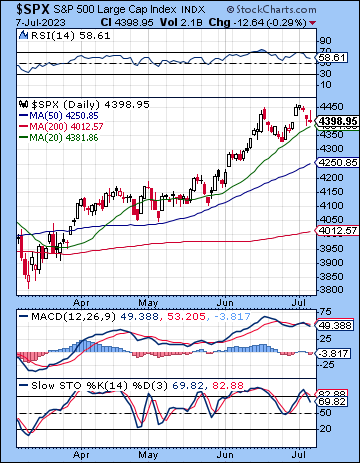

(9 July 2023) Stocks slipped last week as strong employment data renewed expectations for further rate hikes. The S&P 500 fell 1% to 4398 while the Nasdaq-100 finished at 15,036. This bearish outcome was not unexpected as I noted the likelihood of some gains early in the week which would likely be followed by some selling on Thursday and Friday. Indeed, Thursday’s Moon-Mars-Neptune alignment coincided closely with a significant down day.

(9 July 2023) Stocks slipped last week as strong employment data renewed expectations for further rate hikes. The S&P 500 fell 1% to 4398 while the Nasdaq-100 finished at 15,036. This bearish outcome was not unexpected as I noted the likelihood of some gains early in the week which would likely be followed by some selling on Thursday and Friday. Indeed, Thursday’s Moon-Mars-Neptune alignment coincided closely with a significant down day.

It seems we may be back in a ‘good news is bad news’ environment. Last week’s strong ADP jobs data reflected the relative strength of the economy and put a damper on any talk of an immediate recession. The robust employment report translated into sharply higher bond yields in anticipation of additional rate hikes from the Fed. With markets now pricing in a 92% chance of a rate hike at the next FOMC meeting on July 26, the benchmark 10-year yield soared to 4.06% on Friday, thus testing its March highs. These latest gyrations in the bond market saw the yield inversion moderate to just -0.88% as traders at the short end of the curve (2-year) hedge their bets about further hikes. Nonetheless, it is clear that the bond market is on the verge of a major shift in inflation expectations. If core inflation pressures persist in July against a backdrop of increased bond supply, it could prompt a test and potential breakout at key technical resistance of 4.25% on the 10-year Treasury. Such a move would likely be bearish for stocks as elevated yields would constitute greater competition with equities. Further yield increases do seem likely in the near term given the ongoing afflictions to the Treasuries horoscope which are likely to last for most of July.

The planetary outlook leans bearish for the near term. The progressions calendar shows a net negative score for the next two weeks and increases the probability for further downside ahead of the Fed meeting…

[…]

This week (July 10-14) has some downside risk. The early week looks more bearish as there is an unusual alignment of Mercury, Mars, Rahu and Pluto. The presence of Mars in the mix increases the downside risk for Monday and Tuesday. While I would lean bearish for Monday, we should note the potential bullish influence of the Moon-Venus alignment on Monday morning. While this doesn’t look particularly strong, it could mitigate some of the other bearish influences for a few hours. Similarly, while Tuesday morning could see continued fallout from the Mercury-Mars-Rahu alignment, some recovery is possible by Tuesday afternoon as the Moon approaches its conjunction with Jupiter…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: David McSpadden