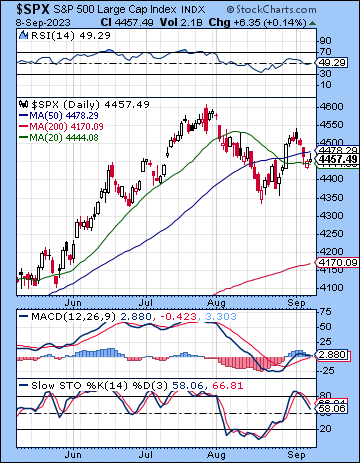

US Stocks

(10 Sep 2023) Stocks fell last week as rising oil prices rekindled inflation fears and pushed bond yields higher. The S&P 500 lost more than 1% on the week to 4457 while the Nasdaq-100 finished at 15,280. This bearish outcome was unexpected as I thought the combined influence of the Venus and Jupiter stations might have offset the ongoing negative bias in the progressions calendar.

(10 Sep 2023) Stocks fell last week as rising oil prices rekindled inflation fears and pushed bond yields higher. The S&P 500 lost more than 1% on the week to 4457 while the Nasdaq-100 finished at 15,280. This bearish outcome was unexpected as I thought the combined influence of the Venus and Jupiter stations might have offset the ongoing negative bias in the progressions calendar.

Markets remains fixated on inflation risks as ‘higher for longer’ is gradually becoming the consensus view. While most traders now expect the Fed to stand pat at its Sep 20 FOMC meeting, the chances of a November hike are approaching 50% as last week’s economic data was quite strong. Weekly jobless claims are stable and show no sign of any kind increase that would hint at a slowdown in the labor market. ISM non-manufacturing data came in above expectations and also did not offer any evidence for the recession scenario. And with crude oil pushing to new highs for the year, the Fed will likely have no choice to maintain its tight monetary policy into 2024. Both the dollar and bond yields were higher on this ‘good news is bad news’ for the stock market. While bond yields are still testing double top resistance, the longer the 10-year yields is in this elevated 4.00-4.30% zone, the more likely it will breakout higher. If yields rise further, stocks are almost certain to suffer the consequences as the tightening of credit would weigh on growth and earnings.

The planetary outlook is mixed. While last week’s pullback was surprising despite the bullish transit set ups, there is are still some noteworthy bullish influences in September that could postpone any potentially deeper decline. First, the progressions calendar is a bit less bearish than last week and thus could serve to mitigate any downside. Even though the progressed influences resist precise timing, there is some reason for bulls to remain hopeful and for bears to be cautious. The transit picture is also still somewhat bullish this week as Venus forms a plausibly bullish aspect alignment with Jupiter…

[…]

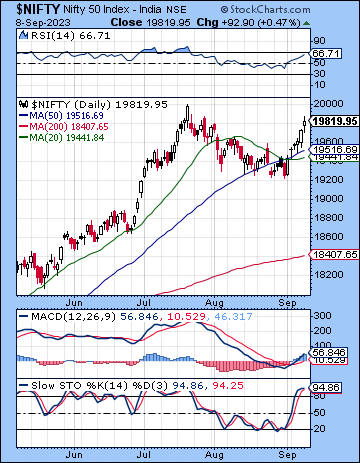

Indian Stocks

Stocks extended their rebound last week as positive economic data combined with hopes that the Fed may be close to ending its rate hike cycle. The Nifty gained 2% on the week to 19,918 while the Sensex finished at 66,598. This bullish outcome was in line with expectations as I thought the Venus and Jupiter stations and their alignments with the Sun and Mercury would likely coincide with some upside.

Stocks extended their rebound last week as positive economic data combined with hopes that the Fed may be close to ending its rate hike cycle. The Nifty gained 2% on the week to 19,918 while the Sensex finished at 66,598. This bullish outcome was in line with expectations as I thought the Venus and Jupiter stations and their alignments with the Sun and Mercury would likely coincide with some upside.

Indian markets continue to outperform most of its global counterparts as the indices are once again approaching their all-time highs. With growth forecasts substantially higher than both China and the developed Western economies, India is in a better position to withstand stagflation and recession scenarios. Inflation remains a concern, however, as central banks are attempting to engineer a soft landing that constrains further price increases with only one or two additional hikes in interest rates. Last week’s US data suggested that growth was sufficiently strong to warrant further hikes, most likely in November and in early 2024. The upcoming FOMC meeting on Sep 20 will give the Fed another opportunity to clarify its hawkish bias going into next year. But if US labour markets stay as strong as they have been in recent weeks, it seems unlikely that the Fed will commit to a pivot anytime soon. This ongoing strength in the labour market is one reason why bond yields remain elevated as the US 10-year Treasury is holding above the important 4% level. Further rises in yields and any consequent appreciation in the dollar would therefore be a headwind for most global equities.

The planetary outlook is mixed for the month of September. Further upside is possible over the next week or two as Venus forms an extended alignment with Jupiter due to the recent stations of both planets. However, without any additional triggering aspects from the Sun or Mercury, further upside may be more modest than what we have seen recently. The progressions calendar for the next two weeks also seems fairly neutral and argues against any major new up trend in the near term. The second half of September looks more bearish as the progressions look more negative and we will see a series of potentially bearish Mars aspects with Jupiter, Saturn, Neptune and Ketu (South Lunar Node)…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Out&Seen