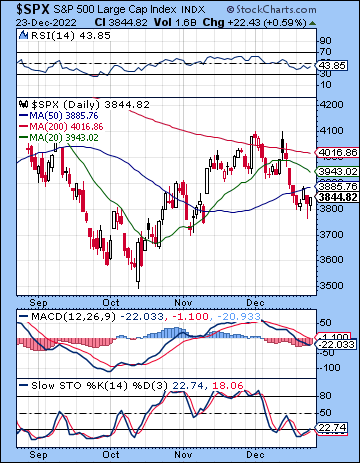

(24 December 2022) US stocks were mostly lower last week as worries over higher interest rates in 2023 continued to weigh on sentiment. The S&P 500 finished the week slightly lower at 3844 while the Nasdaq-100 fell by 2% at 10,985. This bearish outcome was somewhat unexpected as I thought the bullish midweek alignments of Sun-Jupiter and Venus-Uranus might have offset the other negative influences in the week.

(24 December 2022) US stocks were mostly lower last week as worries over higher interest rates in 2023 continued to weigh on sentiment. The S&P 500 finished the week slightly lower at 3844 while the Nasdaq-100 fell by 2% at 10,985. This bearish outcome was somewhat unexpected as I thought the bullish midweek alignments of Sun-Jupiter and Venus-Uranus might have offset the other negative influences in the week.

The market has entered a lighter volume holiday period here where moves can be exaggerated in either direction. While inflation is still a concern, recession risks and corporate earnings are likely going to be main drivers in the coming weeks. Proof of the diminishing importance of inflation was seen in Friday’s PCE inflation number which came in a bit hotter than expected. While the market sold off early, it rebounded and finished positive by the close. This is a sign that inflation is not quite the same bogeyman that it was earlier in the year. And while Treasury yields did push a bit higher on the PCE report, the extent of the yield inversion continued to moderate as the 2/10y spread has staged a retreat since its early December minimum. While yield inversions are the normal precursor to recessions, it is less well known that inversions typically end as the slowdown takes hold and unemployment begins to rise. Thus, the yield inversion ended in 2000 and 2007 just as the layoffs began to accumulate and the markets moved lower. If the 2-year Treasury yield slips below the 10-year yield in the weeks ahead it will reflect falling inflation expectations and the increasing likelihood of further declines at the short end of the curve amid deteriorating economic fundamentals. More specifically, the 2y/10y chart shows some significant horizontal resistance at -0.50. If the 2/10yr spread moves back above this level – and especially if it moves back into normalized positive territory — it would suggest that recession fears are taking precedent over inflation expectations, either due to weak corporate earnings or worsening employment numbers. In other words, while the inverted yield curve has been bearish for stocks, the normalized yield curve could also be bearish for stocks in the near term.

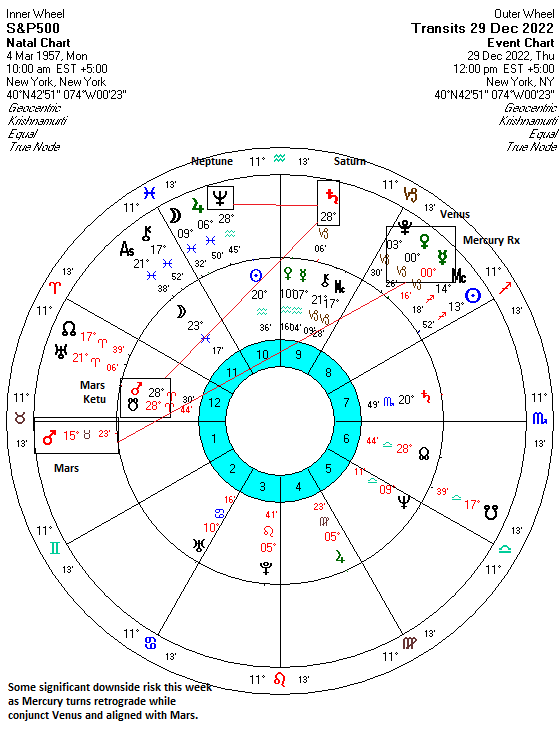

The planetary outlook still has a bearish bias. The Saturn-Neptune alignment is still very much a key factor over the next two weeks as the bearish pairing is correlated with declines, as we saw in April and May when these two planets last aligned. The alignment is more likely to coincide with further downside since it forms near-exact aspects with Mars-Ketu in the SPX horoscope and the Moon in the NYSE horoscope…

Click here to subscribe and read the rest of this week’s newsletter.