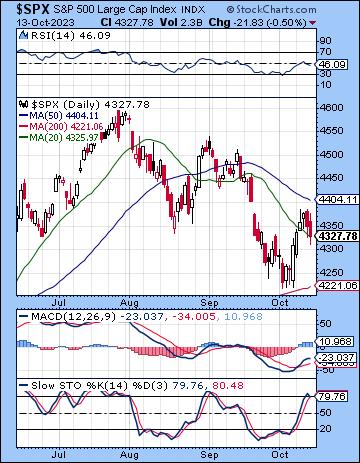

(15 October 2023) After a choppy week, stocks finished modestly higher as concerns about the Israeli-Hamas conflict were largely offset by restrained inflation data and falling bond yields. The S&P 500 added 0.45% on the week to 4327 while the Nasdaq-100 finished at 14,995. This modestly bullish outcome was more or less in keeping with expectations given the range of influences in play last week. We saw some very brief bearish fallout from the early week Mars-Pluto square which coincided with the Gaza attack, and was then followed by some midweek gains on the Mercury-Jupiter alignment. The late week selling on the Mars-Saturn alignment was somewhat stronger than expected but nonetheless confirmed a choppy and fairly neutral week.

(15 October 2023) After a choppy week, stocks finished modestly higher as concerns about the Israeli-Hamas conflict were largely offset by restrained inflation data and falling bond yields. The S&P 500 added 0.45% on the week to 4327 while the Nasdaq-100 finished at 14,995. This modestly bullish outcome was more or less in keeping with expectations given the range of influences in play last week. We saw some very brief bearish fallout from the early week Mars-Pluto square which coincided with the Gaza attack, and was then followed by some midweek gains on the Mercury-Jupiter alignment. The late week selling on the Mars-Saturn alignment was somewhat stronger than expected but nonetheless confirmed a choppy and fairly neutral week.

The dark cloud of unpredictable Middle East violence now hangs over the market. Despite decent inflation data and strong bank earnings last week, markets are on tenterhooks awaiting any new developments from the region. While the geopolitical situation is unnerving, the fact that stocks could finish higher on the week suggests that sentiment remains fairly resilient. Of course, that could all change if the war widens to other fronts in Lebanon, Syria and, most importantly, Iran. The price of crude oil may be the key barometer in this respect as any threat of an embargo or sanctions involving OPEC states would be a clearly negative influence on stocks. While crude oil did rise in price last week, it has yet to break out above its September highs. For now, the anticipated inflationary effects of the current geopolitical premium on oil prices remain low as evidenced in the decline in the 10-year Treasury to 4.63%. If crude continues to rise and yields reverse higher, however, then stocks would likely sell off once again.

The planetary outlook is mixed but with a potentially bullish bias in the near term. After last week’s Mars-Pluto and Mars-Saturn alignments, we are basically done with the bearish influence of Mars for now. This reduces the number of bearish influences for the next couple of weeks and could open the door to some more upside. Besides a reduction in bearish influence, there is an increase in the number of bullish transit influences in the coming days as Jupiter aligns with Pluto on Monday (Oct 16) and with Venus on Saturday (Oct 21). While neither of these is a very strong bullish influence, it would be unusual to not see at least some upside from these transits. In addition, we should note that the progressions calendar score this week is +4 and marks a modest improvement over last week. This is another reason why the market may not sell-off sharply just yet…

Click here to subscribe and read the rest of this week’s newsletter