A very unscary Halloween on Wall St

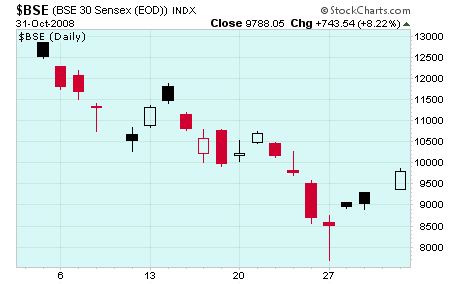

US stocks rose 1.5%, as the market posted its largest weekly gain in over 30 years. The Dow finished the session at 9325 while the S&P closed at 968. Global markets continued their rally earlier in the day, as Indian stocks soared 7%. The BSE Sensex closed at 9788 while the NSE Nifty stood at 2885 at the close of trading. I was clearly mistaken in my expectation for weakness here as the the market has put together several consecutive up days for the first time in several weeks.

Nonetheless, I remain convinced that next week will see another sharp move down as the tense Venus-Saturn-Uranus configuration sends a shock to the markets. The aspect becomes exact on November 4, and as I’ve said previously, it’s very possible that the market may have to react to some unforeseen developments in the US election. While I would not rule out another up day Monday in the US, I do think we are headed down over the next two weeks, probably to a retest of 7773 on the Dow and 7697 on the Sensex.

Posted by Christopher Kevill at 10/31/2008 06:29:00 PM EDT

US stocks slide after Fed lowers 50 pts

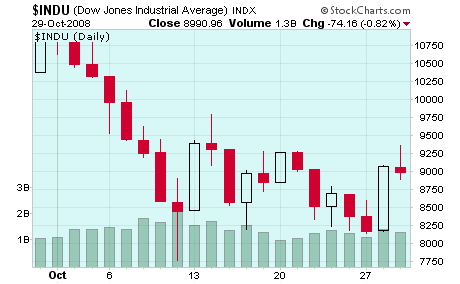

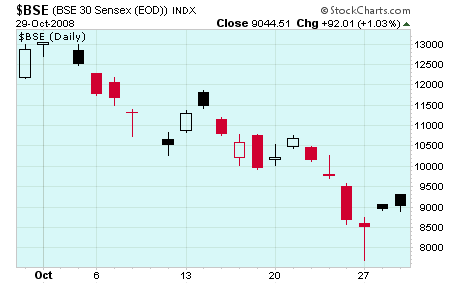

New York closed down 1% after the Fed cut its prime lending rate 50 basis points to 1%. The Dow had been up over 9300 but sold off sharply in the last 15 minutes and ended the day at 8990 while the S&P closed at 930. Indian stocks were up modestly on the day with the Sensex at 9044 and the Nifty at 2697.

I had thought the market might hang on to more of its gains today, but it was not to be as bearishness returned at the close. This sets up a more negative sentiment Thursday and Friday and going into next week. There is a veritable Sword of Damocles hanging over this market as Mars moves under the exact aspect of Saturn in the next few days just as Saturn and Uranus are set to oppose one another early next week with the money planet Venus getting caught exactly in the middle. Look for volatility to increase here and we will likely see 8100-8500 intraday by Friday on the Dow. A retest of 7773 is more likely Monday or Tuesday. The Sensex will likely trade below 8000 on Friday, with closes below 7500 next week.

Stocks surge 11% as credit freeze eases

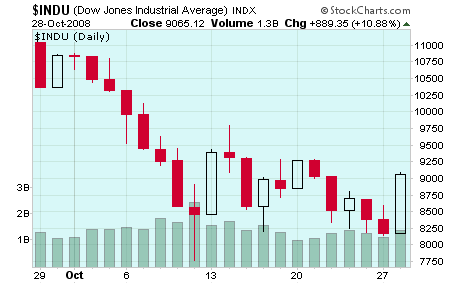

In a stunning and dramatic rally, stocks soared amidst growing signs that the worst of the credit freeze was over. The Dow was up over 800 points and closed at 9065 while the S&P finished at 940. The rally was a continuation of a rally that began overnight in Asia and specifically, Hong Kong, where buyers rushed in to buy up bargains.

I did not foresee this rally, although I was fairly tentative about the market sentiment in advance of tomorrow’s Fed meeting and that that some gains midweek were likely. In my weekly forecast I also noted the possibility of a Tuesday afternoon rally ahead of the Sun-Moon conjunction, although I had no inclination that we would witness such as huge upswing. While I am still cautious about this market, I do think that the strength of this rally should not be underestimated. A retest of the 2003 lows in November seems improbable now, and even a retest of 7773 is going to be a purely speculative play. Tomorrow will likely see another plus day ahead of the meeting and some selling afterwards but likely positive overall. 9500 is possible. But Thursday and Friday still look quite negative to me, so I think the market will once again trade down towards the 8500-9000 range. For those thinking of closing out short positions, that might be the a good opportunity. Monday also seems negative from here, so I would be reluctant to take on any large long positions this week. The market will likely continue to be volatile for another week or two. But on balance I think November will be positive, especially in the second half of the month.

Posted by Christopher Kevill 10/28/2008 06:10:00 PM EDT

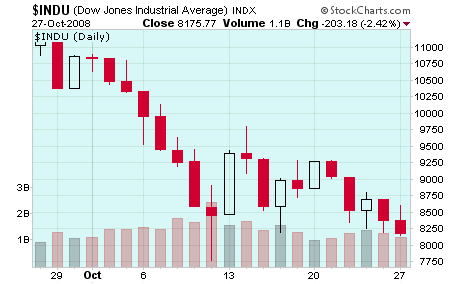

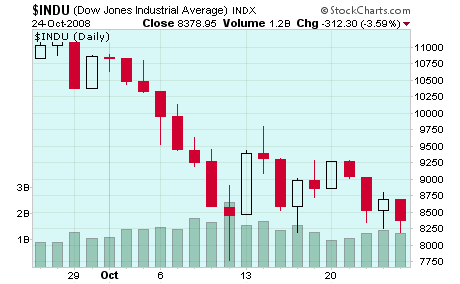

Rally fails; stocks slide 3% at the close

After spending most of the day in positive territory, stocks in New York fell sharply at the close and ended down across the board. The Dow lost 200 points and ended the day at 8175 while the S&P closed at 848. While today’s session did not retest the Oct 10 lows, it was somewhat noteworthy in that it was the lowest close yet. The negative mood followed mostly bearish global trading as Indian markets fell over 2%. The Nifty continued to probe the downside getting as low as 2252 intraday before closing at 2524. The Sensex similarly dipped below 8000 before rallying to finish at 8509.

In the end, my call for a retest today was overstated, although the day did end up negative. I am maintaining my basic position here that a significant retest is imminent and may come as soon as tomorrow, although I am not holding my breath on it. We may well see a close below 8000 and an intraday retest of 7773. I think the retest of the 2002-03 lows may have to wait until Friday or perhaps next week. And indeed, there is a chance they may not come at this time at all. Look for Indian markets to retest their intraday lows by Friday and into next week.

Posted by Christopher Kevill at 10/27/2008 05:45:00 PM EDT

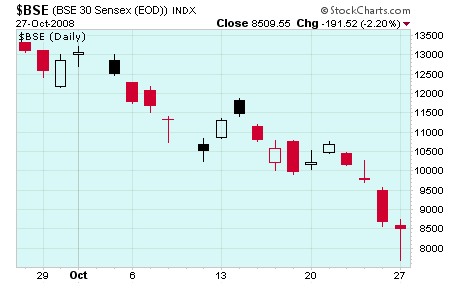

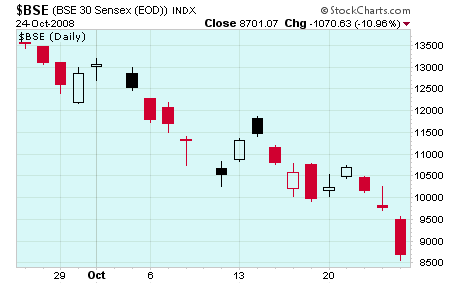

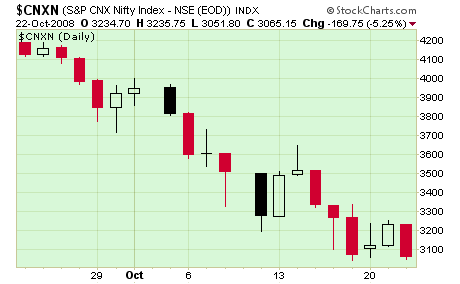

US stocks drop 3% on global recession fears

It was another losing day on Wall St. as stocks probed ever closer to the Oct 10 lows as investors contemplated the grim possibility that the US recession may go global. After falling below 8200 at one point, the Dow closed at 8378 while the S&P ended trading at 876. The New York decline followed an even more negative session in other world markets. In India, the RBI unexpectedly left rates unchanged and the markets sold off precipitously as the Nifty lost 12% and closed at 2584 while the Sensex finished at 8701.

India’s disastrous decline was somewhat foreshadowed in the Mars conjunction to natal Rahu in the NSE chart I had mentioned earlier. While I was calling for a generally day negative across the board, I wasn’t quite prepared for the extent of panic in Indian markets. I still think we’re at least another week from the bottom, but India may have seen the worst of this decline with this 12% loss today. Still with a lot of support near the 2000 level on the Nifty, one wonders if it can go all the way there in the next two weeks. Monday is shaping up to be very negative globally and in the US in particular. I’ll post more details in my weekly forecast.

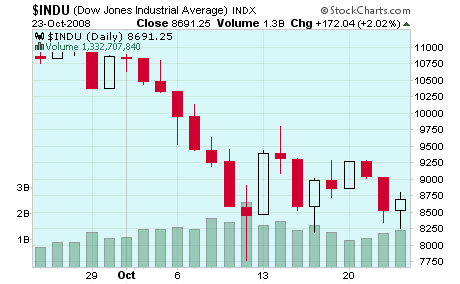

US stocks rally 2% at the close

After yet another mostly bearish day of trading, US stocks rallied near the close as the Dow closed at 8691 while the S&P finished at 908. The optimism borne in New York followed a negative day in Asia as the Nifty closed below 3000 to 2943 and the Sensex likewise broke below another major psychological level of 10,000 and ended the day at 9771.

With the long-awaited up day now behind us, we can look towards tomorrow for an indication of next week’s trends. With Mercury applying towards Rahu’s aspect while Mars simultaneously applies to aspect Rahu, it is hard to make a convincing case that this rally will continue. While I think Monday’s planetary influences are clearly worse, Friday’s also seem somewhat negative.

Posted by Christopher Kevill at 10/23/2008 08:22:00 PM EDT

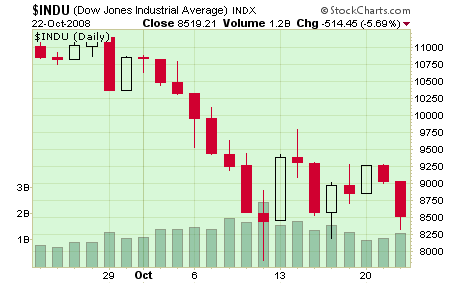

US stocks plunge 6% on corporate earnings outlook

The full-fledged gloom returned to Wall St today as stocks sold off sharply on an increasingly bleak profitability outlook. The Dow closed at 8519 and the S&P ended the session down 6% at 896. The mood in Asia was also negative as the Nifty closed down 5% to 3065 and the Sensex at 10,169.

It seems the market is accelerating its pace for a retest of the Oct 10 lows and will in fact get there by Monday Oct 27. While I had thought we would see more upside this week, the overall trend is more or less in keeping with our expectations. I’m even less certain about tomorrow’s session than I was about today’s (which was incorrect) as there are some divergent indicators both ways. With the Moon moving into aspect with the Sun and Pluto near midday, one might be tempted to say that the morning might be higher, with more selling in the afternoon. But even with the possibility of gains, this is no time to be long. By contrast, Friday and next Monday look more clearly bearish.

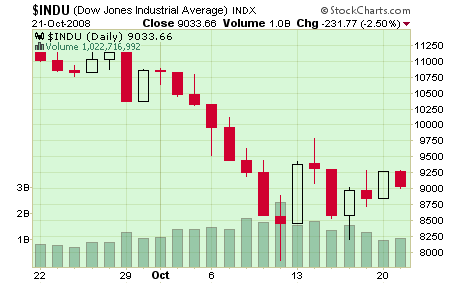

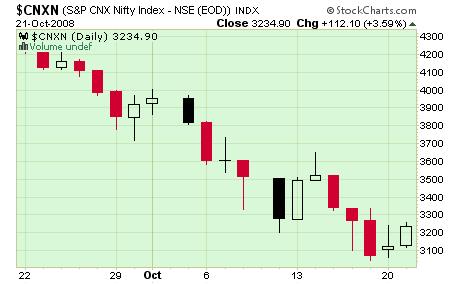

US stocks slide 3% on earnings worries

Stocks in New York dropped today as investors began to chew over some lower earnings forecasts. The Dow closed at 9033 while the S&P finished at 955. Earlier in the day, Asian stocks surged higher as the NSE Nifty gained over 3% and stood as 3234 at the end of trading.

That "negative tinge" I mentioned yesterday completely overwhelmed whatever optimism there was that the banking system was now on more solid footing. I still think we have at least one more up day in the market this week, and Wednesday in the US (Thursday in Asia) is the best bet, as the Moon is in Ashlesha. At this point, Thursday seems like a toss-up.

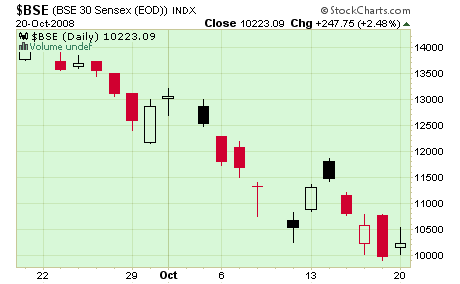

New York rallies over 4%

Stocks rose sharply today on growing confidence that the worst of the banking crisis had passed. The Dow closed up over 400 points and ended at 9265 while the S&P finished the day at 985. In Mumbai, the Nifty added 2% to close at 3122 while the Sensex once again rose above 10,000 and ended the day at 10,223.

While I had thought we might have a big down day here, it seems that the expected midweek rally has arrived early. Tomorrow may have a negative tinge to it, but I’m not sure it will be enough to stop the rally momentum that is taking hold here. So look for more upside is this week, maybe back up to last week’s highs. However, I remain committed to my view that by Friday, we will again be moving down.

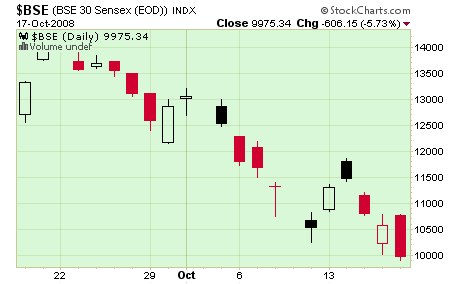

Friday, October 17, 2008

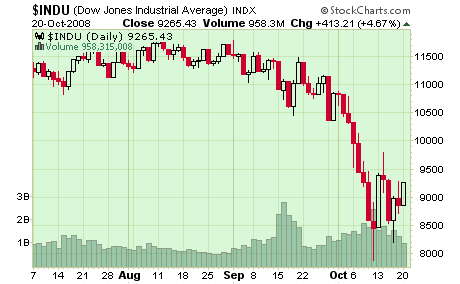

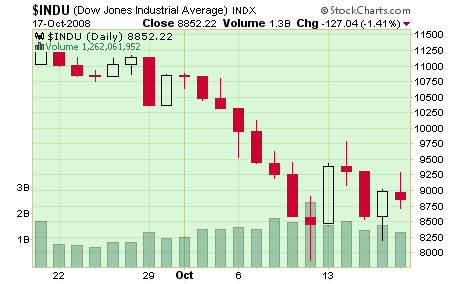

New York stocks fall at the close

It seems that even Warren Buffett can’t save this market. After the billionaire investor (or perhaps philanthropist?) announced he was buying US stocks, the markets valiantly attempted to rally but ended the day down once again. The Dow lost 127 points and ended the day at 8852 while the S&P finished at 940. Indian markets once again got hammered and declined 6% as the Nifty closed at 3074 while the Sensex closed below 10,000 for the first time since June 2006.

Today’s ingress of the Sun into Libra, its sign of debilitation, has certainly not changed investor sentiment. In fact, I would argue it is a sign that sentiment will get worse in the short term, particularly as Mars comes under the aspect of Saturn over the next two weeks. But more immediately, Monday is looking quite negative and we could see a sudden retest of 8000/840 then, or perhaps carrying on into Tuesday.

Posted by Christopher Kevill at 10/17/2008 06:47:00 PM EDT

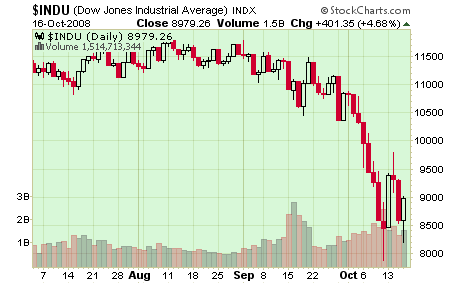

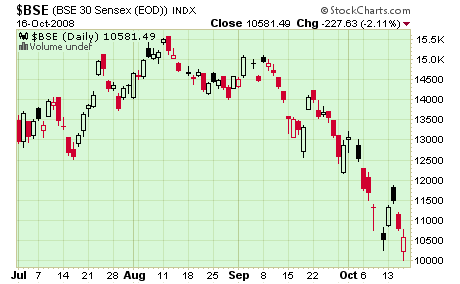

Thursday, October 16, 2008

New York up 4% after late day rally

After a day of huge price swings, US markets finished strongly higher as the Dow closed at 8979 and the S&P at 946. This came on the heels of a generally down day on other world markets as the BSE closed near last week’s lows and ended down 2% at 10,581 and the Nifty at 3269.

Yesterday I had wondered if the Dow might see 9000 today and as luck would have it, I wasn’t far off. But the operative word there is luck. As previously suggested, Asian markets are likely to follow suit Friday as Moon is in its sign of exaltation in aspect to benefic Venus. I would expect a move up to 3400 here. But Friday in the US may be another matter altogether. That’s partially because the Moon-Venus aspect perfects before the markets open so its influence will be diminishing by 9.30. The Sun’s ingress into Libra tomorrow is another possible negative influence since its dispositor Venus is in malefic Scorpio. Overall, I’m not certain but the energy seems more negative here. Monday looks decidedly worse so we may be on track to retest the Oct 10 lows (8000/840) at that time.

Posted by Christopher Kevill at 10/16/2008 05:31:00 PM EDT

_________________

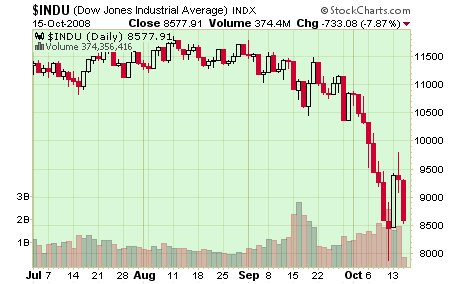

Wednesday, October 15, 2008

US Markets slide 9% on retail worries

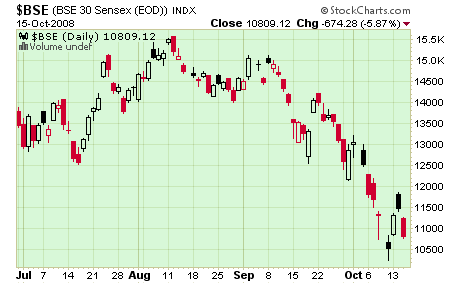

Stocks in New York succumbed once again to the growing realization there will be no quick fix to this economic downturn on the release of some very bad retail numbers. The Dow plunged 733 points and ended at 8577 while the S&P lost 9% and ended the day at 907. Indian stocks also lost ground earlier in the day as the Nifty was down 6% closing at at 3338 while the Sensex finished at 10,809.

The volatility this week has been incredible and has made mincemeat out of my daily predictions. Nonetheless, our overall bearish stance has been borne out by the failure of Monday’s rally to gain a foothold. Yesterday I wondered if Thursday would be the best day for a rally. I think this is all the more likely now in light of today’s drop and the better than expected Ebay earnings posted after the bell. I would not rule out 9000 tomorrow on the Dow. Friday in the US looks less favourable and Monday looks even worse. It is possible we will be retesting the Oct 10 intraday lows sooner than I thought, although next week looks like there may be a two or three day rally off the Monday lows so that might keep us in the 8500-9000 range. As always, I will refine my forecast as time goes on. But overall, I think we’re still on track for a low in the first week of November, possibly between 7500-8000 on the Dow, and perhaps below 3000 on the Nifty, and maybe 9000 on the Sensex.

Posted by Christopher Kevill at 10/15/2088 05:07:00 PM

Tuesday, October 14, 2008

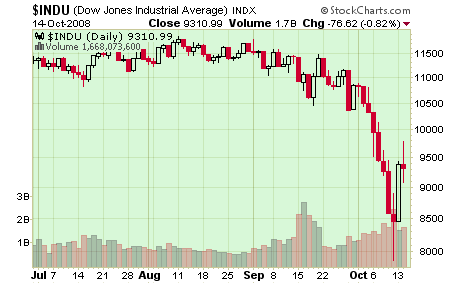

New York fails to hang on to gains; Dow ends down 1%

After a strong opening rally to 9750, the Dow lost ground the rest of the day and closed lower by almost 1%. At the close it stood at 9310 while the S&P ended the day at 998. This pattern echoed similar intraday patterns in other markets. In Mumbai, the Nifty opened sharply higher at 3650 but ultimately failed to sustain the rally and closed slightly up on the day at 3518.

I think there is still a possibility for gains tomorrow and Thursday, although Thursday’s Moon-Jupiter trine looks like a more reliable indicator of a higher close. This will likely translate to a rise on Asian markets on Friday. It’s possible we will again see 9750 at some point, with 10,000 as a genuine, if less likely, outcome. Overall, I think we are within 5% of the top of this rally.

Posted by Christopher Kevill at 10/14/2008 06:10:00 PM

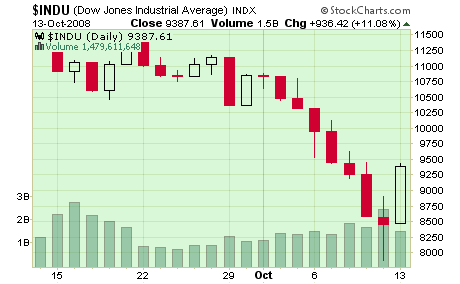

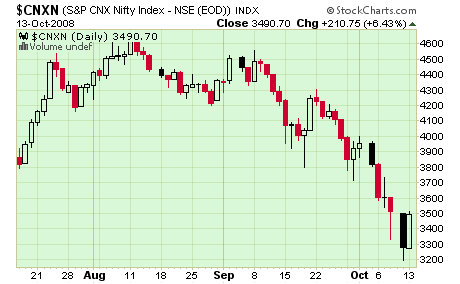

Monday, October 13, 2008

Markets up 11%; Dow has biggest single day point gain in history

New York markets surged today on renewed optimism that further global cooperation between governments and banks could avert disaster and minimize the damage from an imminent recession. The Dow closed up 936 points to 9387 while the S&P rose 11% to end the day at 1003. The rally built upon gains made in other world markets as the Nifty closed up 6% to 3490.

While I expected a rally to occur in the next couple of weeks, this explosive rise caught me totally off guard. I think we will likely see more upside tomorrow but watch for more tentative rallies later in the week with a negative close by Friday. Next week looks more negative than positive, although there will be at least two up days.

So everyone is asking: have we seen the bottom? I would say no. From a technical perspective, the relatively low volume of 1.5 billion shares is a clue that this is not a durable rally. I think this rally may top out at 9500 to 10,000 on the Dow, (perhaps 3800 on the Nifty) but we will be headed down soon enough. Watch for the low to take place in the first week of November. It may well be a retest of the Friday low, although I’m not certain of that. Another possible retest will occur in the first half of December.

Posted by Christopher Kevill at 10/13/2008 06:23:00 PM

_______________

Stocks in freefall; Dow closes below 9000

In the face of a torrent a bad economic news including global bank nationalizations, investors lost hope late this afternoon as markets sold off over 7% in New York. The Dow closed below 9000 for the first time since 2003 and finished the day at a bracing 8579 while the S&P ended trading at 909.

While not quite ‘crashworthy’, this was more or less in keeping with my standing prediction for a large percentage decline (5-10%) for today, October 9th.

I believe there is more downside tomorrow, although my sense is much of the negative planetary energy has already been expressed. It’s possible we will see a further decline to the much-talked about support level of 7500-8000, but I think there will be a lot of buyers at 8000 so we should expect a lot of intraday volatility. Of course, it’s conceivable that the Dow goes below these levels, but it’s not probable and even if they do, they won’t stay there very long.

I think Friday will be the much-sought after capitulation and near term bottom after which we will rise into next week. We are now facing a two month bottoming process where there will be some retesting of the lows we likely make tomorrow. Early November is the first probable retest, and then again in the first two weeks of December.

Wednesday, October 8, 2008

Markets teeter on the edge

For the past several weeks and months, I have been writing about the likelihood of a major decline in the second week of October and so far that prediction has been fulfilled as the Dow has broken decisively below 10,000. However, I had reserved a special place for the end of this week, particularly for October 9th. According to my understanding of the planets, this time window showed the greatest potential for a sell off. The Sun is moving under the influence of Rahu while conjoining the natal Saturn in the USA chart. Tomorrow morning, the Moon conjoins the natal Ketu of the USA chart. Previously I had suggested that a worse case scenario had been 9000. I now think I was being overly conservative in order to avoid seeming alarmist. While I had thought we would be retesting the 2002 lows of 7500-8000 by November, it’s very possible that we might see those levels as soon as tomorrow or Friday. So will this crash actually happen tomorrow? Yes, it could although I acknowledge a margin for error that extends over the weekend to next Tuesday (the US markets are closed Monday). Alternatively, it’s also possible a full blown crash may be averted for a few weeks until November and we may only see another big down day on the order of 5-10%.

Tuesday, October 7, 2008

Markets continue to bleed red; Dow falls below 9500

Indian markets similarly started off in the green on the strength of the RBI rate cut, but succumbed to selling pressure and ended unchanged. It seems that Nifty 3400 may be breached quite soon before any kind of rally. Look for 3000 by November.

After the smoke clears this weekend, I think the market will stabilize from about Oct 15 to 23. This might be enough reason to try to cover some short positions this week. Another move down is likely after that. It seems that we may get to 8000 by November. Wow.

Oil is moving with stocks and closed mostly unchanged at $89. Another move below $85 is in the cards.

As suggested in our forecast, the Euro had a nice bounce today and finished at 1.3612. Any rallies here are potentially lucrative shorting opportunities.

Gold had a good day and closed up 2% at $886. Rallies may be cut short in the days ahead especially with the approaching Sun-Rahu aspect.

Monday, October 6, 2008

World markets slide on recession fears

Gold finally got a boost from this turmoil and closed at $866. I think there may be intermittent rallies to $900 but long positions should be handled with care as gold will decline precipitously very soon. Gold over $900 might be a good short term shorting opportunity.

As predicted, oil continued its downward trend and closed down $7 to $86. My forecast for $80-85 is now looking overly conservative. There is a lot of downside potential to crude over the next few weeks and so I would stay short.

The Euro also continued to move down as it closed at 1.3511. I had thought the bear market in the Euro would take a bit of a breather this week. Let’s see how the rest of the week plays out. I would stay basically short on the Euro over the next 60-90 days at least.

Friday, October 3, 2008

Stocks sell off after bailout bill passes

In my weekly forecast, I had been uneasy about Friday’s action given the position of retrograde Mercury in aspect to Rahu. This expectation was largely borne out given the sharp reversal that occurred. The New York market had been up 3% in advance of the House vote, and ended up over 1% in the red.

Oil declined with stocks while the Euro and gold were little changed.

So another week, another 4% shaved off equities. Now it seems clear that the bailout can no longer save the market. The stage has been set for next week’s possible carnage, which seems to centre around Thursday or Friday. Breaking through 10,000 seems to be a certainty, and it will likely be a lot lower than that. We could be down another 10% before there’s a relief rally.

Thursday, October 2, 2008

The Gloom Descends

Perhaps more important is the flight to the US dollar that is crushing all comers including the Euro, crude and gold. As predicted, the Euro is in free fall here and ended the day barely hanging onto support levels at 1.3809. And as fears of a major slowdown grow, crude oil fell back $5 to $93. Gold was hammered and lost 4% today and closed at $840. Gold is quickly losing its safe haven status now, and the US dollar has reaped the rewards of the current crisis. I believe this trend is likely to continue for the next few months. It seems that my forecast for $1000 gold will not be realized. We might see $900 at the end of next week, but rallies should be treated as exit points and opportunities for going short. This also holds for crude and the Euro.

By the end of the year, we may see gold at $650, the Euro at 1.20 and crude at $70. This is still in keeping with my previous medium range forecast. The only significant revision is that the short term upside potential has largely already been realized.

Wednesday, October 1, 2008

Markets flat in advance of Senate vote

While the bill was widely expected to pass the Senate, the margin was encouraging for nervous investors (74-25) and should push markets higher tomorrow and likely into Friday. I’m still not convinced the rally will extend to the close on Friday, but certainly we should see some decent gains here. Gold may become a great buying opportunity at $850.

As predicted earlier in the week, the Euro has fallen below 1.40 and may go lower. It closed today at 1.3967.

Tuesday, September 30, 2008

Stocks rebound in New York

The extent of these gains were somewhat surprising, but the comeback is largely in keeping with my forecast for a rally later on in the week. The Senate is going to reconvene tomorrow to vote on a revised bill and this should extend the rally well over 11,000. We are in good shape for highs above 11,300 by Thursday, and if all goes well, perhaps even to our original target of 11,700. I am still thinking the terrain may shift Friday in advance of a difficult or even cataclysmic week next week so long positions here need to be handled with care.

Oil came back after Monday’s record sell off and closed above $100. Although I was not specific in calling for yesterday’s precipitous decline, I have forecast a positive week for crude, so let’s see how high it can go in these relief rallies today and tomorrow. $110 may be a stretch, but $105 is very possible.

Not surprisingly, gold slumped back to $886 today as investors breathed a sigh of relief and no longer sought out the safe haven metal. Look for prices to drop further here, perhaps to $850 before recovering.

Mumbai and other Asian markets were surprisingly strong and rose 2% as the Sensex closed at 12,860 and the Nifty at 3921. 4000 on the Nifty is quite likely this week, with an outside chance at 4100, but it is unlikely to hold next week as we move down again.

The Euro plummeted over 3 cents yesterday down to 1.40, well in excess of our target of 1.42. There’s more downside there this week and it may test 1.38 at some point.

Monday, September 29, 2008

Markets plunge on failed bailout vote

Markets in New York fell off a cliff today after the House of Representatives unexpectedly rejected the emergency financial bailout bill. The Dow lost a record 777 points or 7% and closed near its worst levels of the day at 10,365. The S&P lost 9% or 106 points and closed at 1107. This decline confirms my prediction from two weeks ago that the 29th would be very negative, although I had thought the drop might be more like 5%. Over the weekend, when it seemed that the bill would pass, I wondered if my original prediction had been mistaken, as I wrote in my weekly forecast. As it turned out, it underestimated the losses. Not surprisingly, oil fell $11 to $95 as investors worry of a global economic slowdown and gold rose over $22 and closed at $910. Today’s New Moon in Virgo that featured a beleaguered Mercury may be seen as one important indicator for the decline in stocks.

I think tomorrow’s trading will likely be negative but I don’t foresee any huge drop like today’s. In fact, there may be a stabilizing in the afternoon. I still expect some kind of rally perhaps on Wednesday and Thursday. As in my weekly forecast, Friday is looking quite iffy, perhaps due to some bad economic news in the jobs report.

Next week looks even worse, so we may be preparing for a 1000 point drop in the Dow. Even with a rally later this week that might get the market back to 11,000, I think we’ll be under 10,000 with next week’s collapse. 9000 is a worse case scenario by October 10th, although that is a very speculative target.

Monday, September 22, 2008

After the bailout: stocks slump; oil, gold, Euro rally

Gold has resumed its upward direction as it rose to $913 today. We’re on track to hit $1000 by perhaps next Monday, if not before.

Oil also rallied strongly and closed at $120. While I had anticipated gains early in the week, I was not prepared for this meteoric rise. Clearly, the US dollar is going to be pummeled in the near term as fears grow about the increased debt burden of the US government. This will drive up the value of commodities and other currencies. The Euro also moved sharply higher above 1.48 today.

Just as gold will rally in the coming weeks, it seems certain that it will be joined by oil and the Euro. It’s possible we’ll see the old highs of $147 eclipsed in crude while the Euro may once again be headed for 1.60. Please note, this is a significant revision of my weekly forecast. All these gains will not last long, however, as the Fed will likely have to raise interest rates perhaps in November to defend the greenback.

I am expecting a near term high in gold, oil and the Euro (and other currencies) next Monday the 29th. After that, the rally may slow somewhat but it should continue until about October 15-18. After that, I would begin to expect a change in sentiment that could occur in late October, or may be delayed until early November.

Thursday, September 18, 2008

Dow rallies 400 pts on government regulatory plan

This may be the last chance for investors to exit the market above 11,000 since we can expect further deterioration next week and then accelerating declines after that. At this point, I expect we’ll see 10,000 on the Dow by early October and then a sudden crash-like event probably in the second week of October, perhaps near the Columbus Day holiday that takes the Dow to 9000 or below. November’s crash will likely send the Dow towards the retesting of the 2002 lows of 7500.

Gold continues to be the best safe haven in this market turbulence as bullion hit $900 early in the day before the government announcement and subsequent equities rally. It ended the day around $855. As predicted, volatility is the watchword here this week. There will likely be some more good opportunities to buy gold here at these levels, and there is a good chance it can climb back to $1000. Depending on how bad things get, gold could well go significantly higher than that. I’m expecting a big rise in the last days of September as there are a number of very favourable hits with benefic planets in the GLD horoscope. But I think the bulk of the rise on a percentage basis will occur by October 15th. It is important to remember that this explosive rally will be short-lived as gold is likely to drop precipitously in November and after.

Wednesday, September 17, 2008

Gold surges to $868; Stocks fall further

As Wall St continued to operate in panic mode on the heels of the AIG bailout, investors dumped stocks across the board today and sought the safety of short term treasuries, gold and oil. Gold had its biggest one day jump since 1980 as it soared over $80 and closed at $868.

While I had forecast a volatile week and higher prices generally in September, the extent of this incredible rally caught me off guard. I did however forecast gains for the conjunction of transiting Venus to the MC of the GLD chart and that is exactly what is happening today. Clearly, we have entered the much anticipated September rally that will take Gold back above $900. Given where we are now, $900 is an overly conservative target. I think $950 is more realistic target that we will hit in October. I don’t see prices going straight up from here, however, so gold investors wishing to take long positions may get lower entry points over the coming days.

Remember, however, that this gold rally may be quite short-lived. Once equity markets settle down — most likely after a full-blown crash — then gold will quickly sell off. This seems likely in November although possible dates for a top include October 21, or November 4 and December 12.

Monday, September 15, 2008

Dow plunges 500 points as financial turmoil deepens

This is very close to my prediction of two weeks ago in my long term outlook — repeated in last week’s regular weekly forecast — that the markets would fall back to 11,000 and retest previous lows on either the 12th or 15th of September. The central astrological culprit was the trinal aspect of Rahu to Mars which happened to fall on the natal Saturn of the USA chart. Unlike many other configurations which are sometimes open to a lot of interpretation, this seemed like a clearer bearish indicator.

It’s possible we will go lower tomorrow, although I’m not at all certain. It is hard to precisely correlate price magnitude with levels of planetary affliction. We should see some buying later in the week at least, although Friday looks negative. The market looks quite negative for the coming weeks. More significant declines are likely in early October and then again in the first week of November. The November decline looks worst and may be on the order of 10% or more in a single day. There’s a good chance that the November decline will become known as a "crash".

I’m not sure where or when we might see the bottom but anything is possible here, including all the way down to 7500 and the 2002 lows by December. In other words, we may have another 25-30% to go in the short term. This is admittedly a worse case scenario, but the planets are indicating a grim mood in the coming weeks. A best case scenario might be a decline of another 10% — down to 9700. That seems far too optimistic, however. I think the early October decline will put us under 10,000 as it is.

Thursday, September 4, 2008

New York stocks drop 3%

I had thought the these declines would wait until next week, but it seems they’re upon us now. A retesting of the July lows is likely in the coming days. I don’t think we’re headed straight down from here, but a break below 10,500 is very possible in the next two weeks. Prices may stabilize somewhat after that. The next big move down looks like it will occur around Oct 7-9.

Tuesday, September 2, 2008

Euro, Oil and Gold continue sell off

The earliest chance for a meaningful bounce in commodities will likely be next week. I still think there is significant upside here in the Euro, Oil, and Gold but we may have wait a little while longer.

Monday, September 1, 2008

Oil plunges as Gustav passes

We may have to wait for the end of next week for prices to turn upward.

Thursday, August 21, 2008

Oil jumps to $121 on Russia-US tensions

Although both commodities are now much higher than I had expected in my weekly forecast, at least this late week rise was correctly forecast as gains have accelerated from more tentative moves Monday and Tuesday. It seems that the bottom was formed at the end of last week and the trend now will be up at least until September 12. If this rally does come together soon, it will confirm my previous prediction for a late summer commodities rally.

It’s very possible that tomorrow will see a continued rally in commodities against the falling US dollar. I think it’s possible that Oil will again see $132 in the weeks ahead, possibly $140. Gold looks like it will follow suit, although it may not rise as quickly due to some significant chart afflictions I have noted in previous posts. I think $875-900 is a realistic target.

The Euro rose to 1.4885 and is poised to go over 1.50 tomorrow and into next week. This is setting the stage for a final rally in the Euro to 1.55 after which it will fall sharply back down to earth.

Stocks were flat in New York, although they fell earlier in Asia. It seems that a retesting of previous lows is now inevitable with a probability of new lows being set in the coming weeks. I had thought there was a chance to get above 12,000 on the Dow in the near term, but that now seems like wishful thinking. Tomorrow will be interesting.

Tuesday, August 19, 2008

Equities sell off amidst inflation fears

Gold and Oil rose today as they both attempted to form more solid bottoms. While Monday’s decline did not materialize, it’s possible we’ve seen the interim bottom here as the upward momentum should be intact the rest of the week. Friday will be key.

The Euro continued to tread water with more confidence in the neighbourhood of 1.48. The rest of the week should be mostly favourable.

Wednesday, August 13, 2008

Commodities bounce

Tuesday, August 12, 2008

Gold falls below support level

Whatever the logic of the transit analysis might be, there’s no doubt that the GLD ETF chart is showing this price collapse because the natal subperiod lord Mercury is suffering under the aspect from natal Ketu. Ketu will station on this point for another month, so on the surface, this creates more of an uphill climb for Gold. Several weeks ago, I had thought that we’d see a bottom in August and I still think that’s the most likely outcome. I’m still confident the rally will occur, but there may be new lows here below $800, or even $750, and that will make our $900 target look very ambitious indeed. It’s not easy being a yellow metal this month.

Friday, August 8. 2008

Euro collapses to 1.50

With its biggest single day decline in eight years, the Euro lost 3 full cents today and closed at $1.50 as a growing number of investors recognized that the economic slowdown in Europe would keep interest rates stable in the medium term. This plunge further confirms my forecast for a brutal week for the Euro. Oil and Gold were also down sharply as crude ended at $115 and bullion to $864. All three have had an inverse relationship to equities and the U.S. dollar. The Euro and Gold are just 2% above their 280-day moving average and key support levels, while Oil has already broken below it. If the current trend towards the U.S. dollar continues, these key financial indicators may have a long way to fall.

Astrologically, I think we’ve already seen most of the decline for now, so even if the Euro, Oil and Gold are heading lower, it probably won’t be more than 3-5% over the next two or three weeks. After that, I am expecting a rally to recovers perhaps half to two-thirds of previous highs. That would take us back up to 1.53-1.55 for the Euro, the 900-940 range for Gold and $120-125 for Oil.

But the next leg down will likely be larger than this one. If the Euro loses 8-10% here (1.60 to 1.44-1.48), then the November/December decline will be at least double that, say 15-20%. That would take the Euro down to 1.25 by the start of the new year. Oil and Gold will likely follow suit with losses of similar magnitude.

Commodities retreat further, Euro below 1.54

The rally in the U.S. dollar continues this week as the Euro is now trading below 1.54 for the first time since March. Today’s decline comes as ECB President Trichet has confirmed that he is more concerned with weakening growth than inflation and that interest rate bias would be towards lowering rates. This confirms my prediction for this week that the Euro would be in for a rough ride as the transiting Mars aspected both the natal Mercury and Jupiter in the Euro chart. I only wish I had taken the hint that a falling Euro would translate into falling Oil and Gold prices as well this week. It’s not a particularly complex association given they have been moving in unison for months now.

I think the price correlation between Euro, Oil, and Gold will continue until there is a a significant correction that takes these prices closer to their long term moving average. This would be about 1.45 in the Euro, $100 in Oil, and $850 in Gold. They also display substantial inverse correlation to world equity prices.

Gold falls below $900

To almost no one’s surprise, Gold fell further today, closing at $886. I think we’ll see further declines back to $850, if not below.

Oil also fell back to $118. I think it may fall back to $110 before undertaking another rally later in August.

Monday, August 4, 2008

Oil drops below $120; Gold in danger

Oil staged a heavy retreat, however, and touched below $120 finishing around $121. I had expected Oil to do better today, but I still think there’s a good chance it will hold on to these levels for the rest of the week. That said, the downside risk to Oil is clearly greater than any upside movement, so I would be reluctant about taking any new long positions. September will see another bonafide rally once a more sturdy bottom is formed in August.

The Gold decline today to $907 has me re-evaluating my forecast for this week. I think my previous $930 target would now require a miracle. A more likely scenario would be for Gold to keep dropping this week, perhaps below $875. There is a real possibility it will test its 280-day moving average at $850 over the next couple of weeks. The Sun’s movement towards a conjunction with Ketu may therefore be the signal of an end of the current phase of prices above $900.

Another rally will begin starting in the last week of August.

Tuesday, July 29, 2008

Stocks rise in NY

As the US dollar rallied, Oil, Gold, and the Euro all lost ground. I believe there will be a turnaround here which will get us back to $125/930/1.57.

Friday, July 18, 2008

NY recovers; Oil falls below support

As predicted, Mercury’s further drift into Gemini correlated with crude breaking through $132 support this week and closed under $130. Mars was also in an unhelpful position with respect to natal Jupiter. With some hard progressed aspects forming in the coming days, the 30-day outlook looks precarious for oil. It will be prone to sharp declines below $120, and we may possibly see $110 again. While I had previously thought oil would recover in August, I think the rebound may be pushed back to September and October.

Wednesday, July 9, 2008

New York slides

Oil recovered a little bit today but stayed down around $136. I think we’ll see more downside for the balance of the week.

Gold bounced back $5 to close at $928. After a rough Tuesday that saw an intraday as low as $912, prices are still off last week’s levels. Again, I think there is more downside risk here.

Monday, July 7, 2008

The Downward Spiral

Gold ended down, more or less as predicted. Oil also dropped back to $141 and signalled the possible end to this current rally.

Monday, June 30, 2008

NY rally fails

Bombay looked very weak Monday and closed down over 2%. The BSE is vulnerable to very large drops if there are any significant down days in New York, such as may occur tomorrow July 1. The BSE may have more strength Wednesday and Thursday, however as the Moon-Venus-Jupiter aspect perfects on a potentially significant natal point. But that may only put off the inevitable decline under 13k on the Sensex next week.

Tokyo was down only modestly and closed at 13,481. The Nikkei is likely to finish above 13k this week and perhaps closer to break even which would be a victory of sorts. I think most of the bearishness will hit next week.

As predicted, the Euro sold off almost half a cent today and closed at 1.5744. A flat week seems to be the best one can hope for.

Oil and Gold were largely unchanged, although Oil did reach another high this morning hitting above $143. I still think Oil has a ways to go here. I am less certain about Gold.

Thursday, June 26, 2008

NY drops 3% as winter lows retested

The severity of this sell off underscores just how pivotal the coming two weeks will be as Mars applies to Saturn. The S&P now has the all-important 1270 support level in its sights and if we break through that in the coming days, then the market will be in real trouble. I think we have some ways to go on the downside, possibly as much as 10%, which would take the Dow below 10,500 and 1170 on the S&P. Those are worse-case targets though and are little more than guesses. I’m loath to predict Friday’s trading, as things could go either way.

The BSE has managed to stay above 14k so far, but no doubt will sink below tomorrow. It seems I will be off in my forecast of Friday levels. It is going to be vulnerable to steep losses in the coming weeks.

As predicted, the Euro is having a bullish week as the greenback sold off in the wake of the Fed meeting that left rates unchanged. It’s already at the target of 1.57 and tomorrow bodes well.

Oil gained over $5 Thursday and closed at or near a record of $140. This confirms our bullish forecast for Oil for the week. We’ll easily hit $150 next week as Mercury crosses the ascendant of the Futures chart.

In a stunning turnaround, Gold rose over $30 today and hit $915 after being down in the earlier part of the week. It is well within range of our target price of $920. I am expecting prices to stay strong here and it may move higher Friday.

Monday, June 16, 2008

Oil sets record hitting $139

Gold also had a strong day as forecast, although it settled back in the afternoon to close at $886. Let’s see if it goes above $900 tomorrow.

In keeping with the retreating US dollar, the Euro followed commodities higher, closing well above 1.54. This bodes well for our bullish forecast for the week. If anything, the forecast rally may turn out to be too conservative.

Against expectations, stocks in New York were flat. I expect bearish sentiment to rule tomorrow, especially in the afternoon.

The BSE did well Monday. There is now a good chance it will close above 15k for the week. However, the upside remains limited.

Wednesday, June 11, 2008

Oil rallies above $136; Dow falls

The BSE has also been struggling this week so it will be interesting to see how low it can fall. It seems certain to break through 15,000, but it may finally revisit winter lows if the selling develops a head of steam. It’s very possible if the Nifty Futures chart works as advertised. The natal conjunction of Sun and Venus at 27 Taurus is currently under aspect from tr. Rahu while tr. Sun and Venus more or less exactly conjoin their natal positions. There is a lot of energy there for a significant price movement. And given that Tr Rahu is conjunct the natal Uranus opposed by tr Mars, it really does look quite precarious for long positions. This is not to say a sudden rally might also manifest from the Rahu-Sun-Venus configuration, but all things considered, I think the sentiment should be negative, especially for Friday.

I missed the early week sell off in the Euro, but today’s rally has put it in better position for a late week move upwards. Friday is key here since the tr Venus conjoins the natal Moon in the 10th house. By rights, it should be a major rally. This will be a good test of the usefulness of the Euro chart (Jan 1 1999, 00.00).

After coming off Friday’s highs, Oil again rallied today on reports of falling US inventories and closed up $5 to $136. I had forecast continued strength this week and today’s action partially validates that prediction. The tr Sun and Venus are very close to the Ascendant in the US Oil ETF chart so that may be one possible source of the rally. Also they are applying to trine Neptune close to the MC in the futures chart, so if all goes according to plan (which it never does), we may see Oil well over $140 by the end of the week.

Gold had a good day today finally as it closed up $14 to $883. I had predicted the early week sell off from the tr Mars opposing the Gold ETF Moon, although I hadn’t quite allowed for that much of a rout. I still think we have some upside to explore for the rest of the week, although my forecast high of $920 may be overly optimistic.

Friday, June 6, 2008

Oil soars on US dollar weakness

Oil is up again today — over $6 right now, to $134.

I can’t help but think this is part of the rally I forecast last week that would result from the Tr Sun and Venus approaching the Asc of the futures chart. Of course, one unknown was exactly where the ascendant of the Oil futures chart was. The 9.00 am chart has an ascendant of 22 Taurus, which is exactly where Sun and Venus are today. This massive rally yesterday and today would appear to be good confirmation of the this chart.

If we take the 9.20 chart (Asc 27 Taurus), then we could assume that this rally still has a ways to go through next week as the Sun and Venus will continue to apply to the ascendant until Jun 11-12.

If the 9.00 chart is correct, then we might see a pullback early next week. If the 9.20 chart is correct, then the pullback may occur late next week or the week after. Either way, I don’t think this rally will last too much longer.

Posted by Christopher Kevill at 6/02/2008 10:30:00 AM

Monday, June 2, 2008

New York slips

As predicted, New York lost about 1% today as the indexes closed at 12,503/1385. This may have been in part due to the Moon-Saturn square. While there is a good chance for a rally tomorrow and into Wednesday, my conviction isn’t rock solid. I think we’re entering into a potentially difficult period over the next week as Mars applies to the Ketu. The natal Uranus in the 1792 chart sits at 24 Cancer so that may be one possible target for the transiting Mars.

And next week will feature the Sun-Venus (28 Taurus) in tight conjunction squaring the transiting Uranus (28 Aquarius). And remember too that the natal Mars in the 1792 chart sits at 27 Leo. That’s forming a t-square which is almost never favourable. So it’s hard to see the market moving much higher here and the downside risk is considerable. I think it will probably start moving lower before the end of this week, with the bigger losses occurring next week. I believe there is a genuine risk of a major decline here — perhaps as much as 5% so we might see the SPX below 1320 at some point in the next two weeks.

The Euro didn’t quite get the bounce today that I thought it would as it never really got off the ground and finished only marginally higher. It ended up at .5542.

I also predicted Oil would be stronger but that, too, ended up only 0.22 to $127.50. Tomorrow ought to see more on the plus side.

Gold fared somewhat better, so my bullish prediction was partially fulfilled as closed at $897 up 5.50. Let’s see if it can stretch out this rally another day.

Posted by Christopher Kevill at 6/02/2008 05:52:00 PM

Wednesday, May 21, 2008

New York drops 1.5%

Stocks dropped today on the release of the Fed notes which suggested that the current phase of rate cuts are likely over. The Dow closed at 12,601 while the SPX ended at 1390. While I had thought we were due for an up day midweek in advance of the bearish Sun-Saturn square Thursday and Friday, it seems that the pessimism got a head start. I think this is the beginning of a leg down that will last through next week. The Mercury will station squaring Uranus next week (although the markets will be closed for Memorial Day Monday), so this really may be quite a volatile and negative run here. I would not be surprised to see us approach the bottom of recent trading ranges — 11,800/1270, although the Dow has been beaten up more than the SPX so it will be more likely to get there. We may even get into a position of actually re-testing those levels next week. If Friday is really bad (-2%), then the re-test scenario will be more likely.

While tr Venus conjoins the natal Mercury in the 1792 chart, Sun is applying to its degreewise square with Saturn just one degree past the natal Sun in this chart. Happy Birthday, NYSE — I can’t imagine a worse gift than a Sun-Saturn square in a return chart. It bodes very poorly for the year ahead. Also, the Mercury is stationing square Uranus but that is also square the natal 1792 Mars and forms a very volatile t-square. I think May 30 may be the short term bottom.

Wednesday, May 21, 2008

Oil passes $132

As predicted, the speculative frenzy in oil continues as it is currently trading over $132. This confirms my sense that the approaching Mercury station in tight aspect to Rahu is fueling this price spiral. A key additional element is that this stationing Mercury is sitting just a few degrees from the Ascendant of the Oil Futures chart. Last week, I had thought that the Mars square to the Moon-Saturn would force prices down, but it’s clear that this Mercury-Rahu pattern is much stronger. With Mercury still going forward until Monday, prices should continue rising. I would not rule out $140 at this point.

Prices may decline after Monday when Mercury goes retrograde, but even there it’s important to remember that everything else will still be intact. It will still be under the aspect of Rahu for another week, and it will still conjoin the natal ascendant of the futures chart. This suggest that even if the decline happens, it may not last. As a pure guess, I think we could it fall back $10 from whatever high it ends up making this week But I can see that another mini-rally is possible by the second week of June as tr Sun and Venus conjoin the late Taurus ascendant.

All in all, I don’t see oil prices falling back sharply in the coming three weeks. By the second half of June, we may start to see some sanity again. I expect prices to fall gradually back down to earth through July and early August.

Thursday, May 15 2008

NY stocks rise on grand trine

New York is up 1% yesterday on better than expected inflation news. While

the decline I forecast early in the week has yet to make an appearance,

it’s interesting to note that the rally I expected today did come off as

planned. This may be associated with the grand trine of Jupiter (28

Sagittarius), Sun (0 Taurus) and Moon (0 Virgo) where all planets are

120 degrees from each other. I am still expecting a significant pull

back sometime this week.

The moral of this story may be the predominant influence of transiting

patterns over any relevant natal chart configurations.

Tuesday, May 6 2008

Oil above $120

Crude is again above $120 today and climbing. Finding a compelling

explanation for this is difficult, although I suspect it can be linked in some way to the approaching Jupiter station at 28 Sag on Friday near the 8th equal house cusp of the futures chart. This can’t really explain one-day price movements, but it does illuminate a speculative (unearned = 8th house) top.

One possible peak to watch out for will be on Friday when tr Mercury

opposes the natal Jupiter in the futures chart. By most parameters,

Mercury is pratyantardasha (subsubperiod) lord, so this Jupiter

influence ought to give a boost to prices.

After Friday’s station by Jupiter, the separation of this Mercury aspect, and tr Mars aspect to the Moon-Saturn, prices should tumble significantly next week. $110 is possible.

Friday, May 2, 2008

NY holds onto gains

As a potentially bullish indicator, American markets held onto yesterday’s gains as the Dow closed above the critical psychological level of 13,000 and the S&P closed above 1400. Even more importantly, both averages closed above their 200-day moving average which ought to have made investors giddy at the prospect of even higher highs. Today’s job report was much better than forecast as the US economy only lost 20,000 jobs in the past month. For all these positive indicators, however, one gets the sense that the market isn’t brimming with optimism. Trading volumes are down since March and market breadth is not a favourable as it might be if a significant bull run is imminent. In other words, there is good reason to believe that this rise is petering out and bumping up against resistance levels here. As a side note, I would add that Warren Buffet meets with Berkshire-Hathaway investors in Omaha tomorrow. It will be interesting to see if the implied pessimism of the Mercury-Saturn square on Saturday carries over in his message.

While I’ve been mistakenly bearish in the face of the past couple weeks of rising prices, I am maintaining my generally bearish stance. Saturn’s turns direct today and will oppose the S&P Mercury. Jupiter turns retrograde next Friday the 9th which may also change the hitherto bullish market sentiment. Monday May 12th looks particularly volatile on the downside. After the lows are made somewhere between May 15-25, I think we see another meaningful rally that approaches current levels. This will set the stage in mid to late June for a more substantial correction that retests the winter lows.

Wednesday, April 30, 2008

Fed cuts 25 pts

New York ended modestly lower after the Fed cut rates 25 pts today. As predicted, the market did get a little boost leading up the announcement and also shortly after coinciding with the favourable transit of the Moon to the S&P natal Venus. The failure of the market to hold on to these gains by the close sets the stage for what will likely be more downward pressure Thursday and Friday. Friday may see a significant sell off, perhaps on the order of 2%.

Both Bombay and Tokyo both closed marginally lower Tuesday in advance of the Fed meeting. Thursday may be fairly quiet but look for selling to pick up for Friday.

The Euro bounced back a little and closed above 1.56. This was in keeping with my expectation. There’s a good chance for further upward movement Thursday.

Oil fell further today closing at $114. I had wondered if there would be a pause in the decline, but this is proof that we can look forward to a fairly sharp pullback as Mars moves deeper into Cancer. There is a chance for some sort of snapback rally, perhaps on Friday, but this will be short-lived and probably won’t last til the close. $110 is very possible by the end of the week.

As forecast, Gold also fell Tuesday closing at $865. Prices will likely be lower by Friday, perhaps near $850..

Tuesday, April 29, 2008

NY quiet ahead of Fed meeting; US dollar rises

New York edged lower in anticipation of tomorrow’s Fed meeting. The transiting Moon will be at 13 Aquarius at the time of the mid-afternoon announcement, which puts it in the neighbourhood of the S&P Venus in the 10th house. Other things being equal, this is a good placement that might give the market a little boost. And yet, the Mars in the second degree of Cancer aspecting the 1792 Jupiter suggests that any gain will be short-lived. The market may wait until Thursday or Friday to sell off to any extent.

Bombay is coming off a bullish Tuesday that saw the Sensex up 2% to 17,400. Another up day is very possible Wednesday as transiting Sun comes under the helpful influence of the natal Jupiter in the BSE-100 chart. This may push the Sensex over some key moving averages and give sentiment a boost. If the market only closes slightly above these levels, then the bullish signal will remain to be confirmed. A correction is only possible for Friday or perhaps Monday.

As forecast, the Euro headed lower as it closed today at 1.5575. Look for the sell off to continue tomorrow, although prices may firm up for the end of the week.

Oil plunged over $3 Tuesday and closed at $115.62 as my prediction for a major correction was partially borne out. Wednesday doesn’t look obviously bad, so it’s possible that current prices may hold, at least until Thursday or Friday when they will certainly turn lower again.

Gold closed down $18 to $876, as per my bearish prediction. Prices could hold up Wednesday around here, but by Friday, look for lower lows.

Thursday, April 24, 2008

US dollar rebounds

Some good news on durable goods caused the US dollar to rebound on expectations that the Fed was near the end of its easing phase. This put a dent in the speculation that has been fueling the recent rise in the Euro and crude oil. The Euro closed down two full cents to under $1.57. While I had expected a sharp pullback, I thought the decline would not get started until next week. This is useful lesson on the unreliability of exact transit points as tr Venus had yet to conjoin the natal Saturn. I think we will likely see the retracement continue for the next week as tr Mars will aspect the natal Venus. I think there will be rallies in the weeks ahead, but the short term future looks quite bearish. We could be under 1.50 very quickly. I take some solace in the fact the 1.60 forecast was achieved, if only briefly.

Oil sold off as well closing near $116. This decline was also a little premature as Venus still hasn’t quite left Pisces yet. Perhaps the skies are not as neatly divided as one would like. The Sun-Saturn sell off I had forecast came a day later than expected. I don’t see us selling off hugely Friday but a down day is likely. Next week does look more bearish, so we may fall back below $110.

Gold fell back sharply to $890 today mostly on the renewed interest in the US dollar. I had wondered about the possible negative effects of the Mars opposition to Venus at the end of the week. That bearish manifested a day earlier than forecast, however, and may well extend the weakness into tomorrow. I don’t think we’re headed straight down here, but the trend will be mostly negative over the next couple weeks.

US stocks ended up modestly to return to where they started the week. Microsoft’s earnings outlook has sparked some after-hours selling, so we’ll see how negative the market will be Friday.

The Sensex has held on to early gains this week but has been unable to build upon them. I think it will fall back near Monday’s levels.

Tuesday, April 22, 2008

New York sags; Oil climbs higher

New York dropped almost 1% today as the Dow closed at 12,720 and the S&P at 1375. This basically confirms our bearish weekly forecast so far. Let’s see if the down trend continues as the Mars-Jupiter aspect tightens.

The Euro touched above 1.60 for the first time and closed at 1.598. This is in keeping with our expectation. Look for it to close above 1.60 tomorrow or Thursday.

Oil continued its upward climb at it closed above $118, and reached as high as $119 intraday. This also confirms are bullish forecast as Venus continues its transit of Pisces. It will certainly push higher later in the week.

Gold was higher for the second straight day, closing at $920, right in line with my weekly forecast. I am expecting bigger gains as the week goes on, so that is something to watch for.

Saturday, April 19, 2008

Market Review — week of Apr 14-18

On positive earnings news from Google, New York rallied strongly Friday to finish the week at 12,849 on the Dow and 1390 on the S&P. This left our bearish forecast in the dust. I missed the upward move by overestimating the negative influence of Ketu on the transiting Sun and Mercury. Stocks are near some key resistance levels here, so any more upside would be seen as a very bullish breakout move. I think it’s possible we may see some up days here that put us over that 13,000/1400 threshold, but the downside risk is still greater so new gains will likely not hold. Next week features the apparently bearish Mars-Jupiter opposition coming exact so we will have to watch that carefully. A longer lasting rally is more likely to begin in May after the the Sun-Saturn square has occurred and run into early June.

Bombay had a bullish week closing at 16,481. Again, optimism returned despite our analysis to the contrary. One plausible explanation of the upward movement can be seen in the BSE Nifty Futures chart where tr. Venus conjoined the equal 9th house cusp while the natal lagnesh Moon was aspected by tr Sun and Mercury. Both of these are clearly bullish signals and suggests that this chart warrants further consideration as a useful proxy for the BSE.

Tokyo followed the upward trend this week and gained about 1% to close at 13,476. This confirmed our bullish forecast based on the TSE 1949 chart as tr Venus approached the unequal 10th house cusp.

Euro closed Friday at $1.581, down over a cent after touching $1.595 briefly midweek. This also confirmed our negative forecast for the week, although only barely. Our Thursday revised forecast was borne out by Friday’s sell off as the transiting Sun finally combined with the natal 8th house Saturn, albeit a couple of degrees after the fact. There are still a preponderance of bullish factors at work in this chart that should tend to push it higher in the coming weeks, although after May 9th, that climb may be weakened, perhaps mortally.

Oil became a haven for speculators as it powered to new all-time highs, closing at $116.83 on Friday. Our bearish prediction was defied by the strength of transiting bhukti lord Venus exalted in Pisces and transiting the 11th house of gains in the futures chart. My expectation was that the influence of the tr Sun and Mercury over the natal 12th house Mars would take prices down. The fact that this Mars sits in the unequal 11th house suggests that whole sign house placements may demand alternative interpretations from time to time. While Venus’ movement into Aries after the 25th may bring a slowing of recent gains, I think we’ll have to wait for May and Mars’ ingress into Cancer to bring prices down.

Gold closed down $27 to $915. After a surprisingly strong week, at least our revised Wednesday forecast indicated the possibility of a Friday decline with tr Venus coming within range of the aspect from natal Saturn in the futures chart. The medium term factors are still in place for a rally in the next couple of weeks, although I note that the Mars-Jupiter opposition next week will activate the natal Venus in the futures chart. This is likely bullish given Mars’ rulership over the 11th house, but it is not certain.

Wednesday, April 16, 2008

Markets rise on earnings optimism

New York was up 2% today on the basis of good earnings from Intel, as some investors began to believe that the worst was over. While I called for a decline this week, I still think we can look for a significant decline over the next 4 or 5 trading days. My original downside target of 11,750/1270 probably won’t be met here, but look for a 2% down day, most likely early next week.

Closing yesterday at 16,244, Bombay continues to be strong this week. Tr Venus conjoins natal 1875 Rahu tomorrow so that should account for the up day that is in store but beware of gains made with Rahu — they often don’t last. There are still some potentially negative influences such as the Mars conjoining the natal Sun but given the market behaviour so far, it may be that Mars rules good houses in the natal chart, i.e. its conjunction coincides with gains and not losses.

Tokyo is above 13,000 and will likely climb higher as forecast. Tr Venus is approaching the MC as Sun-Mercury activate the powerful 10th house Rahu in the natal chart.

The Euro is a record high of 1.595 today laying waste to my expectation for a pullback as Sun-Mercury conjoined the natal Saturn. Certainly, the Euro is due to continue rising over the next few weeks, but it is overdue for a brief correction here. The fact that tr Mars is squaring the natal Mars only reinforces my belief that it is headed sharply lower day (>1%) at some point this week.

While oil did retreat to $112 in morning trading, it rose past $114 in the afternoon. Our longer term forecast has it going higher over the next few weeks ($120 is likely), so it seems that short term negative transits are manifesting as very temporary pullbacks that do not last through to the close. A few dates to watch out for as possible tops then are: 1) Apr 25 when tr Venus enters Aries which is the 12th house in the Oil futures chart; 2) April 28th when tr Mars enters Cancer and thereby afflicts the Moon-Saturn conjunction in the futures chart; 3) May 4th when tr Rahu begins to separate from tr Neptune, which may have had a bullish influence on the price of crude and; 4) May 9th when Jupiter turns retrograde and begins to move away from the equal 8th house cusp in the futures chart. All these factors may each contribute to the easing of the price once we get into May.

Gold rose again today closing at $948. It is also on track with our medium term forecast to continue rising until the Jupiter station in May. The next chance for a price decline might be Friday, and then again early next week. A pressing question now might be whether or not gold can climb back over $1000 on this current Jupiter rally. Given its ability to shake off some apparently negative transits, I’d say it’s very doable. It will have about two weeks to do it.

Tuesday, April 15, 2008

Commodities continue advance

Oil and Gold show no signs of backing off their recent gains. Oil has hit another all-time high today at $113. This is contrary to my expectations as I thought the Sun-Mercury transit would produce more of a pullback this week. This may still happen since the Sun-Mercury falls under the aspect of natal Ketu tomorrow and Thursday. However, whatever declines occur will be at levels much higher than forecast, perhaps back to $110-112. So while there will be some days of profit taking, it’s clear to me that the bullish mood leading up to the coming Jupiter station on May 9 continues to rule these markets. The next decline in crude is most likely early next week as the tr. Sun opposes the natal Saturn in the futures chart. This will drop prices by 2% or more. This opposition is generally a more difficult aspect than the Sun-Mercury conjunct natal Mars.

As a caveat on my bearish Gold forecast, I had wondered if the tr Mars to natal Saturn conjunction might be too far past exact to move the market down Monday. In light of the modest gains we’ve seen so far this week, that is likely what has happened as the tr Jupiter approaching the natal Venus overwhelmed everything else. I still think we will see significant declines (>2%) over the rest of week, however, as tr Venus falls under the 10th house aspect of the natal Saturn. We should finish below $920 by Friday. I think gold will generally move higher over the next two weeks until Jupiter changes direction but there will be days of significant declines as well.

Friday, April 11, 2008

Market Review – week of April 7 – 11

New York tanked 2% on GE’s disappointing earnings report Friday, as the averages closed at 12,325 and 1332. This was a nice confirmation of last week’s forecast for a finish under 12,400/1340. Presumably, this was a delayed reaction to the Sun-Jupiter and Mercury-Mars squares that perfected Thursday. Given that General Electric is a bellwether for the market and the economy, these bad earnings are the necessary fuel to take us much lower next week as we have been predicting. With one or two more companies underwhelming with earnings, there is a very real chance (50-50) that we could see a re-test of the March lows (11,700/1270). We’re entering a more solidly bearish time over the coming weeks where even larger declines are possible. At the moment, I think a short term bottom might occur in the first or second week of May. I’ll post more of my thoughts on this Sunday.

The BSE continues to defy gravity as it finished the week up on Friday, at a healthy 15,807. Given the NY decline, a Monday drop is certain which will fulfill our now belated forecast.

Tokyo also closed Friday up 378, to finish at 13,323. Like Bombay, this was higher than our forecast. I think Asian markets will be playing catch up on the downside with American markets next week, although Japan will likely be a better performer.

The Euro closed Friday above $1.58. Our forecast had it declining this week, so we were premature. The planetary alignments for next week are decidedly negative in the Euro chart. $1.55 or below is very possible. Aside from some short term moves down, I think we’ll likely see more strength in the Euro until Jupiter turns retrograde on May 9.

Oil finished up at $110, which was above our expected range of $105 -108, but not entirely unexpected. We will see some correction next week.

Gold closed down Friday to close at $927. The unexpected upside here clearly shows the underlying strength of the bull market in gold. Declines are likely next week, maybe to $900 or below, but the Jupiter station in May does look more and more like a medium term turning point.

Thursday, April 10, 2008

Gold revived

While I missed this week’s price rise in Gold, I think I understand it a bit better now. It appears that we’re more likely to see price increases as long as tr Jupiter (27 Sg) is closing in on the natal Venus (29 Sg) of the futures chart. In my forecast last year, I originally believed that a price peak would be likely near the Jupiter station in May, but recent declines had shaken my confidence in that forecast. It seems that the declines occurred while tr Jupiter was moving in between natal Mercury (22 Sg) and natal Venus (29 Sg) and where it had less strength to boost prices.

There will be further price dips, such as Friday and possibly Monday as the Mars contacts the natal Saturn. But as long as the Jupiter is applying to the Venus, I think we will tend to see increases, possibly over $1000. I’ll refine this upward limit in the days ahead, depending on what kind of pullback we see through the weekend. The short term top should occur near the Jupiter station May 9. Once Jupiter turns away from Venus, prices should weaken.

Interestingly, the bearish conjunction of tr Mars to the natal Saturn actually perfects over the weekend so that might also reduce the downside somewhat so the price may bottom out well above $900. Next week we should see the gains return.

Tuesday, April 8, 2008

That gentle sinking feeling

Worldwide markets slipped back Tuesday after Monday’s relative strength. New York ended down about 0.5% closing at 12,576/1365. We should see continued downward momentum Wednesday, but some upward intraday movement is still possible.

Bombay saw some profit taking after Monday’s unexpected rise as the Sensex closed down 169 pts to 15,587. I expect more significant movement on the downside Wednesday, maybe to 15,000.

Tokyo fell back 1.5% to 13,250. Expect more of the same Wednesday, although 13,000 resistance may hold.

Against our expectations, the Euro is holding fast to $1.57 after Tuesday’s trading. The negative pressure should increase as the week goes on, although the selling may be fairly modest and focused on Thursday’s trading.

Oil was rock solid today holding onto Monday’s gain to close up a bit at $108.86. This confirms my weekly forecast for rising prices in the early part of the week. There will likely be some pullback as we go on this week.

Gold dropped back $9 to $918 Tuesday after a strong Monday. I think most of the momentum will be down this week starting Wednesday as tr Moon conjoins the natal Ketu. We are on target to close under $900 for the week.

Friday, April 4, 2008

Stocks finish flat/ Market Review — week of Mar 31- Apr 4

Stocks in NY ended the day flat to close up for the week with the Dow at 12,606 and the S&P at 1370. While we thought the market might show more strength Friday, this was largely in keeping with our weekly forecast, although we closed a little higher than expected.

Tokyo closed down modestly on Friday. Our call to close higher than 13k on the Nikkei was correct as the index finished at 13,293. Bombay closed down Friday which went against expectation and closed at 15,343. I underestimated the bearish importance of the transit Sun conjunction with the natal Rahu in the BSE 1875 chart. The BSE did much poorer than expected this week and this bodes poorly for next week as well and beyond. There is some real downside potential here in the coming weeks.

The Euro finished strong as predicted as it closed at 1.573, up half a cent. Unfortunately, our forecast for a gain this week did not come to pass as we only managed to return to the Monday open. This reflects the growing strength of the US dollar generally. Next week may be the last chance to hit $1.60 for a while, and I’m thinking it may not happen, since the week after next looks very bearish.

We missed the our revised Friday forecast on Oil however, as it rose $2 to finish at $106. Our weekly forecast did have crude rising, so getting the direction right is some consolation. Next week will likely see Oil trend downwards.

Gold finished higher by $3 to end the day at $913. We missed the big sell off Monday so our weekly forecast was far too optimistic. I expect the weakness to continue next week, especially by Friday.

Thursday, April 3, 2008

Commodities firm up

Not much movement in New York today, as the markets closed up slightly. My guess was for a mostly flat day and that’s what we got. Transiting Moon conjoins Venus in Pisces in the 11th house of the S&P chart tomorrow so there will be some bullish sentiment out there supporting the market. We could see a a significant up day (>1%) if the market is up on the open. I will be watching the effects of the Pisces ingress of Moon shortly after 10. If it’s up already by then, then it will likely move higher by the close.

Tokyo investors look like they are taking some profits in early Friday trading. We should still finish above 13k on the Nikkei for the week, however. The BSE closed mostly flat Thursday at 15, 832. The market opens with the Moon in exact trine to the natal Sun in the 1875 chart. I would look for a gain Friday.

The Euro was pretty solid at 1.566, but did not move higher at all. Tomorrow should be a bigger up day as the Moon moves towards the natal Jupiter. Let’s see if we can hit $1.58 again.

Oil held firm near $104 as we thought it might. I think we should see some retreat in oil on Friday, especially in the afternoon EDT. If the negative trend is established early before the Moon moves into sidereal Pisces (at 10 a.m), then we may drop below $102, perhaps well below. If the open isn’t too bad, then the decline will be more modest.

As predicted, Gold made a small gain to $908. I think it’s due for another decline however as the transiting Sun comes under the square aspect from natal Saturn in the futures chart. If this aspect really kicks in, we could be back under $900 by the close.

Wednesday, April 2, 2008

Oil and gold bounce back

Stocks in NY finished slightly lower fulfilling the downside bias we expected with the Moon-Rahu conjunction at the open. I’m not sure about tomorrow — I can’t find a definitive trend. Another flat day is possible. By contrast, Friday looks more solidly bullish.

Tokyo closed above 13,100 yesterday as we forecast. I think it will add to recent gains Thursday, and possibly Friday also. 13,500 by the end of the week is within reach.

The BSE also gained about 1% yesterday to close at 15,750, but this rise was much less than on other markets. This is what I had wondered about with the tr Venus falling under the Mars aspect. The gains were, indeed, less than expected in the wake of New York’s big 3.5% gain the previous day. I think it will see only a mild price move Thursday, possibly on the up side. Bombay is headed for a sharp drop early next week however with the Mars coming to the natal 1875 Mercury, which will activate the nodes as well. Could be 5% on the downside.

The Euro stabilized as forecast, and even managed a 0.007 gain. This should continue through to Friday.

Oil and Gold came back after yesterday’s sell off as we thought they might. Gold came back nicely to $900, while Oil exceeded our expectations by rising to $104.78. Oil should continue to move up, although much less strongly than today. Gold may hold steady or rise a bit.

Tuesday, April 1, 2008

Confidence returns

New York stocks jumped over 3% today as investors began to feel that the worst of the sub-prime crisis is over. The Dow finished up 391 to 12,654 and the S&P closed up 47 to 1370. This rise was not unexpected, particularly in light of yesterday’s modest up day that broke the negative sentiment from last week and the Sun-Mars square. I think we will see at least one more up day this week, possibly two. I think we will move above the 12,750/1380 resistance level and even 13,000/1400 is in reach. Tomorrow opens with the Moon conjunct Rahu so trading should be hectic. There should be a downside bias.

Logic suggests that Bombay ought to follow NY up tomorrow, and yet I see that tr Venus falls under the aspect of natal Mars in the 1875 BSE chart. This introduces some bearishness into the mix that may take hold in the afternoon. Hard to imagine it pushing closing prices lower, but perhaps gains will be less than expected (<4%) Tokyo is up over 13,000 in early trading Wednesday, as per our forecast. Look for more strength through the week.

Like oil and gold, the Euro backed off recent highs and sold off 2 cents back under $1.56. I think it will rise towards the end of the week, although tomorrow may see some treading of water near these levels. $1.58 is looking pretty far away right now.