- Rally likely to continue in the early week, unlikely to retest January highs

- Markets will resume downward trend towards 2008 lows by late February, early March

- Gold to continue rally, possibly to $1000 by Feb 20

- Crude oil to strengthen this week

This week we will likely see the rally continue in the early part of the week although some weakness later on may erase some of the gains. With the stimulus package expected to pass the Senate by Wednesday, this is the most likely scenario. So even with some late week weakness, we could finish higher overall. Monday’s lunar eclipse takes place right at the start of trading at 9.38 a.m. and may increase the volumes and the size of the price swings. As eclipses go, it looks somewhat challenging given the close harmonic aspect between the Sun and Moon and malefic Saturn. But since the influence of eclipses can last several weeks, it does not mean that the market will begin to fall immediately. The Sun moves into Aquarius Thursday and then conjoins Neptune early on Friday. These may indicate a shift in sentiment that will presage the market falling next week.

This week we will likely see the rally continue in the early part of the week although some weakness later on may erase some of the gains. With the stimulus package expected to pass the Senate by Wednesday, this is the most likely scenario. So even with some late week weakness, we could finish higher overall. Monday’s lunar eclipse takes place right at the start of trading at 9.38 a.m. and may increase the volumes and the size of the price swings. As eclipses go, it looks somewhat challenging given the close harmonic aspect between the Sun and Moon and malefic Saturn. But since the influence of eclipses can last several weeks, it does not mean that the market will begin to fall immediately. The Sun moves into Aquarius Thursday and then conjoins Neptune early on Friday. These may indicate a shift in sentiment that will presage the market falling next week.

If the rally does continue this week, we will likely remain trapped in a fairly narrow trading range here. While 8600/900 is very possible here, I don’t foresee a run all the way up to SPX 940 or 9000 on the Dow. Next week looks more bearish as the Sun moves deeper into Aquarius and in opposition to the Saturn while Mars conjoins Jupiter and Rahu. With the approach of the Venus retrograde cycle on March 6, I am maintaining a bearish bias for the time being. We can look forward to a significant low around February 27, with further major lows around March 23 and April 10. At this point, I am unsure which one will mark the bottom for the first half of 2009, although I lean towards the later dates given that the Venus retrograde cycle begins March 6. After April 10, the market will likely move higher in a more sustainable rally.

Trading Outlook: With the rally likely extending into this week, investors may wish to take short positions perhaps around midweek. From a longer term perspective, the lows set in the coming weeks will be good opportunities to go long until the summer. Given the uncertainty about which one will be the bottom, investors may consider scaling into positions gradually over the next two months. In that sense, the notion of "buying on the dips" may not be far off the mark.

Mumbai saw a modest decline last week after a retesting of the 2750 support level finally gave way to Friday’s rally which had the Nifty closing at 2843 and the Sensex at 9300. While I had been generally bearish in my outlook, Friday’s rally was surprising given the tense Venus-Pluto aspect that followed so closely after the Saturn-Uranus opposition on Thursday. As difficult as the latter aspect is, it may require a stronger trigger than was available last week in the form of the transiting Moon. The Mars aspect to Saturn at the end of February is another trigger candidate that will be strong enough to release the bearish energy in the Saturn-Uranus opposition. Friday’s rally was likely the result of a combination of factors such as the Jupiter-Rahu conjunction and the large number of planets with strong sublords. Venus was its own sublord on Friday (and it is currently exalted) while Jupiter and Mercury were both in the sub of Rahu. Although Rahu is a troublesome planet in itself, its close conjunction with Jupiter currently imbues it will consider bullish energy.

We can expect Friday’s optimism to continue into this week as exalted Mars moves closer to the Jupiter-Rahu conjunction. In addition, Jupiter will form a harmonic aspect with the ascendant in the NSE chart and this will give a further boost to prices. But with the Sun approaching a conjunction with Neptune on Thursday and Mercury moving to the malefic 8th house of the Nifty natal chart, there will be a build up of negative energy by week’s end. Still, there may be enough positive influence there to push the market towards January highs. It’s unlikely the Nifty could hit 3150, but 3000 is possible here as is 10,000 on the Sensex. The late week action looks more solidly negative with the Sun-Neptune conjunction in the first degree of Aquarius so by Friday the Nifty could be in the 2850-2950 range.

We can expect Friday’s optimism to continue into this week as exalted Mars moves closer to the Jupiter-Rahu conjunction. In addition, Jupiter will form a harmonic aspect with the ascendant in the NSE chart and this will give a further boost to prices. But with the Sun approaching a conjunction with Neptune on Thursday and Mercury moving to the malefic 8th house of the Nifty natal chart, there will be a build up of negative energy by week’s end. Still, there may be enough positive influence there to push the market towards January highs. It’s unlikely the Nifty could hit 3150, but 3000 is possible here as is 10,000 on the Sensex. The late week action looks more solidly negative with the Sun-Neptune conjunction in the first degree of Aquarius so by Friday the Nifty could be in the 2850-2950 range.

At this point, I am still calling for a significant low on or near February 27. This should be lower than Nifty 2700 and will likely be a serious retest of the October lows. There will be a rally attempt in early March that will run into the Venus retrograde cycle that begins March 6. Look for a possible top to that rally near March 10. The next important low should be near March 23, followed by a third and perhaps final trough around April 10. All three of these lows should be below 2850, although I am unsure which one will be lowest and will form the bottom for the first half of 2009. I hope to develop a clearer picture of these relative levels in forthcoming newsletters.

Trading Outlook: Since we are expecting significant lows in the coming weeks, rallies above current levels will be attractive shorting opportunities, particularly at key resistance levels including 2950 and 3150 on the Nifty. More cautious investors may wish to wait until the momentum has turned negative before taking positions. Investors wishing to go long may want to scale into positions near the probable lows.

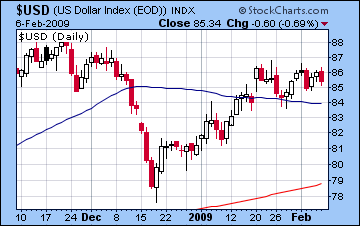

The US dollar slipped a bit last week, mostly due losses incurred Friday on the reawakening of optimism for equities that reduced the dollar’s safe haven appeal. We can expect the dollar to fall further this week as Venus conjoins Ketu in the dollar natal chart. This negative dollar trend is also reflected in the fact that Mercury will transit the natal Venus in the Euro chart. The Euro strength will be greatest Monday and Tuesday when this aspect is closest and that should be enough to push it past 1.30. After that, Mercury will fall under the natal Saturn, so some significant pullbacks are likely back under 1.30 perhaps back to current levels by week’s end. The dollar should be a beneficiary of the decline in equities towards the end of February and we should see the index over 90. Meanwhile the Rupee put up some modest gains last week as it rebounded from trading below 49 to finish around 48.5. It should continue to move closer to 48 early in the week before easing off by Friday perhaps ending near or slightly above current levels. The recent stability in the Rupee is likely to be disturbed at the end of the month and we could see it more decisively past 49 and perhaps even 50. With more trouble ahead for equities, the US dollar will remain strong against most other currencies at least until early March. This strength can be seen in the USDX chart where transiting Jupiter will aspect the natal Mars and simultaneously sit on the equal 2nd house cusp. The 2nd house, it will be recalled, represents wealth and therefore this is a very bullish placement.

The US dollar slipped a bit last week, mostly due losses incurred Friday on the reawakening of optimism for equities that reduced the dollar’s safe haven appeal. We can expect the dollar to fall further this week as Venus conjoins Ketu in the dollar natal chart. This negative dollar trend is also reflected in the fact that Mercury will transit the natal Venus in the Euro chart. The Euro strength will be greatest Monday and Tuesday when this aspect is closest and that should be enough to push it past 1.30. After that, Mercury will fall under the natal Saturn, so some significant pullbacks are likely back under 1.30 perhaps back to current levels by week’s end. The dollar should be a beneficiary of the decline in equities towards the end of February and we should see the index over 90. Meanwhile the Rupee put up some modest gains last week as it rebounded from trading below 49 to finish around 48.5. It should continue to move closer to 48 early in the week before easing off by Friday perhaps ending near or slightly above current levels. The recent stability in the Rupee is likely to be disturbed at the end of the month and we could see it more decisively past 49 and perhaps even 50. With more trouble ahead for equities, the US dollar will remain strong against most other currencies at least until early March. This strength can be seen in the USDX chart where transiting Jupiter will aspect the natal Mars and simultaneously sit on the equal 2nd house cusp. The 2nd house, it will be recalled, represents wealth and therefore this is a very bullish placement.

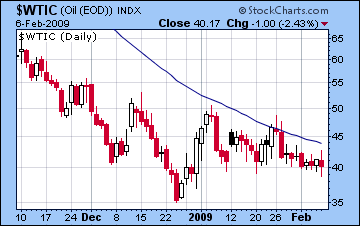

Reports of increasing supplies pushed crude oil lower last week as it closed barely above $40. The inability of crude to rally much above its lows is a good indicator of the power of stationary Ketu (South Node) and its exact aspect to the the Sun (15 Pisces) in the Futures chart. We could see crude rally this week as transiting Venus approaches the natal Sun and comes under the helpful aspect of natal Jupiter. Given that Venus is exalted here and slowing down, it is more powerful than normal, so there is a chance for a significant boost, perhaps above $45. While crude is in an extended bottoming phase here with lows between $30 and $40, the outlook for the rest of year is very bullish indeed. The Jupiter-Neptune conjunction in June occurs around 3 degrees of Aquarius and this will be very close to the Midheaven (10th house cusp) in the Futures chart and will simultaneously be in aspect to the natal Rahu. This ought to be an indicator for a significant improvement in crude at that time, perhaps to the $70-80 level. With transiting Venus crossing the ascendant of the Futures chart in late July, that may well mark the high for crude. Crude may become weaker in the second half of the year, however, as Jupiter leaves this supportive position. With the Moon subperiod beginning in late April, crude will be vulnerable to price declines when benefic transits are absent. The Moon’s natal conjunction with Saturn may be a burden on its subperiod that runs from April 2009 to August 2010. After that, the Mars subperiod begins and that may indicate even lower prices as it is placed in the 12th house and is closely aspected by malefic Ketu. Given these longer term influences, it seems unlikely that we will see crude over $100 anytime soon, or if we do, it will not be for long.

Reports of increasing supplies pushed crude oil lower last week as it closed barely above $40. The inability of crude to rally much above its lows is a good indicator of the power of stationary Ketu (South Node) and its exact aspect to the the Sun (15 Pisces) in the Futures chart. We could see crude rally this week as transiting Venus approaches the natal Sun and comes under the helpful aspect of natal Jupiter. Given that Venus is exalted here and slowing down, it is more powerful than normal, so there is a chance for a significant boost, perhaps above $45. While crude is in an extended bottoming phase here with lows between $30 and $40, the outlook for the rest of year is very bullish indeed. The Jupiter-Neptune conjunction in June occurs around 3 degrees of Aquarius and this will be very close to the Midheaven (10th house cusp) in the Futures chart and will simultaneously be in aspect to the natal Rahu. This ought to be an indicator for a significant improvement in crude at that time, perhaps to the $70-80 level. With transiting Venus crossing the ascendant of the Futures chart in late July, that may well mark the high for crude. Crude may become weaker in the second half of the year, however, as Jupiter leaves this supportive position. With the Moon subperiod beginning in late April, crude will be vulnerable to price declines when benefic transits are absent. The Moon’s natal conjunction with Saturn may be a burden on its subperiod that runs from April 2009 to August 2010. After that, the Mars subperiod begins and that may indicate even lower prices as it is placed in the 12th house and is closely aspected by malefic Ketu. Given these longer term influences, it seems unlikely that we will see crude over $100 anytime soon, or if we do, it will not be for long.

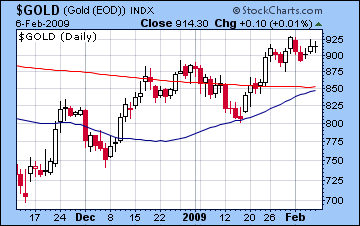

As US equities rallied last week, gold took a breather from its recent rally and closed Friday at $914, down less than 2% from the previous week. The retreat was not entirely unexpected given transiting Mars’ aspect to the nodes in the GLD chart. With the equity rally likely to extend into this week at least a few more days, gold may be susceptible to declines, particularly as transiting Mercury will oppose the natal Saturn. The bullishness should return by Thursday at the latest as the transiting Moon conjoins the natal Jupiter in aspect with Venus. A possible interim top in gold may occur near Feb 20 when Venus, Jupiter, and Rahu will all be in aspect to the natal Jupiter. Looking ahead, the Jupiter station conjunct Neptune in June appears to coincide with a significant rally in gold as Jupiter will be very close to the natal Venus in the GLD chart, which is itself just a couple degrees away from the Midheaven (10th house cusp). It is hard to imagine how the May-June period will be anything other than bullish for gold. After that time, however, the dominant planetary influence may be transiting Ketu which will be hitting several important points in the GLD chart from about July to September. Given Ketu’s malefic energy, this would seem to describe a significant decline in the price of gold over the late summer period. I will examine the probable price impact of these longer term transits in forthcoming issues.

As US equities rallied last week, gold took a breather from its recent rally and closed Friday at $914, down less than 2% from the previous week. The retreat was not entirely unexpected given transiting Mars’ aspect to the nodes in the GLD chart. With the equity rally likely to extend into this week at least a few more days, gold may be susceptible to declines, particularly as transiting Mercury will oppose the natal Saturn. The bullishness should return by Thursday at the latest as the transiting Moon conjoins the natal Jupiter in aspect with Venus. A possible interim top in gold may occur near Feb 20 when Venus, Jupiter, and Rahu will all be in aspect to the natal Jupiter. Looking ahead, the Jupiter station conjunct Neptune in June appears to coincide with a significant rally in gold as Jupiter will be very close to the natal Venus in the GLD chart, which is itself just a couple degrees away from the Midheaven (10th house cusp). It is hard to imagine how the May-June period will be anything other than bullish for gold. After that time, however, the dominant planetary influence may be transiting Ketu which will be hitting several important points in the GLD chart from about July to September. Given Ketu’s malefic energy, this would seem to describe a significant decline in the price of gold over the late summer period. I will examine the probable price impact of these longer term transits in forthcoming issues.