- Early week declines likely; Dow 7600/SPX 800; Nifty 3050/Sensex 9800

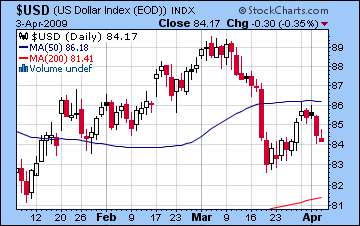

- Dollar likely to resume strength

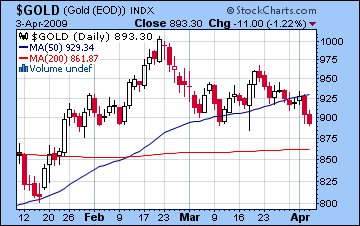

- Gold slipping further towards $850

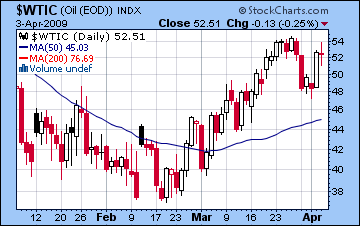

- Crude oil likely to fall back below $48

- Early week declines likely; Dow 7600/SPX 800; Nifty 3050/Sensex 9800

- Dollar likely to resume strength

- Gold slipping further towards $850

- Crude oil likely to fall back below $48

And so it seems most likely that we will see a break in the up trend in this holiday shortened trading week. Besides the Mars-Saturn aspect, I should also point out another potentially bearish indicator. Uranus, the planet of shock and sudden energy, changes signs this weekend as it enters sidereal Pisces according to the Lahiri ayanamsha. This sign change occurs every seven years and has been correlated with significant world events and major stock market declines. Most famously perhaps was the entry of Uranus into Sagittarius on October 17, 1987. This preceded by just two days the biggest single day decline in US history. The next ingress occurred on February 6, 1994 when Uranus entered Capricorn. This came just two days after world stock markets had a major down day of 5-8%. At the time, this was the 8th largest point loss for the DJIA. Of course, this planetary measurement doesn’t always produce a large decline, (as it didn’t in January 2002, for example, when stocks dropped only 2%), but there is enough of a partial correlation there to take note of it and be aware of the possibilities, especially given the presence of a more explicitly malefic pattern in the Mars-Saturn aspect. The releasing of this unpredictable Uranian energy may amplify market sentiment. Could it push markets up further? It’s conceivable, but I think there are too many other negatives out there for this to happen. It’s significant that the Uranus ingress into Pisces will occur in a wide opposition aspect with Saturn with Mars closing in fast. This is additional evidence that the ingress may produce more negative energy. I think Monday to Wednesday are most negative, with a one-day 5% decline very much in the cards. Monday will see the Moon conjoin Saturn opposite Mars, so this alignment may well produce a negative result. Tuesday may see some rebound as the Moon opposes the Venus-Uranus conjunction, especially in the afternoon. Wednesday seems negative again, as the Moon, Sun, Saturn and Chiron are all parallel by declination. Thursday may see a stronger recovery as the Sun, Mars and Jupiter are all in close aspect. It is also possible that this favourable alignment may push stocks higher as early as Wednesday, perhaps in the afternoon. It seems likely that the most bullish day of the week will be Thursday. So depending on how low we go early on, I think the week could finish somewhere around 7600-7800/800-820.

And so it seems most likely that we will see a break in the up trend in this holiday shortened trading week. Besides the Mars-Saturn aspect, I should also point out another potentially bearish indicator. Uranus, the planet of shock and sudden energy, changes signs this weekend as it enters sidereal Pisces according to the Lahiri ayanamsha. This sign change occurs every seven years and has been correlated with significant world events and major stock market declines. Most famously perhaps was the entry of Uranus into Sagittarius on October 17, 1987. This preceded by just two days the biggest single day decline in US history. The next ingress occurred on February 6, 1994 when Uranus entered Capricorn. This came just two days after world stock markets had a major down day of 5-8%. At the time, this was the 8th largest point loss for the DJIA. Of course, this planetary measurement doesn’t always produce a large decline, (as it didn’t in January 2002, for example, when stocks dropped only 2%), but there is enough of a partial correlation there to take note of it and be aware of the possibilities, especially given the presence of a more explicitly malefic pattern in the Mars-Saturn aspect. The releasing of this unpredictable Uranian energy may amplify market sentiment. Could it push markets up further? It’s conceivable, but I think there are too many other negatives out there for this to happen. It’s significant that the Uranus ingress into Pisces will occur in a wide opposition aspect with Saturn with Mars closing in fast. This is additional evidence that the ingress may produce more negative energy. I think Monday to Wednesday are most negative, with a one-day 5% decline very much in the cards. Monday will see the Moon conjoin Saturn opposite Mars, so this alignment may well produce a negative result. Tuesday may see some rebound as the Moon opposes the Venus-Uranus conjunction, especially in the afternoon. Wednesday seems negative again, as the Moon, Sun, Saturn and Chiron are all parallel by declination. Thursday may see a stronger recovery as the Sun, Mars and Jupiter are all in close aspect. It is also possible that this favourable alignment may push stocks higher as early as Wednesday, perhaps in the afternoon. It seems likely that the most bullish day of the week will be Thursday. So depending on how low we go early on, I think the week could finish somewhere around 7600-7800/800-820.

With the markets now standing about 25% above the March 6 lows, it seems increasingly likely that those lows will hold. I had previously thought that the market would decline in the late March-early April time frame but that negative energy has been displaced, presumably by the oncoming conjunction of Jupiter and Neptune. I have previously noted that the March 24 New Moon contained a very notable Ketu influence on several planets. I wondered if this would likely produce large price swings in both directions given Ketu’s often disruptive and unpredictable energies. So far, most of the movement we have seen has been to the upside, although many technical indicators now show an overbought condition. Perhaps this extreme optimism is in keeping with Ketu’s penchant for creating illusions. It seems more likely now that much of April will see a more negative bias to stocks as the Ketu influence reverses polarity. If we see lower prices this week as forecast, I would expect more weakness in the early part of next week (April 13-14) and then strength midweek and into Friday (April 15-17). This will likely fail to match the highs we set last week, but it may come close. After that, it looks mostly down for April 20-24 with a possible tradeable bottom occuring in the early part of the week of April 27 – May 1. I think that is the most likely scenario, although if we see a big Uranian-fueled decline this week, then it’s possible that the lows this week will be as low as we are going to go. I don’t think that will happen, but it’s conceivable. At this point, the latter part of the month looks more bearish.

Trading Outlook: Given the massive rally in the past four weeks, it’s become very hard to short this market. Nonetheless, there is good reason to consider the short trade this week, assuming there is enough time to do so Monday before any major pullback occurs. Investors seeking to build long positions may wait until we see a good decline this week. Having said that, the more likely scenario would suggest that lower prices are coming in late April. As always, taking positions in stages is perhaps the best approach.

Stocks in Mumbai rallied for the fourth consecutive week as investors were encouraged by the new Japanese stimulus plans and the prospects for a coordinated global recovery arising from the G20 meeting. Overcoming a significant decline Monday, stocks ended 3% higher on the week as the Sensex closed at 10,348 and the Nifty at 3211. While I did expect some gains for midweek on the Venus-Jupiter aspect, I underestimated their scale and hence my bearish forecast was proven wrong. The early week decline was largely in keeping with expectations given the Sun-Mercury conjunction and their entry into Revati. I also suggested the possibility that the bulk of the anticipated down move from the Mars-Saturn aspect may, in fact, be delayed until this week. This is precisely what may be unfolding starting on Monday.

We can expect most of the negative sentiment attached to the Mars-Saturn aspect to manifest this week as markets are likely to correct, perhaps substantially. An additional factor is that Uranus, the planet of sudden change and explosive energy changes signs over the weekend as it enters sidereal Pisces according to the Lahiri ayanamsha. When Uranus changes signs every seven years, it can correlate with significant world events and stock market declines. For example, on October 17, 1987 Uranus entered Sagittarius and just two days later global markets experienced their worst one-day decline in history. The next Uranus ingress occurred on February 6, 1994 when it entered Capricorn. Two days before that, markets fell between 5-8%. Of course, this correlation isn’t perfect as there are many instances where it did not coincide with a large decline. But it is important to be aware of the possibilities in this situation, so investors should be aware of the downside potential. It may be that there is enough surrounding negative planetary energy that the Uranus ingress could amplify the the price swing. Saturn is in a wide opposition aspect to Uranus and transiting Mars is fast approaching. These twin malefic influences on Uranus increase the chances that a negative market outcome is likely this week. The early part of the week seems more bearish, as Monday sees the Moon conjoin Saturn in Leo opposite Mars. Tuesday has a chance at some kind of bounce, but Wednesday may again see stocks fall as there is a declinational parallel involving Moon, Sun, and Saturn. At the same time, there is a potentially bullish pattern of the Moon-Venus-Uranus so that could be interpreted either way. Thursday seems more positive as a partial aspect forms involving Sun, Mars, and Jupiter. Thursday seems to be the most positive day of the week. A possible target here would be 3050/9800, although I would not be surprised to see the Nifty trading below 3000 at some point this week or early next week.

We can expect most of the negative sentiment attached to the Mars-Saturn aspect to manifest this week as markets are likely to correct, perhaps substantially. An additional factor is that Uranus, the planet of sudden change and explosive energy changes signs over the weekend as it enters sidereal Pisces according to the Lahiri ayanamsha. When Uranus changes signs every seven years, it can correlate with significant world events and stock market declines. For example, on October 17, 1987 Uranus entered Sagittarius and just two days later global markets experienced their worst one-day decline in history. The next Uranus ingress occurred on February 6, 1994 when it entered Capricorn. Two days before that, markets fell between 5-8%. Of course, this correlation isn’t perfect as there are many instances where it did not coincide with a large decline. But it is important to be aware of the possibilities in this situation, so investors should be aware of the downside potential. It may be that there is enough surrounding negative planetary energy that the Uranus ingress could amplify the the price swing. Saturn is in a wide opposition aspect to Uranus and transiting Mars is fast approaching. These twin malefic influences on Uranus increase the chances that a negative market outcome is likely this week. The early part of the week seems more bearish, as Monday sees the Moon conjoin Saturn in Leo opposite Mars. Tuesday has a chance at some kind of bounce, but Wednesday may again see stocks fall as there is a declinational parallel involving Moon, Sun, and Saturn. At the same time, there is a potentially bullish pattern of the Moon-Venus-Uranus so that could be interpreted either way. Thursday seems more positive as a partial aspect forms involving Sun, Mars, and Jupiter. Thursday seems to be the most positive day of the week. A possible target here would be 3050/9800, although I would not be surprised to see the Nifty trading below 3000 at some point this week or early next week.

Looking further ahead, I think the correction may extend into early next week, either Monday or Tuesday (April 13-14). But after that, the market should rally again and perhaps retest last week’s highs. Much depends on how low we go this week and whether or not the Uranus factor kicks in and takes the market down hard. If it does, then the rally may only come back to 3100 before heading lower into the second half of April. These late April lows are likely to be lower than what we see this week, but that is not certain.

Trading Outlook: This never-ending rally has made shorting a particularly dangerous enterprise. Nonetheless, the presence of a variety of negative factors make a decline more likely this week, especially early on. Investors seeking to establish long positions may wait for significant declines before scaling in. Given the uncertainty about the lows, it may be prudent to take positions in stages.

With the rally continuing in stocks, the US dollar came under pressure last week as the USDX fell back to 84. I thought the dollar would fare better ahead the probable sell off in stocks. Alas that did not occur, as the Sun-Venus conjunction in partial aspect to the natal Jupiter had no supportive effect. The dollar situation is a bit of a puzzle this week, as there are few obvious bullish indicators which ought to be present if we get a retreat in stocks. Moreover, the Mars-Saturn opposition aspect occurs across the 4th and 10th house cusps on the natal chart and this is ordinarily not a positive influence. However, the Sun does form a favourable trine aspect with the ascendant and natal Uranus, so one can make a plausible case for a rise. The Euro chart looks worse, so there is an inferential case to be made for dollar strength. The late week looks more negative as transiting Venus is in aspect with natal Saturn. Overall, I think 86 is possible this week. April still looks generally bullish for the dollar, but next week could be bearish.

With the rally continuing in stocks, the US dollar came under pressure last week as the USDX fell back to 84. I thought the dollar would fare better ahead the probable sell off in stocks. Alas that did not occur, as the Sun-Venus conjunction in partial aspect to the natal Jupiter had no supportive effect. The dollar situation is a bit of a puzzle this week, as there are few obvious bullish indicators which ought to be present if we get a retreat in stocks. Moreover, the Mars-Saturn opposition aspect occurs across the 4th and 10th house cusps on the natal chart and this is ordinarily not a positive influence. However, the Sun does form a favourable trine aspect with the ascendant and natal Uranus, so one can make a plausible case for a rise. The Euro chart looks worse, so there is an inferential case to be made for dollar strength. The late week looks more negative as transiting Venus is in aspect with natal Saturn. Overall, I think 86 is possible this week. April still looks generally bullish for the dollar, but next week could be bearish.

The Euro bounced back after Monday’s decline to 1.315 and finished very strong just below 1.35. I was too bearish in my forecast for the Euro last week, although I was correct in thinking that the lows would not occur at the end of the week. It seems the strength came from the Moon transiting the 10th and 11th houses in the Euro chart. This week Mercury moves into conjunction with natal Saturn, a very bearish signal. Also Mars will aspect its natal place, and together this should produce a significant move back down towards 1.31. Some recovery by Thursday is likely, however, so the Euro may finish closer to 1.33-1.34. The Indian Rupee pushed lower last week closing below 50 for the first time since February. Look for it to rise above 50 again, perhaps as high as 51.

The recent rally in crude remains more or less intact. After a sharp sell off early last week, crude rebounded strongly and closed unchanged on the week near $52. I made a more bearish forecast, although I wondered if we would see more declines delayed until this week as the Mars-Saturn aspect came exact. Monday’s decline to $48 remains something of a mystery, given the relatively favourable placement of both the Sun and Mercury in the Futures chart. One possible explanation may lie in the USO chart where Mars conjoined the natal Uranus while Venus conjoined the natal Rahu.

The recent rally in crude remains more or less intact. After a sharp sell off early last week, crude rebounded strongly and closed unchanged on the week near $52. I made a more bearish forecast, although I wondered if we would see more declines delayed until this week as the Mars-Saturn aspect came exact. Monday’s decline to $48 remains something of a mystery, given the relatively favourable placement of both the Sun and Mercury in the Futures chart. One possible explanation may lie in the USO chart where Mars conjoined the natal Uranus while Venus conjoined the natal Rahu.

Nonetheless, the high volatility in this market will continue this week as we should see crude pull back to $48 and likely back to $45 as transiting Mercury conjoins natal Mars in the Futures chart. Some rebound is probable at the end of the week, but I don’t think it will climb back to its current levels. Watch for more retreat early next week on the 13th and possibly the 14th as transiting Mars conjoins natal Mercury in the Oil ETF chart. A spike up afterwards is very likely. I expect weakness to continue as transiting Ketu approaches the natal Saturn in the USO chart and conjoins it on April 27. The rally after that may be very strong.

Gold continued its retreat last week as it fell 3% and closed at $893. Despite the favourable Sun-Mercury conjunction in close aspect to natal Jupiter in the GLD chart, gold could only manage a feeble $5 rise earlier in the week. This is an indication that gold is weakening here and we will likely see lower prices over the next week. I had forecast some decline late in the week or early this week, but the extent of the negative sentiment on gold arrived sooner and was deeper than expected.

Gold continued its retreat last week as it fell 3% and closed at $893. Despite the favourable Sun-Mercury conjunction in close aspect to natal Jupiter in the GLD chart, gold could only manage a feeble $5 rise earlier in the week. This is an indication that gold is weakening here and we will likely see lower prices over the next week. I had forecast some decline late in the week or early this week, but the extent of the negative sentiment on gold arrived sooner and was deeper than expected.

We could see it approach $850 fairly quickly here as the transiting Sun falls under the aspect of the natal Saturn in the Futures chart on Monday. At the same time, Mercury aspects natal Venus in the GLD chart, so that may offset declines then. Tuesday may be more solidly bearish as Mercury moves under Saturn’s aspect. April looks mostly negative for gold, so $800-850 is not out of the question. Next week may see some relief as Venus will come to station on the 4th house cusp of the GLD chart so some bounce is possible then. Gold’s fortunes should improve more substantially in the last week of April when we will likely see a sharp rally into May.