(9 November 2025) Stocks fell sharply last week as worsening consumer sentiment data signaled economic slowing and reignited recession worries. Among the worst hit sectors was technology as investors may be starting to take a more skeptical view of elevated AI stock valuations. The ongoing US government shutdown only added to the uncertainty as some passenger flights were canceled as a result of the shortage of air traffic controllers.

(9 November 2025) Stocks fell sharply last week as worsening consumer sentiment data signaled economic slowing and reignited recession worries. Among the worst hit sectors was technology as investors may be starting to take a more skeptical view of elevated AI stock valuations. The ongoing US government shutdown only added to the uncertainty as some passenger flights were canceled as a result of the shortage of air traffic controllers.

The decline was broadly in keeping with expectations for a pullback given the bearish influence of the Mars-Uranus opposition and the upcoming Jupiter-Saturn trine aspect. Thursday’s significant decline in particular highlighted the catalyzing effects of the Moon as it exactly conjoined Uranus and opposed Mars.

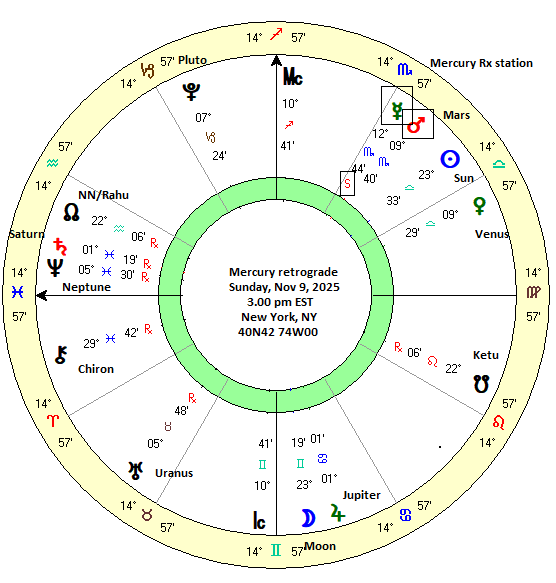

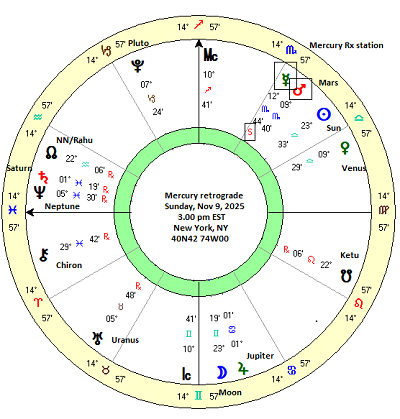

The next potential market mover could be this Sunday’s Mercury retrograde (Rx) station. Mercury will begin its backward journey through the sky on November 9 and will resume its normal forward motion on November 29. Mercury retrograde has a reputation for bringing disorder and disruption, although in my view its bark is usually worse than its bite. In terms of financial markets, Mercury retrograde is seen as a bearish influence, especially around the time of the retrograde and direct stations when Mercury slows down to a fraction of its normal speed.

Mercury Rx: a trend reversal pivot?

However, my previous studies of Mercury retrograde suggest it is not as bearish as many people believe. While there is a slight negative correlation, it does not seem to be large enough to be the basis of a viable trading strategy. On the other hand, there is more robust evidence to suggest that the Mercury retrograde station can act as a pivot whereby prevailing price trends are subject to reversals. Out of these various reversal scenarios, the strongest evidence was for the bearish reversal in which prices tended to fall after the retrograde station but only if they had been trending higher in the days leading up to the retrograde station.

We should note that our current circumstance does not resemble that bearish reversal scenario. Stocks have already trended lower since their October 29 high.as the S&P 500 has fallen about 3% to Friday’s close of 6728. Could Sunday’s Mercury retrograde station actually act as a bullish pivot in which the prevailing down trend reverses higher? It’s possible but the evidence for such a bullish reversal is quite weak. My previous study showed very little upside following the retrograde station where stocks had fallen by more than 1% in the 6 days prior to the station.

I attempted to replicate the current market situation by using a 2% decline threshold for sorting previous Mercury retrograde cases from my original study back in March. However, there was also scant evidence for a bullish reversal thesis as the table below suggests. The first four columns show price changes before the retrograde station across various intervals. The first column shows the average price decline in the 15 days before the retrograde station was 3.89%. The median wasn’t far off at -3.40%. (N.B. These are not averages for all the Mercury retrograde stations but only for the cases that had a decline of more than 2% in the 6 or 8 days before the station.). If there was a tendency for markets to reverse higher after the retrograde station then the intervals on the right-hand columns (“0dr 4dr”, 0dr 6dr” 0dr 8dr”, etc) should show positive outcomes.

While they are more positive than the preceding intervals, they are not strongly positive. The 6-day interval following the Rx station (“0dr 6dr”) had an average of -0.67% and a median of -0.35%. The percent of positive results has increased to 52% but this is more or less what chance would expect anyway. The entire 20 to 24-day retrograde period in these cases is still a bit negative as seen in the last column on the right (“0dr 0dd” = the day of the Rx station until the day of the direct station). The average for this subset of negative cases was -0.65% while the median was -0.29%. While there is a moderating of the downside after the retrograde station, there isn’t much evidence for a bullish reversal afterwards. This is further illustrated in the cumulative chart below that shows the price trend through the entire retrograde cycle starting at 15 days before the Rx station(“-15dr”), through to the direct station 20-24 days later (0dd”), and then 15 days after the direct station (“15dd”). The initial decline before the Rx station is quite evident, but prices generally don’t recover much after that.

A second variable: Mars conjunct Mercury retrograde

But we know that all Mercury retrogrades are not created equal. Their market effects also depend on other planetary alignments during the retrograde cycle. This is one reason why there is not a strong average effect across all Mercury retrogrades. Whether or not they are bullish or bearish also depends on if Mercury is aligned with a bullish or bearish planet. As it happens, this week upcoming will see Mercury retrograde conjoin Mars. On Nov 9 when Mercury turns retrograde, it will be three degrees away from an exact conjunction with Mars. Mercury will then reverse its direction and form an exact conjunction with Mars on Wednesday, November 12.

Since Mars is a natural malefic, this pairing with Mercury carries some theoretical downside risk. And yet, the conjunction is often considered a less problematic aspect on the whole than the opposition or the square. So what can we expect from this week’s Mercury’s conjunction with Mars?

To answer that question, I compiled a dataset of all the previous times when Mercury stationed retrograde while in a conjunction with Mars. A 5 degree maximum orb was used in order to more closely approximate the current set up where Mercury and Mars are just 3 degrees apart. These criteria yielded 46 cases going back to 1896 and included both retrograde and direct Mercury stations. Closing prices on the Dow Jones Industrial Average (DJIA) were recorded at various intervals before and after the Mercury station. They are shown on the table below.

However, a look at the summary statistics table below suggests very little, if any, net effects. The longer intervals such as the 30-day interval starting from 15 days before the station until 15 days after (“-15d 15d”) were modestly positive (average = 0.53%; median = 1.29%) but not wildly out of line from the 0.43% expected value based on a 5.2% average annual return for the years 1896 to 2019. Most of the shorter intervals were also positive. However, we should note that the shorter intervals 3 days before and 3 days after were slightly negative, suggesting a short-lived bearish effect around the day of the Mercury station. While negative, no intervals reached the threshold of statistical significance (p<0.05). The cumulative price chart tells the same story of a fairly neutral to positive effect that follows the upward sloping line of expected values, albeit with a slight dip around the “0d” marker denoting the day of the Mercury station.

Mercury conjunct Mars: Mercury Rx stations only

But if we divide the sample into retrograde stations and direct stations, we see a more pronounced effect. Since our immediate concern is the Nov 9 Mercury retrograde station, let’s take a closer look at retrograde stations only (n=25) when they were conjunct Mars. The summary statistics table below reveals somewhat more negative outcomes across different intervals although the longer intervals are still generally positive. However, we should note a stronger bearish influence in the right hand columns for the shorter intervals.

In fact, two of these reached statistical significance: the 6-day interval (“-3d 3d”) that straddled the Rx station and the “0d 3d” interval which was the change in prices from the day of the Rx station to 3 days afterwards. This was not a huge effect — just -0.64 and -0.38% respectively on average — but the relatively low standard deviation suggests it was a fairly consistent negative outcome for that interval. Indeed, 17 out of 25 cases (68%) yielded negative outcomes for the 6-day interval from 3 days before the station until 3 days after. (“-3d 3d”) The cumulative price tracking chart reflects this clear negative tendency around the time of the Rx station at “0d” and “3d”.

Mercury Rx station conjunct Mars — applying only

We can refine out sample further by separating the Mercury-Mars conjunction into applying conjunctions and separating conjunctions. An applying conjunction occurs when two planets are moving towards each other whereas a separating conjunction occurs when they are moving apart. Since the Mercury-Mars conjunction this Wednesday (Nov 12) will be an applying conjunction after the Nov 9 Rx station, a smaller sample of 19 cases was compiled which were also applying conjunctions following the Mercury Rx station.

The summary statistics table and trend chart below suggests a similar neutral to positive pattern but with a somewhat deeper dip immediately after the Mercury retrograde station. This makes sense since retrograde Mercury will apply to its conjunction with Mars in the 3-5 days following its station. This result offers supporting evidence for the notion that the Mercury-Mars conjunction is bearish for stocks with 14 cases out of a total of 19 being negative, although the average decline is less than 1% during that 3-day period.

Conclusion

This study suggests that the Mercury retrograde station becomes somewhat more bearish when in close proximity to Mars. However, the negative effect is quite modest and only lasts a few days and dissipates once the Mercury-Mars conjunction begins to separate. Nonetheless, the effect has a fairly high probability (>70%) as reflected by its statistical significance.below the key threshold of p<0.05.

However, this study found little support for the trend reversal thesis following the Mercury retrograde station. Based on previous declines that preceded the Mercury retrograde station, prices only experienced a fairly normal mean reversion. Thus, the Mercury retrograde station did not act as a clear pivot whereby a bearish price trend would suddenly turn bullish. Prices generally moderated in the days following the Rx station to a point where at least the declines usually did not get significantly worse.

In light of the recent pullback in US stocks, the Mercury retrograde station does not offer strong evidence for a bullish reversal. That said, it seems more likely that further downside may be fairly limited.

Implications for this week

Based on the historical evidence, this week’s Mercury-Mars conjunction may exert a bearish influence. The most concentrated period of bearish influence lasts 3 days after the Rx station and would take us to Wednesday, Nov 12. After that, odds for further downside diminish substantially. Despite the probable negative effect of the Mercury-Mars conjunction, a rebound is still possible this week.

And we should recall also that we are still well within the most effective window of the bearish Jupiter-Saturn alignment as the120-degree trine aspect is closest on Nov 17. Research shows that the period that precedes its exact alignment is more vulnerable to downside. No doubt some of the recent decline is directly related to the effects of this upcoming alignment. But we cannot rule out further downside during the time leading up to Nov 17.

Disclaimer: Not intended as investment advice. For educational purposes only.