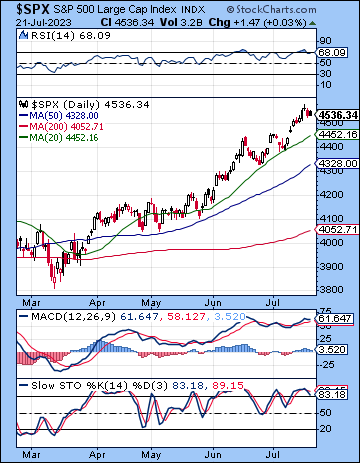

(23 July 2023) Stocks were mixed last week as the dollar rebounded in advance of this week’s FOMC meeting. The S&P 500 added 30 points on the week to 4536 while the Nasdaq-100 fell by 1% to 15,425. Other indexes were positive, however, as the Russell 2000, the Dow and the New York Composite all finished higher. This mixed outcome was not unexpected as I thought the first half of the week had some upside potential on the Venus alignment while the late week was vulnerable to declines on the Mars-Saturn opposition. This outcome more or less came to pass although the early week gains were somewhat larger than expected while the late week selling was quite modest.

(23 July 2023) Stocks were mixed last week as the dollar rebounded in advance of this week’s FOMC meeting. The S&P 500 added 30 points on the week to 4536 while the Nasdaq-100 fell by 1% to 15,425. Other indexes were positive, however, as the Russell 2000, the Dow and the New York Composite all finished higher. This mixed outcome was not unexpected as I thought the first half of the week had some upside potential on the Venus alignment while the late week was vulnerable to declines on the Mars-Saturn opposition. This outcome more or less came to pass although the early week gains were somewhat larger than expected while the late week selling was quite modest.

All eyes are on the Fed this week as Chair Powell will likely attempt to maintain his resolutely hawkish stance despite sharply declining inflation data. With a 25 basis point hike already priced in, markets will be watching Powell’s forward guidance in light of the obviously diminishing inflation threat. With 3% headline inflation now apparently signaling the ‘all clear’, core inflation is still 4.8% and could easily tick higher again if oil prices were to rise. The 30% decline in oil over the past year is one of the main reasons why inflation has fallen. Part of the decline can be explained in the normalization of supply after the Ukraine invasion but another major factor is the Biden administration’s huge draw from the Strategic Petroleum Reserve. While Biden may continue to tap into these reserves to keep oil prices down heading into an election year in 2024, the fact remains that any sudden increase in oil prices are likely to have a significant impact on inflation. This may be one legitimate reason why the Fed will continue to argue against any rate cuts until 2024. Even if the stock market is focused on the bullish soft landing narrative, the bond market seems more accepting of the hawkish message as the 2-year yield ended the week higher at 4.82%, less than 20 basis points from its recent high. If Powell delivers hawkish comments, a move back above 5% would likely be bad news for stocks. Stocks would be in a better position to rally only if bond yields don’t move much after the FOMC or indeed drift lower.

The planetary outlook is mixed. This week will be the first test of the Venus retrograde thesis. If there is going to be a major trend change from up to down, it needs to happen this week. The late week selling in megatech was a good start but bears need some follow-through here in order to get the ball rolling…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: DonkeyHotey