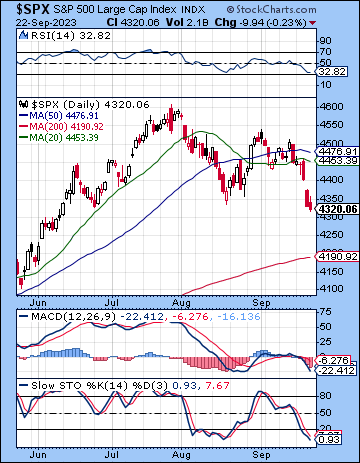

(24 September 2023) US stocks sold off last week as the Fed disappointed markets by reiterating its commitment to keep rates higher for longer. The S&P 500 fell 3% on the week to 4320 while the Nasdaq-100 finished at 14,701. This bearish outcome was in keeping with expectations given the exact Mars aspects to Jupiter and Saturn and the ongoing Saturn-Pluto-Uranus-Chiron alignment.

(24 September 2023) US stocks sold off last week as the Fed disappointed markets by reiterating its commitment to keep rates higher for longer. The S&P 500 fell 3% on the week to 4320 while the Nasdaq-100 finished at 14,701. This bearish outcome was in keeping with expectations given the exact Mars aspects to Jupiter and Saturn and the ongoing Saturn-Pluto-Uranus-Chiron alignment.

The Fed’s latest dot plot dashed hopes for a quick pivot on rates with further hikes still possible and now only two cuts planned for 2024. With the funds rate likely staying at or above 5% through most of next year, credit is likely to stay tight and should begin to undermine growth and earnings forecasts in the coming weeks. This new sobering reality was reflected in the new highs in bond yields as the 2-year hit 5.12% while the 10-year ended the week at 4.44%. While the rise in the short end of the curve was less surprising given the possibility of another hike this year, the rise at the long end is more worrying. If rates are going to remain elevated in order to achieve the Fed’s stated inflation target of 2%, then one would think that recession risks should be rising which would tend to take longer dated yields lower. One reason may be on continuing strength in the labor market as initial jobless claims actually ticked lower last week at 201K. The other reason for the rising yield at the long end is that long-dated Treasuries are simply finding fewer buyers, possibly as a result of growing US indebtedness and the risk of another credit downgrade. If 10-year yields continue to rise, the Fed may be forced to step in once again and either begin Yield Curve Control (YCC) or purchase bonds in yet another program of quantitative easing (QE). Perhaps the only quick way that 10-year yields can reverse their up trend is for a risk-off event, such as March’s bank failure episode or some geopolitical development. Otherwise, bond bulls will have to wait for economic data to begin to show more obvious signs of deterioration.

The planetary outlook leans bearish in the near term. Last week’s decline aptly fulfilled some of the bearish Mars energy from a series of late September and early October aspects. With the bullish Venus-Jupiter square (exact Sep 17) now out of the way, the path has been seemingly opened for more malefic influences to manifest…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Christine Puccio