(16 November 2025) After a volatile week, US stocks finished largely unchanged as investors considered the possibility that the Fed may not cut rates at its December meeting. Financial markets appear to be in a holding pattern at the moment just below their recent highs amid signs that early AI enthusiasm may be fading as corporate layoffs start to mount.

(16 November 2025) After a volatile week, US stocks finished largely unchanged as investors considered the possibility that the Fed may not cut rates at its December meeting. Financial markets appear to be in a holding pattern at the moment just below their recent highs amid signs that early AI enthusiasm may be fading as corporate layoffs start to mount.

Last week’s volatility was not surprising given the bearish influence of Wednesday’s conjunction of Mercury retrograde with Mars. Since our study showed only a modest and short-lived effect, the neutral weekly outcome was within general expectations.

There are several planetary alignments to note this week. Perhaps most important is the Jupiter-Saturn trine that makes its closest approach on Monday, November 17. Our study of this 120-degree alignment showed that its bearish effect is largely confined to the period before it is exact when the aspect is applying. Once it begins to separate, the negative influence diminishes and it becomes a more neutral influence on average. So there is an argument that the worst of this aspect is already over, although lesser correlations in the aftermath of the aspect do not preclude further downside.

As if to punctuate its importance, the Sun will also form a Grand Trine with Jupiter and Saturn on Monday. Our study of previous Grand Trines involving Mercury and Mars as the fast-moving third planet pivot showed a modest bullish bias. Whether or not the Sun follows this same bullish pattern is harder to say, however. Plus, these Grand Trines are quite rare and therefore cannot form a large enough sample to make any statistically significant predictions. Nonetheless, Monday’s Sun-Jupiter-Saturn alignment does hint at some bullishness to start the week. Tuesday’s Moon-Venus conjunction also has a bullish lean, although I have yet to do a proper study of this pairing which would provide empirical support for this view.

If the first half of the week features limited bullish influences, the second half of the week looks more vulnerable to declines. Retrograde Mercury conjuncts the Sun and Moon while and opposing Uranus on Wednesday and Thursday. The Uranus influence can heighten volatility, although here again studies have yet to be conducted to confirm this deductive assertion.

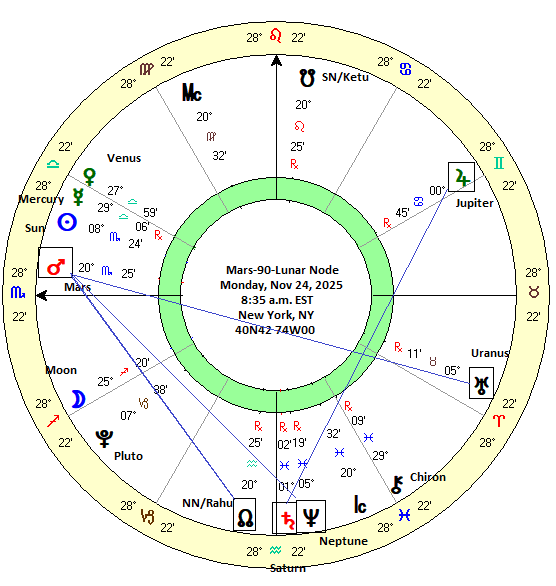

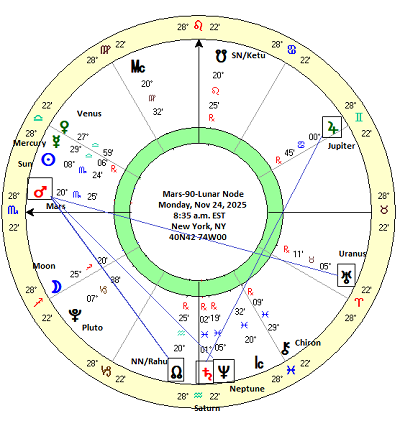

A potential trouble spot is the square alignment between Mars and the North Lunar Node, or “Rahu” as it is known in Vedic astrology. This aspect is exact next Monday, November 24 but will move within range later this week. Friday’s Moon-Mars conjunction could well serve as a trigger for this larger alignment involving the Lunar Nodes. Since both Mars the Nodes are considered natural malefics, there is some reason to expect a negative market reaction when they move into a 90-degree square alignment. But is this bearish assumption justified by the evidence?

Mars-90-Lunar Nodes (Rahu)

To answer this question, I compiled a dataset of the last 67 times that Mars was square the lunar nodes. The true lunar node position was used for this study. In order to see the market effect of this alignment, daily closing prices of the S&P 500 were recorded at various intervals starting at 18 days before (-18d) the exact square until 18 days (18d) after the square. When the interval fell on a holiday or weekend, the next closest trading day was used. The table below lists the 67 previous Mars-Lunar Node squares from 1970 until 2025.

Despite a fairly large sample size, the summary statistics table doesn’t show much of an effect across various intervals. The first column shows the price change for the longest interval of 36 days (“-18d 18d”). The average price change was 0.28% while the median change was somewhat higher at 0.85%. The median change was actually very close to the expected value of 0.81% which was the pro-rated price change based on an 8.2% average annual return for the S&P 500 for 1970-2025. Even if the average is below the expected value, it doesn’t reach anywhere near statistical significance (p = 0.393) suggesting the net effect of this square aspect across the longest interval is quite neutral.

However, if we look more closely, we do note a pattern whereby the intervals that precede the exact square have a lower average than the intervals that follow the exact square. For example, the 18 days before the square (-18d 0d) had an average of just 0.03% whereas the 18 days after the square (0d 18d) had an average of 0.25%. This pattern of bearish before/bullish after was repeated for all other intervals pairs — the 12-day, the 6-day and the 3-day. While this is interesting, none of the averages reached the significance threshold of p<0.05. But it does suggest that the period before the exact Mars-Lunar Node square is on average more bearish that the period afterwards. This may be worth keeping in mind when considering the possible effects of the upcoming Mars-Lunar Node square on Nov 24. The period after Nov 24 would therefore be more likely to be more positive than the period before.

The relatively modest effect of this square is clearly demonstrated in the cumulative trend chart below. The average and median lines are quite choppy reflecting some random noise in the data. And the fact that the median closely tracks the expected value is evidence that this alignment has very modest effects indeed. The average does generally stay below the expected line, however, so that offers at least some marginal evidence for a net bearish influence.

Implications for this week

This study provides only limited evidence for a bearish influence from the upcoming Mars-Lunar Node square. We should therefore temper any downside expectations from this pattern. At the same time, the study does highlight the slight bearish influence for the period that precedes the square alignment. And for that reason, some downside is a bit more likely than not this week and before next Monday’s exact square. Friday’s Moon-Mars conjunction would therefore appear to be a plausible candidate for a down day.

We should also note that the Mars-Lunar Node square will also form a larger alignment with Uranus and Neptune. If using 15-degree aspect multiples — the 24th divisor of the circle — Mars (20 Sc/14 Sg) aligns with NN (20 Aq/14Pi) and Uranus (5 Ta/29Ta) and Neptune (5Pi/29Pi). The degree and sign positions are the planets’ Lahiri and Tropical zodiac longitudes, respectively. The fact that the Mars-Rahu aspect could also activate Uranus and Neptune should be considered another potential bearish influence this week, even if direct evidence is lacking.

Despite the downside risk apparent in the Mars-NN/Rahu pairing, we should be reluctant to entertain any overly bearish scenarios since the Jupiter-Saturn trine aspect will be weakening (separating) this week. Over the past two to three weeks, the applying Jupiter-Saturn trine has been one of the reasons for the market pullback. Now that it will be weakening, there may be a reduction in available bearish energy.

If you would like to receive these weekly posts as an email, please subscribe to my free weekly Empirical Astrology Substack newsletter.

Disclaimer: Not intended as investment advice. For educational purposes only.