(16 March 2025) This week we will see if Friday’s stock market rally was just an oversold bounce or the start of something more sustainable. US stocks are now officially in correction after falling by more than 10% since their February 19 top. One reason why stocks could extend their rebound from here is that Mercury turned retrograde on Saturday, March 15. While Mercury retrograde has a bearish reputation, its stations can also mark turning points in the prevailing market trend.

(16 March 2025) This week we will see if Friday’s stock market rally was just an oversold bounce or the start of something more sustainable. US stocks are now officially in correction after falling by more than 10% since their February 19 top. One reason why stocks could extend their rebound from here is that Mercury turned retrograde on Saturday, March 15. While Mercury retrograde has a bearish reputation, its stations can also mark turning points in the prevailing market trend.

As my recent study of the Mercury retrograde cycle suggested, there is some modest evidence to support this bullish reversal trend change thesis. The study found that if stocks have been trending lower before the retrograde station, there is a 60-70% chance that stocks will move higher thereafter. This bullish reversal at the time of a Mercury retrograde station last occurred on August 5, 2024 when the station exactly marked the day stocks ended their three-week pullback and resumed their up trend. Thursday’s lunar eclipse could also be regarded as another celestial event that might signal a trend change since eclipses are associated with interruptions of the status quo.

In addition to Mercury, this week will see a fairly rare three-planet conjunction of the Sun, Neptune and Rahu (North Lunar Node). More precisely, the Sun exactly conjoins Rahu on Monday and then transits over Neptune on Wednesday. This is only the fourth such triple conjunction in the past 60 years. Previous conjunctions have delivered mixed market results, however. The November 1974 triple conjunction saw stocks rise initially by 1% but then reverse lower by 3% as the Sun began to separate from Rahu and Neptune. The January 1992 conjunction saw stocks rise by 1% during the three days where the conjunction was in closest alignment. The February 2008 conjunction saw markets rise by 1% as the Sun conjoined Neptune but then fall by 2% when the Sun conjoined Rahu. Obviously, these three previous cases aren’t much to go on and the mixed outcomes preclude making any clear forecast, especially given the previous moves were quite small in both directions.

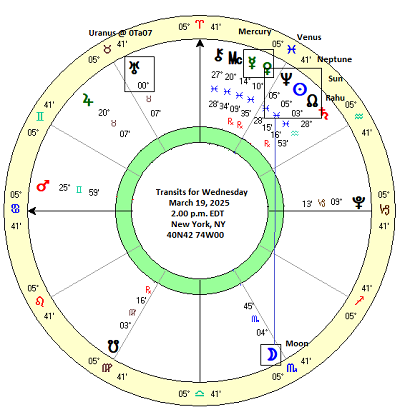

Some early week volatility is nonetheless possible as Uranus re-enters the sign of Taurus according to the Krishnamurti ayanamsha. Since this is the third and final ingress in this year-long process we shouldn’t anticipate any major fireworks. That said, unexpected developments can become more likely at the time when Uranus changes signs.

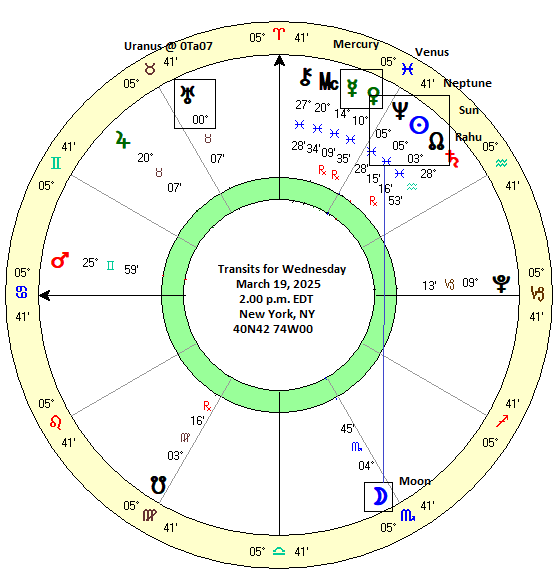

We should take special note of the transits on Wednesday because that is the day that the Federal Reserve meets to update its interest rate policy. While the Sun-Neptune conjunction seems indeterminate, sentiment might get a boost from the 5th house/120 degree aspect with the Moon in the afternoon. This alignment is almost exact at 2 p.m. EDT when the Fed statement is released.

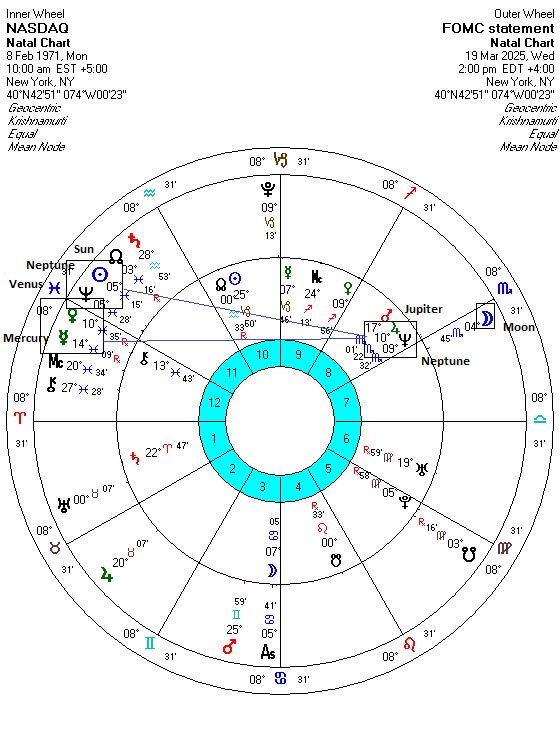

Another reason why we could see stocks rally further this week are the transit hits to the NASDAQ horoscope (Feb 8, 1971). On Wednesday, transiting Venus (10 Pisces) exactly trines the natal Jupiter-Neptune conjunction (10 Scorpio).

And with transiting retrograde Mercury nearby at 14 Pisces and the Sun-Neptune conjunction (5 Pisces) also coming under Jupiter’s 5th house/trine aspect, there could be a more optimistic mood in financial markets this week.