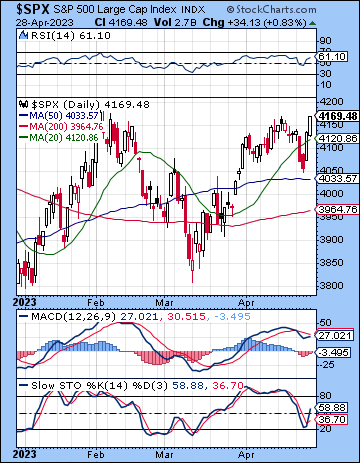

(30 April 2023) Stocks finished the month of April on a positive note on mostly strong corporate earnings and relatively low initial jobless claims. The S&P 500 gained less than 1% on the week to 4169 while the Nasdaq-100 closed at 13,245. This bullish outcome was unexpected as I did not foresee the extent of the gains in the second half of the week, even if the Venus-Uranus-Chiron alignment did suggest a bounce. The selling in the early week pullback closely coincided with the bearish Sun-Rahu-Saturn alignment.

(30 April 2023) Stocks finished the month of April on a positive note on mostly strong corporate earnings and relatively low initial jobless claims. The S&P 500 gained less than 1% on the week to 4169 while the Nasdaq-100 closed at 13,245. This bullish outcome was unexpected as I did not foresee the extent of the gains in the second half of the week, even if the Venus-Uranus-Chiron alignment did suggest a bounce. The selling in the early week pullback closely coincided with the bearish Sun-Rahu-Saturn alignment.

Well, it’s all up to the Fed now. Wednesday’s FOMC meeting is likely to be the next catalyst as stocks push up against key resistance. Last week’s PCE core inflation number came in stronger than expected at 4.9% and probably left the Fed with little choice but to hike rates by another 25 basis points. As usual, markets will be more focused on Chair Powell’s forward guidance and whether or not the Fed is any closer to reaching the terminal (i.e. maximum) interest rate. Equity investors are hoping for a rapid pause and pivot at the June FOMC meeting in order to loosen credit and spur more lending in order to grow the economy. However, the bond market remains uncertain about the future path of interest rates as the benchmark 10-year yield is stuck in a zone near the 200 DMA at 3.50%. As long as inflation remains a threat, yields will stay relatively high, and could be a headwind for stocks. In fact, it is possible to discern a bullish inverted head and shoulders pattern in the UST10Y chart which projects a rise in rates towards 3.90% in the event of a move above the neckline of 3.60%. This suggests that inflation may well be “sticky” for some time to come and will force the Fed to keep rates “higher for longer.” If Powell sounds hawkish in his FOMC testimony, stocks would be more vulnerable to declines.

The planetary outlook remains bearish for the near term. While last week’s gain somewhat complicates the overall picture, downside risk is still elevated as we enter the month of May…

Click here to subscribe and the rest of this week’s newsletter