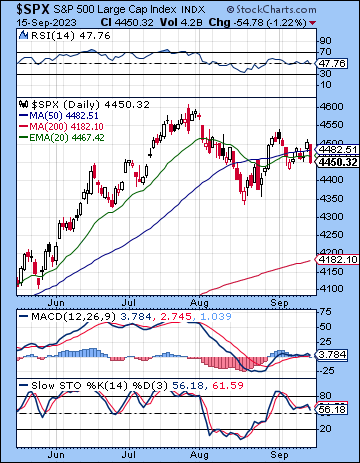

(17 September 2023) US stocks ended the week modestly lower as worries over the auto workers strike negated the impact of some positive economic data. The S&P 500 fell just 0.2% to 4450 while the Nasdaq-100 finished the week at 15,202. While I thought we might have seen a bit more overall strength, the intraweek gains did coincide with the bullish influence of the Venus-Jupiter and Sun-Uranus alignments. Thursday’s intraweek high also coincided closely with the bullish Sun-Moon-Jupiter alignment.

(17 September 2023) US stocks ended the week modestly lower as worries over the auto workers strike negated the impact of some positive economic data. The S&P 500 fell just 0.2% to 4450 while the Nasdaq-100 finished the week at 15,202. While I thought we might have seen a bit more overall strength, the intraweek gains did coincide with the bullish influence of the Venus-Jupiter and Sun-Uranus alignments. Thursday’s intraweek high also coincided closely with the bullish Sun-Moon-Jupiter alignment.

Friday’s sell-off also reflected market skittishness ahead of this week’s FOMC meeting. While almost no one expects the Fed to hike rates on Wednesday, there are persistent concerns that Powell will maintain a hawkish stance and further postpone a pivot towards monetary easing. Last week’s rise in annual inflation –due, in part, to base effects – helped push bond yields back up to key resistance. The 10-year Treasury is yielding 4.33% while the 2-year is now back up to 5.03%. These elevated yields reflect not only the expectation of further inflation pressures, but the likelihood that the Fed will be forced to keep rates higher for longer. With unemployment starting to tick higher, it seems increasingly likely that the higher rates will force lending to slow and thus dampen economic growth. Needless to say, higher bond yields are a major headwind for stocks right now and any further increase will surely be bad news for equities.

The planetary outlook leans bearish. The progressions calendar looks fairly neutral for the next few weeks with scores between -2 and +2. While this mostly neutral influence tends to argue against any major moves, it is only one part of the overall puzzle. The transit influences look more bearish. Some of last week’s strength came from the close Venus-Jupiter square. This positive influence will diminish this week as it begins to separate. More clearly bearish influences may also come to the fore over the next two to three weeks. First, there are a series of Mars alignments that should translate into some downside. Mars casts its most malefic 210-degree aspect to Jupiter this week right around the time of the Fed meeting. Mars then goes on to align with Saturn, Uranus, Neptune and finally Ketu (South Lunar Node) on Oct 5…

[…]

Indian Stocks

Stocks rallied to new all-time highs last week on positive corporate guidance and an improving inflation outlook. The Nifty gained almost 2% to 20,192 while the Sensex finished the week at 67,838. This bullish outcome was in keeping with expectations given the ongoing Venus-Jupiter alignment.

Investors are feeling confident and optimistic following India’s successful hosting of the latest G20 conference. The meeting reflects India’s rising global importance and its current high rate of growth is expected to continue despite ongoing inflation concerns. For now, the higher growth rate is expected to justify further tightening of credit without causing any significant economic fallout. Markets have priced in further RBI rate hikes as the yield curve has now inverted: the 2-year government bond now yields 7.18%, one basis point above the 10-year at 7.17%. While inverted yield curves are associated with recessions, there is usually a significant time lag (6-12 months) between the time of inversion and the onset of economic contraction. Yields will likely be in focus again this week as the Fed meets on Wednesday to issue its latest economic statement. US yields are once again on the rise as markets are expecting inflationary pressures to continue well into 2024. Both the US 2-year and 10-year Treasuries are again pushing up against their recent highs and are threatening to breakout higher. Even though Indian stocks have so far been immune to the fallout of rising rates in the US, this may not be the case if rates and the dollar experience a rapid rise from current levels. The recent weakness of rupee above the 83 level therefore warrants careful monitoring.

The planetary outlook has rising downside risk. While stocks have been bullish in the first half of September around the alignment and twin stations of Venus and Jupiter, that situation is likely to change in the second half. As Venus begins to separate from its alignment with Jupiter over the next few days, there may be diminishing positive energy…

Click here to subscribe and read the rest of this week’s newsletter