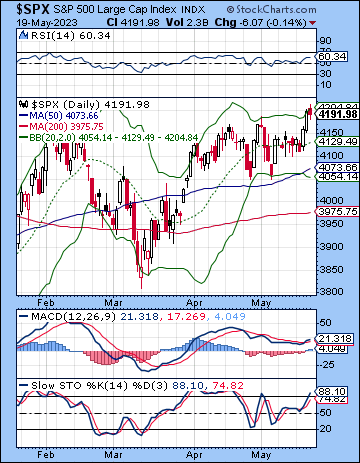

(21 May 2023) Stocks rebounded last week on hopes that both political parties in Washington could find a debt ceiling compromise in order to prevent a default. The S&P 500 gained almost 2% on the week to 4191 while the Nasdaq-100 added 3% on the week to 13,803. While this bullish outcome was unexpected, the market did rally into midweek as forecast on the exact Jupiter-Pluto alignment. But as often been the case recently, the early and late week bearish alignments involving Mercury and Saturn coincided with only very modest pullbacks which did little to alter the up trend.

(21 May 2023) Stocks rebounded last week on hopes that both political parties in Washington could find a debt ceiling compromise in order to prevent a default. The S&P 500 gained almost 2% on the week to 4191 while the Nasdaq-100 added 3% on the week to 13,803. While this bullish outcome was unexpected, the market did rally into midweek as forecast on the exact Jupiter-Pluto alignment. But as often been the case recently, the early and late week bearish alignments involving Mercury and Saturn coincided with only very modest pullbacks which did little to alter the up trend.

Despite the ongoing strength in stocks, we saw some potentially important developments last week which could signal some underlying changes in financial markets. Bond yields are climbing once again, though this time not because of inflationary pressures but in part because of the possibility of a debt ceiling deal. Any deal between the White House and the GOP would open the door to the issuance of at least another $1 Trillion of new debt which would flood the bond market with fresh supply thus forcing up yields. As I noted last week, bond yields broke above resistance at 3.60% and are threatening to move significantly higher, perhaps as high as their inverse head and shoulders target of 3.90% on the 10-year.

The dollar followed suit as it extended its breakout above the 103 level as investors abandoned precious metals in favor of the greenback. And yet for all these major moves, stocks were left largely untouched given the optimism surrounding the possibility of a debt ceiling deal. It remains to be seen if we will have a deal in DC in the coming days given the traditional enmity between the two sides. If talks break down, the impact on equities would be immediate, while a deal to raise the ceiling and issue more debt may only negative impact stocks at some later date, once markets confronted the implications of significantly higher interest rates. In other words, there is some uncertainty for stocks with both scenarios, although the greater risk would come from further stalemate ahead of the X-date which is supposedly sometime in June.

The planetary outlook still has some downside risk. The PCI progressed cycles still have a slight bearish bias although this is largely a background influence over the coming weeks. I had thought we might have seen more evidence of these difficult progressed alignments in NYSE and NASDAQ horoscopes, but so far nothing has manifested. The transits also have a bearish bias, especially now that the bullish Jupiter-Pluto alignment (exact May 18) is separating and thus weakening…

Click here to subscribe and read the rest of this week’s newsletter