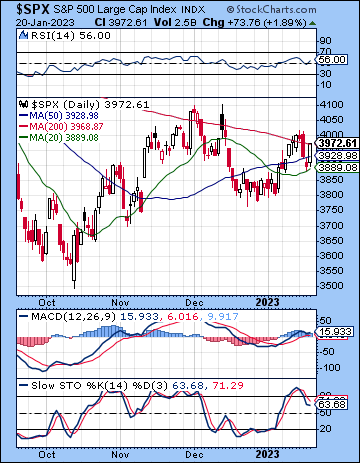

(21 January 2023) US stocks moved lower last week as weak retail sales once again fueled recession concerns. The S&P 500 lost less than 1% on the week to 3972 while the Nasdaq-100 finished slightly higher at 11,619. This mostly bearish outcome was in line with expectations as I thought the protracted Mars-Mercury alignment would coincide with some downside. The late week rebound was also not unexpected given Mercury’s return to normal forward motion after Wednesday’s direct station.

(21 January 2023) US stocks moved lower last week as weak retail sales once again fueled recession concerns. The S&P 500 lost less than 1% on the week to 3972 while the Nasdaq-100 finished slightly higher at 11,619. This mostly bearish outcome was in line with expectations as I thought the protracted Mars-Mercury alignment would coincide with some downside. The late week rebound was also not unexpected given Mercury’s return to normal forward motion after Wednesday’s direct station.

Markets appeared to have shifted their focus from inflation to recession. Wednesday’s wholesale PPI report came in below expectations and provided further evidence that inflation may well have peaked. And yet markets sold off anyway because retail sales and other indicators were showing more signs of weakness. The bond market is starting to price in much slower growth for 2023 as the yield inversion has deepened to its lowest level since the 1980s. In recent weeks, the 2/10 yr inversion has fallen to levels below those of the 2000-2003 or 2007-2009 bear markets. This deep inversion is the strongest signal of an approaching recession, even if the exact timing remains to be seen. Nonetheless, we should note that the worst parts of those preceding recessions occurred only after the yield inversions ended as short term yields fell as a reflection of declining economic activity. This week’s layoff announcements from Microsoft and Google were an early warning sign of things to come as the labor market remains tight with new jobless claims hovering near their historical lows.

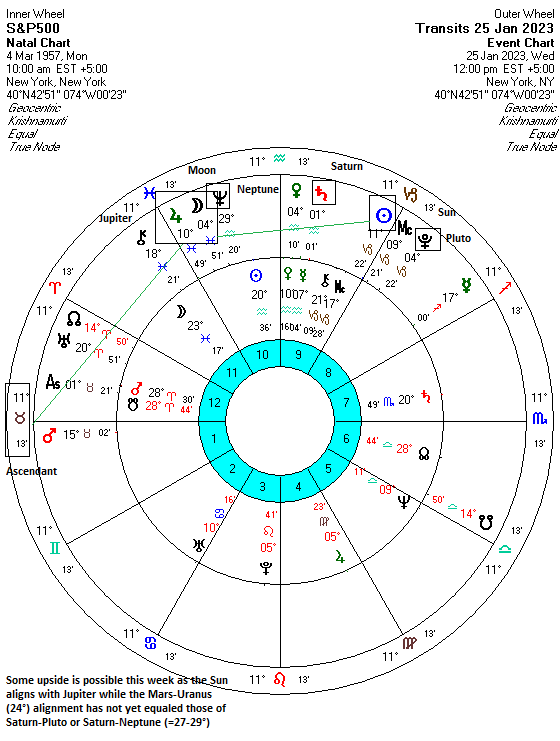

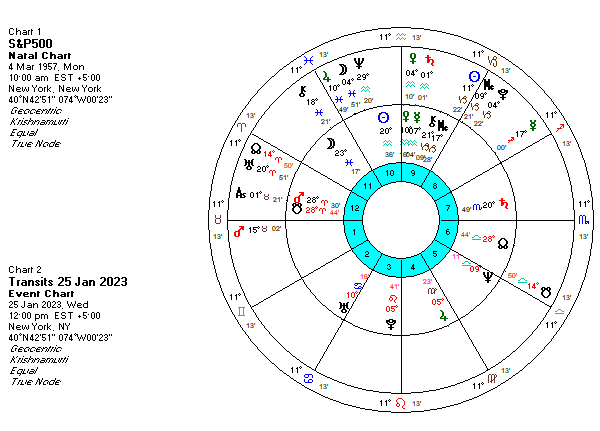

The planetary outlook is mixed in the near term. With the Mars-Mercury aspect now in the rearview mirror, there is a short term opening for some upside before the FOMC meeting on Feb 1. While I am uncertain about the eventual strength of the bullish influences over the next 5-10 days, bears should be more careful here. The transits look a bit less bearish for this week, even if the PCI progressions still lean bearish over the next several weeks…

Click here to subscribe and read the rest of this week’s newsletter