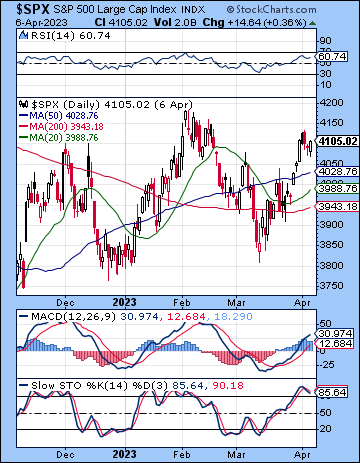

(9 April 2023) US stocks ended the week modestly lower as weak employment data clouded rate hike expectations. The S&P 500 finished fractionally lower at 4105 while the Nasdaq-100 lost one percent on the week to 13,062. This bearish outcome was generally in keeping with our forecast, even if declines turned out to be fairly tame. The bulk of the midweek downside coincided with the bearish alignment of Mercury, Rahu and Saturn.

(9 April 2023) US stocks ended the week modestly lower as weak employment data clouded rate hike expectations. The S&P 500 finished fractionally lower at 4105 while the Nasdaq-100 lost one percent on the week to 13,062. This bearish outcome was generally in keeping with our forecast, even if declines turned out to be fairly tame. The bulk of the midweek downside coincided with the bearish alignment of Mercury, Rahu and Saturn.

The battle of wills continues between the market and the Fed. Investors remain hopeful for rate cuts to begin before the end of the year while the Fed has given no indication that it will pivot towards a more accommodative stance until early 2024. Data seems unclear at the moment as Friday’s relatively strong NFP jobs report appeared to offset previous data that showed an increase in jobless claims. Nonetheless, the FedWatch odds for a 25 basis point hike at the next FOMC meeting on May 3 now stands at 67%. While markets may be able to reconcile itself to another well-telegraphed hike, Fed forward guidance will be a matter of greater interest. Markets may not be so forgiving if Powell maintains his hawkish tone to keep rates high “until the job is done”. The bond market is raising alarm bells over a possible slowdown as 10-year yields broke key support last week and finished Friday at 3.30%. Even if unemployment is typically a lagging indicator, there is ample evidence for slowing as The Atlanta Fed’s GDPNow estimate has now fallen to just 1.5% growth for Q1. The Fed is becoming mired in a classic stagflation conundrum: keep rates high to bring inflation down while risking a recession or take the foot off the monetary brakes to prevent a recession but risk another wave of inflation. The divergence between the Fed’s intentions and the market’s hopes therefore could fuel more volatility leading up to the next FOMC meeting.

The planetary outlook remains bearish for the month of April. While the size of last week’s pullback was rather disappointing, bears still have some good planetary set ups on their side over the next two or three weeks…

Click here to subscribe and read of the rest of this week’s newsletter