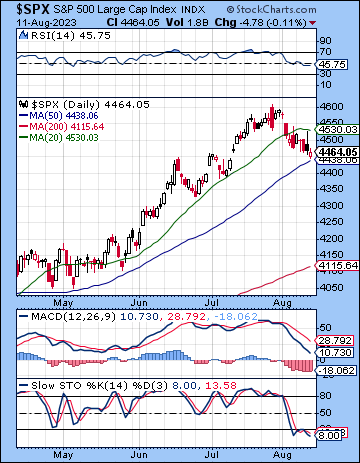

(13 August 2023) Stocks edged lower last week as renewed inflation concerns boosted bond yields and the dollar. The S&P 500 ended fractionally lower on the week to 4464 while the Nasdaq-100 lost more than 1% to 15,028. This bearish outcome was somewhat unexpected as I thought we might have seen more upside from the Sun and Mercury alignments with Jupiter.

(13 August 2023) Stocks edged lower last week as renewed inflation concerns boosted bond yields and the dollar. The S&P 500 ended fractionally lower on the week to 4464 while the Nasdaq-100 lost more than 1% to 15,028. This bearish outcome was somewhat unexpected as I thought we might have seen more upside from the Sun and Mercury alignments with Jupiter.

Markets did not like last week’s inflation data which came in hotter than expected. Most worrisome were the higher Core CPI and PPI, both of which showed higher monthly increases for July. While inflation is well off last year’s highs, there is rising risk of a protracted period of elevated inflation above the Fed’s 2% target. And with oil prices surging, it seems unlikely that inflation will come down in any meaningful way this year. This effectively puts any rate cuts off the table until early 2024 at the earliest For now, the FedWatch tool is not factoring in any further hikes and is only forecasting a cut in rates in May 2024. Bond yields have pushed higher with the benchmark 10-year ending the week at 4.16% — just 9 basis points away from its Oct 2022 high. Both yields and the US dollar are on the verge of major technical breakouts which would likely shake up financial markets. If yields break above 4.25%, stocks will become more vulnerable to a significant sell-off. Conversely, if yields retreat below 4% and break the recent rising trend line, stocks may well rally once again.

The planetary outlook leans bearish in the short term. Despite a positive Progressions Calendar score last week and some bullish short term transits, stocks could not stage much of a rally. It seems the bearish influence of the Venus retrograde cycle remains the decisive factor for now. I would therefore expect more downside in the coming weeks from this Venus influence, at least until its direct station on September 3…

[…]

This week (Aug 14-18) is hard to call. The negative impact of Venus will be a continuing influence but the unusually high number of short term transits this week creates a more mixed picture. The early week looks somewhat more bullish than the second half, however, as the Sun aligns with Uranus. Tuesday’s Sun-Moon-Venus-Uranus alignment could be more bullish in this respect…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Roadsidepictures