Stocks rise into Jupiter station; midweek Mercury-Rahu may create uncertainty

So stimulus if necessary, but not necessarily stimulus. US Stocks staged an impressive rebound last week as Friday’s speech from Fed Chair Bernanke put off any decision on further quantitative easing (QE3) until September. This deferred decision was good enough for markets as the Dow climbed 4% closing at 11,284 while the S&P500 finished the week at 1176. The picture was more bearish in Mumbai, however, the Sensex made new lows for the year closing at 15,848. The Nifty ended the week at 4747.

So stimulus if necessary, but not necessarily stimulus. US Stocks staged an impressive rebound last week as Friday’s speech from Fed Chair Bernanke put off any decision on further quantitative easing (QE3) until September. This deferred decision was good enough for markets as the Dow climbed 4% closing at 11,284 while the S&P500 finished the week at 1176. The picture was more bearish in Mumbai, however, the Sensex made new lows for the year closing at 15,848. The Nifty ended the week at 4747.

This outcome was disappointing as I had expected more across the board selling on the late week Mars-Saturn aspect. While Thursday was lower when the aspect was exact, the size of the decline was more modest than expected. Indian markets were more directly affected by this bearish combination, however, due to a close affliction in the BSE natal chart. We also saw some significant gains on most global markets in the early week period from the Sun-Venus-Neptune pattern. The Sun-Neptune opposition coincided quite closely with the precipitous drop in gold on Tuesday and Wednesday just as the Sun was entering tropical Virgo.

So while bearish Saturn still seems to be the dominant energy these days, we saw a glimpse of Jupiter’s optimistic nature last week ahead of its retrograde station on August 30. It is not unusual for planets to express themselves more fully around the time of their direct and retrograde stations, especially a slow moving and powerful planet like Jupiter. Bernanke’s tentative approach to the Fed’s next move was perhaps an appropriate manifestation of this competing energy of both Saturn and Jupiter. A weaker Jupiter might have precluded any further easing, but on this occasion we got a kind of stalemate between the need to expand and the need to constrain. Interestingly, the next Fed meeting will occur on September 20-21, just a few days before the Saturn-Ketu aspect. This suggests that optimism may be in short supply and there could be a limited appetite for more easing as Saturn’s preference for austerity is more in evidence. The interaction with Ketu suggests some kind of fundamental or structural reordering may be in the air. This could result either from new and unusual moves the Fed makes, or perhaps from the reaction to its announcement. What would happen if the Fed threw another stimulus party but nobody came?

This week looks like a mixed bag. Jupiter’s retrograde station on Monday and Tuesday could be a mostly positive influence here. A bullish Venus-Jupiter aspect early in the week gives way to another dubious looking aspect between Mercury and Rahu by Wednesday. The end of the week offers up a dog’s breakfast of aspects as the bullish Sun-Jupiter aspect occurs simultaneously to a nasty Mars-Rahu aspect. These could conceivably cancel each other out, butthe presence of Mars is cause for some concern here.

A slow motion crash?: markets fall with Saturn

They say that when you’re in a car accident, everything slows down. You become acutely aware that it’s going to happen, and your senses heighten to take in the details as it all unfolds. These days the stock market appears to be involved in its own version of a slow motion accident. Stocks fell for the fourth straight week last week as the meeting between Merkel and Sarkozy produced little in the way of tangible solutions for the European debt crisis. In New York, the Dow fell more than 4% closing at 10,817 while the S&P500 finished the week at 1123. It was a similar story in Mumbai as the BSE-Sensex lost 4% closing at 16,141 with the Nifty ended the week below the 5K level for the first time since 2010 at 4845. While the extent of the late week declines were a little surprising, I was correct in my forecast for gains around the early week triple conjunction of Sun, Mercury and Venus. Most markets rose into Wednesday around this bullish alignment, but once the planets began to separate and weaken, the selling resumed. As I noted in last week’s post, the Rahu aspect to Mercury created more the potential for more uncertainty and opened the door to unexpected and sudden developments.

They say that when you’re in a car accident, everything slows down. You become acutely aware that it’s going to happen, and your senses heighten to take in the details as it all unfolds. These days the stock market appears to be involved in its own version of a slow motion accident. Stocks fell for the fourth straight week last week as the meeting between Merkel and Sarkozy produced little in the way of tangible solutions for the European debt crisis. In New York, the Dow fell more than 4% closing at 10,817 while the S&P500 finished the week at 1123. It was a similar story in Mumbai as the BSE-Sensex lost 4% closing at 16,141 with the Nifty ended the week below the 5K level for the first time since 2010 at 4845. While the extent of the late week declines were a little surprising, I was correct in my forecast for gains around the early week triple conjunction of Sun, Mercury and Venus. Most markets rose into Wednesday around this bullish alignment, but once the planets began to separate and weaken, the selling resumed. As I noted in last week’s post, the Rahu aspect to Mercury created more the potential for more uncertainty and opened the door to unexpected and sudden developments.

With fear and anxiety rising over the renewed possibility of a recession, the declines have for the most part been fairly orderly. The 500 point daily swings in the Dow notwithstanding, we have not a proper crash yet, as the correction has been marked by a series of down days with the usual number of rebound up days sprinkled in to keep people guessing. The absence of any big news shock-type crash event has allowed the decline to inflict its damage piece meal. Most investors have largely stayed in the market hoping that this gradual decline will eventually turn around.

But as I have been suggesting for a while, the planets do not favour a reversal higher any time soon. Saturn the pessimist is very much in control here as it comes under the dual influences of Mars and Ketu. Both Mars and Ketu are considered negative and tend to bring out the worst in Saturn, i.e. excessive fear and caution. The Mars-Saturn aspect has been gathering energy over the past few weeks and may well peak this week as the exact aspect occurs on Thursday, August 25. The Saturn-Ketu aspect isn’t due to be exact until September 23 so there is some reason to expect that the current negative outlook won’t change significantly in the near term. Nonetheless, the first (slim) chance for a reversal will occur after Thursday.

Transits for Thursday August 25, 2011 9.30 a.m. New York

What’s doubly problematic for the markets right here is that Mercury, the planet of trading and commerce, ends its retrograde cycle on Friday. Its direct station at 24 Cancer therefore still falls under the influence of Rahu at 26 Scorpio. This increases the possibility of more unexpected movements in the markets and is generally a negative influence, especially given the Mars-Saturn square aspect. Coincidentally, Fed Chair Ben Bernanke will make his annual speech from Jackson Hole on Friday morning — just hours after the exact Mars-Saturn aspect and hours before the Mercury direct station. The proximity of these events increases the odds that his speech will move markets significantly, although the direction is somewhat less clear. We can see some positive aspects in play that day such as the Sun-Venus aspects to Uranus and Pluto. However, the Mars-Saturn square is about as bad as it gets. But since it will be separating from its exact aspect at the time Bernanke is speaking, it is possible it will have less negative impact. Bernanke is expected to announce some kind of new policy to help the flagging US economy but it is unclear just what he has in mind. Since expansionary Jupiter turns retrograde on August 30, it seems more likely that Bernanke will offer some new program to increase liquidity and credit availability. However, it seems less likely that any new program will have the same positive market effect as last year’s QE2 announcement.

The bottom line is this Mars-Saturn aspect could well produce more downside this week. It also increases the possibility of some larger, crash-type moves. I’m not saying a crash is probable, but the presence of these difficult aspects increases the odds of a crash from the usual 1 in 1000 to something quite a bit higher, like 1 in 4. That’s no where near probable (50%+), of course, but it is something to consider. Perhaps 2011 will be remembered as the slow motion crash.

Mars panics markets in wake of downgrade; triple conjunction offers relief

All the panic and turmoil was very much in keeping with expectations as I anticipated that the Mars alignment with Uranus and Pluto would be negative. While we did not see any obvious manifestations of literal violence, the market did move violently as the unpredictable and powerful energy of the Mars affliction took its toll. I thought we would see most of the damage in the first half of the week and that was indeed the case in the US, Europe and Asia as Tuesday marked the low, at least on an intraday basis. Once the Mars alignment began separating after Wednesday, there was a gradual lessening of volatility and trading volume as prices rose into Friday.

All the panic and turmoil was very much in keeping with expectations as I anticipated that the Mars alignment with Uranus and Pluto would be negative. While we did not see any obvious manifestations of literal violence, the market did move violently as the unpredictable and powerful energy of the Mars affliction took its toll. I thought we would see most of the damage in the first half of the week and that was indeed the case in the US, Europe and Asia as Tuesday marked the low, at least on an intraday basis. Once the Mars alignment began separating after Wednesday, there was a gradual lessening of volatility and trading volume as prices rose into Friday.

While we can correlate the gradual strengthening of Saturn in recent weeks with the return of pessimism and caution, the US debt downgrade may also be seen in terms of the Uranus-Pluto square aspect. As I have written previously, the Uranus-Pluto square is the ultimate celestial prime mover these days as these two distant planets will remain in aspect until 2013. This aspect is mostly negative because it erodes stability and is often correlated with long term structural changes in the economy and society. This loss of stability therefore increases uncertainty and as we know, markets do not like uncertainty. As a result, the Uranus-Pluto aspect is usually negative for the value of riskier assets like stocks and positive for safe havens like gold, bonds, and certain unimpeachable currencies.

The passing Mars alignment to this destabilizing Uranus-Pluto aspect last week was a significant release of this powerful energy for change and disruption. The US debt downgrade to AA+ by S&P is emblematic of this fundamental change, as the world’s leading economy is no longer as strong as it once was. The debt downgrade may ultimately mark a key historic turning point in the eventual decline of the US from its previously unchallenged status as world superpower. Such epochal changes are typical of Uranus-Pluto aspects as old orders stagnate and decline while new structures and organizations rise to fill the vacuum.

This week looks calmer and even rather positive. There is a triple conjunction of Sun, Venus and retrograde Mercury that occurs in the last degree of Cancer on Tuesday/Wednesday. This is likely to generate more optimism and help to boost prices. The presence of the aspect from Rahu (North Lunar Node) is somewhat of a wild card, however. Rahu can distort and confuse the issue so this can reverse the polarity of a planet from positive to negative or exaggerate its effects. I think exaggeration is more likely this week as a dose of unsustainable Rahuvian enthusiasm could take over. The insanity continues in a different form. No matter how positive the news may be here, the planets suggest that the longer term prospects for economic recovery do not look very promising.

Stocks plunge on Mercury-Neptune; Mars-Uranus-Pluto is next

The tumultuous events in the markets last week reminded me of Karl Marx’s description of capitalism: "All that is solid melts into air." Financial stability evaporated last week in the aftermath of the US debt ceiling deal and the spreading debt contagion in the Eurozone. What was remarkable was the speed at which safe, reliable assumptions about future growth seemed to disappear as investors got a harsh reality check. In New York, the Dow lost more than 6% closing at 11,444 while the S&P finished the week at 1199. The damage was less severe in Indian markets as the BSE-Sensex lost 4% closing at 17,305 with the Nifty ended the week at 5211.

As expected, the Mercury-Neptune opposition did coincide with significant fallout from the US debt deal. To make matters worse, Mercury stationed and turned retrograde on Tuesday so this amped up the strength of this affliction and Mars joined the alignment on Thursday, the day the Dow tumbled 500 points. Score one for astrology. While I had been unsure if the US would make the Aug 2 deadline, I was fairly certain that the market would react badly, which it did. Some of those mitigating Jupiter aspects only offered passing relief to the rising fear as Monday’s Sun-Jupiter aspect delivered gains in Asia as well as a positive open in New York. These gains were the result of the immediate sense of relief from the signing of the debt ceiling deal. But it was all Mercury-Neptune after that as disillusion and dismay ruled the roost. Now that the US is compelled to follow a more austere regime of government spending, who is left to stimulate a stagnating economy that seems to be on the verge of a double dip recession? Well, no one it seems and therein lies the root of the sell-off. With Obama’s hands tied and Fed Chair Bernanke also seemingly "out of bullets" despite new rumours of a possible QE3, markets are beginning to realize that the past two years was based entirely on "free" borrowed money which has not created a solid foundation for a sustainable bull market.

As expected, the Mercury-Neptune opposition did coincide with significant fallout from the US debt deal. To make matters worse, Mercury stationed and turned retrograde on Tuesday so this amped up the strength of this affliction and Mars joined the alignment on Thursday, the day the Dow tumbled 500 points. Score one for astrology. While I had been unsure if the US would make the Aug 2 deadline, I was fairly certain that the market would react badly, which it did. Some of those mitigating Jupiter aspects only offered passing relief to the rising fear as Monday’s Sun-Jupiter aspect delivered gains in Asia as well as a positive open in New York. These gains were the result of the immediate sense of relief from the signing of the debt ceiling deal. But it was all Mercury-Neptune after that as disillusion and dismay ruled the roost. Now that the US is compelled to follow a more austere regime of government spending, who is left to stimulate a stagnating economy that seems to be on the verge of a double dip recession? Well, no one it seems and therein lies the root of the sell-off. With Obama’s hands tied and Fed Chair Bernanke also seemingly "out of bullets" despite new rumours of a possible QE3, markets are beginning to realize that the past two years was based entirely on "free" borrowed money which has not created a solid foundation for a sustainable bull market.

While I was surprised by the intensity of the decline, I noted in last week’s forecast that the planets for early August looked quite bad and that one couldn’t "rule out any negative or disappointing scenarios" for the next two weeks. We have a truckload of disappointment and negativity now, especially since Standard and Poor’s has downgraded US debt to AA+ for the first time in its history. This sets up the likelihood of more downside this week as investors try to adapt to the new glass half-empty reality.

If last week’s Mercury-Neptune was the first shoe to drop, this week’s potent Mars-Uranus-Pluto alignment will the second. More like a boot perhaps. This is a very nasty pattern that can manifest as situations of shock and violence that are extremely disruptive. The debt downgrade is likely the partial result of this pattern as Mars slowly moves into position in the celestial cockpit. I have noted in previous forecasts how we are entering an extended period of upset and reorganization from the Uranus-Pluto square aspect. This aspect between these slow moving planets began earlier this year and will last into 2012 and 2013. It is likely to reshape the economic and political landscape much as it did the last time around. The previous Uranus-Pluto square occurred in 1931-1932 at the height of the depression and the beginning of Nazi Germany and FDR’s New Deal in the US. Fast-moving Mars is currently activating this pattern so we should expect more chaos and uncertainty this week. I would not rule out a crash here, although governments may intervened to mitigate the damage so they may be able to prevent worst case scenarios. The alignment is closest on Tuesday and Wednesday so the first half of the week is perhaps more dangerous than the second half. I would expect some rebound to occur by Thursday and especially Friday on the Sun-Venus-Uranus pattern.

Week of August 1 – 5

Washington fiddles as markets burn; Mercury opposes Neptune

Markets did not take kindly to the protracted US debt ceiling negotiations as the risk of a default loomed larger with the approach of the August 2 deadline. Stocks in New York fell more than 4% with the Dow closing at 12,143 and the S&P500 finishing the week at 1292. It was a similar story in Mumbai as the RBI’s surprise fifty-point rate hike on Tuesday only added to anxiety levels. The BSE-Sensex lost more than 2% closing at 18,197 with the Nifty ending the week at 5482. I thought the chances were high for early week decline on the entry of Mars into sidereal Gemini and that corresponded with Tuesday’s significant losses. However, my expectation for a late week recovery was wide of the mark as markets remained on edge as the debt drama entered its final act. While I had expected some disappointment and confusion over these debt ceiling negotiations, I thought we would see them closer to the deadline. However, the problems inherent in the critical Mercury-Neptune opposition have manifested somewhat earlier here.

Markets did not take kindly to the protracted US debt ceiling negotiations as the risk of a default loomed larger with the approach of the August 2 deadline. Stocks in New York fell more than 4% with the Dow closing at 12,143 and the S&P500 finishing the week at 1292. It was a similar story in Mumbai as the RBI’s surprise fifty-point rate hike on Tuesday only added to anxiety levels. The BSE-Sensex lost more than 2% closing at 18,197 with the Nifty ending the week at 5482. I thought the chances were high for early week decline on the entry of Mars into sidereal Gemini and that corresponded with Tuesday’s significant losses. However, my expectation for a late week recovery was wide of the mark as markets remained on edge as the debt drama entered its final act. While I had expected some disappointment and confusion over these debt ceiling negotiations, I thought we would see them closer to the deadline. However, the problems inherent in the critical Mercury-Neptune opposition have manifested somewhat earlier here.

As I have noted previously, the poignant coincidence of Mercury turning retrograde while in close opposition to Neptune exactly on the August 2 deadline is already delivering its karmic payload in the form of all the confusion surrounding the debt talks. Not only is it unclear if a deal will get done in time, but no one is really certain how binding the deadline actually is. Some commentators have suggested that Obama could extend it a few days in order for both sides to hammer out the details. Others have suggested the government won’t run out of money for another week or two. And even if a deal is struck, US debt may still suffer a credit downgrade anyway by one of the rating agencies. In the end, it’s all about preserving a good credit rating so that the US can continue to borrow money at low interest rates. Anything that jeopardizes confidence in the ability of the US to repay its loans will result in higher rates which will hurt the economy. The stock market is also likely to take a negative view of higher interest rates.

Mercury’s retrograde station this week — due near midnight EDT on Tuesday — heightens the negative effect of its aspect with Neptune. Since Neptune is no friend to clear logical thinking, we should expect more fallout from these negotiations as uncertainty and unproductive analysis is likely to persist for much of the week. Could the US actually default here? While I had not seriously considered the possibility, I have noted that this Mercury-Neptune aspect did boost the possibility of such an outcome. A more likely outcome is some kind of confused interregnum where somehow the key players buy extra time to work out a deal. This may or may not be before the August 2 deadline. The planets look pretty bad over the next couple of weeks so I would not rule out any negative or disappointing scenarios.

With Mercury turning retrograde late Tuesday/early Wednesday, we could easily see more downside in stocks. That said, there are a couple of Jupiter aspects that could give a temporary lift to sentiment. The Sun forms a square aspect with Jupiter on Monday and into Tuesday while Venus does likewise on Thursday and into Friday. The presence of this influence offers some possibility for gains, although it is unclear to what extent the gains will apply to stocks. Perhaps commodities like gold and oil will be more directly influenced by these bullish aspects.

Stocks rise on Greek bailout; US debt ceiling deal looks problematic

Stocks generally moved higher last week as the EU attempted to arrest the ongoing debt contagion by agreeing to a second Greek bailout. In New York, the Dow was ahead by almost 2% closing at 12,681 while the S&P500 finished at 1345. Indian markets followed suit as the BSE-Sensex moved above a key resistance level closing at 18,722 and the Nifty finished at 5633. Not surprisingly, Monday’s Mercury-Rahu aspect turned out to be bearish across the board. Buyers came back on Tuesday as the market reversed higher near the entry of Mercury into Leo. This was largely in keeping with expectations as I thought the midweek would be more positive. Sentiment continued to stay mostly strong all the way into Friday, however, as the potential trouble from the Mars-Ketu conjunction did not manifest until after markets had closed for the week, i.e. Boehner suddenly ended debt talks with Obama and the Norway attacks.

The US debt ceiling talks appear to be going right down to the wire as Republican Speaker John Boehner walked away from negotiations with President Obama late Friday. If a deal is not reached by the August 2 deadline, the US will default on its debt since it could no longer borrow enough money to cover its expenses. Nobody really expects this to happen, but what is unknown is the kind of deal that will be struck and who will gain political advantage. The political posturing is likely more important here as both parties are vying to make their case for the 2012 election cycle.

Transits for Monday July 25, 2011 9.30 a.m. New York

This week sees Mars enter sidereal Gemini on Monday and Tuesday. This excess of Mars energy can be a disruptive influence which may increase the odds of declines early in the week. But the mood is likely to turn positive by midweek as the Sun forms a alignment with Uranus and Pluto on Wednesday and Thursday. The late week period also features a supportive configuration involving Mercury, Venus and Neptune. So while we could see some downside in the first half of the week, the chances are fairly good that the subsequent rebound will more than make for it.

Stocks fall on Venus-Saturn; Sun and Mercury to change signs

Despite Ben Bernanke’s best efforts to talk up the market by keeping the door open for a possible QE3, markets drifted lower this past week as the world seems increasingly mired in debt quicksand. The more it struggles to escape through bailouts and austerity programs, the deeper it sinks. In New York, the Dow tumbled lost about 2% closing at 12,479 while the S&P500 finished at 1316. It was much the same story in Mumbai as the BSE-Sensex fell back below technical support levels closing at 18,561 with the Nifty finishing at 5581. Amidst all this uncertainty, gold reached a new all-time high closing at $1590.

This bearish result was in keeping with expectations given the influence of aspects involving malefics Mars and Saturn. Monday’s decline fit nicely with the Mercury-Mars aspect while Tuesday’s loss reflected the Venus-Saturn aspect with a good dose of Moon-Mars that bumped up the arrival time by a day. The midweek rally attempt on the Moon-Venus aspect fell short, however, and weakness returned in time for Friday.

All the talk this week was about debt and how to avoid its worst consequences. The news out of Europe suggested that current debt levels in Ireland and Italy were unsustainable as bond yields shot up to reflect the increased risk of default in these over-leveraged economies. The bond vigilantes are back in force and they smell blood. In the US, the debate over the debt ceiling reached a new level of urgency as there appears to be no deal on the horizon yet with the August 2 deadline fast approaching. Both parties agree on the need for some austerity measures and significant government spending cuts, but Obama and the Democrats want to raise taxes also and thereby bridge the budget gap from both sides. A major agreement to cut spending in the long term looks more unlikely now, as both parties may have to content themselves with a short term fix. Whether financial markets will be satisfied with such a band-aid solution remains to be seen, although the Moody’s downgrade threat of US credit rating from AAA would suggest there could be some negative fallout. A minor deal would likely send bond yields higher as it would increase the risk of default as well as increase future supply. Of course, failure to make any kind of deal would trigger a US default and generate even nastier consequences in the bond market. This would likely increase volatility in the stock market with potential short term gains, closely followed by declines as investors would realize that the whole financial house of cards would be one step closer to collapse.

In astrological terms, all this talk about debt and austerity is very Saturnian. After two years of Jupiter’s faith in a Keynesian future of borrowing and spending, the return of Saturn’s "less is more" approach has marked a discernible shift in tone. There is a growing realization that Jupiter-driven stimulus measures cannot solve our current economic problems alone. Saturn reminds us that sometimes the best solutions are ones where we pare back to essentials and discard what is no longer needed. Saturn’s solutions tend to be harsh, not unlike purging the system of toxins. Although they can be unpleasant, they can be effective in the long run. However, Saturn is not fully in command of the sky at the moment as Jupiter still exerts some influence. This suggests that bailouts and the Keynesian spending approach will likely retain some appeal for governments such as the EU alongside the demand for greater responsibility and austerity.

Transits for Monday July 18, 2011 9.30 a.m. New York

This week is more of a mixed bag. The early week Mercury-Rahu aspect could go either way, although it’s always hard to put much trust in Rahu. Mercury enters Leo on Wednesday so that may suggest some upside is more likely. The Sun’s entry into sidereal Cancer this week could signal a change in direction, especially for the gold market. A reversal lower in gold would therefore be somewhat more likely. I will be paying close attention to the late week period as Mars approaches its conjunction with Ketu (south lunar node). This is a potentially explosive pairing that could spark some hard selling, although the exact conjunction will only occur after the close on Friday in New York. This may mute its effects.

Stocks rise with Jupiter again; Venus-Saturn due this week

Stocks ended higher last week as improved corporate earnings kept the summer rally going for another week. Despite Friday’s decline on the disappointing jobs report, the Dow added 75 points for the week closing at 12,657 while the S&P500 finished at 1343. Indian stocks also rose as the Sensex broke above some important technical resistance and ended the week at 18,858 while the Nifty closed at 5660.

This bullish outcome was not unexpected as I thought that Jupiter’s optimism would carry the day. The early week gains in Mumbai coincided quite closely with Monday’s Venus and Jupiter aspects, even if they were fairly modest. As expected, the midweek Mars-Saturn aspect tempered Jupiter’s bullishness and we saw some mild selling occur in most global markets. Once that negative influence had passed, Jupiter took over again and stocks and commodities moved higher on Thursday’s Venus-Uranus aspect. And as often happens, we got a reversal just as the powerful Jupiter-Pluto aspect peaked on Friday.

With all of the main medium term Jupiter aspects now out of the way for a while, one wonders where stocks are headed to next. The easy gains are likely behind us now as bulls will be harder pressed to find other sources of planetary fuel. They may well be running on fumes for a while. And yet Saturn doesn’t appear to be offering much to the bears here either in the way of aspects, so we could see some aimless wandering for the key indexes.

This week offers up some decent bear food in the form of Saturn’s square aspect to Venus. This makes its tightest angle on Tuesday/Wednesday, although I would expect the Moon’s position opposite Mars on Tuesday makes that day somewhat more negative. The early week also features a Mercury-Mars aspect that is iffy at best so it’s hard to imagine stocks making much more headway here. There could be a bias towards caution this week that generates some selling. Of course, we should see some up days along the way too, although they are likely to be offset by Saturn’s influence.

Stocks take flight on Jupiter; New Moon/eclipse cycle to be tested again

Jumping Jupiter! Stocks soared last week as investor confidence was restored following Greece’s approval of the EU’s austerity program. The biggest gains were in New York as the Dow climbed 5% closing at 12,582 while the S&P500 finished at 1339. Indian stocks also rose by almost 3% as the Sensex briefly touched 19K before settling at 18,782. The Nifty closed above a key technical resistance level of 5600 ending the week at 5627.

While I had expected some upside on the strong Jupiter aspects, I did not expect the move to be so forceful. It was an impressive manifestation of Jupiter’s bullish energy as its more powerful aspects with Uranus and Pluto aligned nicely with its aspect with the faster-moving Mars. All this Jupiter energy translated into a big relief rally as stocks bounced off their recent lows. What was more perplexing, however, was the failure of Friday’s solar eclipse to generate any selling pressure. Indian markets pulled back modestly on Friday, but US markets continued to run higher. It was a sobering reminder of the limits of my astrological knowledge, and perhaps the epistemological limits of astrology itself.

While the eclipse may not have exactly coincided with a decline, it is still a phenomena worthy of our attention. Recently, US markets have tended to make highs near the New Moon, and then fall into the period of the Full Moon. Eclipses are a special type of New Moon where the orbits of the Moon and Earth intersect sufficiently for the Moon to cast a shadow upon the Earth. The May 2 high occurred right on the day of the New Moon, while the lower high on June 1 also fell within one day of a New Moon and solar eclipse. If stocks begin to fall this week in the wake of the eclipse, then the pattern will have repeated once again. I’m not sure we have seen a high, since this New Moon cycle is only one of several that affects the markets. But it nonetheless increases the odds somewhat that a reversal lower is imminent.

One reason why this New Moon/eclipse reversal may not quite fit with that pattern is that Jupiter still looks quite strong. It will form its exact trine aspect with Pluto on Friday July 8 and then begin to weaken once again. This suggests there will be a significant amount of bullish buying power available for this week so that may reduce the probability of an immediate post-eclipse decline.

But astrology is nothing else if not a multi-headed hydra, and there are always other influences to consider. Wednesday’s Mars-Saturn aspect, although technically a "minor" one, is a potential source of bearishness. This could depress sentiment in the midweek period, especially since Monday and perhaps Tuesday appear to be fairly positive with the Mercury-Jupiter aspect. The end of the week offers the bulls another opportunity to take the reins as Venus moves into alignment with Uranus and Jupiter. So while those short-term aspects look mixed to positive this week, we will still have to wait and see if the New Moon cycle will assert itself once again. I’m not holding my breath on that, but Jupiter’s bullish influence may well be fading after this week.

Stocks attempt rebound; Saturnian solar eclipse due Friday

Stocks attempted to rebound from their recent lows last week as falling oil prices and the adoption of a new austerity program in Greece gave some reason to cheer. In New York, the rebound didn’t quite take as the Dow ended slightly lower on the week closing at 11,934 while the S&P500 finished at 1268. Indian stocks fared better, however, as the BSE-Sensex rose by 2% closing at 18,240 with the Nifty ending the week at 5471. I had expected more weakness early in the week on the Mercury-Saturn aspect. India caught the full force of this influence as stocks declined sharply on Monday. World markets then reversed and we saw some gains in US markets over the next couple of days. Interestingly, the late week bullishness I was expecting from the Sun-Jupiter combo only showed up in Mumbai as Thursday and Friday posted impressive performances as the markets there rallied off support. US markets were a very different story, however, as growth anxiety pushed stocks back to their support levels.

All this talk of austerity and bailouts for Greece is getting a little old, and one wonders if the market may have already discounted a default. The Euro is showing signs of more weakness here but has yet to break below 1.40. I would have thought we might have seen more in the way of constructive policy pronouncements and subsequent cheer leading by this point as Saturn’s influence should be beginning to recede. No such luck, although at least markets have stopped falling for the time being. In the current environment, that is at least something.

Solar Eclipse – Friday July 1, 2011 4.38 a.m. New York

It may well be that the negative Saturn mood will come to the fore once again this week in the form of Friday’s solar eclipse. The eclipse takes place in the early afternoon in India (before sunrise in NYC) and could correspond with another shock of volatility. Eclipses can be destabilizing events at the best of times but this one has the added bonus of occurring in a tight square with Saturn. That could amp up the bearish mood considerably at the end of the week.

Before that time, there are some fairly decent aspects that could bring gains. Mars with Jupiter on Monday, Venus with Mercury, and somewhat more precariously, Venus with Ketu on Tuesday and Wednesday.

Saturn seems reluctant to give up its recent high profile so maybe this eclipse will be its last kick at the can for a while. Just how much damage it will do is an open question, however.

Stocks shaky on lunar eclipse; Jupiter aspect may offer some relief

Fears of a possible Greek default raised volatility last week, even if the EU eventually cobbled together another bailout package to delay the inevitable collapse of that Mediterranean nation. In New York, the Dow made new lows Wednesday but rallied by Friday closing slightly higher on the week at 12,004 while the S&P500 finished at 1271. Indian stocks were more negative, however, as the RBI boosted interest rates again to deal with its intractable inflation problem. The Sensex lost more than 2% closing at 17,870 while the Nifty ended the week at 5366.

As expected, last Wednesday’s lunar eclipse did shake things up as stocks and commodities like oil and gold fell sharply at midweek. The downgrade of Greek debt, coupled with Asian central bank tightening created a pessimistic mood throughout financial markets. While the Mercury-Jupiter aspect did deliver some rebound by Friday, this rise did not occur in Mumbai where caution over domestic inflation prevailed. There is a growing sense that there will be no quick fixes for the world’s economic woes. The Fed has signaled it won’t launch QE3, most likely because it’s between a rock and a hard place at the moment. A new round of stimulus would sink the Dollar and likely boost interest rates on Treasuries as buyers of US debt would likely demand a greater risk premium. Of course, by doing nothing, the Fed is allowing the economy to sink or swim. But high unemployment, falling house prices, and a burgeoning government debt are all acting like very heavy millstones.

It’s all very Saturnian of course as the ringed planet infuses its distinct brand of gloom and fear into our collective psyche. After completing its retrograde cycle last Monday, Saturn is now moving forward, albeit very slowly. Reversals in planetary direction can often mark changes in market direction, especially when other evidence supports. Wednesday’s eclipse could definitely qualify in that regard, although we still have one more to go on July 1.

Transits for Monday June 20, 2011 9.30 a.m. New York

Eclipse periods tend to be more volatile than normal periods, and occur every six months lasting from between two to four weeks. This one began on June 1 and will last until July 1. Eclipses can coincide with reversals and declines, especially when the eclipses are afflicted by malefic planets. Saturn is considered malefic and it likely made this recent eclipse more negative. The upcoming solar eclipse on July 1 will also be quite Saturnian since Saturn will exactly square the Sun/Moon conjunction. This does not necessarily mean the market will keep falling until July 1 or beyond, however, It does mean that it increases the likelihood of more uncertainty and pessimism around that date. Whether or not it shapes the larger trend and invites a larger reversal higher depends on other factors and their relative influences.

This week looks like a mixed bag as Mercury is squared by Saturn on Tuesday. There is also an alignment of Sun, Mars and Neptune on Tuesday and Wednesday that could correspond to some additional anxiety. I would therefore expect the first half of the week to be more bearish, with a chance of a nasty decline. On the other side of the cosmic ledger, we can see that Jupiter may be increasing its profile here. Jupiter tends to be bullish in its effects and its approaching aspect with Uranus will be highlighted by its contact with the Sun on Friday. That should increase the odds of some kind gain towards the end of the week. Where the market ends up overall is harder to say, although it is possible we could finish close to current levels.

Stocks fall into Saturn-Pluto; Lunar eclipse due on Wednesday

Stocks slumped again last week as the Fed Chair Ben Bernanke ruled out any additional stimulus plan (QE3?) for the foreseeable future. In other words, the buffet is closed and there will be no more free lunch. In New York, the Dow lost almost 2% closing at 11,951 while the S&P500 finished the week at 1270. In keeping with recent trends, Indian stocks fared somewhat better, however, as the Sensex slipped by less than 1% closing at 18,268 while the Nifty ended the week at 5485. While the early week period looked a little shaky with the Mercury-Saturn aspect, I thought we would have more of a bounce later on as the Jupiter-Neptune aspect tightened. As it turned out, only Thursday got the benefit of the Jupiter bounce in the US market. Friday’s decline corresponded fairly closely with the approaching bearish Mars-Rahu aspect.

So this is still very much a Saturnian market. Saturn’s portfolio of pessimism, loss, and recession is very much front and centre here as fears about inflation have been pushed into the background. This plausibly reflects the current planetary geometry quite well as inflationary and growth-oriented Jupiter lost some influence in the wake of its early May aspect with Rahu. In its place, Saturn has strengthened as it prepares to reverse its direction and square Pluto this week. As we know, a slow Saturn is a powerful Saturn. And a powerful Saturn tends to focus public attention more on the intractability of the Eurozone debt crisis, the flagging US recovery, and the unsustainability of emerging market expansion in countries like India and China.

Lunar Eclipse Wednesday, June 15, 2011 4.12 p.m. New York

This week could bring some important new developments that shift financial thinking in significant ways. Saturn ends its 4-month long retrograde cycle on Sunday night and forms its tightest aspect with Pluto at that time. This is generally a difficult combination, although Saturn’s change in direction from backwards to forwards can mark an analogous change in sentiment. However, there are a number of difficult aspects in the mix here that suggests more downside in the near term. Mercury conjoins Ketu on Monday while Mars forms an aspect with Mercury on Tuesday. Of course, Wednesday has a big asterisk beside it because the lunar eclipse occurs in the afternoon before the end of the trading in the US. There is a lot of celestial traffic here and it should produce some noteworthy moves both in the markets and perhaps also on an institutional and policy level. Eclipses are all about interruption of the status quo so trend reversals are somewhat more likely at this time. The late week period features some short term Mercury aspects that seem fairly benign so perhaps that increases the likelihood of gains by Friday.

Stocks fall with Saturn and eclipse; Jupiter strengthens this week

US stocks staged a significant retreat last week as disappointing employment data suggested that the recovery may be in trouble. In New York, the Dow fell by more than 2% closing at 12,151 while the S&P500 finished at 1300, just above a critical technical support level. This bearish outcome seemed to reflect the planetary energies fairly well as the midweek Sun-Saturn aspect and solar eclipse coincided with Wednesday’s big drop. I had been uncertain about Friday given the Neptune retrograde station but that decline was not a surprise. Indian stocks fared better, however, as they benefited from more early week upside which US markets missed due to the Memorial Day holiday. Despite two losing sessions at the end of the week, the Sensex rose by almost 1% to 18,376 with the Nifty settling at 5516.

The glass is looking half empty here as concerns grow that all the stimulus measures from the US Federal Reserve over the past two years are no longer working as advertised. But if QE1 and QE2 aren’t enough, then surely this makes another round of stimulus more likely in the form of QE3? Well, one should never discount a government’s desire to print more money to get out of jam, but there may be less tolerance for such a move now.

Transits for Monday, June 6, 2011 9.30 a.m. New York

It turns out that all that "free" money really isn’t free at all and comes with a price. The US debt has ballooned to $14 trillion and counting, the Dollar has plunged, and commodities like oil and gold have risen sharply. This has created an inflationary environment all around the world which has wreaked havoc in many emerging markets. It now also threatens to overtake the US economy as the implications of Bernanke’s currency devaluation scheme are becoming more apparent. There is more talk that the US is running out of policy options and may simply have to face the music, even if it means rising unemployment, more falling house prices, and little or no growth for the near term. All this negativity is very much in keeping with strengthening Saturn as debt, recession and economic pessimism now predominate the discussion. I tend to think that Saturn could well remain in control up until the conclusion of its retrograde cycle on June 13 when it forms a square aspect with Pluto.

For all the gloomy Saturn influence, we could see more Jupiter this week as it forms an aspect with Neptune. While Neptune does have a bearish side, its aspects with Jupiter tend to be more bullish. Upside is perhaps even more likely in the second half of the week as Venus joins the alignment. Ahead of that time, however, Saturn will again be front and centre as its aspect with Mercury on Tuesday could indicate shakier markets in the early part of the week.

Stocks slip on Mars-Saturn; Neptune turns retrograde on Friday

Stocks edged lower last week as uncertainty over the strength of global recovery continued to weigh on sentiment. In New York, the Dow rebounded at the end of the week but still closed slightly lower at 12,441 with the S&P500 finishing at 1331. Indian stocks followed a similar script as a late week rally wasn’t enough to erase previous losses. The BSE-Sensex closed a little lower at 18,266 with the Nifty ending the week at 5476. As expected, we did see declines coincide with the alignment of Mercury, Venus, Mars and Saturn in the first half of the week. Monday’s decline was larger as Venus conjoined Mars while in difficult aspect with bearish Saturn. However, I thought we might have had a little more downside on Wednesday’s exact Mars-Saturn aspect. As it happened, Indian stocks were lower on Wednesday but the mood changed by the time US markets opened as New York reversed and began to rally off its lows.

Some disappointing US economic data last week saw a broad-based selloff in the Dollar as investors priced in another delay in an interest rate hike, perhaps to 2012. There is increasing chatter among commentators that further weakness in the US will force Bernanke to cobble together yet another stimulus package to keep the sinking ship that is the US economy afloat for another few months. As QE2 winds down at the end of June, rumours of QE3 may become a more important factor in the market dynamic in the weeks and months ahead. As a rule, such stimulus programs are associated with expansionary Jupiter since they aim to boost demand and invigorate economic activity. With Jupiter still taking a backseat to Saturn these days, it seems somewhat unlikely that any hint or formal announcement of QE3 will be immediately forthcoming. Saturn is moving very slowly ahead of its direct station on June 13, so the main focus is likely to remain on Saturn-type issues such as debt, slowdown and general pessimism. After that time, we may see more Jupiterian energy prevail as Jupiter forms a succession of putatively bullish aspects with Neptune, Uranus and Pluto in June and July before it makes its retrograde station at the end of August. This latter time frame is therefore a more likely window when we could see the announcement of some kind of additional Fed stimulus.

Transits for Tuesday May 31, 2011 9.30 a.m. New York

This week we may see a bit of everything. The early week again seems bearish as Monday’s Mercury-Rahu aspect is quickly followed by a Sun-Saturn pattern on Tuesday and Wednesday. Wednesday is also noteworthy because there will be a solar eclipse at 17 degrees of sidereal Taurus on that day. This is likely to reflect an increase in caution in many markets including stocks and commodities. A minor contact between Mercury and Jupiter on Thursday offers some hope for a rebound, however. Friday may be the most interesting and unpredictable day of all. That is the day that Neptune turns retrograde. What’s interesting about this retrograde station is that it will occur while in a tense square aspect with Mercury. This is normally a bearish combination. The complicating factor is that Neptune is sitting very close to its aspect with bullish Jupiter. For this reason, the retrograde station could end up being a positive influence, even with the dubious input from Mercury. While the final outcome is somewhat uncertain, it does suggest that a larger than normal price move is more likely on Friday.

Week of May 23 – 27

Stocks slip on Mercury-Mars; Saturn poised to strengthen this week

Stocks trended lower last week as renewed worries over Greece offset positive earnings reports. In New York, the Dow fell less than 1% closing at 12,512 while the S&P500 ended the week at 1333. It was much the same story in Mumbai as the Sensex lost 200 points closing at 18,326 with the Nifty finishing the week at 5486. I thought we might have seen more early week upside on the Sun-Jupiter and Mercury-Venus-Neptune alignments but it seems that the market is still working through the after effects of that Jupiter-Rahu aspect from early May. In addition, a shadow Saturn aspect to this alignment generated more caution than I had anticipated. We finally got a reversal higher midweek as Mercury and Venus teamed up with Uranus. As expected, Friday’s Mercury-Mars conjunction was bearish, although this only manifested later in the day in Europe and the US, after Indian markets had closed.

Not surprisingly, we saw more developments in the Eurozone debt problem as Fitch downgraded Greece’s debt another two notches while Germany showed greater reluctance to cut blank cheques for their spendthrift southerly neighbours. This appears to be conforming to the strengthening of Saturn here as the focus shifts from speculation and inflation (Jupiter-Rahu) to debt and recession (Saturn). Saturn symbolizes caution and pessimism so it tends to be associated with economic contraction and declining prices. In that sense, it is the necessary antidote to inflation. In other words, Saturn is deflationary in its effects. When Saturn is strong and afflicted, prices tend to fall. Saturn tends to strengthen around close aspects with other planets and when its velocity is reduced near its stations. Saturn is due to station next on June 13 when it ends its retrograde cycle and return to its normal forward motion. At that time, it will form a fairly close square aspect with Pluto. So on that basis, it is tempting to think that the markets will stay weak until that time.

Transits for Monday May 23 2011 9.30 a.m. New York

This week will be an important test of this approaching Saturn energy. Early in the week, there will be a triple conjunction of Mercury, Venus and Mars. Mars is a potential troublemaker here so that may increase in the chances of lower prices. But Saturn will also form a close 150 degree aspect to this triumvirate so is another potentially bearish influence. If we do get a decline into midweek, then that will provide additional evidence that Saturn is strengthening and would boost the odds for a larger correction that lasts into that mid-June station.

Stocks end flat in wake of Jupiter-Rahu; Sun-Jupiter offers hope early

Stocks were mostly unchanged last week as renewed concerns over Greece were offset by improving economic data. In New York, the Dow edged lower closing at 12,595 while the S&P500 finished the week at 1337. Mumbai was similarly indecisive as the Sensex ended pretty close to where it started at 18,531 and the Nifty following suit at 5544. While it wasn’t very exciting, the end result was not hugely unexpected. I was not wrong in thinking there could be more upside leading into Wednesday’s triple conjunction of Mercury, Venus and Jupiter. Most global markets rose in the first half of the week as the positive influence from these planets overshadowed any potential bearishness from the aspect with Rahu. Significantly, this affected most asset classes including oil, gold and silver as commodities also rallied back from the previous week’s sell-off. Indian markets did not participate in the early week rise perhaps because of the more negative implications of rising oil prices. As expected, stocks and commodities were mostly bearish in the aftermath of the triple conjunction as the US Dollar gained more ground.

Transits for Monday May 16, 2011 9.30 a.m. New York

This week actually features some positive aspects, especially in the early part of the week. Monday’s Sun-Jupiter aspect is complemented by a very nice Mercury-Venus-Neptune aspect which should increase the likelihood of gains in the first half of the week. Wednesday’s Mercury-Venus-Uranus alignment should add another layer of optimism to the proceedings. Of course, the market could still decline in spite of these bullish short term aspects as we are in the shadowy, leeward side of the Jupiter-Rahu aspect. Nonetheless, declines may be further delayed until the short term picture becomes more difficult. The end of the week is perhaps a better example of this tense energy as Mercury catches up with Mars while in aspect to Pluto.

Stocks fall amidst commodity selloff; triple conjunction this week

Financial markets went into spasm last week as the speculative commodities trade came to a crashing halt. The Humpty-Dumpty world of gold, silver and crude oil all came tumbling back down to earth with a thud against a backdrop of central bank tightening in Asia, a dollar recovery in the US and the possibility of Greece leaving the Eurozone, not to mention the US assassination of Osama Bin Laden. Stocks did not escape the turmoil as equities succumbed to inflation fears and poorer than expected US economic data. In New York, the Dow closed down more than 1% at 12,638 while the S&P500 ended the week at 1340. Indian stocks also declined by more than 3% as the Sensex closed at 18,518 and the Nifty finished at 5551.

Financial markets went into spasm last week as the speculative commodities trade came to a crashing halt. The Humpty-Dumpty world of gold, silver and crude oil all came tumbling back down to earth with a thud against a backdrop of central bank tightening in Asia, a dollar recovery in the US and the possibility of Greece leaving the Eurozone, not to mention the US assassination of Osama Bin Laden. Stocks did not escape the turmoil as equities succumbed to inflation fears and poorer than expected US economic data. In New York, the Dow closed down more than 1% at 12,638 while the S&P500 ended the week at 1340. Indian stocks also declined by more than 3% as the Sensex closed at 18,518 and the Nifty finished at 5551.

All this turbulence appears to be an adequate reflection of the slow-moving Jupiter-Rahu aspect which finally comes exact on May 7. As I have noted over the past several weeks, the approach of the Jupiter-Rahu aspect has the potential to disrupt the financial landscape in fundamental ways. Specifically, the focus of this aspect centered around notions of speculation and growth expectations. Jupiter symbolizes growth and optimism but Rahu often creates a distorting or unsustainable greed effect so it is quite fitting that this speculative froth would have be taken out of the market at this time. Silver has fallen 30% in the span of a single week while crude oil has declined by 10%. It is possible that we could be at the beginning of a major sea change in assumptions as the long-struggling US Dollar may have turned the corner now as it rose 2% for the week. Once the Dollar gets back on its feet, it will likely fuel further exiting of the "risk trade" in commodities and likely in stocks as well.

Another reason why we could be witnessing a shift in the prevailing trends is that Saturn is now backing up into a square aspect with Pluto. The aspect will still be four degrees away from exact so it may not be as powerful as it might be, but it could well provide another source of Saturnian caution for the market in the weeks ahead. Once Saturn returns to direct motion on June 13, this aspect will begin to separate and eventually weaken.

Since Jupiter makes its exact with Rahu this week, it would be tempting to think that it’s all downhill from here. It very well could be, although there may be sources of bullish sentiment in the mix also. Of critical importance will be the triple conjunction of Mercury, Venus and Jupiter on Wednesday May 11. These are three normally bullish planets that should generate some buying in and around their exact alignment. As a general rule of thumb, sentiment usually rises before the aspect is exact. The complicating factor here is that this bullish triple conjunction will occur under the shadowy aspect of Rahu. That may increase the likelihood of a quick reversal lower at any point in the proceedings and could seriously undermine rally attempts. In any event, it promises to be an active and interesting week.

Week of May 2 – 6

US stocks gain on Jupiter-Rahu inflation play; Mars is stronger this week

US Stocks rose last week as investors cheered Fed Chair Ben Bernanke’s restated commitment to the zero interest rate policy for the foreseeable future. In New York, the Dow gained more than 2%

closing at 12,810 while the S&P500 finished at 1363. Bernanke’s comments also prompted gains in inflation hedges as such gold, silver and oil. It was a different story in India’s already inflation-ravaged economy as the Sensex lost more than 2% closing at 19,135 while the Nifty ended the week at 5749.

As expected, we did see some decline on Monday’s Mercury-Saturn opposition aspect. The US market rebounded after that as the bullish Sun-Venus-Pluto pattern coincided with gains that lasted for the rest of the week. The gains were largely a response to the pro-inflationary stance of the Fed, as most asset classes gained ground against a falling dollar. The Indian market fared less well, however, since the Fed policy would likely increase inflationary pressures that are already threatening the domestic economy. Interestingly, Friday’s gains in crude and gold coincided with the Moon’s entry into sidereal Pisces. I suggested last week that this transit might well coincide with gains in crude as it would enhance the strength of the five planets (Uranus, Mars, Mercury, Venus, Jupiter) that already occupy this constellation.

Transits for Monday May 2, 2011 9.30 a.m. New York

The recent gains in most asset classes is very much in keeping with the speculative nature of the approaching Jupiter-Rahu aspect. Jupiter’s tendency towards expansion and growth is exaggerated by Rahu’s penchant for distortion and disruption. The combination of these influences can result in greed and speculative excess that are commonly found in bubbles and manias. It is therefore no surprise that we see gold reaching new all-time highs every week and silver going parabolic. One of the features of Rahu, however, is that while it can generate gains, these are often unsustainable in the long term. Once the Jupiter-Rahu aspect begins to separate on May 7 (or May 13 depending on which measurement of Rahu/NN one uses), we will need to watch for signs of a trend reversal. There is an increased likelihood that this aspect may bring about changes in the financial landscape. Nothing is guaranteed obviously, but it is a combination that has the power to change the status quo.

This week begins with a potentially tricky aspect between Mars and Rahu. Since Mars is also entering sidereal Aries on Tuesday, this could increase the probability of some downside in the early week. This may be strong enough to manifest in most markets. But we could see a return to the pro-inflation bullishness after that, as the approaching conjunction between Venus and Mercury is likely to bring some gains into midweek, and perhaps later. Friday looks somewhat less positive, however, as the Moon conjoins Ketu/SN.

Week of May 2 – 6

US stocks gain on Jupiter-Rahu inflation play; Mars is stronger this week

US Stocks rose last week as investors cheered Fed Chair Ben Bernanke’s restated commitment to the zero interest rate policy for the foreseeable future. In New York, the Dow gained more than 2%

closing at 12,810 while the S&P500 finished at 1363. Bernanke’s comments also prompted gains in inflation hedges as such gold, silver and oil. It was a different story in India’s already inflation-ravaged economy as the Sensex lost more than 2% closing at 19,135 while the Nifty ended the week at 5749.

As expected, we did see some decline on Monday’s Mercury-Saturn opposition aspect. The US market rebounded after that as the bullish Sun-Venus-Pluto pattern coincided with gains that lasted for the rest of the week. The gains were largely a response to the pro-inflationary stance of the Fed, as most asset classes gained ground against a falling dollar. The Indian market fared less well, however, since the Fed policy would likely increase inflationary pressures that are already threatening the domestic economy. Interestingly, Friday’s gains in crude and gold coincided with the Moon’s entry into sidereal Pisces. I suggested last week that this transit might well coincide with gains in crude as it would enhance the strength of the five planets (Uranus, Mars, Mercury, Venus, Jupiter) that already occupy this constellation.

Transits for Monday May 2, 2011 9.30 a.m. New York

The recent gains in most asset classes is very much in keeping with the speculative nature of the approaching Jupiter-Rahu aspect. Jupiter’s tendency towards expansion and growth is exaggerated by Rahu’s penchant for distortion and disruption. The combination of these influences can result in greed and speculative excess that are commonly found in bubbles and manias. It is therefore no surprise that we see gold reaching new all-time highs every week and silver going parabolic. One of the features of Rahu, however, is that while it can generate gains, these are often unsustainable in the long term. Once the Jupiter-Rahu aspect begins to separate on May 7 (or May 13 depending on which measurement of Rahu/NN one uses), we will need to watch for signs of a trend reversal. There is an increased likelihood that this aspect may bring about changes in the financial landscape. Nothing is guaranteed obviously, but it is a combination that has the power to change the status quo.

This week begins with a potentially tricky aspect between Mars and Rahu. Since Mars is also entering sidereal Aries on Tuesday, this could increase the probability of some downside in the early week. This may be strong enough to manifest in most markets. But we could see a return to the pro-inflation bullishness after that, as the approaching conjunction between Venus and Mercury is likely to bring some gains into midweek, and perhaps later. Friday looks somewhat less positive, however, as the Moon conjoins Ketu/SN.

Week of April 25 – 29

Stocks gain on Sun-Venus; more gains possible this week

This outcome was more or less in line with expectations as the Mercury-Mars-Saturn alignment on Monday and Tuesday was likely to induce more selling. Monday was lower but the market generally reversed higher by Tuesday resulting in perhaps a somewhat abbreviated negative influence from these planets. The midweek gains correlated quite closely with the bullish Sun-Venus-Neptune pattern as investors pushed up prices through to the end of the week.

One wonders how long Bernanke will let the Dollar fall. While a low Dollar helps to make exports cheaper and boosts job growth, all that imported oil the US relies upon for its energy needs is becoming a burden on the economy. $5 a gallon gasoline is going to reduce discretionary consumer spending and this will tend to reduce economic growth. Eventually, something will have to give. Either the Fed defends the Dollar and lets the stock market fall, or the Dollar is permitted to devalue indefinitely which will drive up inflation and reduce growth. Jupiter moves into alignment with Rahu in early May so that may well reflect some changes (Rahu) in growth outlook (Jupiter).

his week begins in the immediate aftermath of a Mercury-Saturn opposition. Mercury actually turns direct on Saturday, but it will still be just one degree from its exact aspect from bearish Saturn. So it is possible this could be a drag on sentiment, especially in Indian markets. But more upside looks fairly likely going into midweek as the Sun and Venus will align with Pluto. This is likely to boost most asset classes. The end of the week is somewhat fuzzier, however. Stocks may be more mixed, with oil perhaps more likely to rise as the Moon enters watery Pisces on Friday.

Week of April 18 – 22

Markets drift lower; Mercury-Mars-Saturn this week

Stocks edged lower last week as inflation fears and unimpressive corporate earnings weighed on markets. In New York, the Dow rallied late in the week but still ended lower closing at 12,341 while the S&P500 finished at 1319. In Mumbai, the Sensex reversed after Wednesday’s gain and closed lower at 19,386 while the Nifty finished at 5824. I thought we might see more early week upside on the Mercury-Jupiter conjunction but we only saw some gains arrive on Wednesday. Friday’s Sun-Rahu aspect was more of a toss-up and this coincided with a decline in India, although the US market continued to rise.

Inflation remains an ongoing concern here as oil and gold are both seen as hedges against rising prices and a falling US Dollar. Both phenomena are at least partially due to the Fed’s QE2 policy which comes to an end on June 30. The debate now is whether the economy and the market are strong enough to stand on their own two feet once this policy ends. While the jury is out on that question, it does seem reasonable to assume that once the injection of Fed cash ends, there will be less inflationary pressure around the world. This will tend to moderate or lower asset prices including stocks, oil and gold. However, it seems unlikely that prices will simply begin to fall the day after QE2 ends. Markets typically don’t work that way.

Transits for Monday April 18, 2011 9.30 a.m. New York

It seems more likely that we could get some adjustment in asset prices before the end of the Fed’s buy back program. We have seen some correction already, especially in emerging markets like India, although oil and gold are still riding high. As Jupiter approaches its aspect with Rahu in early May we could see a new dynamic enter the market. Rahu tends to disrupt the status quo so its association with Jupiter (wealth, finances, growth) may interrupt the prevailing trend. Rahu can also symbolize speculation and greed, so it’s possible that some markets will continue to rise until the aspect is exact.

This week begins with a difficult alignment of Mercury, Mars and Saturn. Mars opposes Saturn on Monday while Mars conjoins Mercury on Tuesday. Since the bearish planets (Mars, Saturn) outnumber bullish Mercury, there is a greater likelihood of declines this week, especially in the early going. The late week period offers somewhat more positive outcomes as the Sun and Venus form aspects to Neptune.

Stocks flat after Sun-Jupiter-Saturn; Mercury-Jupiter upcoming

This flat result was not wholly unexpected as I noted we would see both positive and negative aspects in play. The cluster of planets in the Sun-Jupiter-Saturn alignment made outcomes more difficult to predict. US markets peaked with Wednesday’s Sun-Jupiter conjunction while India peaked Monday, albeit with some intraday rally attempts in midweek that failed to hold. (Wednesday actually marked the intraweek high.) I thought we might see more downside early on around the Mars-Uranus conjunction but aspect passed uneventfully. It is interesting to note that many world markets made some significant highs last week around this alignment. In the case of the Dow, it made a new high for 2011 while India’s Sensex pushed to a new high in this post-correction rebound. Whether these highs will hold for any length of time remains to be seen, but given the importance of the planets involved in this alignment, it adds just a little more evidence to the bearish view that more downside may be around the corner. Market reversals will sometimes occur near multi-planet alignments not unlike what we saw last week.

The other thing worth noting is that the Sun will also be in aspect with Rahu (North Lunar Node) at the end of the week. Rahu is a more unpredictable planet so this aspect may increase the likelihood of declines. While gains are still possible under this combination, it is not a reliably bullish factor.

Week of April 4 – 8

Stocks rise with Venus; Sun aligns with Jupiter-Saturn

Stocks extended their rebound last week as investors chose to look beyond the Middle East and focus on improving growth prospects. In New York, the Dow was up over 1% closing at 12,376 while the S&P500 finished the week at 1332. While we did see some early week declines around the Mars-Ketu aspect, the pullback was most modest than expected. The midweek Moon-Venus conjunction also corresponded fairly well with the midweek gains. Investors were even more upbeat in India as the Sensex rose 3% closing at 19,420 and the Nifty ending the week at 5826. There was no downside at all in the early week, however, as the Mars-Ketu aspect failed to correlate with any selling.

While most markets have rallied back from recent lows, stocks still appear to be trapped in a corrective phase, especially in emerging markets such as India. This is broadly in keeping with the bearish influence of the Jupiter-Saturn opposition. As this influence is now gradually weakening, the next major aspect on the horizon is the Jupiter-Rahu aspect in early May. If Jupiter symbolizes optimism and growth, Rahu is associated with distortions and excessive acquisitiveness. Rahu (North Lunar Node) is considered a natural malefic that can cause problems of indulgence and excess, such as in speculation. While it is sometimes linked to an expansion, this is often unstable and is subject to sudden collapse. Often, the influence of Rahu brings negative consequences.

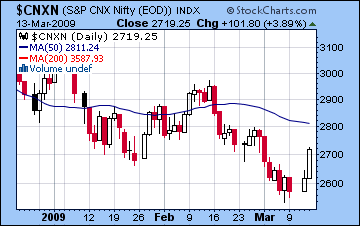

In February 2009, Jupiter conjoined Rahu in Capricorn just as stocks were falling rapidly toward their eventual low in early March. While other factors no doubt also played a role in that decline — the tight Saturn-Uranus opposition quickly comes to mind — the close proximity of Jupiter to Rahu is noteworthy. We will have an roughly analogous situation in early May so that warrants close observation.

Transits for Monday April 4, 2011 9.30 a.m. New York

Markets rise on Sun-Uranus; Mars-Ketu due on Tuesday

This recent rise in stocks is perhaps somewhat anomalous with the close opposition aspect between Jupiter and Saturn, now just one degree from exact. As a general rule, closer aspects are more powerful in their effects and if this aspect is mostly negative, then stocks should tend to decline around the date of their exact aspect, which is March 28-29 in this case. While that is likely true, it is important to note that both Jupiter and Saturn are slow moving planets and usually require faster-moving triggering planets to release their energy. We didn’t have a triggering 3rd planet last week, so that was one reason why the markets recovered. So even though the aspect will begin to separate and therefore weaken after Monday, its mostly bearish energy can be released for days or even weeks afterwards if we get the right triggering planets involved in the alignment. This appears to be the case now as we have a series of transits involving fast-moving inner planets (Sun, Mercury, Venus, Mars) that will all conjoin Jupiter in the month of April. It promises to be a fascinating time.

It’s also worth noting that planetary energies for good or ill will not always manifest clearly in the market. Negative energy such as what we see with Saturn aspects can sometimes show up in the form of a war, or natural disaster that may not have any obvious economic implications. The 2004 tsunami in the Indian Ocean was an example of this type of event that occurred near a negative planetary alignment of Saturn and Pluto and yet did not have any effect on the market. All of which is to say that there is still a lot we don’t know about the relationship between the motions of the planets and life on Earth. Astrology’s empirical foundation is fragmentary at best (not unlike economics perhaps!), and this is why it exists in a rather isolated, dark corner safely away from the mainstream.

Transits for Monday, March 28, 2011 9.30 a.m. New York

Week of March 21 – 25

Global markets slide on Japan; Jupiter-Saturn tightens its grip

Japan’s nuclear crisis delivered another blow to the markets last week as investors pondered the implications of a disruption of the global supply chain. In New York, the Dow broke below the 12K level falling almost 2% to 11,858 while the S&P500 finished at 1279. It was much the same result in India as another RBI rate hike added to the inflation anxiety with the BSE-Sensex slipping 2% to 17,878 while the Nifty ended the week at 5373.

This negative outcome was very much in keeping with my bearish general expectation ahead of the Jupiter-Saturn opposition aspect. However, some of the intraweek moves did not perform quite as anticipated, even if I suggested a higher level of ambiguity here. The early week Mars-Saturn aspect was bearish as expected in the US, although India ended flat over Monday and Tuesday. More interesting was the outcome of the midweek Mercury-Jupiter conjunction. Usually this is a bullish influence, although I noted that the proximity of Saturn’s aspect might mitigate of those effects. Well, Saturn not only mitigated them, it basically reversed them as US stocks fell into Wednesday. Indian markets appeared to adhere more closely to the negative effects of Fridays’ Mercury-Saturn aspect as this activated a key pattern in the natal horoscope of the BSE.

So far, the Jupiter-Saturn aspect appears to be fulfilling its bearish promise as we prepare for the exact opposition on March 28-29. As I have noted, these two giants of the solar system usually make news whenever they come together by aspect. As symbolic opposites, they represent the extremes of optimism/pessimism, expansion/contraction and gain/loss. While their energies some sometimes be constructively combined when they are favourably placed or aspected by benefic planets, they tend to be somewhat incompatible. While one might think they are roughly equal in strength, in practice Saturn tends to carry the day. That’s because as a more distant planet, it moves more slowly. In astrology, the general maxim is: the slower the planet, the greater the strength. This is perhaps a sobering reminder of the nature of the human experience: the strongest of the visible planets symbolizes structure, pessimism, and loss! Thanks, I needed that.

This week presents another mixed bag of aspects starting with Monday’s Sun-Uranus conjunction. Uranus’ risk-seeking outlook often manifests as gains on aspects like this, although the upside may not last long as the conjunction is exact before the start of trading in New York (although after the close in Mumbai). The Venus-Ketu/SN aspect may exert an influence on proceedings starting on Wednesday and lasting into Thursday. This is often a negative influence, although it is somewhat unreliable in that respect. Due to natal chart hits, Indian markets may be feel its effects more than the US. The end of the week is quite mixed as Venus heads towards its conjunction with Neptune. This is quite a bullish influence, especially for gold and oil, but it may well pan out to include most asset classes. However, it is exact only on Saturday so Asian markets may be less likely to feel it. But potentially offsetting influence here is that Mars enters sidereal Pisces on Friday and that can be a bearish influence. Given that mix of energies, I would not rule out any outcome.

Week of March 14 – 18

Markets slide on growth worries; Mercury-Jupiter conjunction this week

It’s interesting to see how the discussion about inflation has evolved in recent weeks. Back when Jupiter (optimism, expansion) was in fairly close conjunction with Uranus (risk, change), we saw rising inflation in the emerging economies like India and China but the potential downside risks seemed fairly minimal as growth was expected to continued at a brisk clip. That optimism began to waver after the exact conjunction in early January as India’s market began to decline in earnest. Clearly, more investors were realizing that inflation could be a big problem that could hamper growth in the future.

Transits for Monday March 14, 2011 9.30 a.m. New York

But US and European markets continued to climb as inflation was less of a problem in those recession-ravaged economies. It was only with the ongoing Middle East crisis and the spike in the price of oil that inflation became a concern in developed countries. This was a reflection of the weakening of Jupiter’s optimism as it began to separate from risk-seeking Uranus and approach cautious and pessimistic Saturn. The notion of good, or at least, benign inflation is now being replaced by bad inflation. Now that Jupiter is moving close to Saturn’s aspect, worries about growth are increasing, the Eurozone debt problem is back on the table and the glass is very much half-empty. In other words, Jupiter’s rosy outlook is getting schooled by Saturn’s sobriety. This is a similar planetary set up to May 2010 when the last Jupiter-Saturn opposition coincided quite closely with the stock market correction and the Flash Crash.