(24 February 2021) The Covid speculative bubble continues to blow bigger in 2021 as investors buy up everything from Bitcoin to blue chips. With the Fed keeping its QE liquidity taps open, stock markets are back in record territory, while home sales soar with the Covid-driven demand for single-family dwellings. While asset prices have been successfully inflated in keeping with the Fed’s mandate, bonds have been the big loser.

(24 February 2021) The Covid speculative bubble continues to blow bigger in 2021 as investors buy up everything from Bitcoin to blue chips. With the Fed keeping its QE liquidity taps open, stock markets are back in record territory, while home sales soar with the Covid-driven demand for single-family dwellings. While asset prices have been successfully inflated in keeping with the Fed’s mandate, bonds have been the big loser.

As hopes have grown for an economic recovery following the November vaccine announcements, bond yields have steadily risen as the interest rate on the benchmark 10-year Treasury note is now near 1.4%. (N.B. bond yields/rates vary inversely with bond prices.) The Fed typically manages short term rates (now at 0%), but longer term interest rates are still determined by the market. Based on the recent rise in yield, the market is signaling that inflation is coming.

Higher yields and higher inflation are something of a double-edged sword. On the face of it, rising yields and rising inflation expectations simply reflect greater economic optimism and the likelihood of stronger growth in the future. However, the downside is that sharply rising yields can quickly become a barrier to growth as many heavily-indebted companies and over-leveraged consumers are forced to pay higher costs to service their debt.

No one really knows at what point bond yields will become a problem for the economy and the stock market. Today’s 1.38% is pushing up against some technical resistance that dates from 2019, but it is unclear how much further it may rise before it starts to affect home sales, for example, since mortgages are based on the 10-year interest rate. So there are really two questions here: 1) how much further are yields likely to rise and 2) at what point could they become a problem? The first question is probably easier to address than the second.

The Horoscope of US Treasury Bonds

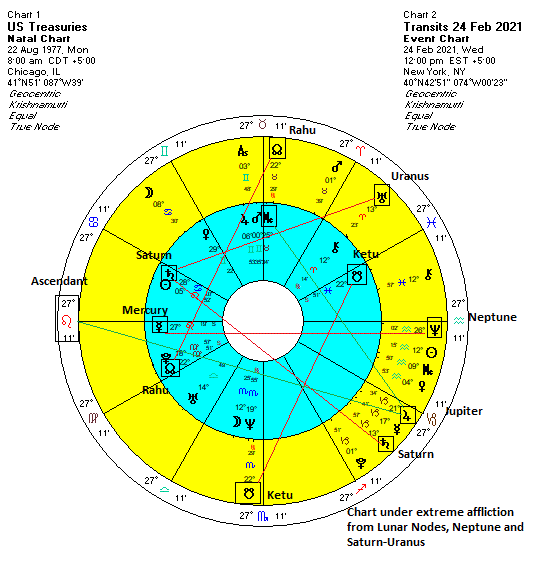

Using the horoscope of the first public trade of US Treasuries in August 1977, we can see why bonds have been under such stress in recent months. As a general rule, afflictions to this chart from malefics should reflect falling bond prices and rising yields, while favourable influences from benefics should reflect rising bond prices and falling yields.

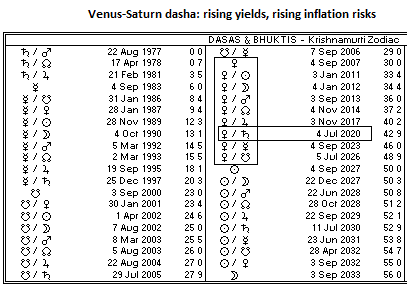

First off, we can see that the current dasha Venus-Saturn period (2020-2023) is difficult. While major dasha lord is benefic Venus, I have found that it is the minor dasha lord that is usually more consequential in the short run. Saturn is a natural malefic planet, of course, and it is very poorly placed near the equal house cusp of the 12th house of loss. Moreover, it receives an aspect from malefic Ketu (South Lunar Node). This is a very bad Saturn placement and is one reason why bond yields have been on the rise.

While dashas are usually not decisive in determining outcomes, they become more important when the dasha lords are clearly good or clearly bad. That is very much the case here with the Saturn minor dasha lord. It is worth noting that the Venus-Saturn dasha period will last until September 2023.

All other things being equal, this is a negative influence on bonds for the next two years which could see yields rise further. While other factors such as transits will also play a role in shaping the trend in yields (see below), this dasha influence at least suggests that the long term interest rates are less likely to go below zero as has been the case in several other countries. We can also suggest that bonds are more likely to increase in value — and yields will fall — during the Venus-Mercury dasha period in 2023-2026.

The transit picture also provides a plausible explanation for the recent up trend in yields. The chart is currently suffering from simultaneous afflictions. We can see that minor dasha lord Saturn (28 Leo) is in exact alignment with the ongoing Saturn-Uranus square, as reckoned by 15 degree multiple aspects (105/165). Transiting Neptune (26 Aquarius) is exactly opposite the Ascendant and Mercury (27 Leo) and has been a slow-moving but powerful negative influence on bonds for the past 6-12 months. Finally, the Lunar Nodes are in a 120- degree/trine alignment with their natal position as Ketu is trine natal Ketu and Rahu is trine natal Rahu. No wonder yields are spiking and rekindling inflation concerns in some quarters.

Could yields go higher in the near term? Further upside is possible but the fact that all these afflictions are basically at their maximum impact right now suggests that yields could come down fairly soon as the afflictions lessen. Not only will the afflicting planets begin to separate after this week, but Jupiter is likely to have a more positive influence on the chart in the month of March. Jupiter will aspect the MC/Midheaven (i.e. the 10th house cusp) in March and will also conjoin the 6th house cusp in late March. Jupiter will then enter an alignment with Neptune and may well have the effect of transforming Neptune’s ongoing negative effect into a positive effect. Therefore, bond prices are more likely to rise and yields will fall in March and possibly into April.

So while we could see a bit more upside in yields in the coming days, I would expect this Jupiter influence to eventually take yields significantly lower in the weeks ahead. Now just why that would happen is another question. It could be the result of some disappointing economic data or the failure to pass the Biden stimulus bill or perhaps even a resurgence in virus infections.

Weekly Market Forecast

Stocks have been more volatile over the past week as inflation worries have weighed on sentiment. After selling off late last week and early this week, the markets have bounced back once again following more reassurances from Fed Chair Powell today. The pullback was an expected reaction to last week’s Saturn-Uranus square but it is unclear how much more of an impact this alignment will have in the short term.

Next week’s Mercury-Jupiter conjunction looks largely positive, especially given the alignment with Rahu, the North Lunar Node. While Rahu is associated with distortions and sudden changes, it can be act as an amplifier when it is aligned with benefic planets such as Jupiter and Mercury.

For more details,

You can be notified of new posts if you follow ModernVedAstro on Twitter.

Please note that this is a more general and much abbreviated free version of my

investor newsletter which can be subscribed to here.

Please read my Disclaimer

Market forecase for week of 15 February 2021

Market forecast for week of 8 February 2021

Market forecast for week of 1 February 2021

Market forecast for week of 25 January 2021

Market forecast for week of 18 January 2021

Market forecast for week of 11 January 2020

Market forecast for week of 4 January 2021

Market forecast for week of 28 December 2020

Market forecast for week of 21 December 2020

Market forecast for week of 14 December 2020

Market forecast for week of 7 December 2020

Market forecast for week of 30 November 2020

Market forecast for week of 23 November 2020

Market forecast for week of 16 November 2020

Market forecast for week of 9 November 2020

Market forecast for week of 2 November 2020

Market forecast for week of 26 October 2020

Market forecast for week of 19 October 2020

Market forecast for week of 12 October 2020

Market forecast for week of 5 October 2020

Market forecast for week of 28 September 2020

Market forecast for week of 21 September 2020

Market forecast for week of 14 September 2020