(24 March 2021) Bond yields have moved back up to their pre-Covid levels in recent weeks as investors reassess inflation risks amid the optimism of the vaccine rollout and the growing prospects for economic recovery. Yesterday, Fed Chair Jay Powell cautioned that inflation would likely rise this year but it would be “transitory” and unlikely to last. That may well be, but financial markets will likely have the last word in the matter as commodity prices have soared in 2021 and there are increasing number of reports of material shortages and production bottlenecks.

(24 March 2021) Bond yields have moved back up to their pre-Covid levels in recent weeks as investors reassess inflation risks amid the optimism of the vaccine rollout and the growing prospects for economic recovery. Yesterday, Fed Chair Jay Powell cautioned that inflation would likely rise this year but it would be “transitory” and unlikely to last. That may well be, but financial markets will likely have the last word in the matter as commodity prices have soared in 2021 and there are increasing number of reports of material shortages and production bottlenecks.

While rising bond yields can be positive and reflect a return to normal, they also may introduce a new logic for investors. Suddenly, the 10-year Treasury bond is yielding 1.62% which is about equal to the dividend yield of the S&P 500. If yields can stabilize in this 1.5-2% area, then that would suggest a diminishing fear of inflation. And that could make Treasuries more attractive relative to stocks, which could produce some downside for equities as portfolios are rebalanced.

In a post from late February, I suggested that bond yields were unlikely to rise too much further in the month of March. In fact, yields on the 10-year have risen another 15 basis points so that forecast was somewhat wide of the mark. That said, yields have retreated somewhat this week as stocks have pulled back, with the 10-year yield falling from a high of 1.74% on March 19 to today’s print of 1.62%. If I am reading the US Treasuries horoscope correctly, I think yields are likely to fall further in the near term.

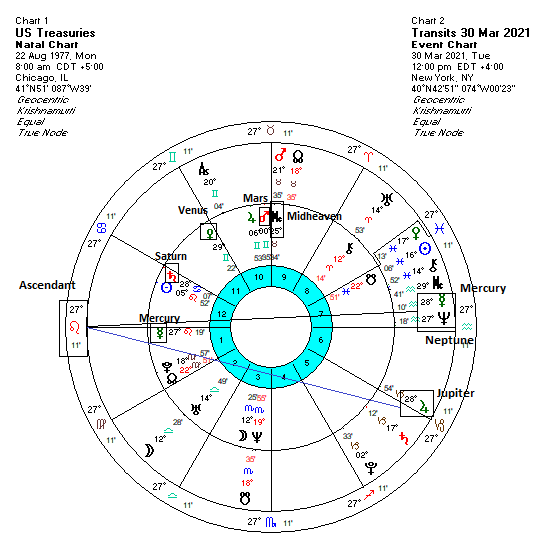

As I noted previously, Jupiter will likely to play a more important role in the Treasuries horoscope here in March and into April. Jupiter is a positive planet, of course, so its influence would likely accompany a rise in the value in bonds and hence a decline in yields. Jupiter has cast its 120-degree aspect on the Midheaven (10th house cusp) in the chart and is now conjunct the equal 6th house cusp at 27 Capricorn — and hence it is aligned with the Ascendant at 27 Leo. This is one key reason why bonds have rallied this week.

We can also see that Mercury is due to conjoin Neptune and align with Jupiter and the Ascendant early next week. While Neptune isn’t bullish by itself, it becomes bullish when it is aligned with Jupiter and other positive planets such as Mercury. I would therefore expect yields to fall further next week on this alignment.

And we should also note that the Jupiter-Neptune-Mercury combination will align not only with the Ascendant (27 Leo) and equal house cusps, but also with natal Mercury (27 Leo), Saturn (28 Cancer) Venus (29 Gemini) and Mars (0 Gemini). Although only Mars is the traditional 5th house aspect, the exactness of the multi-planet degreewise alignment should be seen as an overall plus for bonds.

Since the recent fall in yields has coincided with some modest declines in stocks, if yields were to fall further for whatever reason (weak economic data, a Covid setback, etc.) this would likely coincide with more weakness in stocks. Let’s see how it all shakes out.

For more details,

You can be notified of new posts if you follow ModernVedAstro on Twitter.

Please note that this is a more general and much abbreviated free version of my

investor newsletter which can be subscribed to here.

Please read my Disclaimer

Market forecast for week of 15 March 2021

Market forecast for week of 8 March 2021

Market forecast for week of 1 March 2021

Market forecast for week of 22 February 2021

Market forecase for week of 15 February 2021

Market forecast for week of 8 February 2021

Market forecast for week of 1 February 2021

Market forecast for week of 25 January 2021

Market forecast for week of 18 January 2021

Market forecast for week of 11 January 2020

Market forecast for week of 4 January 2021

Market forecast for week of 28 December 2020

Market forecast for week of 21 December 2020

Market forecast for week of 14 December 2020

Market forecast for week of 7 December 2020

Market forecast for week of 30 November 2020

Market forecast for week of 23 November 2020

Market forecast for week of 16 November 2020

Market forecast for week of 9 November 2020

Market forecast for week of 2 November 2020

Market forecast for week of 26 October 2020

Market forecast for week of 19 October 2020