(6 December 2021) US stocks bounced today on hopes that the Omicron variant may be less serious than originally feared. Despite this oversold rebound, markets have trended lower in recent weeks in the wake of a fresh wave of Covid restrictions and the Fed’s more hawkish stance to combat inflation. As the Fed embarks on tightening its monetary policy, we may well ask if this could be the start of a larger correction, such as we saw with Fed Chair Powell’s previous attempt at tightening in 2018?

(6 December 2021) US stocks bounced today on hopes that the Omicron variant may be less serious than originally feared. Despite this oversold rebound, markets have trended lower in recent weeks in the wake of a fresh wave of Covid restrictions and the Fed’s more hawkish stance to combat inflation. As the Fed embarks on tightening its monetary policy, we may well ask if this could be the start of a larger correction, such as we saw with Fed Chair Powell’s previous attempt at tightening in 2018?

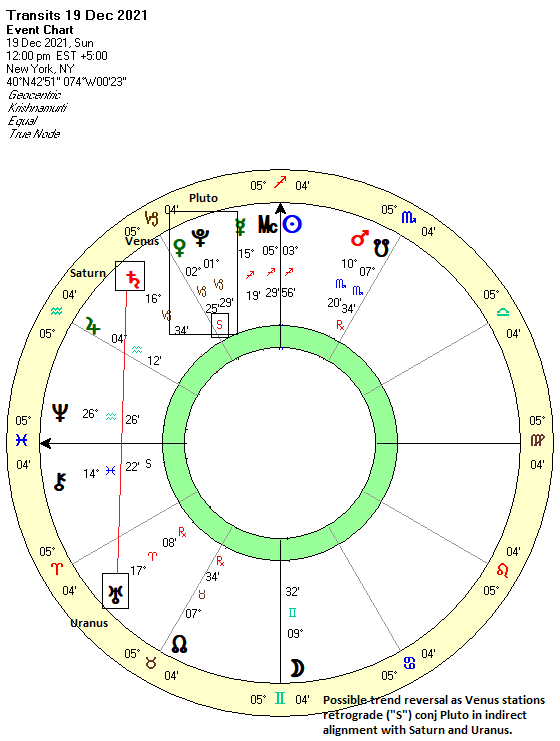

One window on this question may be found in the approaching Venus retrograde cycle. Venus turns retrograde about once every 19 months where it appears to move backwards in the sky for a period of 40 days. Venus is due to station retrograde on December 19 at 2 Capricorn (Krishnamurti/sidereal zodiac) and then return to normal forward motion on January 29 at 17 Sagittarius. In terms of financial astrology, Venus is a bullish planet that signifies value and worth. Its retrograde cycles suggest a more bearish energy, however, since its traditional positive symbolism is reversed so that the collective sense of value becomes susceptible to revision.

Actually, the full retrograde cycle of Venus is comprised of three distinct phases, of the which the more well-known retrograde cycle proper occurs in the middle. The first phase is what is known as the pre-retrograde shadow period, in which Venus is slowing down before it turns retrograde. The shadow period is measured from the point of its eventual resumption of direct motion (here at 17 Sagittarius) until the date of the retrograde station and lasts for about 32-33 days. The Venus pre-shadow period began on November 17 and will end on December 19 when Venus finally stations retrograde. The post-shadow period begins on January 29, 2022 when Venus returns to normal forward motion but is moving very slowly. Venus will conclude its post-shadow period on March 2 when it returns its location of the retrograde station at 2 Capricorn.

The common thread of the entire period from November 17 until March 2 is that Venus will be moving much slower than usual and that for a part of this time will be moving backwards — as seen from our perspective on Earth. While the Venus retrograde cycle has a overall bearish bias, this is not to suggest that this entire 15-week, three phase period will necessarily be negative for stocks. More often, it is only one of these three phases of the cycle tends to be bearish, while the other two phases may be more neutral or even bullish.

And sometimes the Venus retrograde cycle doesn’t produce much of anything. The previous Venus retrograde cycle (May 13, 2020 – Jun 25, 2020) was modestly bullish with no discernible trends, either in the retrograde phase or the two shadow phases. The preceding retrograde cycle (Oct 5, 2018 – Nov 16, 2018) was more bearish, however. Stocks rallied during the initial shadow period throughout September and then peaked in early October just three days before the start of the Venus retrograde phase. Stocks then began a two-month, 20% correction that finally bottomed a week after the end of the post-retrograde shadow period. In that unusual case, the pre-shadow phase was bullish, while the retrograde and post-shadow phases were both bearish.

This time around we have seen the market already begin to decline well in advance of the Venus retrograde cycle. In fact, the start of the pre-retrograde shadow phase (Nov 17) was just five days before the S&P 500 peaked on Nov 22 and US stocks have been falling ever since. So the question is: what is likely to happen when Venus finally turns retrograde on December 19?

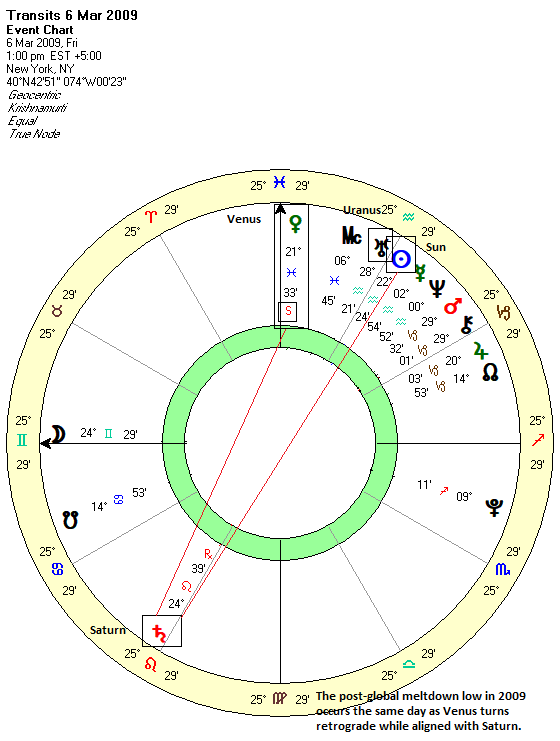

While it is difficult to make firm predictions based on single planetary factors, we can nonetheless speculate that stocks could well reverse their decline closer to December 19 and the retrograde station. There is precedent here in that the major market low on March 6, 2009 following a global financial meltdown occurred on the exact same day that Venus stationed retrograde. As in 2021, stocks had been falling throughout the pre-retrograde shadow period from early February, and indeed had been falling since the start of that year. Therefore, it is worth considering the possibility that whatever trend has been in place during the shadow period, it could reverse after the retrograde station.

We should also consider the condition of Venus at the time of the retrograde station. If it is afflicted, then that would support the scenario of declining markets before the station and then reversing higher after the station. In March 2009, Venus was in a tense 150-degree alignment with Saturn which may have partially accounted for the down trend heading into the station. Now, Venus will be closely conjunct Pluto which introduces the possibility of negative sentiment, although I would not say it is an unequivocally negative association.

More important may be that Venus will form an indirect alignment with the ongoing Saturn-Uranus square aspect. Saturn-Uranus is a bearish pairing and it is due to form an exact 90-degree angle on Dec 23. While Venus does not form any clear aspects with Saturn-Uranus, it will form a 60-degree alignment with the Saturn-Uranus midpoint at 2 Pisces. At normal speed, this Venus-Saturn-Uranus configuration likely wouldn’t have any effect. But with Venus having no velocity at all at its retrograde station, this is more likely to coincide with problems for financial markets. An additional parallel is that Saturn formed an alignment (opposition) with Uranus in March 2009, just as it does here in Dec 2021 with the square.

Therefore, there is a very plausible case that stocks could continue to decline over the next two weeks. If stocks do continue to trend lower before Christmas, the Venus retrograde station on Dec 19 would be one potential time to watch for a reversal higher. Let’s see how this all unfolds in the days ahead.

For more details,

You can be notified of new posts if you follow ModernVedAstro on Twitter.

Please note that this is a more general and much abbreviated free version of my

investor newsletter which can be subscribed to here.

Please read my Disclaimer

Market forecast for week of 29 November 2021

Market forecast for weekof 22 November 2021

Market forecast for week of 8 November 2021

Market forecast for week of 1 November 2021

Market forecast for week of 25 October 2021

Market forecast for week of 18 October 2021

Market forecast for week of 11 October 2021

Market forecast for week of 4 October 2021

Market forecast for week of 27 September 2021

Market forecast for week of 20 September 2021

Market forecast for week of 13 September 2021

Market forecast for week of 6 September 2021

Market forecast for week of 30 August 2021

Market forecast for week of 23 August 2021

Market forecast for week of 16 August 2021

Market forecast for week of 9 August 2021

Market forecast for week of 2 August 2021

Market forecast for week of 26 July 2021

Market forecast for week of 19 July 2021

Market forecast for week of 12 July 2021

Market forecast for week of 5 July 2021

Market forecast for week of 28 June 2021

Market forecast for week of 21 June 2021

Market forecast for week of 14 June 2021