Manchin pulls the plug on Biden’s spending plan

Manchin pulls the plug on Biden’s spending plan

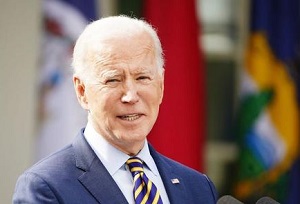

(20 December 2021) Stocks extended their sell-off to start the week after Democratic Senator Joe Manchin abruptly withdrew his support from President Biden’s ambitious Build Back Better plan. Without Manchin’s decisive vote in the 50-50 Senate, the Democrats will not be able pass their $2 Trillion spending package that has been the centerpiece of Biden’s domestic agenda. And if this additional fiscal stimulus isn’t forthcoming, the economy will become more vulnerable to a slowdown, especially in light of the impact of the rapidly-spreading Omicron variant.

The sudden withdrawal of fiscal stimulus was bad news for the stock market which had assumed these trillions of government largesse would eventually filter through the US economy and onto the corporate bottom line. While further negotiations cannot be ruled out in the coming weeks, investors may have to rethink their earnings’ forecasts for 2022 without the help of Washington, DC. Read more…

Stocks fall on inflation worries ahead of Fed meeting

Stocks fall on inflation worries ahead of Fed meeting

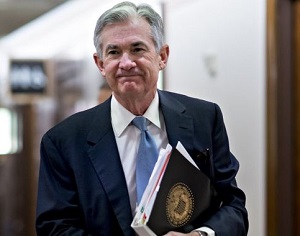

(14 December 2021) The markets are looking jittery ahead of Wednesday’s much-anticipated FOMC meeting where Fed Chair Jerome Powell is widely expected to announce an accelerated tapering of QE asset purchases. Stocks fell for the second straight day on Tuesday after the wholesale PPI inflation number came in higher than expected at 9.6%. The inflation problem comes at a particularly bad time for the Fed in the wake of fresh Covid restrictions in Europe following the rapid spread of the Omicron variant.

This early week sell-off was in line with our expectations given the nasty Mercury-Mars-Ketu alignment. Mars and Ketu (South Lunar Node) are both malefic planets and their conjunction increased the odds of a decline on Monday and Tuesday. The involvement of Mercury in this configuration further added to the tension. In my weekly market forecast from November 3, I had suggested that this Mars-Ketu conjunction could signal major problems for the Fed given its affliction to the natal horoscope of the Federal Reserve (Dec 23, 1913). Read more…

In the shadow of Venus, Omicron weighs on stocks

In the shadow of Venus, Omicron weighs on stocks

(6 December 2021) US stocks bounced today on hopes that the Omicron variant may be less serious than originally feared. Despite this oversold rebound, markets have trended lower in recent weeks in the wake of a fresh wave of Covid restrictions and the Fed’s more hawkish stance to combat inflation. As the Fed embarks on tightening its monetary policy, we may well ask if this could be the start of a larger correction, such as we saw with Fed Chair Powell’s previous attempt at tightening in 2018?

One window on this question may be found in the approaching Venus retrograde cycle. Venus turns retrograde about once every 19 months where it appears to move backwards in the sky for a period of 40 days. Venus is due to station retrograde on December 19 at 2 Capricorn (Krishnamurti/sidereal zodiac) and then return to normal forward motion on January 29 at 17 Sagittarius. In terms of financial astrology, Venus is a bullish planet that signifies value and worth. Its retrograde cycles suggest a more bearish energy, however, since its traditional positive symbolism is reversed so that the collective sense of value becomes susceptible to revision. Read more…

Omicron variant forces new restrictions; stocks move lower

Omicron variant forces new restrictions; stocks move lower

(29 November 2021) The pandemic continues. An official alert from the WHO regarding the new Omicron variant caused markets to sell-off sharply on Friday amid mounting concern that the virus may becoming more transmissible. Many countries have tightened restrictions in response to the new threat although it is still early days. Based on early data out of South Africa, it seems that most cases are mild among vaccinated people, although unvaccinated people may be more likely to be experience serious illness and hospitalization.

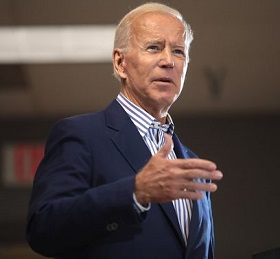

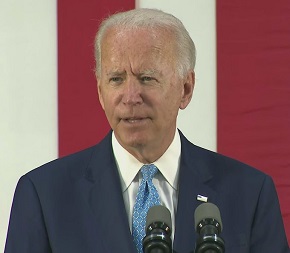

While Friday’s near-panic selling saw stocks fall by more than 2%, markets generally rebounded today after President Joe Biden delivered a reassuring address and ruled out further lockdowns for now. And Fed Chair Jerome Powell was quick to calm markets by noting new uncertainty in the inflation outlook given the disruptive potential of the new variant. This was a way of reminding investors that the Fed tapering of asset purchases may be subject to change. In other words, more monetary stimulus will come if needed. Read more…

Nasdaq soars to record high as Europe succumbs to new Covid wave

Nasdaq soars to record high as Europe succumbs to new Covid wave

(21 November 2021) US markets continued their ascent last week as technology stocks benefited from falling bond yields after a surge in Covid infections in Europe brought new restrictions. Stocks have been in rally mode since October as earnings have generally been strong and the Fed remains wedded to its ultra-loose monetary policy despite sharply rising inflation. The rally is increasingly narrow, however, as most of the gains have been confined to the big tech companies while the rest of the market lags.

How long can this rally last? The life of the bull market may ultimately depend on a rapid end to the current inflation spike since this entire asset bubble (stocks, real estate, bitcoin) is contingent upon the Fed’s near-zero rate policy. In the near term, it is tempting to think that stocks will continue to rise into the New Year since December tends to be among the more bullish months of the year as evidenced by the phenomenon known as the Santa Claus rally. Read more…

Stocks fall as inflation hits 30-year high of 6.2%

Stocks fall as inflation hits 30-year high of 6.2%

(10 November 2021) US stocks fell for a second straight day on Wednesday after the latest CPI data release showed a stunning 6.2% annual rise in inflation. The rise in inflation to its highest level in 30 years prompted investors to dump both stocks and bonds in favor of safe havens such as the dollar and gold. The soaring inflation rate belies the Federal Reserve’s more benign view of inflation as merely transitory. With inflation likely to stay elevated into 2022, more observers now believe the Fed will be forced to hike rates sooner than expected. Of course, this would be bad news for stocks which have come to depend on the Fed’s near-zero interest rate policy.

The sell-off comes as no surprise as I highlighted a particularly bearish alignment of Mercury, Mars and Saturn in last week’s update. As alignments go, it was a fairly high probability bearish pattern since it involved malefics Mars (upset, frustration) and Saturn (loss) and both were in close connection with Mercury (commerce). Read more…

Fed finally tapers QE to address rising inflation

Fed finally tapers QE to address rising inflation

(3 November 2021) Fed Chair Jerome Powell delivered another bravura performance today as he finally announced the Fed would begin to taper its emergency QE asset purchases in November. Stock markets cheered the long-awaited tapering as Powell was careful to note that any interest rate increases would only occur if labor markets showed further improvement. In other words, Powell’s initial act of monetary tightening in this cycle was about as dovish as one could imagine.

Powell continued to insist that inflation was transitory due to supply chain bottlenecks rather than excessive stimulus although he did acknowledge that inflation would remain high well into 2022. This fervent belief in transitory inflation was music to the ears of investors since it means that any actual rate hikes are still some ways off. Markets have come to rely near-zero interest rates since companies can borrow at rock-bottom interest rates in order to buy their own shares back which, in turn, drives up share prices. It also reduces borrowing costs for consumers. Read more…

Microsoft and Google lead tech stocks to new record highs

Microsoft and Google lead tech stocks to new record highs

(27 October 2021) Tech giants Microsoft and Google surged to new all-time highs today after reporting record corporate earnings for the third quarter. Following their early October lows, stocks have generally rebounded into the October earnings season as most earnings have come in above analysts’ expectations. The recent gains are a plausible manifestation of the prevailing energy of Jupiter.

Since the culmination of its retrograde cycle and direct station on October 16, Jupiter (28 Capricorn) has returned to normal forward motion. More importantly, it now forms a close alignment with Pluto (0 Capricorn) and Neptune (26 Aquarius) whereby each planet is separated by 28 degrees.

Whenever three or more planets form this type of symmetrical alignment, the energies of the planets becomes more powerful. Both Pluto and Neptune act as neutral factors here, but Jupiter is almost always bullish and its participation in this alignment is a key source of the current rally. Read more…

Supply chain disruptions fueling inflation

Supply chain disruptions fueling inflation

(20 October 2021) While the worst of the pandemic is behind us, it seems the full impact of its economic consequences are only starting to be felt. Supply chain disruptions are causing havoc all over the world as port facilities are overwhelmed playing catch-up with the backlog as consumer demand returns to something approaching normal. The interruption in global trade has led to shortages in many goods and raw materials and this scarcity has produced a rapid rise in both retail and producer prices.

Inflation has risen sharply across many sectors such as energy, food, base metals and other commodities. The consensus view is that these supply bottlenecks are unlikely to end anytime soon. Even the normally sanguine Federal Reserve is now admitting that its previous prediction of inflation as "transitory" may have been too optimistic. Treasury Secretary Janet Yellen expects these higher levels of inflation to persist well into 2022. Read more…

Global energy shortage pushes oil above $80

Global energy shortage pushes oil above $80

(13 October 2021) Financial markets have turned cautious as an emerging global energy shortage has driven the price of oil and natural gas to their highest levels since 2014. The energy shortages in China, India and several other countries are the partial result of post-pandemic supply chain bottlenecks and have produced regional brown-outs and significant industrial restrictions in power use. The shortages are one reason why inflation has been on the rise as US crude oil prices topped $80 a barrel this week, with Brent surging past $83.

The rising price of oil is putting pressure on the stock market. Higher oil prices create more inflation, which then forces bond yields higher as bond owners demand a higher premium in compensation for their loss of buying power. Higher bond yields increase the cost of borrowing and thereby limit credit expansion and economic growth as debt servicing costs for both consumers and corporations becomes more expensive. Read more…

US debt ceiling melodrama

US debt ceiling melodrama

(5 October 2021) If Shakespeare had lived in Washington, DC, he might have written, ‘All the world’s a stage, and politicians are merely players in it.’ Fortunately for us, he didn’t but we are nonetheless stuck with the predictable melodrama of US politics. And so the debt ceiling negotiations are again taking center stage as the Democrats and Republicans are forced to find ways to compromise without risking a catastrophic debt default by the October 18 deadline.

While nobody really expects a US government default to happen, financial markets have become volatile in recent days as the debt ceiling talks are now inextricably intertwined with negotiations involving the two Biden infrastructure bills. Markets have largely discounted the fiscal stimulus from these bills so there is some downside risk in the event that these bills are not passed. Without these major spending bills, the post-pandemic recovery would be more fragile and thus vulnerable to market disappointment. Read more…

Congress in debt ceiling stalemate as Mercury turns retrograde

Congress in debt ceiling stalemate as Mercury turns retrograde

(28 September 2021) Negotiations in Washington, DC ground to halt today as the two parties could not agree on a way forward to raise the debt ceiling. With the Republicans digging in their heels against a bill which would raise the debt ceiling, odds of a government shutdown were rising before the Thursday deadline.

And if things really go off the rails, there is there the possibility that the government will run out of money as the deadline for a US debt default is October 18. And just to ratchet up the pressure some more, liberal Democrats are now threatening to vote against the bipartisan infrastructure bill if centrist Democrats vote against Biden’s larger $3.5 Trillion stimulus bill.

The melodrama in Washington shouldn’t be too surprising given that Mercury turned retrograde in the early morning hours on Monday. Read more…

China’s Evergrade crisis roils markets

China’s Evergrade crisis roils markets

(21 September 2021) Global stock markets are sharply lower this week as Evergrande, China’s second largest real estate developer, teeters on the brink of bankruptcy. While default now seems inevitable, the more important question is whether the Chinese government will provide a bailout. Even a partial bailout of its $300 billion in debt would help not only the 1.5 million customers who invested their savings in new homes, but it also would reduce the risk of financial contagion. Evergrande is large enough that a disorderly default would damage the Chinese economy and therefore could have ramifications for investors all over the world.

The Evergrande crisis can be seen as a part of an ongoing attempt of the Xi government to tighten regulations throughout the financial sector. Earlier this year, the CCP imposed stricter anti-trust regulations on tech and internet companies such as Alibaba. The regulatory initiative is seen as a part of a campaign to bring the free-wheeling Chinese economy under closer political control by the CCP. Read more…

Stocks fall on possible Biden tax hike

Stocks fall on possible Biden tax hike

(14 September 2021) After their relentless summer rally, US stocks have trended lower in recent days as investors have begun to factor in the possibility of significant tax hikes needed to pay for the ambitious $3.5 Trillion Biden budget proposal. While it is far from clear if the proposal will pass the Senate in its current form given the Democrats narrow majority, markets generally don’t like taxes as they directly impact the corporate bottom line which is the key driver of stock prices. This market weakness is not too surprising given the current major planetary alignments that I outlined last week.

Stocks started selling the day after the Labor Day holiday while Jupiter was approaching its closest alignment with Pluto. I thought we might have seen a bit more upside last week from the bullish entry of Venus into Libra on Monday, September 6. But while some international markets were up on Monday, any positive influence was already largely spent by the US opening on Tuesday. Read more…

September arrives with stocks at all-time highs

September arrives with stocks at all-time highs

(7 September 2021) As the summer holiday season yields to the more sobering winds of September, financial markets await a new catalyst. Buoyed by an accommodative Fed and the prospect of the economic re-opening, stock markets have moved higher over the past several months with few significant interruptions. While valuations may be becoming stretched by conventional measures, most investors are reluctant to sell given the absence of any viable alternatives with interest rates pinned near zero.

And it’s hard to blame them. Inflation may be at its highest level in ten years but that is of little concern for the Fed since it has pre-emptively declared that inflation is "transitory". Even though the cost of housing and food continues to spiral upwards, Fed Chair Jerome Powell is in no hurry to reduce emergency QE asset purchases, let alone actually raise interest rates. Powell needs to keep the liquidity taps turned on full if there is to be any chance to reduce unemployment back to its pre-pandemic levels, no matter how high inflation may rise. Stock markets have mostly accepted this logic and have tagged along for the ride. Read more…

War in Afghanistan ends with final US withdrawal

War in Afghanistan ends with final US withdrawal

(30 Aug 2021) The war in Afghanistan is over. Today, the US withdrew the last of its troops thus ending the 20-year war against the Taliban at a cost of trillions of dollars and countless thousands of lives. The chaotic end came after the Biden White House airlifted as many remaining Americans and Afghan allies as possible before the Taliban reasserted their control over the country. After years of fruitless conflict, the US is back where it started with the fundamentalist Taliban again in charge.

While the defeat is a bitter pill to swallow for Americans, the astrological die may have been cast 20 years ago. The US launched the war back on October 7, 2001 in retaliation for the 9/11 terror attacks by Al Qaeda. The chart for that day shows a very difficult planetary configuration. The first air strikes took place near 9 p.m. local time as the Moon-Saturn conjunction were just over the horizon (1st house) in Taurus. Since every human undertaking is marked by an inception or birth chart, this war was started with very inauspicious stars indeed since any strong Saturn influence tends to towards frustration, loss and failure. Read more….

Delta variant threatens US re-opening

Delta variant threatens US re-opening

(22 August 2021) It all looked so promising. The US was the first country to manufacture an effective Covid vaccine and then successfully administer it to more than half of its population. By late spring, the economy was re-opening as life showed more signs of returning to normal with restaurants doing a booming business, baseball and hockey stadiums enjoying full attendance and family and friends reuniting after the long, difficult lockdowns of 2020. But then along came the Delta variant.

The fourth wave of Covid infections are forcing some jurisdictions to impose new restrictions. Schools are generally open for in-person learning but most students must wear a mask. No new lockdowns have been announced but more states are now seriously considering the possibility, much to the chagrin of many fed up citizens. More worrying are the breakthrough infections. While unvaccinated people are more likely to get sick from the Delta variant, many fully vaccinated people are also testing positive and some are falling ill. New data show that the protective effect of the vaccines is waning so that a third booster dose will be necessary. Read more…

Biden under pressure as Afghanistan falls to Taliban

Biden under pressure as Afghanistan falls to Taliban

(17 August 2021) The US suffered a body blow to its prestige this week after the Taliban defeated the Afghan army and captured the capital, Kabul. The sudden collapse of the US-sponsored Afghan army marks an ignominious end to the 20-year war that cost a trillion dollars and many thousands of lives on both sides. While the US had planned a complete withdrawal of its forces this year, the chaotic end of this nation-building exercise has undermined confidence in US foreign policy and its military capability.

For now, the big loser in this debacle seems to be President Joe Biden. While former President Donald Trump negotiated the withdrawal last year, the Biden White House is responsible for this disastrous end to the US involvement in Afghanistan. Even worse, there are now thousands of American citizens who have been left behind to fend for themselves against the Taliban. Read more…

Gold falls 5% after strong US jobs report

Gold falls 5% after strong US jobs report

(9 August 2021) Judging from the sudden drop in the gold price in the past two sessions, it seems Newton’s Third Law of Motion also applies to financial markets: for every action, there is an equal and opposite reaction. Gold prices have plunged more than 5% since Friday’s strong US jobs report as traders factored in an early start to the Fed’s taper of QE asset purchases. A strengthening economy is generally bad news for gold since higher inflation expectations translate into less Fed stimulus and thus a higher US dollar.

Until recently, gold had been enjoying a bounce since its March lows and had tagged its 200 DMA at $1810. But the sharp sell-off saw prices retest their March lows at $1675 in overnight trading before recovering in Monday’s session to $1726.

We can see a possible planetary explanation for the decline using the horoscope cast for London on September 12, 1919 at 11.00 a.m. Read more…

China stocks plunge after government tightens regulations

China stocks plunge after government tightens regulations

(29 July 2021) Stocks have fallen sharply in China and Hong Kong this week after the government tightened regulations governing education, real estate and technology firms. The Shanghai Composite Index had fallen by as much as 7% by Wednesday although it managed a modest recovery today. Bonds and the yuan also sold off as investors rushed to the exits as the CCP sought to assert its ultimate control over the freewheeling private sector. While many Western stock markets are trading near record highs, China’s market peaked in February and has trended lower ever since.

The decline comes as some analysts have expressed concern about a possible bubble in China’s property market as government stimulus and lax lending practices have pushed prices to new highs. While Beijing has a keen interest in keeping its economy humming along, it may be sacrificing the stock market here in order to push the yuan lower. A lower yuan makes exports cheaper and would be one way to generate future economic growth. Read more…

Delta variant complicates outlook ahead of Fed meeting

Delta variant complicates outlook ahead of Fed meeting

(22 July 2021) It seems the pandemic is not going to end any time soon. The spread of the Delta variant in many countries has dampened hopes for a quick re-opening this summer. More countries are being forced to make difficult choices between re-opening and trying to limit new infections despite increasing numbers of vaccinations. Since unvaccinated people are vulnerable to infection by the more transmissible Delta variant, hospitals may come under renewed stress in the near term.

The new global increase of infections complicates matters for the Fed as it looks towards its next FOMC meeting on Wednesday, July 28. The Federal Reserve is keen to address recent inflationary pressures, however "transitory" they may be. Read more…

A still-divided republic: the US under Biden

A still-divided republic: the US under Biden

(15 July 2021) "A house divided against itself cannot stand." With these words uttered in 1858, the future President Abraham Lincoln warned of the coming US civil war. Borne of a violent war of independence against Britain, the US was never going to be a mild-mannered country. The bloody Civil War (1861-1865) seemed to only cement its cultural proclivity for bold action and conflict, if deemed necessary.

Nowadays, we can see that the US is becoming an increasingly divided country once again as the two warring political parties appear more polarized than ever. This division took root under George W. Bush and Barack Obama, only to see the Trump presidency amplify it even further. Read more…

Stocks fall on Delta variant fears

Stocks fall on Delta variant fears

(8 July 2021) US stocks tumbled today on fears the spread of the Delta variant could upset summer reopening plans. Some investors hit the sell button today after weighing the possibility of more lockdowns despite the largely successful vaccination programs in the US and Europe. This bearish beginning to the month of July is not too surprising given approaching Venus-Mars conjunction which is exact on Tuesday, July 13.

July as a whole may be somewhat vulnerable to declines due to the extended alignment between Saturn and Rahu, the North Lunar Node. Both of these malefic planets are now moving backwards while maintaining a very close 120 degree separation within just two degrees of orb. This extended angular relationship could damage sentiment over the next several weeks. Read more…

Trump organization indicted for tax fraud

Trump organization indicted for tax fraud

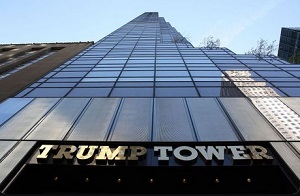

(1 July 2021) Donald Trump’s fortunes have taken a turn for the worse. The organization that bears the name of the former US president was indicted for tax fraud this week by the New York district attorney. On Thursday, the Trump organization CFO Allen Weisselberg pleaded not guilty to the charge. Since Donald Trump was not named in the indictment, he is unlikely to be subject to direct punishment, however.

While Trump has denounced the investigation as a political witch hunt, it seems likely to damage his reputation and could hamper any potential presidential run in 2024. Political betting markets now have Florida Governor Ron DeSantis pulling ahead of Trump as the favored GOP nominee in 2024, 29% to 26%.

This most recent setback for Trump is reflected in his horoscope. In a January post, I suggested that the first half of 2021 could be quite difficult for him, especially between April and June, and that legal troubles were possible. Read more...

Stocks rally on bipartisan infrastructure deal

Stocks rally on bipartisan infrastructure deal

(24 June 2021) Stocks pushed to new all-time highs today on news of an agreement on a pared-down Senate infrastructure deal. President Biden threw his support behind the bipartisan deal but added that he would only sign it if the Democrats’ ambitious reconciliation bill is also passed in the coming months. Investors welcomed the more concrete evidence of fiscal stimulus to keep the recovery going as special Covid unemployment benefits are now ending in a number of states.

We can see the outlines of this legislative success fairly clearly in Biden’s horoscope. Jupiter stationed retrograde this past Sunday, June 20 at 8 Aquarius. This set up a very helpful alignment with his Moon (8 Aries), Uranus (9 Taurus) and Ascendant (10 Scorpio). The Jupiter station is much more powerful (i.e. positive) than a simple Jupiter transit since it has no forward motion for approximately 5-10 days. Therefore, it resonates with the natal planet for much longer than would otherwise be the case. Read more…

Fed signals possible rate hikes amid higher inflation

Fed signals possible rate hikes amid higher inflation

(17 June 2021) So it turns out that inflation may be a problem after all. After Wednesday’s FOMC meeting, Fed Chair Jerome Powell admitted that inflation is likely to run hotter than expected this year. No kidding. US home prices have increased an average of 15% since last year, with comparable rises in many countries around the world.

While he insisted that it is likely to be transitory and will soon return to the 2% target, the Fed nonetheless moved up its timeline for two rate hikes in 2023. Markets reacted negatively to this more hawkish stance as stocks and commodities fell while the US dollar rallied strongly.

Stocks have generally slipped lower this week following Monday’s Saturn-Uranus square aspect. As with most aspects involving the the planet Saturn, this bearish pairing often coincides with periods of pessimism. Read more…

Inflation 2021: a repeat of that 70s show?

Inflation 2021: a repeat of that 70s show?

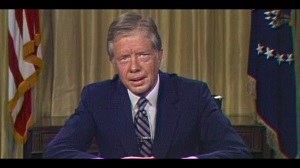

(10 June 2021) As many countries inch closer to economic re-opening, financial markets are keeping a close eye on rising inflation. This morning’s May CPI data for the US rose 5% on an annual basis, the highest since 2008 just before the meltdown. Core inflation also rose 3.8%, which as more than expected. Of course, the question is whether this inflation will be "transitory", to use the Fed’s term, or the start of a protracted period of rising prices perhaps along the lines of the dark days of the Carter administration in the 1970s.

Certainly, the Fed’s transitory view is entirely plausible since there was bound to be a hangover from the huge fiscal and monetary stimulus after the Covid crisis. The bond market seems to be in this camp as yields have continued to trend downwards over the past few weeks. And despite today’s high inflation number, yields fell again with the 10-year closing at 1.45%. If inflation was likely to increase down the road, yields would be rising rather than falling as traders would demand more premium to cover any anticipated loss of value. Read more…

US stocks mixed on inflation concerns

US stocks mixed on inflation concerns

(3 June 2021) US stocks have moved sideways over the past two weeks as inflation risks continue to weigh on sentiment. While the economic outlook is encouraging for 2021 amid re-opening and the successful vaccination campaign, some uncertainty remains. Government income support is gradually being withdrawn in coming weeks as many states are ending the unemployment benefit top-up in an effort to get people back to work. The winding down of fiscal stimulus could thus temporarily weaken consumer demand and undermine the strength of the recovery.

Despite rising inflation, stocks did manage to rebound in late May, albeit to a lower high. I thought we might have seen a bit more volatility at that time, especially given the Saturn retrograde station on May 23. That said, we have seen some modest downside this week in the wake of Mercury’s retrograde station on May 29. While retrograde stations aren’t always bearish, they nonetheless carry an increased risk of downside. Read more…

Bitcoin falls 50% in crypto crash

Bitcoin falls 50% in crypto crash

(20 May 2021) The speculative mania in cryptocurrencies has suffered a body blow over the past week as the price of Bitcoin has fallen 50%. Bitcoin had traded as high as $60,000 in early May but briefly touched the $30,000 level on Wednesday. It has recovered somewhat today and is currently valued at $42,000. Other currencies like Ethereum and Dogecoin have followed suit as the air has suddenly gone out of the crypto balloon. As it happens, the troubles coincided with Elon Musk’s much-anticipated appearance on Saturday Night Live on May 8. Musk is a big booster of crypto and his company Tesla even bought a large stake in Bitcoin and was preparing to accept payment for his cars in Bitcoin.

But things changed recently as Bitcoin’s massive energy use and greenhouse gas emissions have become a lightning rod for criticism. Last week, Musk himself was forced to admit that Bitcoin’s huge carbon footprint essentially disqualified it from becoming a viable alternative currency in its current form. Musk also backtracked on his promise to accept Bitcoin as payment for Tesla vehicles. Read more…

Stocks dive on inflation fears

Stocks dive on inflation fears

(13 May 2021) Inflation fears have hit financial markets this week as April’s annual rate of 4.2% was the highest in 13 years. Most commodities like oil, copper and oil have enjoyed sharp price increases in 2021, but this huge CPI number now forces investors to consider the risks of possible Fed tightening sooner than expected. Inflation is bad enough for markets, but premature Fed tightening would be worse as it would mean less liquidity and faster tapering of the Fed’s QE asset purchases.

This week’s decline is not unexpected given the difficult planetary alignments. As I have noted previously, the month of May looked much less bullish for stocks than April due to the prominence of Saturn. This week Saturn has come under the double afflictions of Rahu (North Lunar Node) and Mars. Saturn is a bearish planet, of course, and this double dose of negativity translated sharp falls across many markets. The S&P 500 was down more than 4% from its high last week, although today did see an oversold bounce as dip buyers stepped in at key support. Read more…

Saturn threatens Biden’s honeymoon

Saturn threatens Biden’s honeymoon

(6 May 2021) By all accounts, Joe Biden has taken firm control of the reins of power in Washington, DC during his first 100 days in the presidency. Biden has overseen the successful vaccine rollout and authored bold stimulus and infrastructure proposals worth more than $5 Trillion. The infrastructure plan is also designed to tackle growing inequality by raising taxes on the wealthy while making improvements in education and housing that benefit lower income people.

Despite the usual partisan criticisms, these initiatives seem fairly popular so far with Biden enjoying a 53-41 approval rating. But as history shows, the honeymoon of new presidents doesn’t last forever. In Biden’s case, I suspect that things may take a turn quite soon.

As I have noted previously, Biden is likely to have to face some very challenging situations here in the month of May. Read more…

India’s Covid crisis

India’s Covid crisis

(29 April 2021) Tragedy continues to unfold in India this week as Covid infections are setting new record highs with each passing day. Official statistics list 379,000 new infections and more than 3000 deaths today but experts suggest that the real numbers may be several times higher than that. Many countries are now sending relief supplies of oxygen and vaccine ingredients to help India meet the challenge of this deadly second wave.

With the vaccination program still in its early stages, the ongoing crisis seems likely to continue for the short term at least. As I noted in a post two weeks ago, the horoscope of India (Aug 15, 1947) is highly afflicted until at least late May. At that time, Saturn is due to turn retrograde and thus it would begin to separate from its opposition aspect from Venus, which is the all-important lagnesh (1st house ruler) in the chart. Read more…

Biden plan to hike capital gains tax surprises markets

Biden plan to hike capital gains tax surprises markets

(22 April 2021) Stocks fell suddenly this afternoon on reports that President Biden intends to nearly double the capital gains tax for wealthy investors. While Biden has made no secret of his intention to increase taxes on the rich, the news caught the market off-guard. Stocks had been fairly choppy already this week as renewed virus concerns has damaged the economic outlook in several countries.

As I noted in last week’s post, stocks are increasingly vulnerable to declines in the weeks ahead as the bullish influence of Jupiter may be starting to weaken. US stocks have been quite buoyant thus far in April as Jupiter approached its alignment with Pluto. While this 30-day degree alignment is not a traditional full-strength Vedic aspect, it nonetheless has coincided with some optimism. After its exact alignment on Tuesday, April 20, however, its positive energy may begin to diminish. Read more…

Covid update: India confronts surge; US sees uptick in cases

Covid update: India confronts surge; US sees uptick in cases

(15 April 2021) Despite the rollout of several effective vaccines across the world, there has been a troubling rise in Covid infections in recent weeks. New, more contagious variants are being blamed for these second and third waves of the virus which has forced new lockdowns in Europe, Brazil, Canada and now India. India’s recent surge in cases to over 200,000 a day greatly exceeds the size of its first wave in 2020, as it now holds the distinction of recording the highest number of daily new cases of any country.

The US has also seen a modest rise in total cases in recent weeks, even though 37% of the population have received at least one dose of the vaccine. The more transmissible variants from the UK, Brazil, South Africa and now India may well be driving the new infections as states such as Michigan, Florida and Pennsylvania may soon be faced with the prospect of locking down yet again. Read more…

Are stocks in a bubble?

Are stocks in a bubble?

(8 April 2021) If the Fed has its way, the party may never end. US stocks cruised to a new record high today as the Federal Reserve again reassured investors that its easy-money policies would remain in place for the foreseeable future. Stock indexes have nearly doubled from their Covid lockdown lows in March 2020 as the Fed’s QE asset purchases has successfully enticed capital into riskier instruments like stocks in an effort to stimulate economic growth.

While the gains have been impressive over the past 12 months, some observers are beginning to wonder how long the good times can last. All theses government and Fed interventions raise the possibility that the 12-year old bull market may have entered an unsustainable bubble stage. And yet as inflation expectations rise alongside bond yields, it is still possible that the rally could continue for a while yet as the trapped Fed has no other options but to further inflate the bubble or else face systemic insolvency. Read more…

Gold falls below $1700 as dollar rallies on reopening hopes

Gold falls below $1700 as dollar rallies on reopening hopes

(31 March 2021) It seems nobody likes gold these days. Bitcoin grabs all the headlines as it approaches $60,000, while gold has been in decline ever since its record high of $2089 last August. More recently, gold has trended lower as optimism surrounding the vaccine rollout and economic re-opening has bid up the US dollar and taken bond yields sharply higher. Typically, gold is inversely correlated with the dollar and long term yields.

This week gold retested its early March low of 1673 before rebounding today to $1715. Gold’s weakness this week is a reflection of difficult planetary set ups. In terms of transits, both the Sun and Venus are under affliction by Saturn and Ketu (South Lunar Node).

As a general rule of thumb, the price of gold tends to fall when either the Sun or Venus comes under the influence of malefics such as Saturn or Ketu. Read more…

Bond yields remain elevated as Fed warns on inflation

Bond yields remain elevated as Fed warns on inflation

(24 March 2021) Bond yields have moved back up to their pre-Covid levels in recent weeks as investors reassess inflation risks amid the optimism of the vaccine rollout and the growing prospects for economic recovery. Yesterday, Fed Chair Jay Powell cautioned that inflation would likely rise this year but it would be "transitory" and unlikely to last. That may well be, but financial markets will likely have the last word in the matter as commodity prices have soared in 2021 and there are increasing number of reports of material shortages and production bottlenecks.

While rising bond yields can be positive and reflect a return to normal, they also may introduce a new logic for investors. Suddenly, the 10-year Treasury bond is yielding 1.62% which is about equal to the dividend yield of the S&P 500. If yields can stabilize in this 1.5-2% area, then that would suggest a diminishing fear of inflation. And that could make Treasuries more attractive relative to stocks, which could produce some downside for equities as portfolios are rebalanced. Read more…

Markets rally as Fed promises no hikes until 2023

Markets rally as Fed promises no hikes until 2023

(17 March 2021) To no one’s surprise, Fed Chair Jerome Powell has refilled the punch bowl yet again. In today’s FOMC meeting, Powell reaffirmed his commitment to an ultra-loose monetary policy of zero percent interest rates and $120 Billion a month in QE asset purchases. Despite recent inflation worries and sharply rising bond yields, Powell asserted there would be no rate hikes until 2023 at the earliest. Markets rallied modestly to new all-time highs as investors anticipated stronger growth in a post-Covid world.

Jupiter is still very much in the driver’s seat here. Since Jupiter is a bullish influence, markets tends to rise whenever it forms a close alignment with a slower-moving outer planet. This seems to be the case at the moment as Jupiter approaches its 30-degree alignment with Neptune, which is exact on March 20. While this is not a major Jupiter aspect by either Vedic or Western reckoning, angular separations of any 30-degree multiples can often coincide with a rise in stock prices. Read more…

Biden health questions raises possibility of President Harris

Biden health questions raises possibility of President Harris

(11 March 2021) Recent events have renewed concerns about President Biden’s health and mental condition. In the latest incident, while giving public remarks, Biden forgot the name of his Secretary of Defense (who was standing right behind him) and could not remember "the Pentagon" as the building which houses the Department of Defense. While the mainstream media has largely given Biden the benefit of the doubt about these kinds of gaffes, there are nonetheless more questions being asked about his fitness for office.

Last month, I suggested that serious afflictions in President Biden’s horoscope in May and June could indicate either a personal health problem or a significant setback in the fight against Covid. While I’m still uncertain, new concerns about Biden’s cognitive decline suggests that the personal health problem scenario needs to be examined more carefully.

To recap, Saturn is due to station retrograde at 19 Capricorn in late May. Read more…

Dow hits new record as Congress passes Covid stimulus bill

Dow hits new record as Congress passes Covid stimulus bill

(10 March 2021) US stocks rebounded strongly from last week’s lows as Congress finally passed the $1.9 Trillion Covid stimulus bill today. President Biden is expected to sign it into law on Friday. This bullish outcome was not unexpected as I noted in last week’s update that bullish Jupiter would likely assume a greater influence on sentiment this week. Stocks began their rebound when Jupiter conjoined Mercury last Friday (March 5). The market rallied further this week as Jupiter formed a 30 degree alignment with Sun and approached another 30-degree alignment with Neptune.

The month of March is shaping up to be a battle royale between bullish Jupiter and bearish Saturn. March began with some apparent additional fallout from the ongoing Saturn-Uranus alignment that was exact on Feb 17 — just one day after the interim high on the S&P 500. Read more…

Stocks volatile on bond and inflation worries

Stocks volatile on bond and inflation worries

(3 March 2021) Stocks are looking more vulnerable in recent days in the wake of last week’s bond market scare. The yield on the US 10-year Treasury bond has remained elevated after the spike to 1.6% as investors are growing increasingly nervous about inflationary pressures. After the recent rally in commodities such as oil, lumber and copper, the bond market is starting to price in higher inflation as rising costs will be passed on to consumers. Bond buyers are therefore demanding a higher risk premium and this is pushing up interest rates at the long end of the curve. Significantly higher interest rates are the last thing the economy needs right now as highly-leveraged companies could soon find it difficult to service their debt.

The planetary influences look quite mixed here as we begin the month of March. The market is still off its mid-February high which coincided almost exactly to the Saturn-Uranus square alignment. Read more…

Rising bond yields signal higher inflation ahead

Rising bond yields signal higher inflation ahead

(24 February 2021) The Covid speculative bubble continues to blow bigger in 2021 as investors buy up everything from Bitcoin to blue chips. With the Fed keeping its QE liquidity taps open, stock markets are back in record territory, while home sales soar with the Covid-driven demand for single-family dwellings. While asset prices have been successfully inflated in keeping with the Fed’s mandate, bonds have been the big loser.

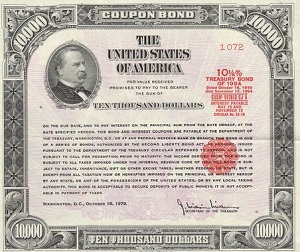

As hopes have grown for an economic recovery following the November vaccine announcements, bond yields have steadily risen as the interest rate on the benchmark 10-year Treasury note is now near 1.4%. (N.B. bond yields/rates vary inversely with bond prices.) The Fed typically manages short term rates (now at 0%), but longer term interest rates are still determined by the market. Based on the recent rise in yield, the market is signaling that inflation is coming. Read more…

Bitcoin tops 50,000

Bitcoin tops 50,000

(17 February 2021) Propelled by a recent endorsement by Tesla’s Elon Musk, bitcoin has resumed its rally here in February, hitting a new record today of 52,000. The cryptocurrency is riding high these days as more mainstream companies like BlackRock and Mastercard are adopting bitcoin either as an investment or as payment. While Bitcoin has tripled in price since November, it remains to be seen if this is merely a speculative bubble or the beginning of a sustainable alternative to traditional fiat currencies.

The recent price increase is due, in part, to the favourable transit of Jupiter. The January pullback coincided with a close 60 degree aspect from Saturn to the natal Moon. Near the interim low in late January, bearish Saturn weakened as it moved past its aspect, and bullish Jupiter conjoined Rahu (North Node) and the 7th house cusp (14 Capricorn). Therefore, Jupiter was exactly opposite the most sensitive point in the chart, the Ascendant at 14 Cancer. This was a very good bullish set-up. Read more…

.jpg) Saturn-90-Uranus: Is this the final year of the bull market?

Saturn-90-Uranus: Is this the final year of the bull market?

(10 February 2021) As US stocks hit another all-time high today, one wonders if this 12-year old bull market will ever end. With the Federal Reserve doing somersaults to keep the bull party going, more observers are talking about the bull market as the default setting for the foreseeable future. Of course, from an historical perspective, stocks do tend to rise over time. But previously, bull markets were followed by bear markets as a reflection of the ebb and flow of the capitalist economic cycle.

But ever since the 2008 meltdown, the Fed has been keen to keep interest rates low and buy bonds and other debt instruments in order to push more investors into risky assets like stocks. The Fed’s stated goal is to generate a "wealth effect" by driving stocks higher so that enriched investors spend more freely and thereby boost the consumer-based economy. Read more…

Covid variants complicate pandemic recovery

Covid variants complicate pandemic recovery

(3 February 2021) As the world enters its second year of the pandemic, progress is very much a mixed bag. On the plus side, several highly effective and safe vaccines are now being rolled out in most countries around the world. While there have been significant bottlenecks in production and distribution, there is a widespread expectation that herd immunity through mass vaccination can be achieved by the end of 2021 in some countries.

On the other hand, several new and more dangerous variants of the SARS-CoV-2 virus have emerged in recent months. The new variants from the UK, South Africa and Brazil are more transmissible and have somewhat higher rates of mortality. However, the current second lockdown seems to have helped to limit the spread of the virus so that new case numbers are starting to decline. Read more…

GameStop short squeeze roils markets

GameStop short squeeze roils markets

(27 January 2021) Stocks tanked today as nervous investors headed for the exits amid the GameStop short squeeze. The video game retailer (ticker: GME) has become the focus of intense speculation in the past two weeks as members of the Reddit chatroom, WallStreetBets, co-ordinated a short squeeze against large hedge funds that had heavily shorted the stock, largely through the purchase of highly leveraged call options.

As a result of the explosive 20-fold rise in the share price, the older, established hedge funds have lost billions of dollars at the hands of mostly young, amateur traders. This generational David and Goliath story is taking place when the market is at all-time record highs, thanks largely to injections of Fed liquidity, QE asset purchases and near-zero interest rates. The unprecedented speculative frenzy is leading some observers to wonder if the current financial bubble is about burst. Read more…

Markets cheer Biden Inauguration

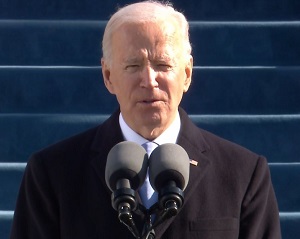

Markets cheer Biden Inauguration

(20 January 2021) US stocks rallied to new all-time highs today as Joe Biden was sworn-in as the 46th president of the United States. Markets have responded favourably to Biden’s promise of more stimulus and more spending amid an ongoing pandemic which has left millions without jobs and without hope. While the economy continues to sputter, the outlook for 2021 is more positive as vaccine rollouts should allow for a full recovery.

The stock rally looks very overbought here as the S&P 500 is trading at 14% above its 200-day moving average. Other indexes are even more stretched as the Nasdaq-100 is trading at 19% above its 200 DMA and the small cap Russell 2000 is trading at an incredible 29% over its 200 DMA. While the powerful upward momentum is clearly bullish, it seems that a significant pullback is only a matter of time. Read more…

Twitter bans President Trump after US Capitol attack

Twitter bans President Trump after US Capitol attack

(13 January 2021) These are anxious days for the United States. In the wake of the attack on the Capitol building in Washington, DC, Americans are being confronted with some serious questions about the direction of their country. Even though the Trump presidency will end next week, Trump is likely to remain a significant source of opposition over the next four years.

Not even a Senate impeachment conviction in the coming weeks will keep Trump from maintaining his hold over most of the conservative half of this deeply divided country. While a conviction of the impeachment charge would forbid him from holding the presidency again, Trump will still have millions of loyal supporters who will continue to feel aggrieved over this election result. Read more…

Trump finale: supporters storm US Capitol to block EC vote

Trump finale: supporters storm US Capitol to block EC vote

(6 January 2021) Despite all hopes to the contrary, 2021 has basically picked up where 2020 left off. Today, supporters of President Donald Trump stormed the Capitol in Washington, DC and stopped the formal certification vote of the Electoral College. Following a fiery morning rally in which the President Trump claimed the election was stolen, protestors pushed through police barricades to occupy the Senate in an attempt block the Electoral College votes from being cast for President-Elect Biden. The EC vote was not completed and will resume later tonight in preparation for the Inauguration on January 20.

The shocking turn of events may be seen as an exclamation point to mark the end of the term of Donald Trump. The riot in DC overshadowed the Democrat win yesterday in both Georgia Senate seats which guaranteed Joe Biden a more comfortable path to enact his policies. Read more…